Best Business Accounts for UK Amazon Sellers

Maximise your Amazon FBA profits by learning about the best business accounts for UK sellers. Our guide provides key details and compares features and fees.

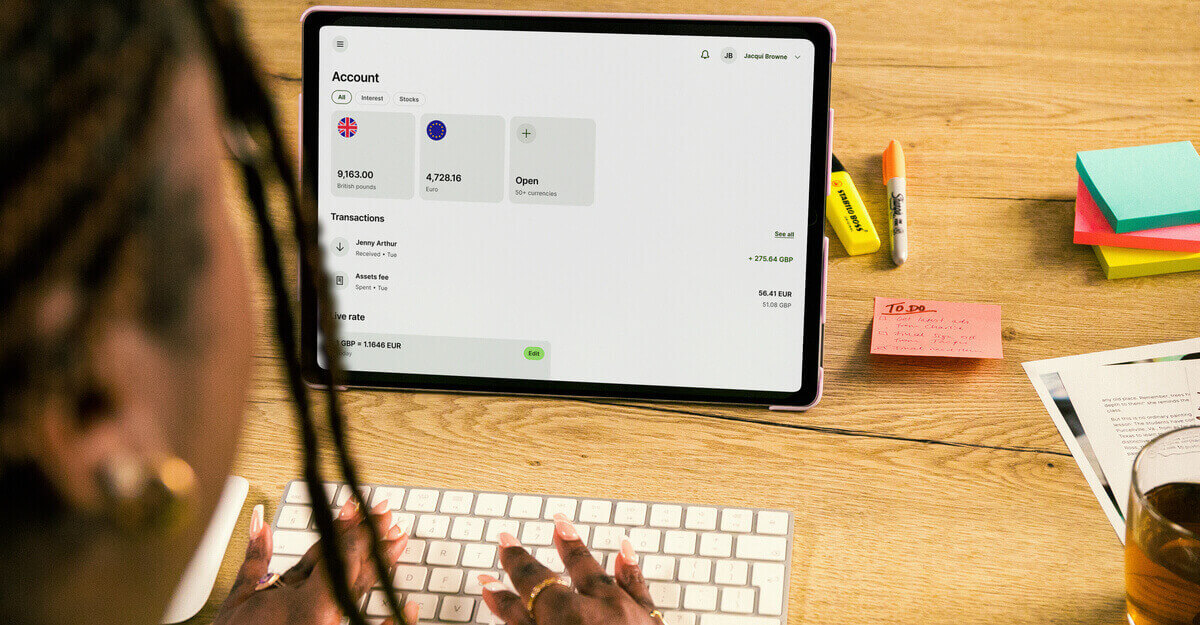

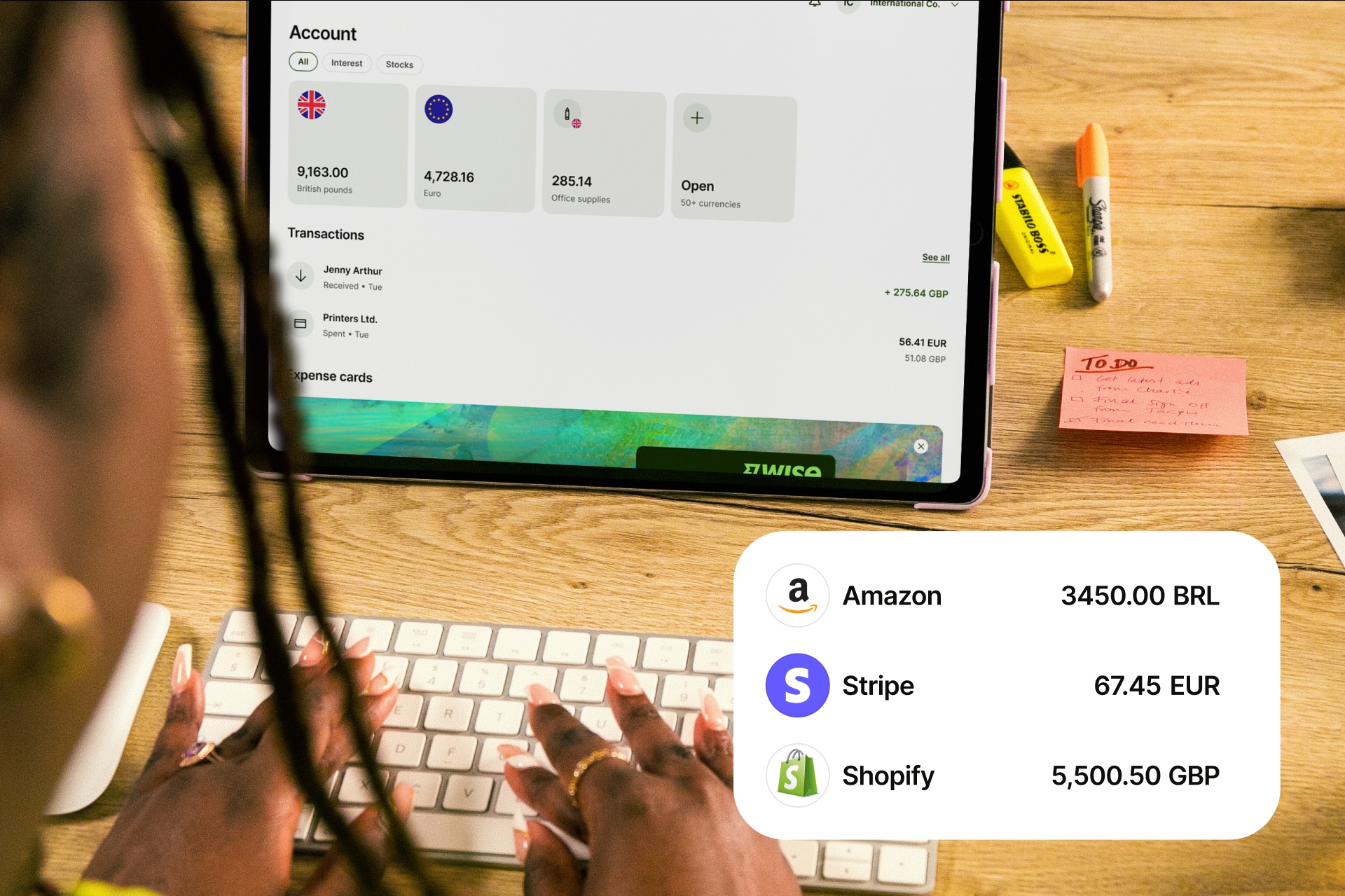

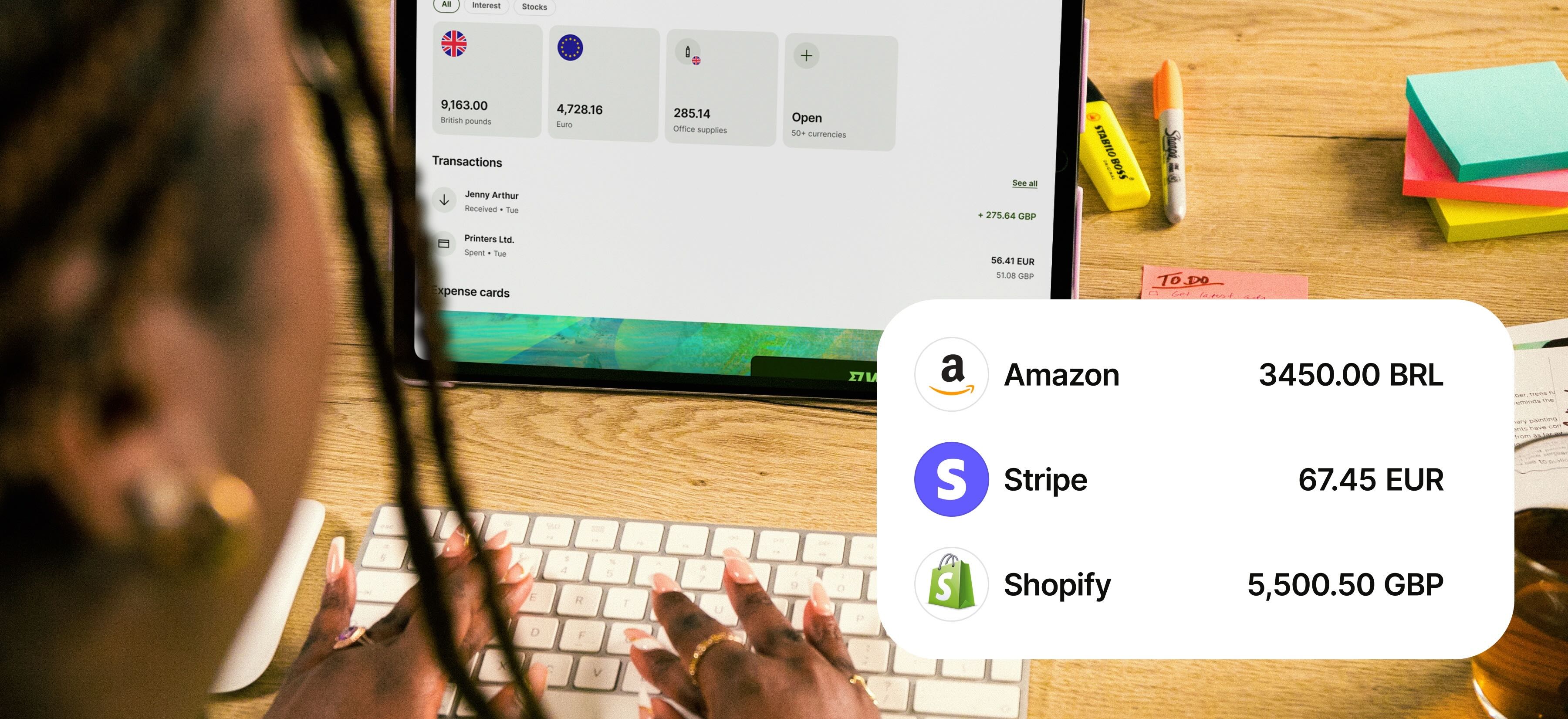

Payoneer offers business accounts which can be used to take customer card payments, receive funds in select foreign currencies, and spend with a linked card. Wise also offers multi-currency business services which include ways to get paid with local and SWIFT account details (only with Wise Business Advanced), and cards for easy spending.

