Best joint business bank accounts in the UK

Looking for the best joint business accounts in the UK? We compare features, fees and best usage to help you find the ideal shared account.

Looking for a new bank account for your business? Many UK companies find an online account easiest to manage, especially if there’s a mobile banking app attached.

There are an increasing number of online and app-based accounts available in the UK right now. With so many options, this can make it tricky to choose the right solution for your business.

We’re here to help, with a handy guide to the best online banks for business accounts in the UK.

We’ll compare each provider based on the things that matter to your business, including fees, features, Trustpilot scores and more.

We’ll also show you a non-bank alternative - Wise Business, which lets you effortlessly manage your business finances across 40+ currencies, including GBP, USD and EUR.

💡 Learn more about Wise Business

Online bank accounts offer lots of benefits to businesses, the main one being that they’re easier to manage. You can simply login or use a mobile app to make transactions and handle everyday banking tasks. This self-service approach can be much simpler and faster, rather than having to visit a branch or call a bank.

The best online business accounts also offer extra features such as integration with cloud accounting apps, invoicing and bulk payment tools.

Below, we’ll see what some of the UK’s best online business account providers have to offer for startups. This includes the following providers:

Let’s start with an at-a-glance comparison between banks and non-banking providers, reviewing features, including monthly fees and what existing customers think of the provider over on Trustpilot:

| Bank/ Provider | Trustpilot score | Monthly fee | Best known for |

|---|---|---|---|

| Tide | 3.9² | £0 to £69.99 depending on plan¹ | App-based business banking |

| Wise Business | 4.3³ | None | Multi-currency accounts and international payments |

| Starling Bank | 4.3⁶ | None⁴ | Fee-free everyday business banking |

| Revolut Business | 4.5⁹ | £10 to £90⁷ | Multi-currency accounts and international payments |

| ANNA | 4.2¹¹ | £0 to £49.90¹⁰ | Straightforward PAYG business banking |

To help you compare options and find the best start up business account, we’ll look at a few key criteria. These are:

Tide is a UK-based electronic money services provider which offers app-based business banking services to small businesses, freelancers, sole traders and registered limited companies in the UK.

It offers accounts under four plans, one of which is free and ideal for startups. However, it does have the following transaction fees:¹

If you want to upgrade, other plans range from £12.49 to £69.99 a month.¹ You’ll get more features and pay less for individual transactions when you move to higher tiers.

While it varies depending on the plan, features of Tide business accounts include:

To open a business account with Tide, you’ll need to be over 18 and have a UK-based business. You’ll need to show a valid photo ID and upload a selfie photo on application. And according to Tide, it takes just minutes to open an account online.¹

Tide has a ‘Great’ Trustpilot rating of 3.8 from over 24,600 reviews².

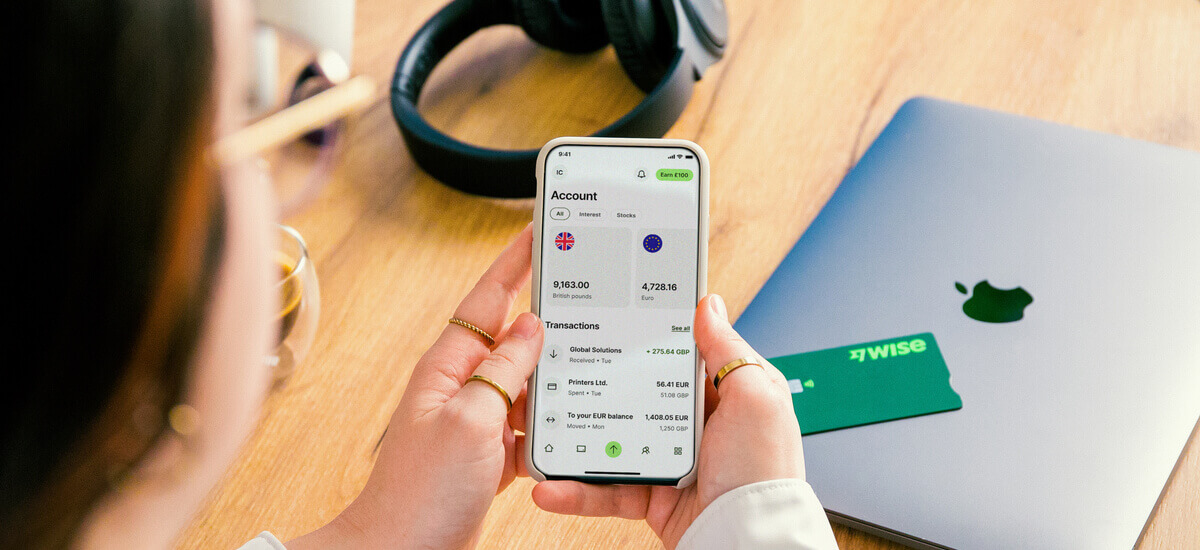

Wise isn’t a bank, but it’s authorised by the FCA in the UK as an e-money institution, and offers online multi-currency accounts and cards for UK businesses through Wise Business.

