WE BELIEVE IN MONEY WITHOUT BORDERS

Mission Update Q3 2023

Mission Update Q3 2023

With Stocks, you can hold your money in a fund that invests in some of the world’s biggest companies. And you can get started with just 1 EUR. Available in Austria, Denmark, Finland, France, Luxembourg, Netherlands, France, Spain, Sweden, Germany, or Norway. Capital at risk.

We launched our Interest feature in Estonia so now even more Wise customers can get a return in-line with central bank rates. Variable rates of 3.24% on EUR and 4.69% on GBP. Your money is invested in a fund backed by government assets. Capital at risk, growth not guaranteed. Variable rate is based on 7 day performance as of 16/10/23. For full 5 year performance, please visit our website.

In addition to our Interest feature, we’ve introduced Stocks in Singapore. Whether you're a personal customer or have a business account, you can open a USD balance, and then hold and grow your money in a fund that invests in some of the world’s biggest companies. All while keeping instant access to up to 97% of your money. Capital at risk.

With Stocks, you can hold your money in a fund that invests in some of the world’s biggest companies. And you can get started with just 1 EUR. Available in Austria, Denmark, Finland, France, Luxembourg, Netherlands, France, Spain, Sweden, Germany, or Norway. Capital at risk.

We launched our Interest feature in Estonia so now even more Wise customers can get a return in-line with central bank rates. Variable rates of 3.24% on EUR and 4.69% on GBP. Your money is invested in a fund backed by government assets. Capital at risk, growth not guaranteed. Variable rate is based on 7 day performance as of 16/10/23. For full 5 year performance, please visit our website.

In addition to our Interest feature, we’ve introduced Stocks in Singapore. Whether you're a personal customer or have a business account, you can open a USD balance, and then hold and grow your money in a fund that invests in some of the world’s biggest companies. All while keeping instant access to up to 97% of your money. Capital at risk.

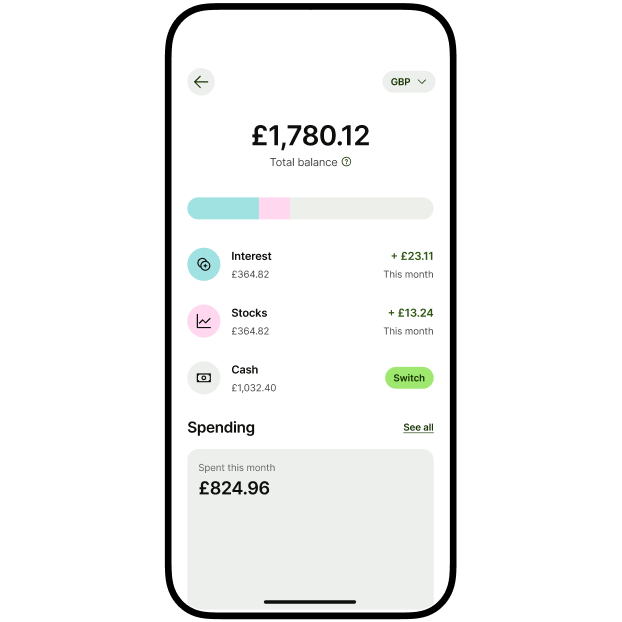

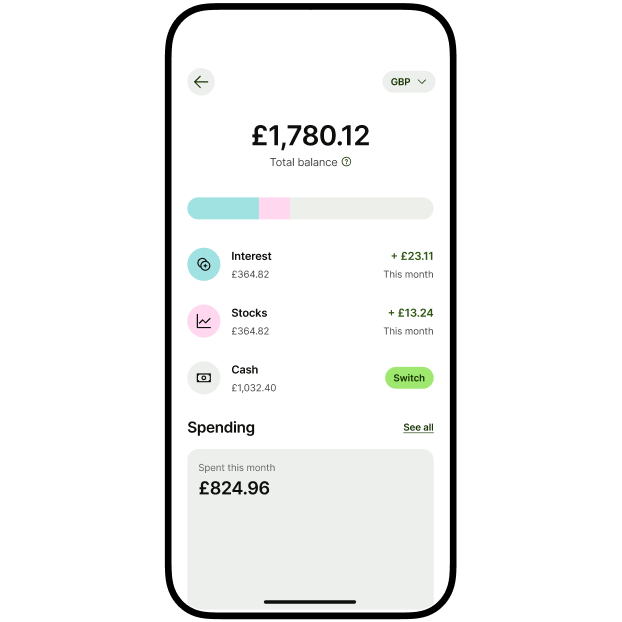

There’s now one place to see: a breakdown of your Wise card spending, how your total balance is broken down into Cash/Wise Interest/Stocks, and your total returns on Interest and Stocks since you started investing.

