Best Business Accounts for UK Amazon Sellers

Maximise your Amazon FBA profits by learning about the best business accounts for UK sellers. Our guide provides key details and compares features and fees.

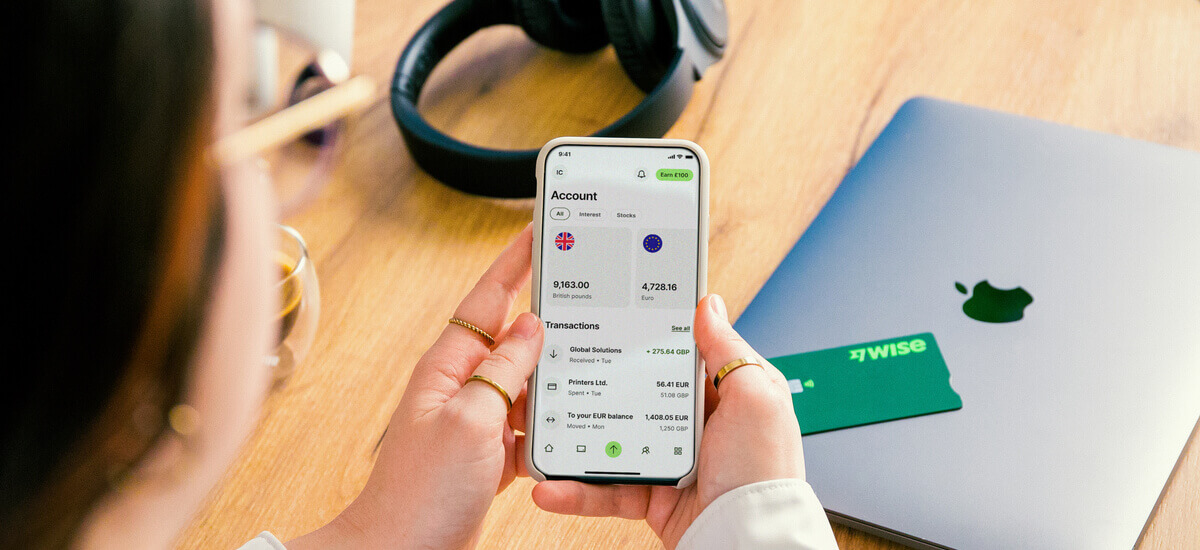

If you’re looking for a flexible way to manage your business finances across borders, Wise may be a good fit, with low cost international accounts, cards and money transfers. However, before you pick an account to use for your business it’s prudent to do a bit of research. So - is Wise legit?

Wise is a safe provider that serves millions of personal customers around the world - and over 300,000 business customers every quarter. Plus, Wise gets a Excellent 4.3 out of 5 stars rate on Trustpilot¹, from +230,000 reviews, with over 90% of reviews giving Wise a solid 4 or 5 star rating, praising the simple and efficient tools on offer.

Join us as we look at Wise security and how Wise ensures your business account is protected.

Let’s dive right into how Wise keeps business and personal customers and their money safe.

Wise has been built with customer safety in mind and has automatic and manual protections running 24/7 to keep customers safe. Wise provides ways to keep the account secure with 2-factor authentication and other safety features, but we’ll break these down, one by one, next.

One important thing to note is that Wise is not a bank, and as such is not part of the FSCS (Financial Services Compensation Scheme).

Instead, as part of the conditions of maintaining a financial service licence in the UK and internationally, Wise must follow a different set of rules to keep customer money safe, known as safeguarding. We’ll explore how that works and how it’s different to FSCS in a moment.

Since Wise is not covered by FSCS protection Wise protects customer funds through safeguarding.

This means that Wise holds all customer deposits in either²:

- Cash deposits with top tier financial institutions - like Barclays and Citibank

- Secure liquid deposits - like government bonds in the UK, US or EU

Safeguarding customer funds does a couple of things. Firstly, this means your money is not held with Wise’s own working capital, so it can’t be used for the day to day running of the Wise business.

And secondly, by holding funds in both trusted global banks and liquid assets, Wise diversifies risk and increases liquidity so funds are available whenever customers may need them.

If you need to send a payment overseas - to pay suppliers, contractors or staff for example - Wise Business can offer easy transfers to 140+ countries, with the mid-market exchange rate and low, transparent fees.

