Four strategies to help banks win at cross-border payments

75% of consumers and SMEs seek out alternative cross-border payment providers beyond their primary bank - now is the time for banks to modernise offerings.

If you’re a UK business owner you’ll need ways to track expenses you and your team incur on behalf of your company. Gathering and reconciling expenses receipts is time consuming and prone to human error. That’s where business expense management tools come in, to cut down on manual admin and allow a smoother expense process for you and your team.

This guide covers Revolut Business expenses tools, features and fees. We’ll also introduce Wise Business which offers Wise Business expenses to manage your business spending easily, in multiple currencies, with low fees and mid-market exchange rate.

💡 Learn more about Wise Business

Yes. You can use the Revolut business expense management feature1 if you have a Revolut Business account, including Basic, Grow, Scale and Enterprise plans. Revolut business expenses app charges apply, which we’ll look at later.

The Revolut expense management feature is available for Revolut Business customers only. Not sure which Revolut account is right for you? Check out our full Revolut Business vs Revolut Personal account review here.

Revolut expenses works with Revolut debit cards, allowing you to issue debit cards to team members for tracked and managed spending. Employees can also manage out-of-pocket spending with the expense tool, and if a purchase they make on a business debit card is rejected as an expense, they can also refund the account directly.

From the point of view of the employee, the process is easy - simply make a purchase with your Revolut Business debit card, and the app will prompt you to upload a snap of the receipt for reconciliation. If you don’t do it instantly, you’ll be reminded².

As an employer, it’s pretty simple to use, too. You’ll need to issue team members with debit cards and set spending permissions in the Revolut app. You - or your nominated admin - can then view, approve or reject expenses as they come in or at intervals, to keep all your finances on track effortlessly.

You’ll need to order a debit card for any team member you want to add to expenses³:

Then, to add a team member to expenses you’ll need to turn expenses permissions on for them, from the Team tab of the Revolut app:

Once this is done there’s no other setup required⁴. Expenses are automatically categorised according to common categories - or if you’d prefer, you can customise your own expense settings to change categories, make expense reconciliation optional and more.

Some Revolut Business accounts have ongoing fees, plus there may be a fee to get a card or cards for your team members. On top of this, there’s a per employee, peer month expense charge. Here’s a roundup:

| Plan/Revolut Business fee | Basic⁵ | Grow⁶ | Scale⁷ |

|---|---|---|---|

| Monthly fee | No monthly fee | £19 per month | £79 per month |

| Card(s) available automatically with account | 1 plastic card per authorised person with no fee | 1 metal card with no fee 1 plastic card per authorised person with no fee | 2 metal cards with no fee 1 plastic card per authorised person with no fee |

| Additional card fees | £4.99 each | £4.99 each | £4.99 each |

| Revolut expenses fee | £5 per active team member/month | £5 per active team member/month | £5 per active team member/month |

| Read more about Revolut Business fees in the UK here |

|---|

All accounts offer 1 plastic card per authorised person with no fee. Grow account holders also get 1 metal card with no fee and Scale account holders get 2 metal cards with no fee. You can have up to 3 physical cards per person, and up to 200 virtual cards.

Each authorised person can have up to 200 virtual cards with Revolut Business at any time. You can generate cards instantly in the Revolut app by going to the Cards tab.

All you need to do is turn on the permissions for the specific employee - Revolut will look after the rest:

When you spend with your Revolut card you’ll be prompted to upload a snap of the receipt for the purchase. Just tap on the push notification and take a picture. You can also add your receipt image later if you’d prefer, by emailing it to your dedicated expense address.

