BIG WORLD. EVEN BIGGER MISSION

Mission Update Q1 2023

Mission Update Q1 2023

Top story

New releases

Speed

Fees

Convenience

Transparency

Get 3.63% variable rate on GBP and 2.25% variable on Euro. Wise Account customers in France, Spain, Finland, Netherlands, Austria and Luxembourg are now able to switch to Interest and keep their money in a fund that holds assets backed by governments and generate a return that follows the central bank interest rate. Investments, even in a low-risk fund, are never guaranteed. Offered by Wise Assets.

The same account, now better for those of you in the US. Whether you're a personal or business customer, you now get the power of an international account with the added security of up to $250,000 in FDIC passthrough insurance when you opt-in to earn interest on your USD balance. You'll benefit from the same instant access when sending, spending, and receiving money. No minimum balance required. *Rate accurate as of May 3rd 2023 and subject to change

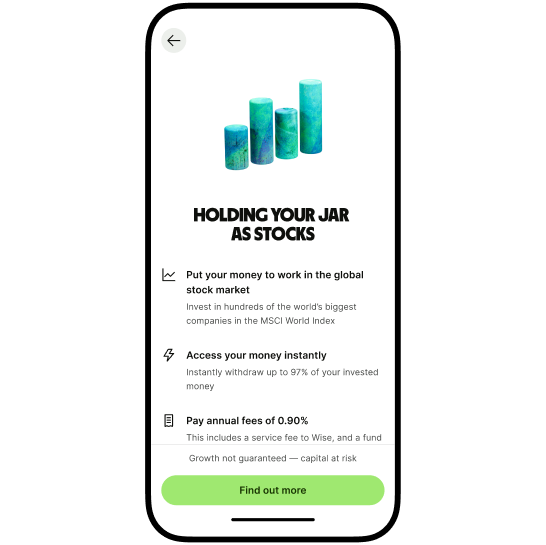

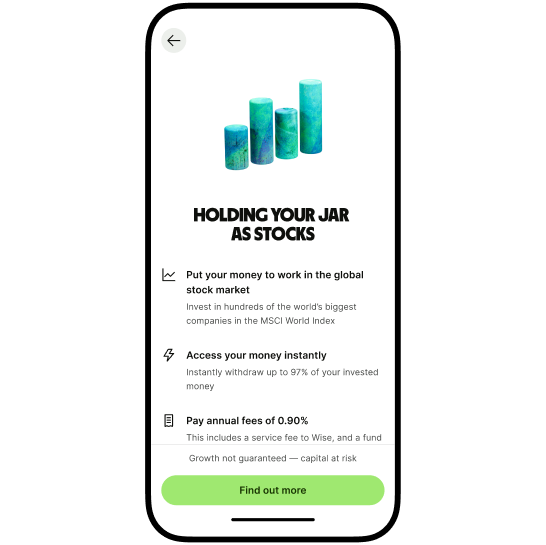

If you’re a personal Wise Account customer in Singapore you can now convert your money to US dollars and hold it in a fund that invests in hundreds of the world's biggest companies. When investing, your capital is at risk.

In the European Economic Area (EEA), if you hold cash in US dollars, Euros, and Great British Pounds then you will have received cashback on your balances since the start of the year.

Get 3.63% variable rate on GBP and 2.25% variable on Euro. Wise Account customers in France, Spain, Finland, Netherlands, Austria and Luxembourg are now able to switch to Interest and keep their money in a fund that holds assets backed by governments and generate a return that follows the central bank interest rate. Investments, even in a low-risk fund, are never guaranteed. Offered by Wise Assets.

The same account, now better for those of you in the US. Whether you're a personal or business customer, you now get the power of an international account with the added security of up to $250,000 in FDIC passthrough insurance when you opt-in to earn interest on your USD balance. You'll benefit from the same instant access when sending, spending, and receiving money. No minimum balance required. *Rate accurate as of May 3rd 2023 and subject to change

If you’re a personal Wise Account customer in Singapore you can now convert your money to US dollars and hold it in a fund that invests in hundreds of the world's biggest companies. When investing, your capital is at risk.

In the European Economic Area (EEA), if you hold cash in US dollars, Euros, and Great British Pounds then you will have received cashback on your balances since the start of the year.

