Strategic planning for international corporate retreats: a comprehensive guide

Plan the ideal corporate retreat abroad. Discover exclusive venues, unique team-building activities, and seamless logistics for a successful event.

As your business grows you might decide it's time to look at automated expense reporting to help optimise your business spending and cut out unnecessary admin and costs. Using expense report automation tools can make it easier to see business spending overall, by category, by team or individual, giving you insights into how costs may be reduced, and productivity improved.

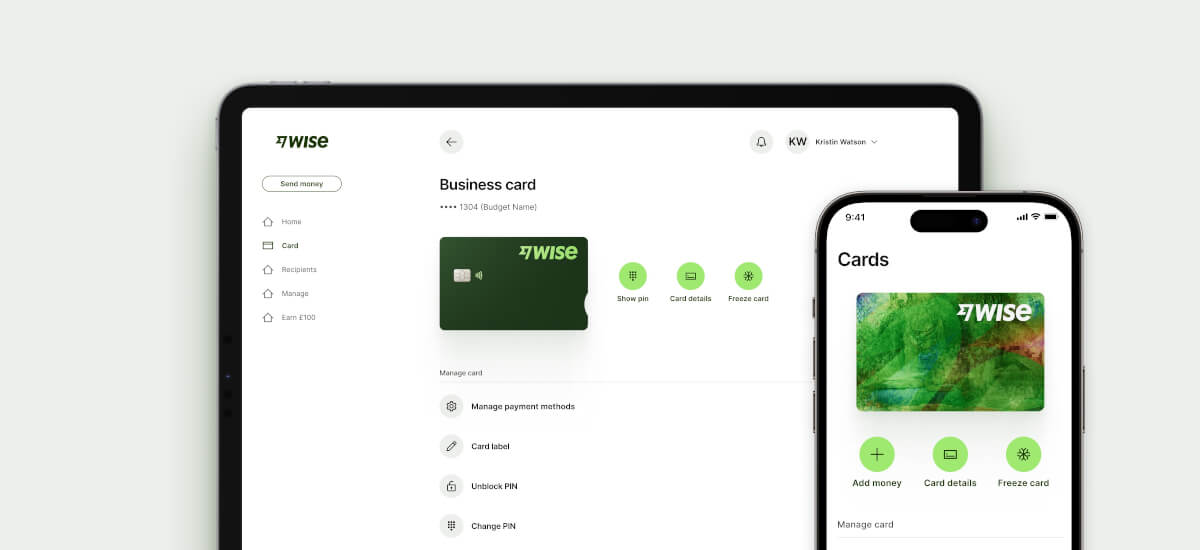

Join us as we walk through the basics of expense automation. We’ll also introduce Wise Business, which offers the Wise card to help manage employee spending across currencies, with the mid-market exchange rate and low, transparent fees.

💡 Learn more about Wise Business

Automated expense reporting offers a complete spend management solution for businesses, which can help save time and money, avoiding duplication or repetition of costs and optimising business spending.

Automated expense reporting aims to bring together employee expenses, employee business travel and invoicing, to give finance teams better insights into employee initiated expenses, such as travel costs, accommodation during business travel, subscriptions and invoice payment.

By making it easy for employees to report spending - and for management and finance teams to view and monitor it - businesses can cut down unnecessary or unauthorised costs. It’s also good for employees, streamlining the expense management system so they get reimbursed more quickly for out of pocket spending on behalf of the business.

The features which come with any automated expense reporting system can vary depending on the customer niche and the focus of the provider, but can include:

Let’s walk through why you may choose to automate expense reports - we’ll also take a look at some options to consider later.

Expense report automation may apply to out of pocket spending, or other employee initiated spending like contracting with a new supplier. The process for expense report automation will look a little different in each case, but as a broad outline, the steps will be the same.

Let’s walk through the steps that may exist for employee out of pocket expense management and approvals, in a business which has implemented expense report automation:

There are many benefits of automating expense reporting which can vary depending on the type of spending and the size and structure of your business. Different providers also offer unique tools which can offer their own perks suited to different customer needs. Here are a few of the benefits of automated expense systems:

There are plenty of great tools and providers available in the UK that help with automating expense reports. Services do vary quite significantly, with different providers catering for their own customer niches.

Some you might want to consider include:

Spendesk1 - view all spending across employee expense, project costs, procurement, marketing, digital spend, and more, in one place, to make it easier to manage liquidity and cash flow. Issue employee cards to streamline the expense process for both the employee and the management.

Concur2 - tool from finance giant SAP, which covers end to end requirements from writing an expense policy, travel and employee initiated invoicing, through to creating the tools to make the process simple for all. SAP works with large global businesses and organisations to help reduce reliance on manual processing and paperwork.

Expensify3 - Spend and travel management tools, including receipt tracking, bill pay and invoices, and company cards to make spending easier for employees. Integrates with many other popular business and finance apps for convenience.

Payhawk4 - Issue physical and digital corporate cards which offer multi-currency functions across some common currencies, set card spend policies and controls, to manage and automate expense claims - options also available for large businesses including accounts payable support and supplier management.

Pleo5 - Physical, temporary, virtual and vendor cards, invoice management processes and employee reimbursement options to make it easier and frictionless to manage company expenses and spending.

If it’s time for your business to embrace automated expense reporting, take a look at this step-by-step guide on how to implement automated expense reports as a UK business.

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

The expense management workflow is the step by step process of managing an expense, from spending, receipt capture and approval, through to reimbursement and reporting. Within this workflow there will be checks and balances such as a policy about what spend is allowed, and automated and manual approval steps to make sure no unauthorised spending is allowed to slip through the net.

Automated expense reporting can take a lot of the manual administration out of the expense reporting and management process. Software can be used to allow employees to record and evidence spending, which is then categorised, approved and reported accurately, allowing for quick reimbursements for the employee, and less admin for everyone.

Yes. Often expense reporting tools can be integrated with popular cloud accounting solutions to make the end to end process of expense management easier.

If you’re managing business spending across different currencies, Wise Business expense cards can be a great tool to use alongside your preferred automated expense reporting system.

Wise Business offers powerful international accounts which support currencies, and which you can use to issue physical and virtual employee and expense cards to make spending and withdrawals easier. Wise always uses the mid-market exchange rate with low fees for foreign currency spending, with no foreign transaction fees to pay - which can make this a very cheap and convenient option if your team needs to spend overseas or in foreign currencies on behalf of your business.

Get started with Wise Business 🚀

Using an automated expense reporting system can mean expense management is easier, cheaper, and less prone to human error. Expense automation removes a lot of the admin burden of the process, and also allows for easier overview and insights into spending which is useful to eliminate unnecessary or unauthorised spend. Use this guide to automated expense reporting to see if it’s right for your business - and take a look at the Wise card if you’re managing company spending across currencies.

Sources used in this article:

Sources last checked December 13, 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Plan the ideal corporate retreat abroad. Discover exclusive venues, unique team-building activities, and seamless logistics for a successful event.

Plan your next corporate retreat in Portugal! Discover top venues, mild weather, and the perfect balance of work and play from Lisbon to the Algarve.

Learn how ecommerce payment processing works and find out more about providers, including their fees and features in this complete guide.

Plan your perfect corporate retreat in Greece. Discover stunning venues, unique team-building activities, and luxurious accommodations for your team.

Explore the corporate retreat cost in the UK and abroad, what drives per-person prices, and how Wise Business can cut FX fees on international spend.

Discover how to plan a corporate retreat in Italy, compare destination costs, and see how Wise Business can cut FX fees when paying venues and suppliers.