Building the future of global money movement

From messaging upgrades to hosted onboarding, here is how we’re evolving to help you and your end customers move money with speed and confidence.

South Korean cross-border payments giant Moin has revolutionised the global payments experience for its customers. Integrating with Wise Platform's Send product, Moin has slashed transaction times by an impressive 95%. Now, around 60% of payments are completed in under 20 seconds. *

Problem: Rapidly changing customer expectations and high operational costs

Traditional international payment methods were slow, costly and inefficient for leading cross-border payments provider Moin.

The South Korean global payments provider faced a familiar challenge - high operating costs led to fees that undermined its ability to compete on price against cheaper, faster alternative providers.

Customers, growing accustomed to the speed, efficiency and transparency of digital services, began demanding more from the cross-border payments provider. They wanted to know the exact cost of their transaction, when it would arrive and the total amount that would reach the beneficiary's account.

Moin knew it needed to urgently address these issues to retain its customers, including over 3,700 universities, making payins and payouts in KRW across South Korea, Singapore, Japan, Hong Kong, the USA and Lithuania. But how could it upgrade its infrastructure to deliver fast and secure international payments services in a cost-effective, seamless way?

This is where Wise Platform came in.

Solution: Collaborating to achieve a competitive advantage

Wise Platform empowers banks, fintechs and enterprises to build global payments solutions. Businesses like Moin work with Wise Platform to integrate its scalable infrastructure to access a network with five direct connections into payment systems and 90+ banking and payment partners.

Through extensive consultations and a detailed assessment of the payment provider’s requirements, Wise Platform and Moin identified the most critical areas for improvement in its service, focussing on speed, cost and transparency.

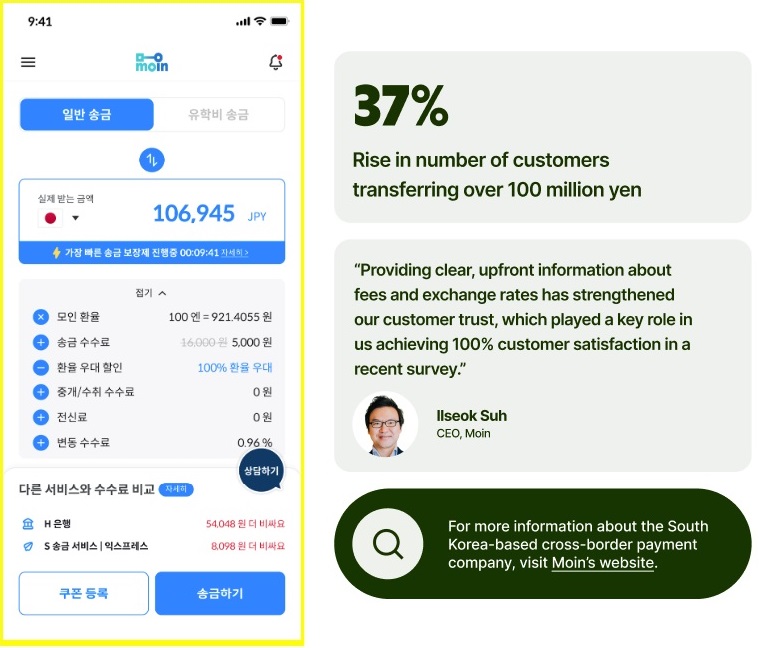

"The integration has significantly improved our operational efficiency, reduced costs and enhanced the speed and transparency of our cross-border payment services. Providing clear, upfront information about fees and exchange rates has strengthened our customer trust, which played a key role in us achieving 100% customer satisfaction in a recent survey.”

Working with the team at Wise Platform, Moin was able to seamlessly integrate the Send solution, minimising its cross-border compliance risk thanks to the infrastructure provider’s 65+ licences worldwide.

Impact: Reduced operational costs and a better customer experience

Moin's partnership with Wise Platform has yielded remarkable results, slashing the company's money transfer time by an astounding 95%. Reflecting on the success of the Send API integration, Moin’s Chief Executive Officer, Ilseok Suh, commented, “Our experience with Wise Platform has been exceptional.

The integration has significantly improved our operational efficiency, reduced costs and enhanced the speed and transparency of our cross-border payment services. Providing clear, upfront information about fees and exchange rates has strengthened our customer trust, which played a key role in us achieving 100% customer satisfaction in a recent survey.”

He added, “The dedicated support from the Wise Platform team has been invaluable, ensuring a smooth implementation and ongoing success. We highly recommend Wise Platform to other businesses seeking to optimise their international payment solutions due to its comprehensive, reliable and customer-focused approach.”

Now, thanks to Wise Platform’s Send solution, Moin can pay out via local transfers to digital wallets, cards and other methods, as well as offering a diverse range of currency options including JPY, AUD, USD, HKD and CAD to its global customers. Furthermore, by displaying the mid-market rate, Moin’s customers have full visibility on the associated costs and how much they’re paying.

What’s more, the increased speed and efficiency of transactions, coupled with the flexibility to transfer large sums of up to 100 million yen in Japanese yen, led to a 37% rise in the number of customers transferring over 100 million yen.

These benefits have not gone unnoticed. As one Canadian customer based in South Korea explained, "I initially tried Moin because its international transfer fees were lower than banks, and I found it reliable, so I keep using it. The low fees and fast service make it my go-to choice for remittances." What’s more, many transactions are now instant, with around 60% completed in under 20 seconds.*

Since the integration, Moin has secured more competitive exchange rates and reduced operational costs. In turn, this has allowed the business to lower fees, which translates to cost savings for its customers.

"What’s more, the increased speed and efficiency of transactions, coupled with the flexibility to transfer large sums of up to 100 million yen in Japanese yen, led to a 37% rise in the number of customers transferring over 100 million yen.”

Wise Platform’s General Manager for Asia Pacific, Samarth Bansal, was keen to share the business’ enthusiasm for this collaboration, commenting, “South Korea is a key remittance market in APAC, yet much of the volume still flows through traditional, inefficient channels. This often results in high costs, slow transfers, and a lack of transparency for customers.

Moin’s commitment to disrupting this outdated system aligns perfectly with our mission at Wise. The business was looking for a global provider to offer the necessary infrastructure without the need to build complex technology from scratch. Together, we’re excited to bring a modern, transparent and more convenient remittance service to South Korea, making international money movement faster, cheaper and better for everyone.”

Today, Moin customers have more currency options than ever and can process payments to more countries, expanding the business’ reach as it scales internationally.

For more information about the South Korea-based cross-border payment company, visit Moin’s website: www.eng.themoin.com

Learn more about Wise Platform

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

From messaging upgrades to hosted onboarding, here is how we’re evolving to help you and your end customers move money with speed and confidence.

Building on momentum, IBKR has now rolled out the same seamless transfer experience to business customers across 50+ countries.

Discover how global fintech Aspire partnered with Wise Platform to deliver over half its payments instantly.

Discover how recipient verification ensures your customers send money to the right people, eliminating payment failures and friction.

Explore the 5 cross-border payment trends defining 2026. From G20 targets to retail customers, discover how global payments are moving from sprint to standard.

Discover how EQ Bank launched international payments in just one month — with 75% arriving instantly* and 70% becoming repeat users.