If you need to make a Payoneer to Wise transfer, you’ll have to first add a Wise account to Payoneer and then arrange the transfer within the Payoneer app. You can then send money from Payoneer to Wise in a selection of currencies.

This guide walks through how to transfer Payoneer to Wise Business, why you might want to, and how the process will work.

There are plenty of reasons why a business may transfer money from Payoneer to Wise.

Perhaps you have a Payoneer account to take customer business payments, but also use Wise to benefit from low cost international transfers. Wise Business account offer currency conversion and overseas payments from 0.33%, which may work out cheaper than using Payoneer. Payoneer transfer costs vary depending on the situation, but can be up to 3% of the payment value1.

Maybe you received a payment to Payoneer but plan to spend it overseas, and want to transfer it to Wise for spending with your Wise Business card later. Wise supports 40+ currencies for holding and exchange, with a business debit card that can be used to spend in 150+ countries with the mid-market exchange rate and low fees.

Or you might need to send a payment from Payoneer to someone else’s Wise account - paying a supplier or a contractor for example. Wise offers global transfers to 140+ countries, which can arrive quickly or even instantly2 - and also has batch payment solutions for paying large numbers of people all at once.

In any case, making a withdrawal or transfer from Payoneer to Wise shouldn’t be too tricky, and we'll cover how to go about this now.