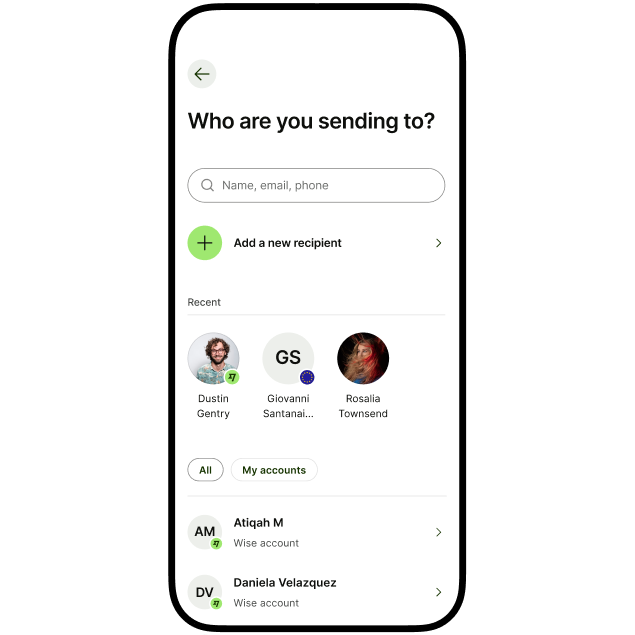

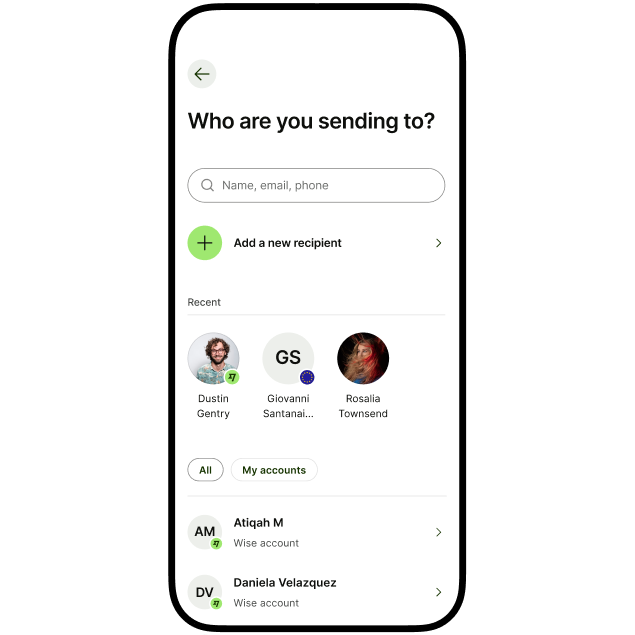

Contacts that you’ve recently sent money to, or received money from, can now be easily accessed from your home screen and at the top of your recipient list. We’ve also merged all your contacts into one list, whether they have a Wise account or not.

