Mettle business bank account review UK

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Revolut®¹ launched back in 2015, and has rapidly expanded to cover a broad range of countries and regions, with multi-currency personal and business account products, cards, and more.

If you’re a freelancer, or if you’ve got a UK registered company, you might be thinking about opening a Revolut Business² account. If you trade internationally, Revolut Business is an attractive option as you can hold and exchange 25+ currencies, making it easier to pay and get paid from abroad.

This guide covers everything there is to know about how to open a Revolut Business account. We’ll also touch on a Revolut Business alternative for you to compare and consider - Wise Business.

Before we get into the details about how to open a Revolut Business account (UK), let’s look at some of the key features and fees for using Revolut Business.

Revolut Business UK offers several different plan options:

- Free - no monthly fee

- Grow - 25 GBP/month fee

- Scale - 100 GBP/month fee

- Enterprise - features and fees are custom made depending on requirements

If you choose the free account plan you’ll find you have a good range of features available, but not everything Revolut offers. Plus, there are fees for some services you get for free with the higher account tiers. That means you’ll need to weigh up which account plan will work best for you, as paying a monthly fee gives access to a higher range of fee free transactions, which may still make it a worthwhile choice for some businesses.

Here are some of the key features offered by Revolut - not all features come with all account plans, so you’ll need to double check the options for the plan you prefer before you sign up:

- Physical and virtual payment cards

- 25+ currencies for holding and exchange

- Local and international transfers

- Crypto exchange

- Bulk payments

- Accept payments online and in person

- Add team members to your account

- Account analytics

- Payroll services

Not sure if Revolut Business is right for you? There are also Revolut Personal account options - learn more about the differences between Revolut Business and Revolut Personal here.

Let’s run through an overview of some of the key features of different Revolut Business account options.

| 💸 Free account available? | Yes³ |

|---|---|

| 💰 Paid account tier options | £25/month for Grow plans, £100/month for Scale plan, with tailor made Enterprise plans also offered |

| 🌍 Currencies supported | Hold and exchange 25+ currencies, spend with your Revolut card in 150+ currencies, get local holding accounts for GBP and EUR |

| 🗺️ Exchange rate | Free Standard plan holders get the mid-market rate + 0.4%; Grow and Scale customers can exchange with no fee and the mid-market rate to their plan limit, with the 0.4% fee kicking in once that limit is exceeded |

| 🏧 ATM withdrawal fee | 2%⁴⁵⁶ |

| 🔗 Accounting integrations | Available |

We’ve mentioned that the different Revolut Business plans have their own features and fees. Here’s a rundown of some of the key differences to help you figure out which is best for you:

| Monthly fee | None |

|---|---|

| Currency exchange | Mid-market rate + 0.4% |

| Local transfers | 5 free per month, then £0.2 each |

| International transfers | £3 each |

| Other key features | Not all account features are available |

| Monthly fee | £25 per month |

|---|---|

| Currency exchange | Mid-market rate for the first £10,000 exchanged, then 0.4% |

| Local transfers | 10 free per month, then £0.2 each |

| International transfers | 100 free per month, then £3 each |

| Other key features | Access all account features, and get 1 free debit card |

| Monthly fee | £100 per month |

|---|---|

| Currency exchange | Mid-market rate for the first £50,000 exchanged, then 0.4% |

| Local transfers | 50 free per month, then £0.2 each |

| International transfers | 1,000 free per month, then £3 each |

| Other key features | Access all account features, and get 2 free debit cards |

You can open a Revolut Business account as a freelancer or a business owner. The exact process you follow, and the documents you need, may vary a bit depending on your personal situation. The good news is that you can open your Revolut Business account entirely online or with your smart device, with no need to visit a physical location or branch.

Here’s how to open a Revolut Business account in the UK:

- Visit the Revolut website or download the Revolut app

- Click Sign up

- Enter the required details (more on what’s needed, next)

- Upload any requested documents for verification - usually a photo of your ID and a selfie⁷

- Your account will be reviewed by Revolut staff, and you’ll be notified when it’s ready to use

Let’s walk through the documents and information necessary to open a business account with Revolut. It helps to know you can open a Revolut Business account as a freelancer, or with a UK incorporated company. The exact process you follow to get your account set up may vary depending on the entity type you have, but you’ll be guided through the requirements by on screen prompts. If you ever get stuck, you can also reach out to Revolut directly to ask for support.

Here’s what you need to open a Revolut Business account⁸:

- Verification of your identity - usually an uploaded photo of your ID and a selfie

- Details of your business operating address

- Details of the nature of your business

- Information about your intended usage for the account

If you’re looking to open a Revolut Business account for your UK incorporated business you’ll need some additional information:

- Basic incorporation details

- Details about the shareholders and directors of your company

- ID verification for the shareholders and directors of your company

- Power of Attorney if you are not a director or shareholder of the applying business

Once you’ve submitted all your information, the team at Revolut will review everything and get back to you by email if there’s any further information or new documents needed.

Revolut aims to have all accounts verified in 24 hours. That means that once you’ve completed your application and uploaded all your paperwork, you can expect to hear more in a day or so.