Features include:

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

There are no monthly fees with Wise Business, only a one-off fee of £50 (Advanced plan) or for free (Essentials plan). Costs for sending money start from 0.33%, and you can withdraw up to £200 a month (max. 2 withdrawals) for free. You can get a Wise Business debit card for a one-off fee of just £3.

Most businesses are eligible for an account. You’ll just need to provide details about yourself, company directors and the business, and complete some verification steps. It could take just minutes to get setup, and you can do it from either your laptop or your phone.

Wise has an ‘Excellent’ Trustpilot rating of 4.3, based on over 260,000 reviews.³

Get started with Wise Business 🚀

Starling Bank is a licensed UK bank which offers a digital business account, which can be customised with add-ons. It also has a Sole Trader account.

There are no monthly fees and most everyday transactions are free (except for international transactions), making it a great choice for startups. Add-ons such as the Business Toolkit and Bulk Payments each have a subscription fee of £7 a month. Read more about Starling fees here.⁴

Features which come as standard with Starling Bank business accounts include:

You’ll be eligible to open a Starling business account if you have a limited company registered at Companies House, or are a sole trader. You’ll also need to be a UK resident and provide valid photo ID along with evidence of your trading activities.

You can apply online, and the application takes around 10 minutes. You’ll then need to wait for your account to be verified and opened.⁵

Starling Bank has an ‘Excellent’ Trustpilot score of 4.3 based on over 44,000 reviews.⁶

Revolut Business is a neobank offering app-based accounts for UK businesses.

You can choose from 4 different plan options, with monthly subscription costs between £10 and £90.⁷ Read more about Revolut Business fees here.

Some features are available across all Revolut business account plans, while some are offered only to higher tier account holders. All accounts come with:

You can open a Revolut business account if your company is based in the UK, fully incorporated and active.

You can apply online, and it usually takes around 24 hours for your application to be reviewed - although it can take longer to get your account open if further verification information is needed.⁸

Revolut has a ‘Excellent’ Trustpilot score of 4.5 based on over 215,000 reviews from both personal and business customers.⁹

ANNA (which stands for Absolutely No Nonsense Admin) is an app-based business account aimed at small businesses.

It has a range of plans available, including a free Pay as You Go option that could work well for startups. Other plans cost between £14.90 and £49.90, offering more features and lower transaction costs the more you pay in monthly fees.¹⁰

The free ANNA PAYG account charges everyday banking fees including £0.20 per bank transfer, £1 per ATM withdrawal and £5 per international payment (plus currency conversion fees).¹⁰

Features include:

You can open an ANNA business account for most types of company. You’ll need to download the mobile app, sign up with your email and provide details of your business, as well as completing verification steps. It’s pretty quick to do, taking around 10 minutes according to ANNA.¹⁰

ANNA Money has an ‘Great’ score of 4.2 on Trustpilot, from over 3,800 reviews.¹¹

If your business or startup needs to pay or get paid in foreign currencies, you could be better off with an provider such as the Wise Business account.

With a Wise Business account, you can hold and exchange 40+ currencies all in one place. You can send payments to 140+ countries and get local account details to get paid in 8+ currencies as if you were a local business.(only with Wise Business Advanced)

Whenever you need to send, spend or exchange foreign currencies, you’ll benefit from the mid-market exchange rate, with low, transparent fees.

Opening a Wise Business account is online and simple, there is no mininal balance requeriments or monthly subscription fees. There's a registration fee of £50 (Advanced plan) or for free (Essentials plan) and your startup can benefit from all of these useful features:

It’s quick and easy to open a Wise Business account, with a fully digital application, verification and on-boarding process. Check out the requirements here.

Get started with Wise Business 🚀

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

In terms of fully licensed UK banks, Starling Bank is one of the easiest to open online as you can do it all via mobile app. But all of the online account providers on our list offer fast and easy signup, although some may take longer than others to approve your application.

Of the online account providers on our list, ANNA Money has the highest Trustpilot score - an ‘Excellent’ 4.4. ¹¹

To choose the right online bank account for your needs, there are a few key factors you may want to focus on. These are price (monthly fees and transaction costs), features and services, ease of use and limitations. This last one is important, as you need an account that can grow with your business. You may also need to consider your international needs when choosing your provider. An international account such as Wise Business can be the right choice if you trade or plan to trade across borders.

After reading our guide to the best online business bank accounts in the UK, you should have a better idea of what’s out there. Just make sure to focus on what really matters to your business, and what it needs in order to thrive and grow.

Sources used:

Sources last checked on date: 05/06/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Looking for the best joint business accounts in the UK? We compare features, fees and best usage to help you find the ideal shared account.

Read our complete comparison of the features and fees of Worldfirst vs Wise Business, written for UK businesses.

Read our comprehensive Sokin multi-currency account review for UK business customers, including pros, cons and features.

Looking for the best business accounts in Northern Ireland? Compare fees, features and benefits to find the account that supports your business best.

Read our comprehensive guide to the best UK business bank accounts for non-residents, including Wise Business, Revolut, Airwallex and Tide.

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.