Morgan Stanley selects Wise Platform to enhance payments capabilities for corporate clients

We’re excited to announce that Morgan Stanley, a leading global financial services firm, has teamed up with Wise Platform, Wise’s global payments...

If you're a business who's dealing with frequent payments in Euros, you may want to look into getting a multi currency account or at least a Euro account in the UK to reduce the hassle of converting back to your local currency each time you receive payments. With a Euro account, you can hold the payments you receive in Euro and convert it whenever you want which can be handy and cost effective.

The Starling Euro Account is one of the many options available, but is it right for you? Here, we’ll look at the features and fees of the Starling Euro account, plus an alternative which could save you money on international transactions: Wise multi currency account the ideal provider for business in the UK trading internationally.

Learn more about Wise Business

multi-currency account 🌎

Is an account offered by Starling Bank to business, which lets you send, receive and hold euros, as well as transferring between GBP and EUR accounts whenever you need to.

You’ll get your own International Bank Account Number (IBAN) and full £85,000 FSCS protection¹.

Other features from Starling Bank Euro Account include¹:

| Services | Fees³ |

|---|---|

| Monthly fees | £2 |

| Hold, send and receive euros | Free |

| Currency conversion fee | 0.4% transfer fee |

When you convert between currencies, make sure that you check the exchange rate that's being applied as it might different than the mid-market rate which means that it's an added fee to the transaction on top of the transfer fee and delivery fee. You also need to take care when converting money between your GBP and EUR accounts in the weekend, since Starling Bank may apply a different exchange rate during this period considering potential fluctuations in the market.⁴

It can get pretty expensive when currency conversion is involved with most traditional banks, Starling Euro account can be an option, but the monthly fee and weekend exchange rate are downsides for this provider. However, alternatives like Wise Business Multi-currency account can reduce the conversion cost for you.

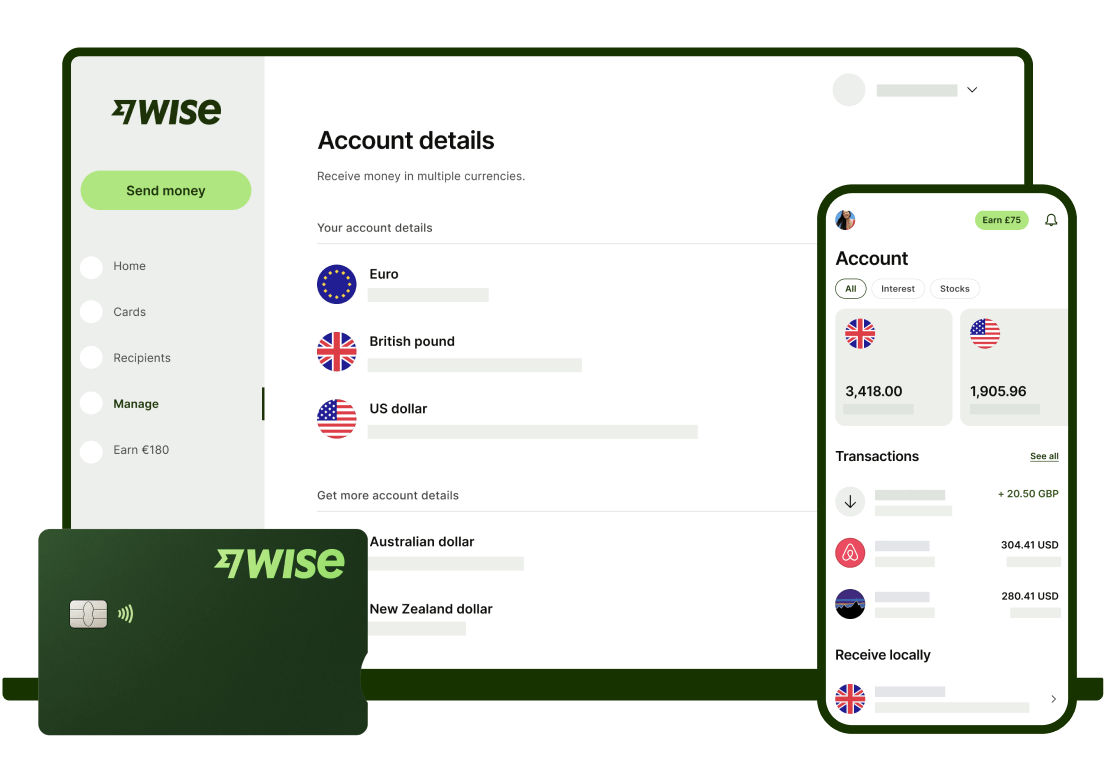

When you open a multi-currency account with Wise, you can take advantage of conversion always at the mid-market rate, remove the cost to receive payments and only get charged a small fee when you convert or make transfers between currencies.⁵

You’ll get a European IBAN and an international business debit card - this covers multiple currencies, so you don’t need a separate card for each currency.

Wise Business doesn't charge a monthly fee, only a small one-time fee to open your account. With Wise multi currency account your business can:

With Wise Business you can even earn a return on the money you hold in multiple currencies. With Wise Interest, you can get a 4.82% variable rate on your GBP balance held in your Wise Business multi-currency account.

Capital at risk. Current rates do not guarantee future growth.

Variable rate is based on 7 day performance as of 10 Aug 2023. This fund has returned an 0.93% annual average over the last 5 years, excluding Wise and fund manager fees. See full 5 year past performance of funds

Wise Business multi-currency account also allows you to send batch payments and integrates with Xero and Quickbooks, so you can cut down admin time and focus on growing your business without borders.

Start saving today with Wise Business

Summary

And that’s it - all the essentials you need to know about the Starling Bank Euro Account, including features and fees. We’ve even thrown in an alternative, so you can check and find the best option for you, whether it’s for personal transfers or for business.

Sources and information:

Sources last checked April 14, 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

We’re excited to announce that Morgan Stanley, a leading global financial services firm, has teamed up with Wise Platform, Wise’s global payments...

Discover how to automate expense reporting with our complete guide that covers step-by-step process, tools and best practices.

Travel and expense (T&E) processes are necessary in any business in which employees may spend on allowable business expenses, which need to be recorded,...

Discover the 6 best reconciliation tools available for businesses in the UK.

Discover the 5 best enterprise management tools for businesses in the UK.

South Korean cross-border payments giant Moin has revolutionised the global payments experience for its customers through Wise Platform's Send product.