Q4 2023 Mission Update: Price

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

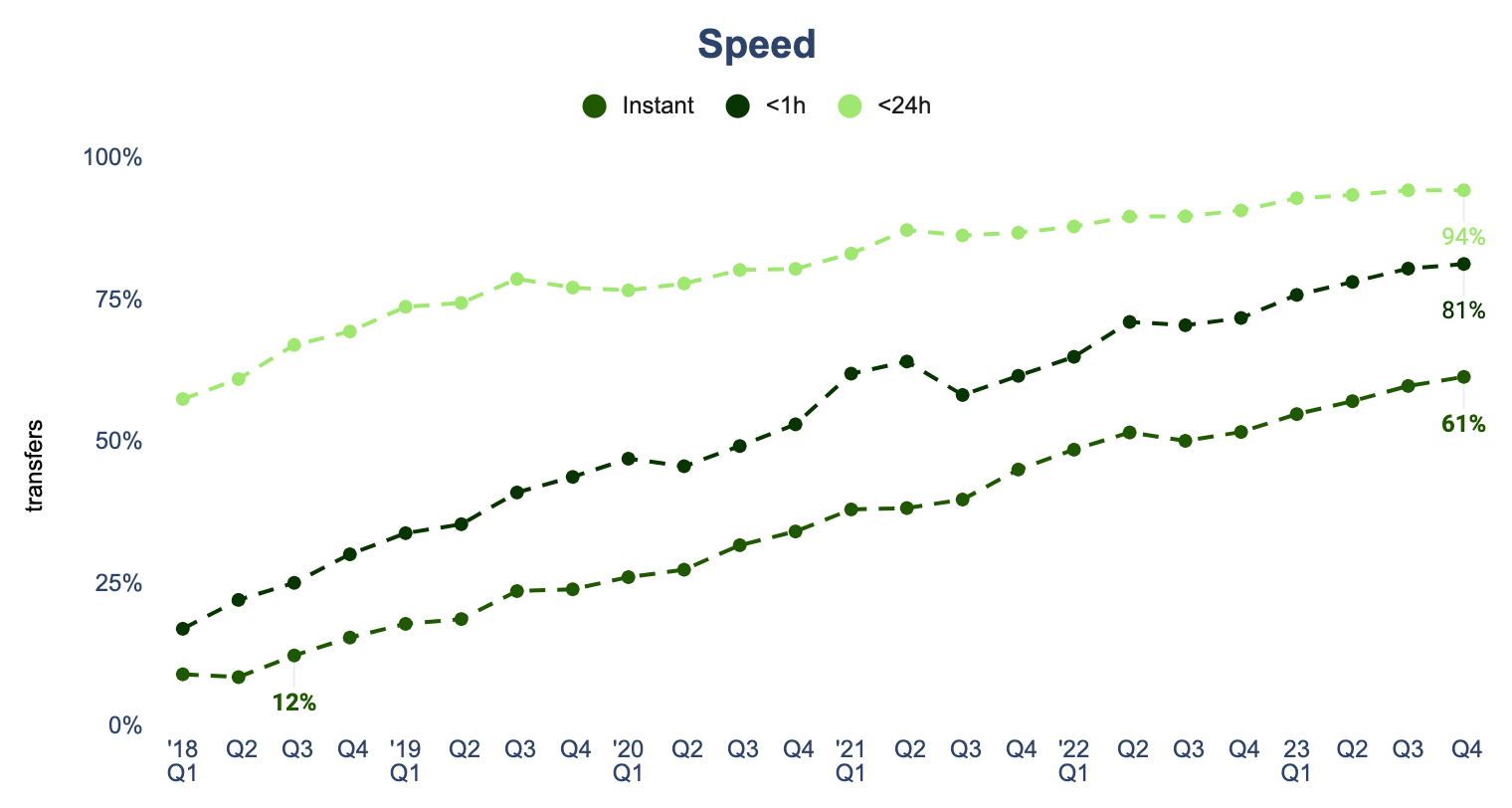

In Q4, 61% of our transfers were instant, meaning they were completed in under 20 seconds. That’s an increase of 1% from Q3.

We’ve been working hard to increase our capability to screen transfers at scale, which has helped us process more transfers instantly. We’ve also improved our alerting so that when we see delays, we can respond to them quickly and fix any issues so that we’re back to our usual levels of instant performance sooner.

We've sped things up when sending money to LKR by improving our transfer routing logic so that any payments made to banks which support real-time payments are processed using our real-time payment rails. We’ve also escalated issues we were having with our partner bank, which they have since addressed, helping to improve our instant performance.

In AUD, we’re now able to make all domestic payments and some cross border payments ourselves thanks to our new direct integration with NPP going live. This means all same-currency transfers are instant (within 20 seconds), and some international transfers are paid out instantly. We're aiming for all international transfers to Australia to be paid out instantly by the end of September.

