Mettle business bank account review UK

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Starling bank offers businesses in the UK digital accounts which can be opened in GBP, EUR and USD, to make it easier to receive, hold and manage business payments. With a business account from Starling you can get a linked debit card, plus extras like batch payments and accounting integrations to cut down on business admin.

This guide covers all you need to know about how to open a Starling business account to hold pounds, euros and dollars - and we’ll also introduce the Wise Business multi-currency account as an alternative option which can hold, exchange, send and spend 50+ currencies.

💡Learn more about Wise Business

| 📝 Table of contents: |

|---|

Starling bank¹ has been around since 2014, and holds a full UK banking licence. With Starling, business customers, including sole proprietors, can open accounts to manage their money online and in the Starling app, with relatively few fees to pay.

Once you have a GBP business account from Starling, you can also open a Starling euro account, and a Starling USD account. Account holders can also access the Starling business toolkit² and bulk payment features for an additional fee. The Starling business toolkit offers time saving tools that can help businesses manage bills, invoices, tax, VAT and more.

If your business has a global footprint, it’s good to know Starling can also offer international business payments to 35+ countries³. Fees vary slightly, but usually include a 0.4% currency exchange fee if you have to convert from one currency to another, and a transfer fee of around 5.5 GBP per payment⁴.

| 💡 Learn more about international payment fees from Starling bank here |

|---|

Let’s start with an overview of some of the key fees and features from the Starling business account options available for small business owners and sole traders - we’ll move into the details of Starling business account requirements in just a moment.

| 💷 GBP account⁵ | No fee |

|---|---|

| 💵 USD account⁶ | £5 per month |

| 💶 EUR account⁷ | £2 per month |

| 💼 Business toolkit fee | £7 per month |

| 💸 Bulk payments fee | £7 per month |

| 🏧 UK ATM charge | No fee |

| 🔗 Accounting integrations⁸ | Xero, QuickBooks, FreeAgent |

| 🔎 Credit check details⁹ | Soft credit check is performed when opening an account, which does not impact your credit score |

To open a Starling business account you’ll need to meet Starling’s eligibility requirements, and provide adequate paperwork to get yourself and your business verified. In general, the Starling business account eligibility requirements are:

If you don't have a company registered in the UK yet you can check Wise Business company formation tool, where you can create a limited company in the UK and open a Wise Business multi-currency account in one go.

To register your Starling business account you’ll need to provide documents about yourself and your business for verification, including¹⁰:

The exact business information and documentation needed will vary depending on the type of legal entity you hold, and the work you do. Examples may include a trade registration document, signed contracts or bank account statements showing your business activity.

Starling business clients have account limits which may vary depending on whether you hold a business or sole trader account. Limits apply on card use and transfers. If you hit a limit on your Starling account, you’ll be notified, and can reach out to the customer service team to get further advice.

Here are the Starling business card limits for spending and withdrawals¹¹:

There are also limits to the value of transfers you can make from your Starling business accounts. Here’s a rundown of the key limits you should know about.

For all payments, additional limits may apply based on the transfer type, and high value transactions may require extra verification checks. If Starling needs any more information or paperwork you’ll be informed at the time you process your transfer.

If you already have a Starling personal account you’ll be able to add a business or sole trader account in the Starling app. Just log into your personal account and tap the menu button. You’ll see the option Open a new account and can tap this to register your business account.

If you’re new to Starling you’ll need to take a few more steps:

- Check you’re eligible for a Starling business account

- Gather the documents required based on your business type

- Download the Starling app and tap Open a new account

- Follow the prompts to enter your personal and business information

- Upload images of your documents for verification

To verify your Starling account you’ll be asked to provide some details and documents about your business. These vary widely based on the type of business entity you have and the sort of work you do. Documents needed could include:

Once your account has been verified you can start to transact - you’ll get your physical debit card in the post in a day or two, and can use your virtual Starling card instantly.

