Mozambique corporate tax - guide for international expansion

Learn about the corporate tax system in Mozambique, its current rates, how to pay your dues and stay compliant, and best practices.

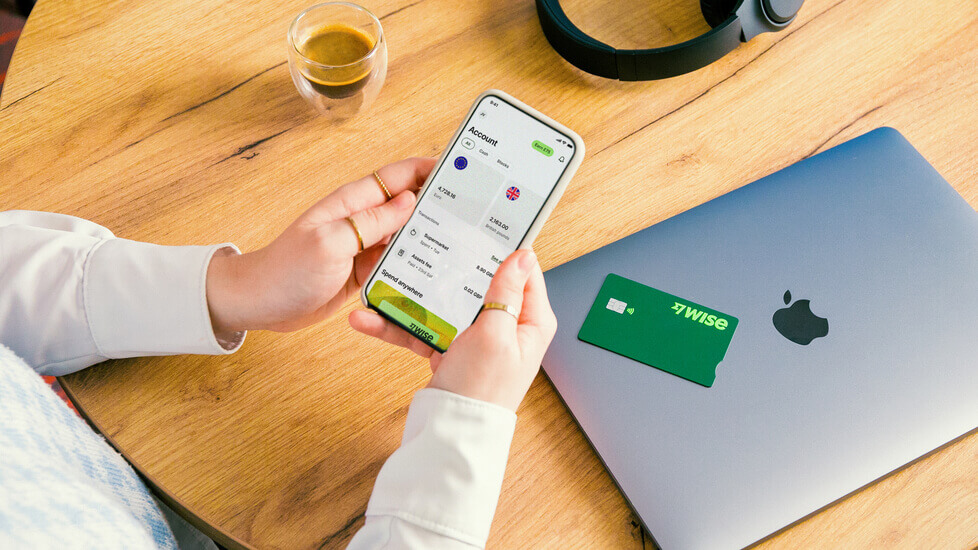

Wise is a financial technology company focused on global money transfers that offers two different types of accounts: a personal account and a business account.

While they share some features, there are key differences between the Wise Personal and Wise Business accounts, especially if you have a business you’re trying to scale and grow internationally.

Let’s start with the accounts’ similarities. With both Wise Business and Personal accounts, you can send fast, transparent, and low-fee international payments in 40+ currencies at the mid-market rate. Both accounts also offer debit cards, either physical or digital, which can be used to spend in different currencies worldwide.

The personal Wise account is for individuals living, working, and travelling abroad. Whether you're planning a trip to Australia or paying a mortgage in Spain, a Wise personal account is the ideal choice for anyone who needs to send, spend, or receive money internationally.

Wise Business account - key features

The Wise Business account offers additional features that are useful for freelancers, small businesses, and established companies with teams. With accounting integration, a free invoicing tool, local account details (only with Wise Business Advanced) , multi-user team access, and batch payments, the Wise Business account makes it easier for you to manage your business, scale up, and save time. See the full list of features here.

Let’s break down the key features only available with the Wise Business account. For a one-time fee of £50 (Advanced plan) or for free (Essentials plan), you get access to each of these capabilities for you and your team. We don't charge any monthly subscription fees or put any of the features behind a paywall. You and your team will have access to all features, and you can tailor them with personalised permission settings and limits.

Since personal users and business have different needs, Wise Business account has a whole different set of features to better support UK business trading internationally:

With both Wise Personal and Wise Business accounts, you can send fast, transparent, and low-fee international payments in over 40 currencies to 160 countries.

To make business payments quicker, Wise offers batch payments for its business customers. The batch payments tool enables up to 1,000 invoices to be processed in a range of currencies from a single spreadsheet or .CSV, simplifying payroll and invoice payments. Never used a batch payments tool? The Wise Business account offers easy-to-use spreadsheet templates to get you started.

To gain a comprehensive overview of your business finances, you can sync your Wise Business account with accounting software like QuickBooks, Xero, Sage, and Wave. This helps you keep track of payments, manage your spending, and keep your accountant happy. You can reconcile these transactions easily and conveniently – something that isn’t possible with a Wise personal account. Choose which currency you sync up and keep track of all your international payments in one place.