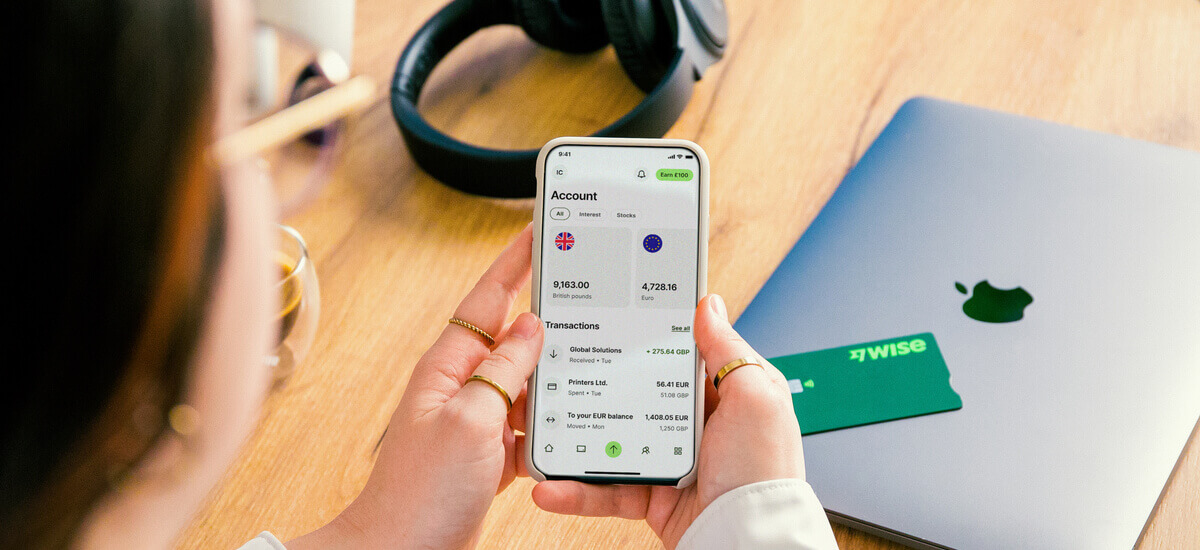

As an alternative to Revolut Business, which also offers smart expense management tools, check out Wise Business, and the Wise Business expenses feature.

Issue your employees Wise Business debit cards, and set individual spending limits for business expenses. Employees can upload receipts instantly after making a purchase so you don’t need to chase receipts, and you’ll be able to view and manage all transactions from your handy dashboard.

Wise cards offer 0.5% cashback on spending and if you’re using your card overseas you’ll get the mid-market exchange rate, no foreign transaction fee, and low conversion costs from 0.33%.

Here are some of the Wise Business features you can access:

- One time £45 account opening charge with no ongoing fees

- No ongoing fees and no minimum balance requirements

- Issue business debit and expense cards for you and your team for easy expense management

- Hold and exchange 40+ currencies using the mid-market rate with no markup

- Send money quickly or instantly to bank accounts in 160+ countries

- Get local account details in 8+ currencies, to be paid easily by others

- Generate invoices and payment links to receive money easily from customers

- Access accounting integrations, batch payments, and a powerful API

Get started with Wise Business 🚀

Revolut Business account holders can add employees to the expense feature, to make uploading receipts, categorising and reconciling expenses easy. There’s an extra fee for this service, but it can cut down on admin time and reduce the risk of human error inexpensive management significantly. Compare the options for Revolut expenses with Wise Business which offers the Wise Business expenses feature with no extra fee, to make spending in multiple currencies on behalf of your business effortless.

Sources used in this article:

Sources last checked 15-Aug-2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

75% of consumers and SMEs seek out alternative cross-border payment providers beyond their primary bank - now is the time for banks to modernise offerings.

Discover why agile partnerships are trumping complex, costly global payments infrastructure builds for banks like yours.

Can you use Payoneer in Nigeria? Find out here in our essential guide for UK businesses, covering everything you need to know.

Can you use Payoneer in the UK? Find out here in our essential guide for UK businesses, covering everything you need to know.

Can you use Payoneer in Argentina? Find out here in our essential guide for UK businesses, covering everything you need to know.

Can you use Payoneer in Türkiye? Find out here in our essential guide for UK businesses, covering everything you need to know.