Send money overseas

Send money overseas from our website or mobile app, in just a few clicks.

Bank transfer fee

0 GBP

Our fee

77.84 GBP

Total included fees (0.31%)

77.84 GBP

- You could save up to 706.57 GBP

Should arrive by Monday

Find out how much it costs to send money overseas

The cost of your transfer comes from the fee and the exchange rate. Many high street banks offer “no fee”, while hiding a markup in the exchange rate, making you pay more.

At Wise, we’ll never do that. We only use the mid-market exchange rate, and show our fees upfront. This table compares the fees you’d really pay when sending money with the most popular banks and providers, or with us.

How do we select providers and collect this data?| Sending 1,000 GBP with | Recipient gets(Total after fees) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1,200.43 EUR | ||||||||||

Transfer fee 3.88 GBP Exchange rate(1 GBP EUR) 1.20511 Exchange rate markup 0 GBP Cost of transfer 3.88 GBP | |||||||||||

| 1,177.34 EUR- 23.09 EUR | ||||||||||

Transfer fee 0 GBP Exchange rate(1 GBP EUR) 1.17734 Exchange rate markup 23.05 GBP Cost of transfer 23.05 GBP | |||||||||||

| 1,162.38 EUR- 38.05 EUR | ||||||||||

Transfer fee 0 GBP Exchange rate(1 GBP EUR) 1.16238 Exchange rate markup 35.46 GBP Cost of transfer 35.46 GBP | |||||||||||

| 1,162.22 EUR- 38.21 EUR | ||||||||||

Transfer fee 0 GBP Exchange rate(1 GBP EUR) 1.16222 Exchange rate markup 35.59 GBP Cost of transfer 35.59 GBP | |||||||||||

| 1,151.10 EUR- 49.33 EUR | ||||||||||

Transfer fee 2.99 GBP Exchange rate(1 GBP EUR) 1.15455 Exchange rate markup 41.95 GBP Cost of transfer 44.94 GBP | |||||||||||

How to send money overseas in 3 easy steps

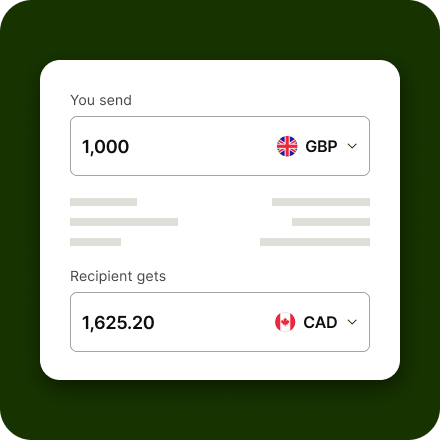

Enter amount to send in GBP.

Pay in GBP with your debit card or credit card, or send the money from your online banking.

Choose recipient .

Select who you want to send money to and which pay-out method to use.

Send GBP, receive EUR.

The recipient gets money in EUR directly from Wise’s local bank account.

Money transfer fees

How much does it cost to send money overseas?

To send money overseas with Wise, you will pay a small, flat fee and a percentage of the amount that's converted. We will always show you the total cost upfront - and you can rely that we won't hide any further fees in the exchange rate.

You can use our handy calculator to find out exactly how much will you pay for your transfer. The cost depends on where you will be sending money from and to, as well as on your chosen payment method.

No big fees, hidden or otherwise. So it's cheaper than what you're used to.

Delivery time for money transfers overseas from the UK

90% of all money transfers from the UK are delivered in 1 business day from the moment we receive payment.

We do everything to complete your money transfer as soon as possible - the final delivery time of your transfer depends on your chosen payment method, where are you sending to and from or when your payment arrives to our account.

As an FCA regulated company we occasionally need to run security checks and request extra documentation, which might have impact on your delivery time.

Your transfer route

Should arrive

by MondayBest ways to send money internationally

PISP

PISP (Payment Initiation Service Provider) payments are instructions you give Wise to make a bank transfer directly from your bank account — without having to leave our app and log in to your online banking. This option is as cheap as a manual bank transfer, but it isn’t supported by all banks yet.Bank Transfer

Bank transfers are usually the cheapest option when it comes to funding your international money transfer with Wise. Bank transfers can be slower than debit or credit cards, but they usually give you the best value for your money. Read more how to use bank transfers as a payment option.Swift

Using Swift to fund your transfer usually means that your transfer will take longer and be more expensive, as your bank will charge a fee. You should also bear in mind that other correspondent banks in between may also deduct their handling fees. Your bank should be able to advise on those fees.

Protecting you and your money

Safeguarded with leading banks

We hold your money with established financial institutions, so it's separate from our own accounts and in our normal course of business not accessible to our partners. Read more here.

Extra-secure transactions

We use 2-factor authentication to protect your account and transactions. That means you — and only you — can get to your money.

Data protection

We’re committed to keeping your personal data safe, and we’re transparent in how we collect, process, and store it.

Dedicated anti-fraud team

We work round the clock to keep your account and money protected from even the most sophisticated fraud.

Send money overseas with the Wise app

Looking for an app to send money overseas? Sending money is easy with Wise app.

- Cheaper transfers abroad - free from hidden fees and exchange rate markups.

- Check exchange rates - see on the app how exchange rates have changed over time.

- Repeat your previous transfers - save the details, and make your monthly payments easier.

Wise works nearly everywhere

- United States dollarRouting number, Swift/BIC, Account number and Account typeGet USD account details

- United Arab Emirates dirham

- Australian dollar

- Bangladeshi taka

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Chilean peso

- Chinese yuan

- Costa Rican colón

- Czech koruna

- Danish krone

- Egyptian pound

- Euro

- British pound

- Georgian lari

- Hong Kong dollar

- Hungarian forint

- Indonesian rupiah

- Israeli shekel

- Indian rupee

- Japanese yen

- Kenyan shilling

- South Korean won

- Sri Lankan rupee

- Moroccan dirham

- Mexican peso

- Malaysian ringgit

- Nigerian naira

- Norwegian krone

- Nepalese rupee

- New Zealand dollar

- Philippine peso

- Pakistani rupee

- Polish złoty

- Romanian leu

- Swedish krona

- Singapore dollar

- Thai baht

- Turkish lira

- Tanzanian shilling

- Ukrainian hryvnia

- Ugandan shilling

- United States dollar

- Uruguayan peso

- Vietnamese dong

- West African CFA franc

- South African rand

See why customers choose Wise for their international money transfers

It’s your money. You can trust us to get it where it needs to be, but don’t take our word for it. Read our reviews at Trustpilot.com.