To make sure the opening process runs smoothly you might want to double check all of the information submitted, and check that all of the documents uploaded are up to date and snapped or scanned according to the requirements. One common reason for delays in opening digital account products is that the image quality for your uploads isn’t good enough - so checking this in advance can save time later.

UK businesses have lots of alternative providers to choose from when picking a new business account. If you’re looking for a low cost digital business account with multi-currency features and no monthly fees, check out Wise Business.

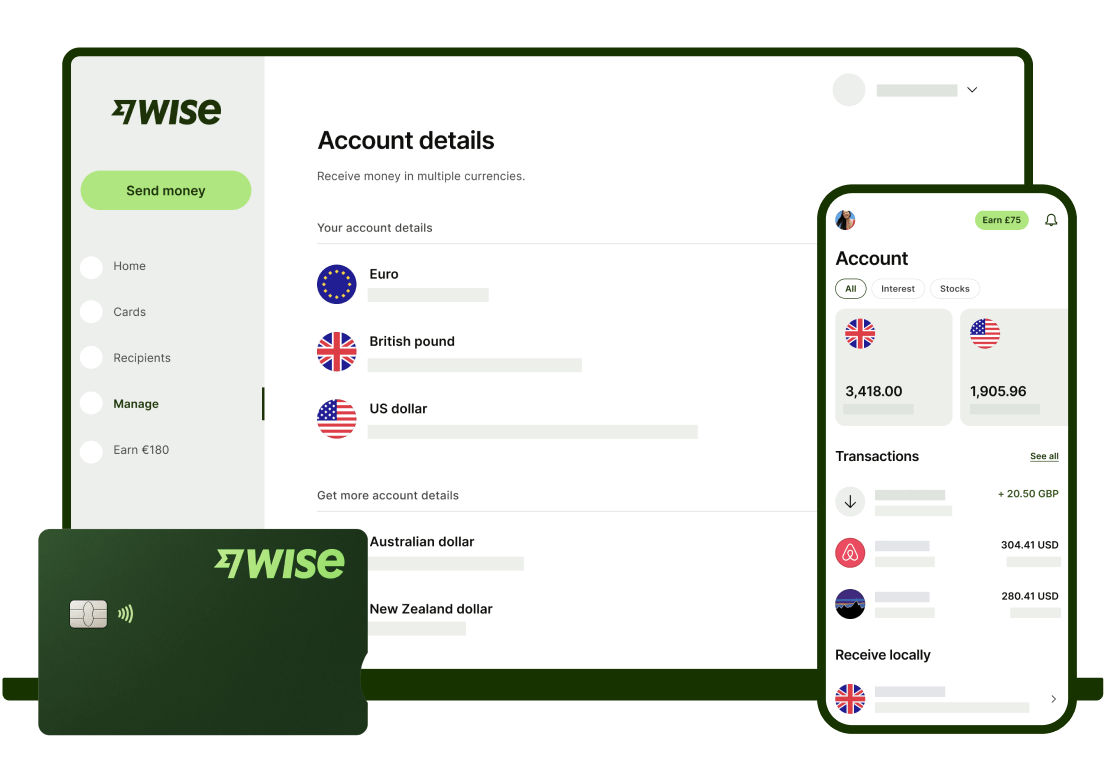

Open a Wise Business multi-currency account online or in the Wise app, to hold and exchange 40+ currencies with the mid-market rate and low fees from 0.41%⁹. You’ll also get your own account details for 9 currencies, so you can get paid easily from 30+ countries.

Need to send payments to employees, contractors or suppliers overseas? You can do that with Wise too. Send money to 160+ countries, with the mid-market rate and fees from 0.41%. All Wise Business accounts can set up batch payments, to pay up to 1,000 people at once, even in different currencies.

With Wise Business you can even earn a return on the money you hold in multiple currencies. With Wise Interest, you can get a 4.82% variable rate on your GBP held in your Wise Business multi-currency account.

Capital at risk. Current rates do not guarantee future growth.

Variable rate is based on 7 day performance as of 10 Aug 2023. This fund has returned an 0.93% annual average over the last 5 years, excluding Wise and fund manager fees. See full 5 year past performance of funds

Start saving today with Wise Business

Not sure which UK business account provider is right for you? You can also learn more about how Revolut measures up against another popular UK provider, Starling®, in this Revolut vs Starling business account comparison.

Revolut Business has an interesting selection of account plans, including Free accounts with no monthly fees, and higher tier account options which have a monthly charge but which also offer enhanced features and more free transactions. Compare the different Revolut Business account plans against an alternative, like Wise Business, to see which might suit you and your company best.

Sources used in this article:

Sources last checked June 13, 2023

Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Wondering what are the fees related to Revolut's Business Account? Read our complete review of plans and service fees.

A guide to the Starling sole trader account vs. business account, comparing the two on features, fees and eligibility.

Can you use Airwallex in Singapore? Find out here in our essential guide for UK businesses, covering everything you need to know.

Find the best business bank accounts in Canada with our easy guide. We compare top banks and digital providers so you can choose what fits your business best.

AIB offers three types of business current accounts. Each of these accounts is specifically tailored to a segment of the market.