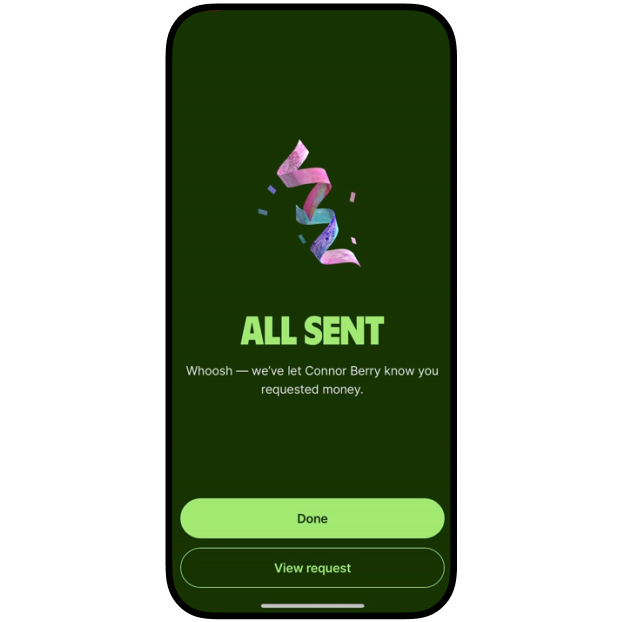

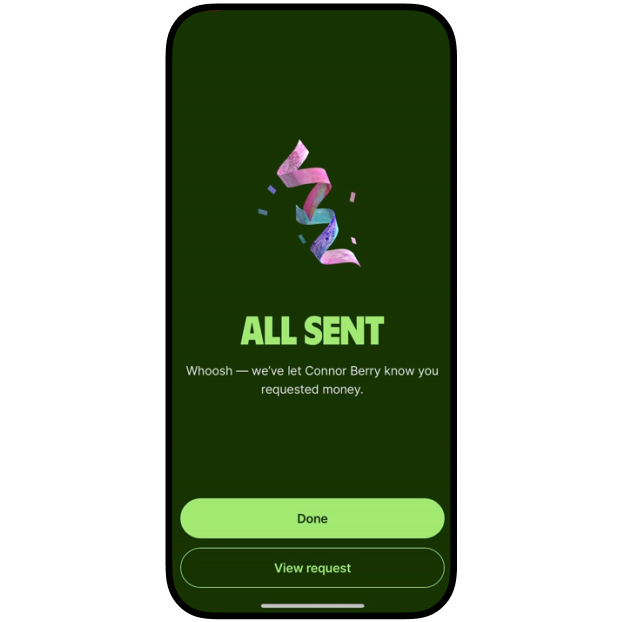

Personal customers can now request money from their contacts on Wise and get paid instantly and conveniently. Their payers would see the request in their Wise account and pay in just a few taps.

If you try to submit an ID document for verification that we’ve been unable to accept in the past, we’ll now warn you instantly. This way you can use a different document and avoid delays.

.png)

There’s now one place to see: a breakdown of your Wise card spending, how your total balance is broken down into Cash/Wise Interest/Stocks, and your total returns on Interest and Stocks since you started investing.

Contacts that you’ve recently sent money to, or received money from, can now be easily accessed from your home screen and at the top of your recipient list. We’ve also merged all your contacts into one list, whether they have a Wise account or not.

Personal customers can now request money from their contacts on Wise and get paid instantly and conveniently. Their payers would see the request in their Wise account and pay in just a few taps.

.png)

If you try to submit an ID document for verification that we’ve been unable to accept in the past, we’ll now warn you instantly. This way you can use a different document and avoid delays.

When you asked for a simpler way to pay QR bills, we took note. Head to the ‘card’ tab in the app, and swipe right to scan a QR bill and pay from your balance.

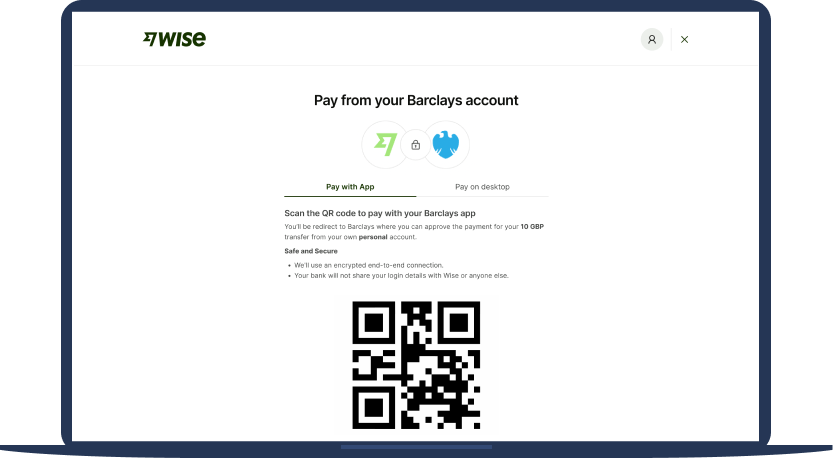

If you have a UK bank account and use Open Banking then you can now login to Wise on your desktop and scan a QR code to fund transfers or top-up your account. No need to remember your bank details or reach for your card reader.

When you asked for a simpler way to pay QR bills, we took note. Head to the ‘card’ tab in the app, and swipe right to scan a QR bill and pay from your balance.

If you have a UK bank account and use Open Banking then you can now login to Wise on your desktop and scan a QR code to fund transfers or top-up your account. No need to remember your bank details or reach for your card reader.