We saw more reliable performance from our partners when sending to IDR which increased the number of transfers successfully paid out instantly.

We also made it faster to send USD outside of the US by paying out SWIFT transfers more frequently. This means that 30% of transfers are now completed in under 6 hours, compared to 8.63% in the beginning of the year.

And finally, in THB, we improved the logic we use to determine how quickly we fund transfers. This allows us to have more money available to fund smaller transfers faster, which has meant that more transfers are successfully being sent instantly.

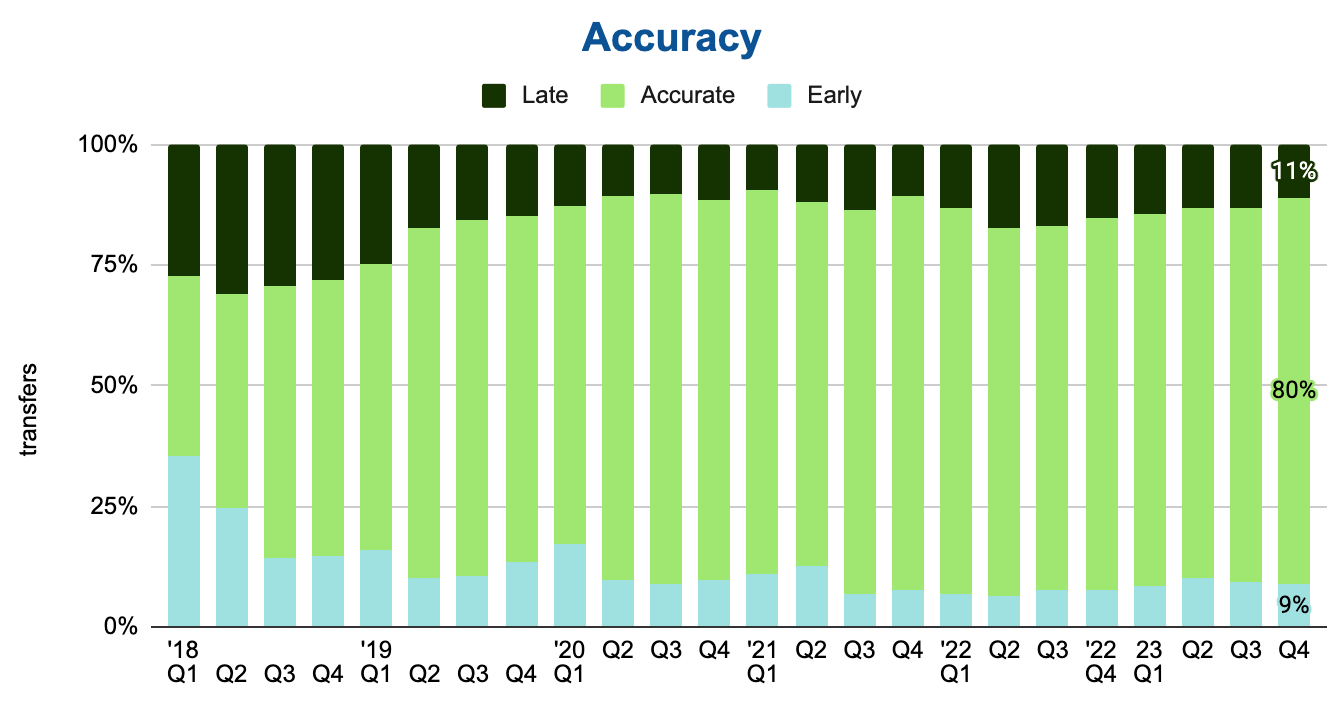

In Q4, 80% transfers arrived on time, which is our best performance in the last four quarters, and a 2% increase on last quarter.

Some of these improvements have come from reducing the screening delays. We also addressed the issue which was causing transfers to AUD to be delayed in Q3, partly thanks to moving over to our direct integration for payouts.

In December 2023, we also saw a significant reduction in pay-in delays for pay-ins made using manual bank transfer in NZD. The reduction in delays was mostly driven by us adjusting our estimates for when we expect to receive the money, so we can provide a more accurate estimate for customers.

One issue we have found is that funding transfers from balance, which should always be instant, is now sometimes taking a minute or two. We're looking into why this is and how we can fix the issue.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

We believe that the world’s a richer place when money moves fast and flows free. That’s why we work hard to ensure our product is as convenient as can be,...

The key indicator that we’re offering a truly convenient product is your ability to use Wise without any hiccups. That’s why we’re measuring convenience (or...

Maximum Speed: Moving at the Speed of Light At Wise, we are committed to providing our consumers with the best possible experience when it comes to...

It was another busy quarter for Wise Platform; from exciting partnership announcements, to podcast deep dives and a whole European tour of conferences,...

Our average price changed from 0.65% to 0.66% in Q2. Overall, this quarter we 😞Increased fees on sending money from EUR, CHF, HUF, MYR, SEK, RON, BGN, HKD,...