Q4 2023 Mission Update: Price

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

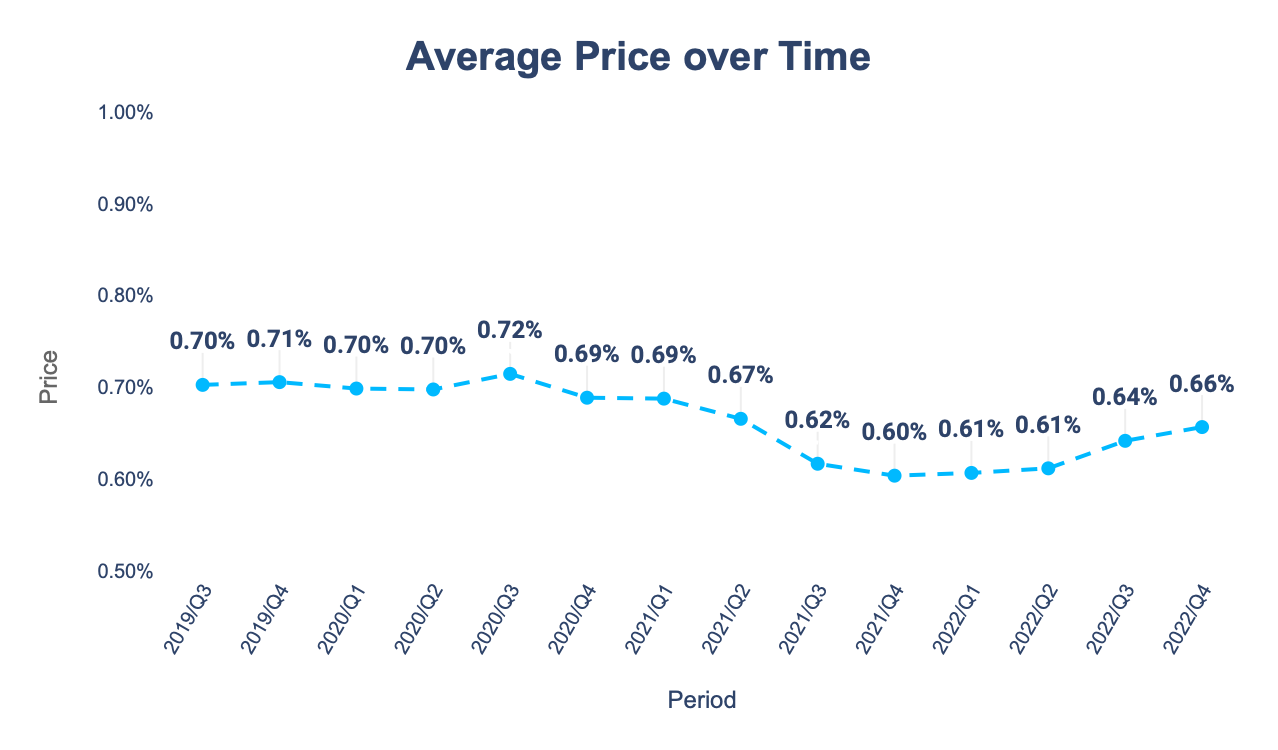

Our average price changed from 0.64% to 0.66% in Q4.

Overall, this quarter we

In short, what is underlying this 0.02% increase are two things.

In Brazil we optimised our cost of trading money. The more customers send money with Wise, both from Brazil and to Brazil - the less we need to trade and the better we can match the supply and demand without additional cost. When we have this cost savings and because we kept all other costs of sending from Brazil in line, we could pass these savings back to you.

In Mexico, we worked together with one of our local payout partners for increasing the volumes we can process together, and therefore, reducing the overall cost of transactions. These savings are now directly passed to our customers.

We now have free same currency bank transfers out of your Wise Balance on several currencies. You asked for this, and we listened. You told us that other providers didn’t charge fees like these, so we found a way to remove them for Balance customers.

And onto further good news, why is Wise trialling paying cashback? Wise keeps your money safe by storing it in some of the world’s biggest banks and investing it in government bonds. As interest rates have risen, Wise is now starting to generate income from your money. Balance cashback is our way of sharing the earnings with you. Your money, your cashback.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

We believe that the world’s a richer place when money moves fast and flows free. That’s why we work hard to ensure our product is as convenient as can be,...

Speed In Q4, 61% of our transfers were instant, meaning they were completed in under 20 seconds. That’s an increase of 1% from Q3. What's changed? We’ve been...

The key indicator that we’re offering a truly convenient product is your ability to use Wise without any hiccups. That’s why we’re measuring convenience (or...

Maximum Speed: Moving at the Speed of Light At Wise, we are committed to providing our consumers with the best possible experience when it comes to...

It was another busy quarter for Wise Platform; from exciting partnership announcements, to podcast deep dives and a whole European tour of conferences,...