Q3 2023 Mission Update: Price

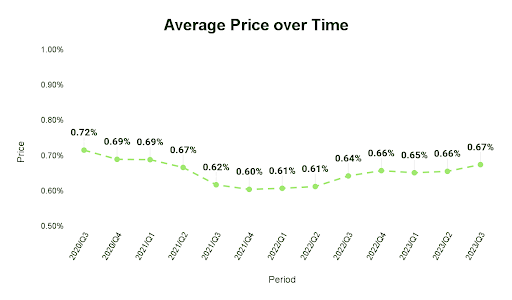

Our average price changed from 0.66% to 0.67% in Q3 2023.

Overall, this quarter we

- 😞Increased fees on sending USD to countries outside the USA when using the SWIFT messaging network

- 😞Increased fees when sending to CNY

- 🥳Decreased fees on sending money to MYR, TRY, CLP.

Why did the average price increase in Q3?

As part of our mission, we charge as little as possible for sending money. Our average fee is 0.67% – a fraction of what the banks typically charge you.

At Wise, we constantly review our fees because we never forget it’s your money, not ours. The money you send, spend, hold with us - we want to offer you the best deal we can. So, when our costs go down, so do your fees.

Over the last three years, we have reduced our average fee from 0.72% to 0.67%, a 7% point decrease. It may not sound like much, but doing this wasn’t easy. We are constantly searching for ways to reduce the cost of trading currencies, work with more efficient partners and make our product easier to use. When we achieve this it means our costs go down which enables us to drop fees for you.

However, there are times where we need to increase our fees. In Q3, fees increased because:

- The fees we pay our partners for payouts in CNY increased,

- And the cost of sending USD to countries outside the USA when using the SWIFT messaging network went up

We know this is disappointing news and we’re sorry about that. However, we’re already working on bringing the cost of running Wise down, so we can lower fees in the future.

But it wasn’t all bad news…

In Q3, we improved how we trade different currencies. This lowered our cost when trading MYR, TRY, CLP, and we passed these savings directly to customers.

And remember.. it's your money, not ours

As central bank rates have increased we are working on ways for customers to earn a fair return on the money they hold with Wise.

Meet Wise Interest:

Customers in the UK, 12 countries in Europe and Singapore can turn on Interest to invest in a fund backed by government assets and get a return that follows the central bank interest rate. Customers get a variable return of 4.87% on GBP, 5.09% on USD and 3.42% on EUR while continuing to be able to send and spend as normal.

Capital at risk. Current rates do not guarantee future growth.

Variable rate is based on 7 day performance for UK based customers as of 20th September 2023. Rates are after Wise and fund manager fees. For the full 5 year past performance of funds, please visit our website.

In the USA:

For customers in the USA we have increased the interest we pay USD balances. Eligible US customers now earn 4.33% APY on their USD balance up from 4.13%. Customers who opt in to earn interest benefit from up to $250,000 in passthrough FDIC insurance on their USD balance from our Program Bank, JPMorgan Chase Bank, N.A.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.