You can withdraw money from your Payoneer account to Wise by adding your Wise currency account details to Payoneer and initiating a withdrawal. We’ll look at how to add Wise to Payoneer in a moment, but first here’s the process for initiating a withdrawal from Payoneer3:

You may be asked to verify your identity using a code if two-step verification is turned on in your account. You’ll also get an email confirming the withdrawal.

Wise Business accounts offer local and SWIFT account details to receive payments in a selection of foreign currencies as well as GBP. You can get your Wise currency accounts in the Wise app. Simply log in and tap the currency balance you’re wanting to withdraw to. You’ll see the account info tab which gives the required details according to the currency.

Once you have your Wise account information to hand you can add Wise to Payoneer by taking these steps:

It usually takes up to 3 business days for the account to be added to your Payoneer account and ready for withdrawals. Watch your email for confirmation that the account has been approved.

You can withdraw money from Payoneer to another account in your name, or by sending a payment to another bank or Payoneer account which is held in a third party’s name. Fees apply, which can include costs for withdrawing in a different currency to the balance amount.

Keep costs low by making a withdrawal which does not require conversion, and which goes to a bank held in the currency of the country it is held in - a GBP account in the UK for example.

The Payoneer fee to transfer or withdraw depends on the currency involved and how much you’re sending. You may pay up to 3% of the transferred amount - but for many payments, the cost is lower. Sending GBP to a GBP account, for example, has a flat fee of 1.50 GBP per payment, or 0.5% for customers who transact frequently.

The exact time taken to make a Payoneer transfer depends on the detail of the payment or withdrawal. However, most transfers arrive in the recipient bank account within 2 business days.

Payoneer offers some handy account services for UK customers, including ways to get paid by customers at home and abroad. Drawbacks can include some of the fees involved, such as annual account fees when you don’t transact frequently, and a 0.5% currency conversion charge. Weigh up the pros and cons of Payoneer against other business service providers to see which works best for you.

Wise Business is safe to use and you can learn more about Wise Security here. Wise is a regulated service in the UK and also in many other countries around the world. In the UK, Wise is regulated and overseen by the FCA, and has to take measures to keep customers and their accounts safe to maintain its licence. These include safeguarding customer funds and using industry standard security protocols.

| Learn more about Wise security in the UK |

|---|

If your company plans to send money from Payoneer to Wise, start by opening a Wise Business account to access international account details to receive payments in 8+ currencies. Wise is trusted by thousands of customers and scores Excellent 4.3 out of 5 stars on Trustpilot with +230,000 reviews4.

"Compared to some payment providers who charge us approximately $7.80 per transaction vs $3.75 via Wise, we’d say that Wise payments are more than 50% cheaper. Based on our volume this translates to around $10k saved monthly on fees alone." Stefani Thrasyvoulou, TalentDesk

Wise Business account is quick and easy to open online, and gives you a powerful platform for sending, receiving and managing your business finances in multiple currencies.

You can also link your Wise Business account with your favourite accounting tools, such as Xero or Quickbooks. This makes keeping track of your company’s finances a breeze.

Get started with Wise Business 🚀

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Use this guide to make a withdrawal from Payoneer to Wise Business to get your money moving without any unnecessary headaches or fees.

Sources used in this article:

Sources last checked October 18, 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Maximise your Amazon FBA profits by learning about the best business accounts for UK sellers. Our guide provides key details and compares features and fees.

Looking for the best joint business accounts in the UK? We compare features, fees and best usage to help you find the ideal shared account.

Read our complete comparison of the features and fees of Worldfirst vs Wise Business, written for UK businesses.

Read our comprehensive Sokin multi-currency account review for UK business customers, including pros, cons and features.

Looking for the best business accounts in Northern Ireland? Compare fees, features and benefits to find the account that supports your business best.

Read our comprehensive guide to the best UK business bank accounts for non-residents, including Wise Business, Revolut, Airwallex and Tide.