If you have several team members managing your expenses, the Wise Business account offers multi-user access. You can customise permissions by individual, whether that's for card spending or what they can see and manage in the business account. This access also extends to the Wise Business card, where you can set spending limits in line with your budget.

With your cards, you and you team can get 0.5% cashback on eligible transactions, no matter in what currencies you're spending.

With business expense cards, you can manage your business spending transparently and according to your needs. Create separate Groups for marketing, administrative expenses, or ad hoc business trips, ensuring you stay in control of who is involved in every aspect of your business. You can send and spend from Groups and assign different team members to different Groups.

You can withdraw from platforms such as Stripe, Amazon, Fiverr, Etsy, UpWork or GOAT to any of your local account details (only with Wise Business Advanced) for free with your Wise Business account. You can choose to keep the money in the currency withdrawn or exchange it at the mid-market rate with low fees in your Wise Business account.

One of the differences between the Wise Personal and Wise Business accounts is the ability to create invoices for free. In your business account, you can send invoices directly to the recipient or download them as a PDF. That way, you can simplify and speed up the process of getting paid in the currency you need, while maintaining control of how your client or customer pays you. Track all your invoices in your Wise Business account, view past and upcoming invoices, and stay on top of your payments, 24/7.

Quick Pay is only available in your Wise Business account and allows you to create a unique Quick Pay link or QR code to receive payments in multiple currencies repeatedly. This eliminates the need to constantly share your account details (only with Wise Business Advanced) — streamlining your cash flow and reducing administrative burdens. We've explained more about this feature here.

With a Wise Personal account, you can receive payments to your local account details in 8+ currencies, including GBP, EUR, and CAD. The difference with the Wise Business account is that it offers both local and **global account details (only with Wise Business Advanced) **.

This feature allow businesses to receive international payments through the SWIFT network in 19 currencies, making international business even more streamlined. Currencies include: AUD, NZD, SGD, SEK, NOK, DKK, PLN, HKD, CHF, CZK, JPY, HUF, BGN, AED, RON, UGX, ZAR, CNY and ILS.

Understanding global account details (only with Wise Business Advanced)

To streamline your cash flow when you're requesting one-time payments, payment links in your Wise Business account may be the perfect solution. Simply fill out the information and track your payment link in the account. When you set up a payment link you can select 'card payment' as one of the accepted payment methods and your customer can pay you with credit or debit card in currencies.

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

To open a Wise Business account you need to follow 5 easy steps and go through our verification process. You can check here all the Wise Business account requirements to get started.

- Sign in to your personal account.

- Go to settings and click on 'Open a business account'

- Share details such as your business location, industry, business registration, name, and other supporting documents. The verification process may differ depending on your role in the company as well as company's size.

- Depending on tier, open for £50 (Advanced plan) or for free (Essentials plan)

- You’re verified! You’ll receive a confirmation email once verification has been processed.

Get started with Wise Business 🚀

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Individuals are limited to one personal Wise account. Similarly, a company can operate a single Wise Business account per registered entity. However, an individual owning several businesses is permitted to establish one Wise Business account for each distinct business they control.

While receiving most currencies is unlimited, card payments have a cap of 10,000 GBP (or its equivalent in other currencies). Note that limits exist for receiving USD and SGD into your account, as well as for payments in India and the Philippines.

Wise Business account fees are simple and transparent.

To open an account, there is a one-time fee of £50 (Advanced plan) or for free (Essentials plan) and no subscription fees to worry about.

Other transaction fees include:

In the United Kingdom, businesses registered as Limited companies, Limited Liability Partnerships, or Partnerships are legally required to maintain a separate business bank account, apart from personal finances.

While sole traders in the UK are not legally mandated to have a separate business account, it is strongly recommended as a best practice for effective financial control and regulatory compliance.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the corporate tax system in Mozambique, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Uganda, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Lithuania, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Kuwait, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Jordan, its current rates, how to pay your dues and stay compliant, and best practices.

How do payments work with Nuvei? This guide explains fees, settlement times, APMs, and cross-border payments.