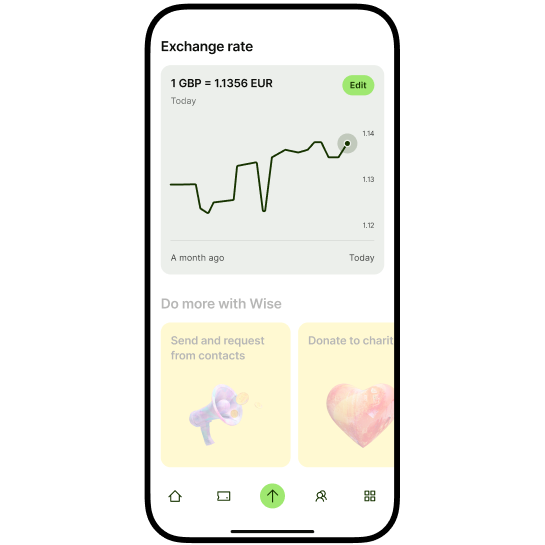

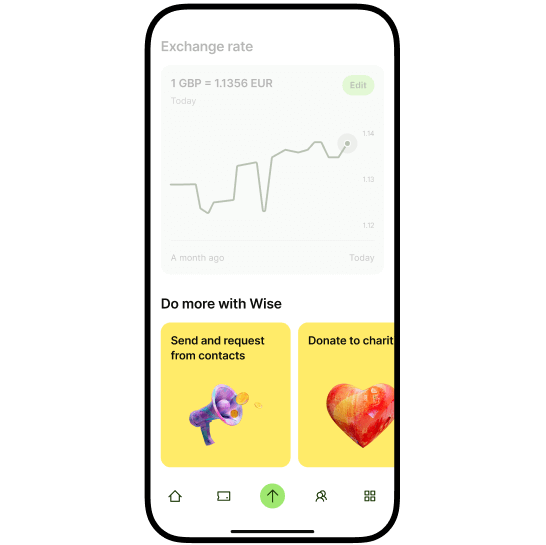

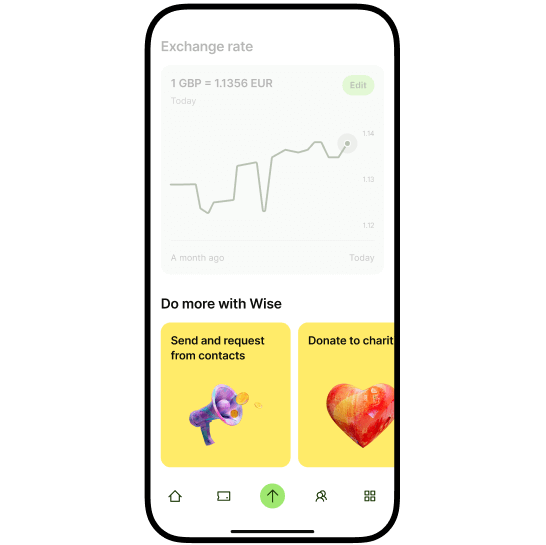

You can now customise the graph on your home screen to follow your favourite currencies without needing to leave the Wise app.

Scroll to the bottom of your home screen to learn how to make the most of your Wise account with the features you’re not using yet.

You can now customise the graph on your home screen to follow your favourite currencies without needing to leave the Wise app.

Scroll to the bottom of your home screen to learn how to make the most of your Wise account with the features you’re not using yet.

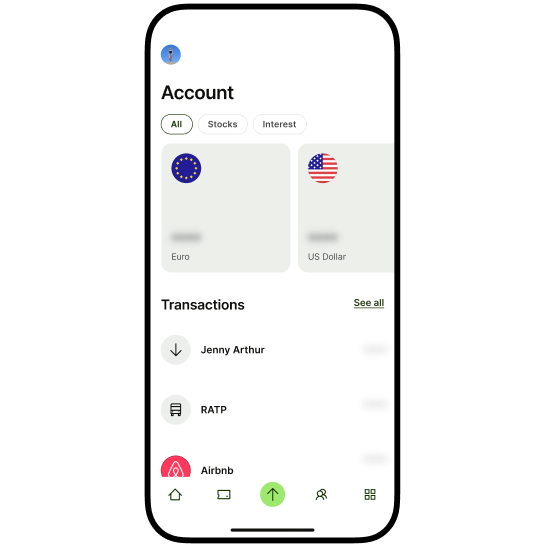

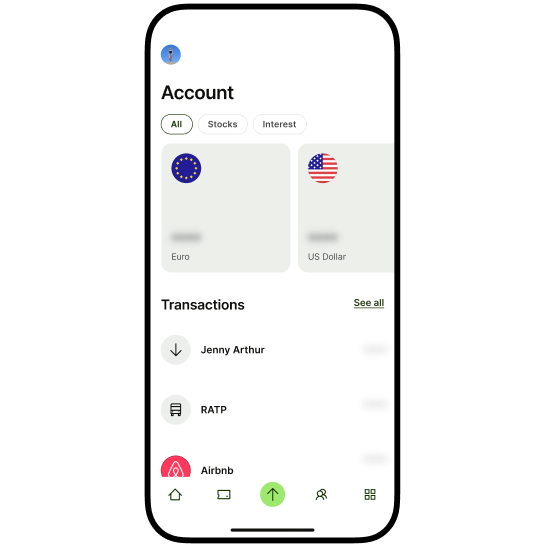

We’ve added merchant logos to your transactions so you can easily spot what you spent, and where.