Wise payments are fast - or even instant³ - and with Wise’s batch payment tool you can even pay up to 1,000 people at one time, in a range of currencies - cutting down admin time significantly.

Wise money transfers are secure and safe to use. Wise will not usually need to hold customer funds when processing a transfer. However, if there is a need to hold funds temporarily - for example, as verification checks take place - your money is safeguarded.

You’ll be able to track your payment through the Wise app at any time. And all Wise accounts are secured with 2-factor authentication, with dedicated anti-fraud teams on hand in the background to spot and prevent suspicious activity.

Wise Business accounts are safe - even if you’re sending or holding a large amount of money.⁴ Business and enterprise level customers frequently need to send and manage high value payments - so Wise has a dedicated support team on hand to ensure the process goes smoothly. In fact, you could even get a discounted fee if you’re sending payments of over 100,000 GBP or the equivalent in other currencies.⁵

Wise Business accounts are safe, with a range of automatic and manual features which keep customers and their money secure.

Before you can create a Wise Business account you’ll complete verification checks which are a legal requirement, and part of ensuring accounts can’t be used for illegal or fraudulent activities. Once you have your Wise Business account set up, you can add 2- factor authentication⁶ to keep your details and transactions secure. You’ll also be able to review your account, transactions and balance - across over 40+ currencies - at a glance in the Wise app.

Wise Business accounts also come with a few other neat features which can both increase security and make it easier to manage your company finances day to day. For example, you’ll be able to get a Wise Business card for yourself, and Wise expense cards for team members, and set spending limits as needed. Set up instant transaction alerts in the Wise app if you want to get live spending updates in real time, and freeze and unfreeze cards as you need to.

You can also add team members to your Wise account, and manage user permissions to make sure everyone has the tools they need to do their jobs without any risk to your business. Employees can view their own transactions, while payers can be authorised to set up transfers, and account admins are able to add new users, manage permissions and more.⁷

Yes. You can hold a balance with Wise Business in 40+ different currencies. You banlance will be safeguarded and secure.

Wise Business cards come with in-built features to help keep your account secure. Of course, you’ll still need to take standard safety precautions like keeping your card PIN secret, and keeping an eye out for unfamiliar transactions. However, generally, the Wise Business card is safe to use, thanks to these security features:

If you’re concerned about a payment on your Wise card which you think may be fraud you’ll be able to freeze the card and report the issue to Wise directly. You’ll get a response within 1 business day, and can discuss with the Wise team what your next steps should be.¹¹

If you’re looking for a secure, convenient and low-cost way to manage your business finances, check out the Wise Business account.

You can open your account online or in the Wise app, and get everything you need to grow your business across borders - including the option to hold a balance in 40+ currencies, international debit and expense cards, and local bank details to get paid in 8+

(only with Wise Business Advanced)

currencies.

Wise currency conversion always uses the mid-market exchange rate with no sneaky exchange rate markups or hidden fees - just low, transparent charges based on the services you need.¹² That can keep down costs.

Besides all that you can get to know Wise Business company formation solution, where you can create a limited company in the UK and open a Wise Business multi-currency account in one go.

Manage your international finances

safely with Wise Business

So there you have it. Keeping your business - and your profits - safe is a priority for any company owner. With Wise Business you’ll know you’re getting an account and services with in-built security features to help keep your money safe. See how Wise Business can help you connect with more customers around the world today.

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Sources:

Sources last checked November 07, 2024

Wise is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011, Firm Reference 900507, for the issuing of electronic money.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Maximise your Amazon FBA profits by learning about the best business accounts for UK sellers. Our guide provides key details and compares features and fees.

Looking for the best joint business accounts in the UK? We compare features, fees and best usage to help you find the ideal shared account.

Read our complete comparison of the features and fees of Worldfirst vs Wise Business, written for UK businesses.

Read our comprehensive Sokin multi-currency account review for UK business customers, including pros, cons and features.

Looking for the best business accounts in Northern Ireland? Compare fees, features and benefits to find the account that supports your business best.

Read our comprehensive guide to the best UK business bank accounts for non-residents, including Wise Business, Revolut, Airwallex and Tide.