Q4 2023 Mission Update: Price

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

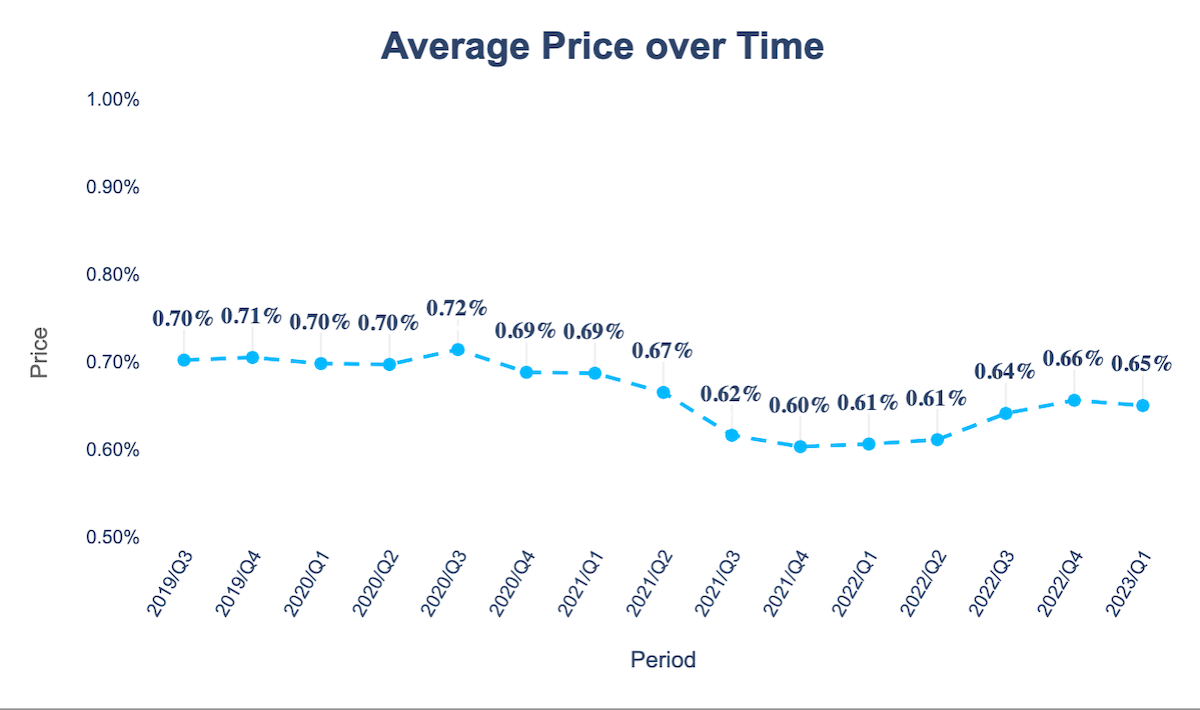

Our average price changed from 0.66% to 0.65% in Q1.

Overall, this quarter we

In short, the 0.01% drop in average price this quarter is driven by the decrease in fees on sending money to BRL and to MXN that went live in Q4 2022.

In Israel, we worked together with one of our local payout partners for increasing the volumes we can process together, and therefore, reducing the overall cost of transactions. These savings are passed directly to customers.

In the US, Wise has launched interest for USD balances. Now, US customers can opt-in to earn 3.92% APY on USD deposits. Earn more with interest deposited monthly into your USD balance, with the added security of up to $250,000 in FDIC passthrough insurance on your USD balance. The same account, now better for our US customers.

In the UK, Wise is trialling cashback for business card transactions. We’re now offering 0.5% cashback on eligible business card transactions to all businesses with Wise Business accounts registered in the UK. This feature is in a trial period at the moment, but we’re working to bring it to all of our business customers soon.

We have increased the amount we pay cashback in the EEA! Wise keeps your money safe by storing it in some of the world’s biggest banks and investing it in government bonds. As interest rates have risen, Wise is now starting to generate income from your money. Balance cashback is our way of sharing the earnings with you. If interest rates rise, we pay more cashback. Your money, your cashback.

As part of our mission, we charge as little as possible for sending money. Our average fee is 0.65% – a fraction of what the banks typically charge you.

At Wise, we constantly review our fees. So, when our costs go down, so do your fees.

In Q2, fees are increasing this time because the cost of running Wise has grown. These include:

Click here to see how much fees are changing on which routes, and click here to check when the changes will apply to you.

We know this is disappointing news, and we’re sorry about that. However, we’re already working on bringing the cost of running Wise down, so we can lower fees in the future.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

We believe that the world’s a richer place when money moves fast and flows free. That’s why we work hard to ensure our product is as convenient as can be,...

Speed In Q4, 61% of our transfers were instant, meaning they were completed in under 20 seconds. That’s an increase of 1% from Q3. What's changed? We’ve been...

The key indicator that we’re offering a truly convenient product is your ability to use Wise without any hiccups. That’s why we’re measuring convenience (or...

Maximum Speed: Moving at the Speed of Light At Wise, we are committed to providing our consumers with the best possible experience when it comes to...

It was another busy quarter for Wise Platform; from exciting partnership announcements, to podcast deep dives and a whole European tour of conferences,...