Applying for a Starling business account can be done from your phone and should only take about 10 minutes as long as you have all the required information and documentation. Starling reports its performance data for verification and the delivery time for debit cards¹⁶:

So, is the Starling business account a good idea? Ultimately, the best business account for you will depend on your personal preferences and requirements. However, here are a few important pros and cons to consider when choosing:

| Pros ✅ | Cons ❌ |

|---|---|

|

|

UK businesses looking for modern ways to manage their money have a good range of providers to pick from, including Starling and Revolut - and also Wise Business.

| 💡 Check out our head to head comparison between Wise Business and Starling Bank Business account |

|---|

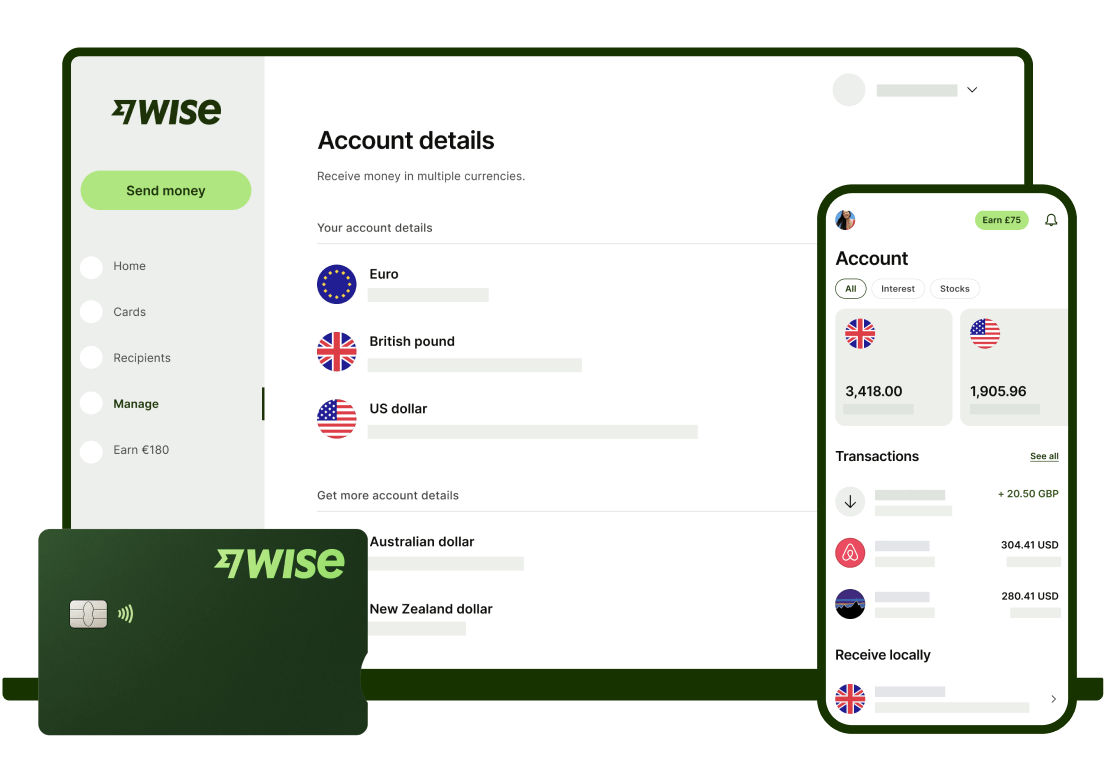

If you work with customers, contractors or staff internationally, Wise Business might be a good fit, with great features including:

Besides all that you can even earn a return on the money you hold in multiple currencies. With Wise Interest, you can get a 4.82% variable rate on the GBP held in your Wise Business multi-currency account.

Capital at risk. Current rates do not guarantee future growth.

Variable rate is based on 7 day performance as of 10 Aug 2023. This fund has returned an 0.93% annual average over the last 5 years, excluding Wise and fund manager fees. See full 5 year past performance of funds

Get started with

Wise Business 🚀

Ultimately, the right business account for you will depend a lot on how you like to work, and the sort of transactions you need to make. Starling has some handy features, including options to pay in cash at Post Office locations. However, Starling’s multi-currency features are somewhat limited compared to business accounts with more of an international focus, like the Wise Business account. Compare a few account providers, including Starling and Wise, to see which suits you best, based on the services, features and fees available.

Sources:

Sources last checked April 28, 2023

Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Wondering what are the fees related to Revolut's Business Account? Read our complete review of plans and service fees.

A guide to the Starling sole trader account vs. business account, comparing the two on features, fees and eligibility.

Can you use Airwallex in Singapore? Find out here in our essential guide for UK businesses, covering everything you need to know.

Find the best business bank accounts in Canada with our easy guide. We compare top banks and digital providers so you can choose what fits your business best.

AIB offers three types of business current accounts. Each of these accounts is specifically tailored to a segment of the market.