Type to search for any transaction type. Whether it’s money you sent, spent, converted, fees, top-ups, or money sent to you from others.

We now give you more information when a transaction gets declined. Whether it's because you don't have enough money in your account or something else, we'll give you next steps to rectify it and get your transaction approved as soon as possible.

We’ve added merchant logos to your transactions so you can easily spot what you spent, and where.

Type to search for any transaction type. Whether it’s money you sent, spent, converted, fees, top-ups, or money sent to you from others.

We now give you more information when a transaction gets declined. Whether it's because you don't have enough money in your account or something else, we'll give you next steps to rectify it and get your transaction approved as soon as possible.

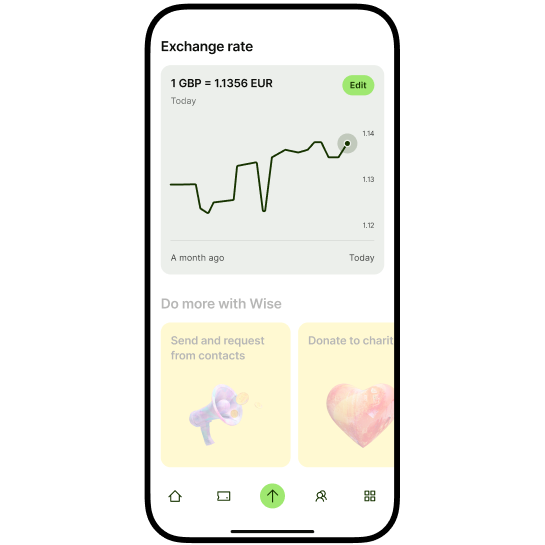

Show your friends how the Wise app works, while keeping your sensitive data hidden.

We’ve added an extra layer of protection and you’ll now be prompted to enter your Wise password when you login via a third party.

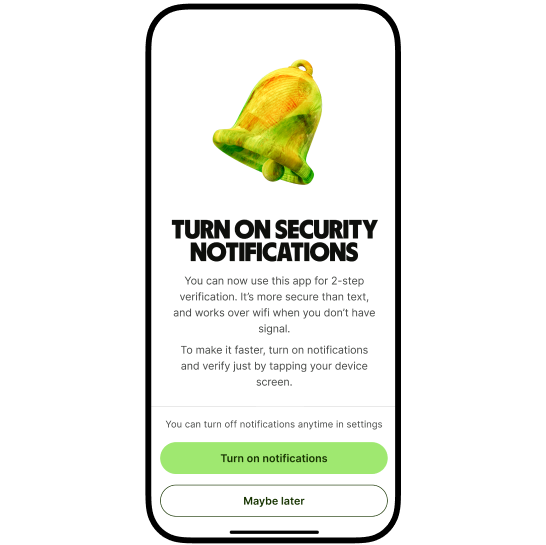

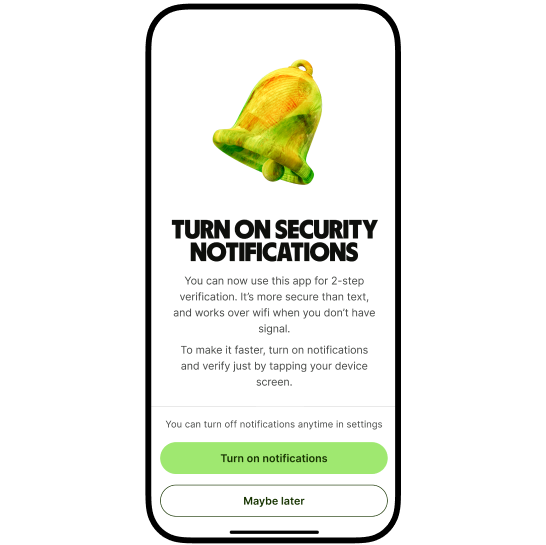

We’ve added more security to Wise accounts right from the beginning - when you register. When you create a new account, you’ll now be asked to complete a 2-step verification using a push notification.

Show your friends how the Wise app works, while keeping your sensitive data hidden.

We’ve added an extra layer of protection and you’ll now be prompted to enter your Wise password when you login via a third party.

We’ve added more security to Wise accounts right from the beginning - when you register. When you create a new account, you’ll now be asked to complete a 2-step verification using a push notification.

What's new?

What's new?