Ghana Corporate Tax - Guide for International Expansion

Learn about the corporate tax system in Ghana, its current rates, how to pay your dues and stay compliant, and best practices.

As a small business owner, ensuring timely and accurate payments is crucial for your success and sustainability as you grow and scale your business. Getting paid quickly not only provides you with the necessary cash flow to meet your financial obligations but also enables you to reinvest in your business growth and development.

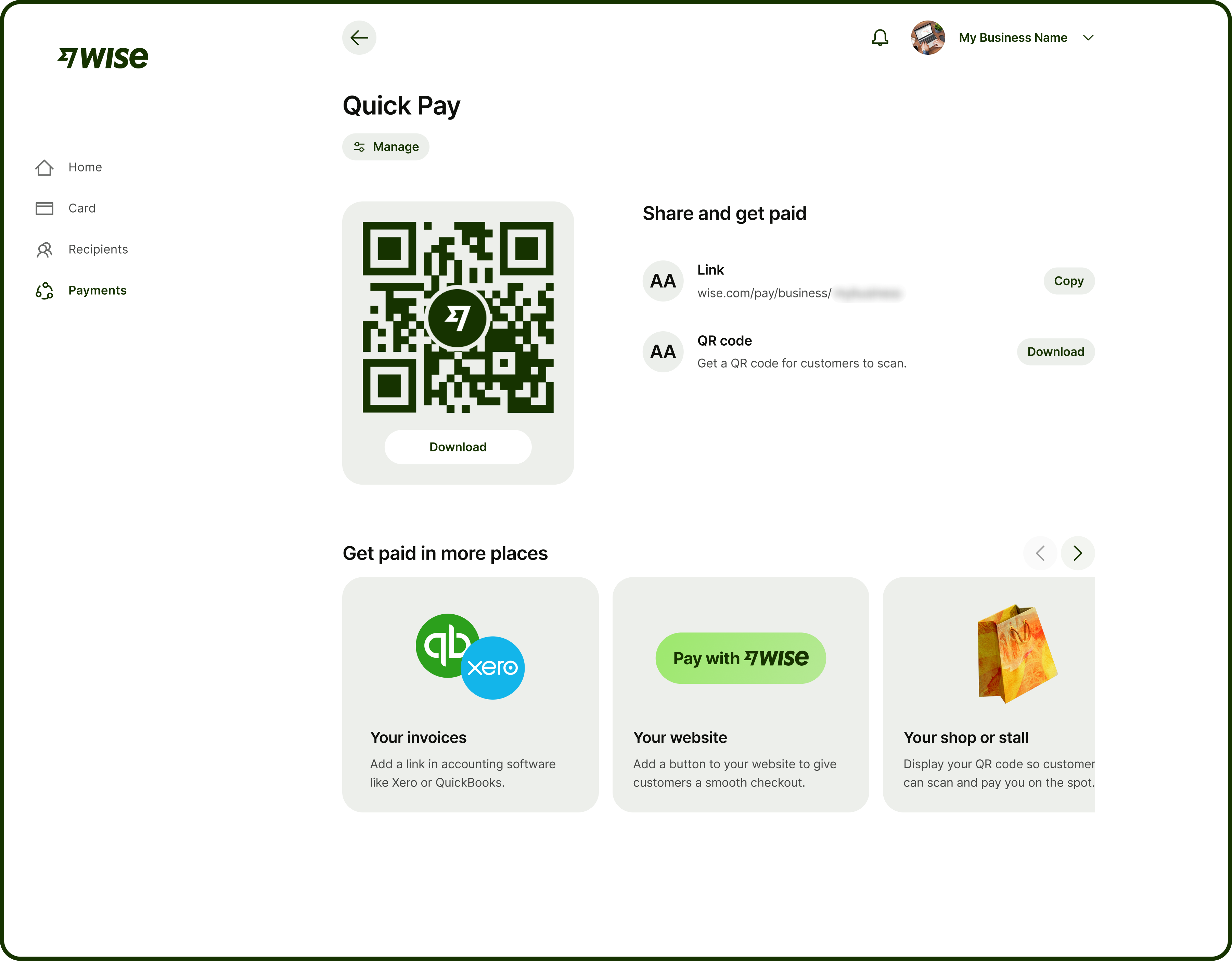

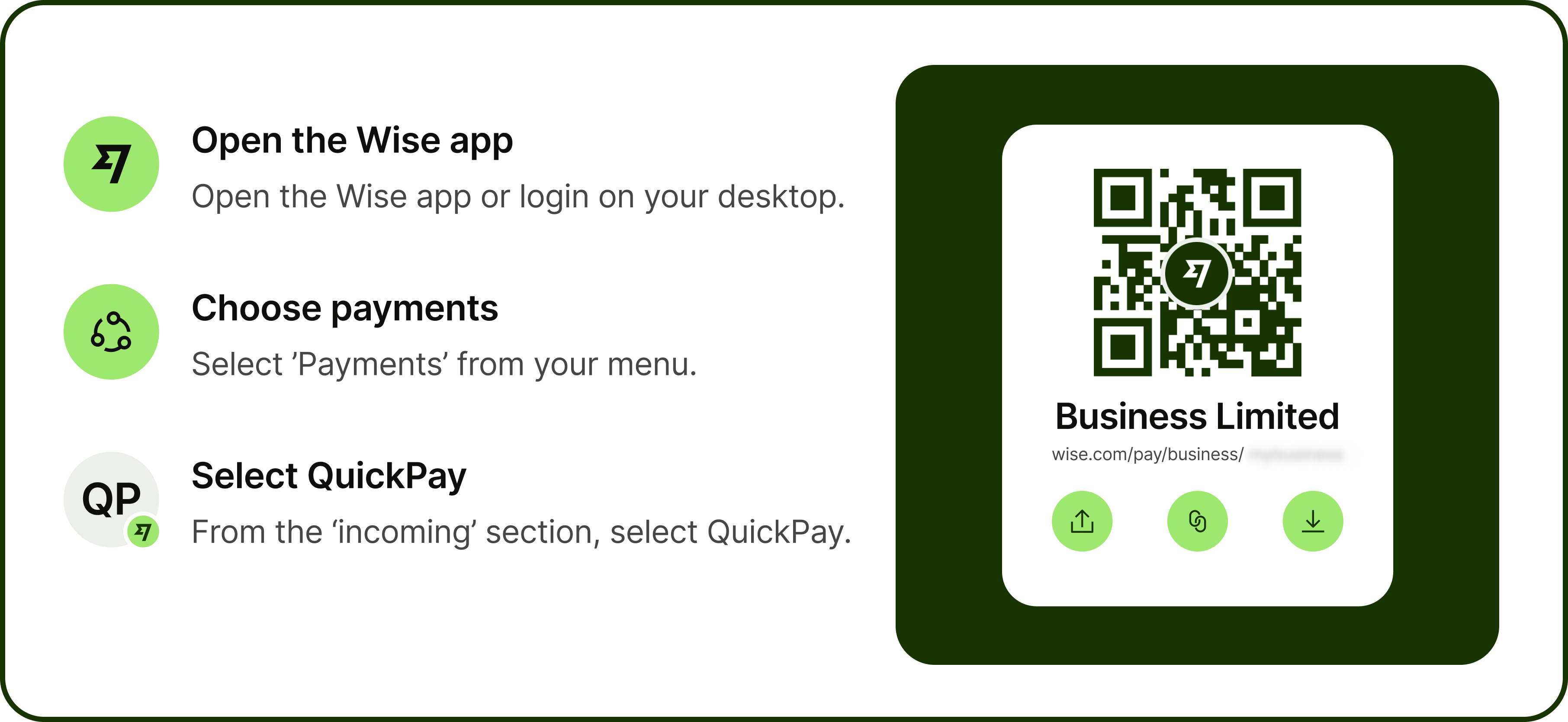

At Wise, we're committed to help businesses get paid faster and that's why we offer local account details (only with Wise Business Advanced) in multiple currencies including GBP and EUR, global account details (only with Wise Business Advanced) in 13+ currencies and payment links, so you can get paid by customers around the world with no hidden fees. That's why we're excited to launch Quick Pay, a unique link or QR code to use again and again to get paid different amounts, without needing to update or reshare it.

Quick Pay allows businesses to create a unique Quick Pay link and QR code to receive payments in multiple currencies repeatedly. Your customers and clients can use it to pay you easily, whether they have a Wise account or not. This means you don't have to constantly update your payment links or share your account details (only with Wise Business Advanced), streamlining your cash flow and reducing the burden of administrative tasks.

Setting up a Quick Pay is easy. You can manage it in real time and turn it off when needed. It's available on both desktop and in your Wise app.

Turn off anytime you need

Select ‘Manage’ and switch Quick Pay off, just like that. You won’t be able to use your link or QR code to receive payments until you switch it back on again.

**We're currently offering the following payment methods:

Pay with Wise

Send a payment request link

Free and easy to do, just create and share your link and once the payment is complete, the money will land directly into the balance of the currency you requested. Use any of the local account details (only with Wise Business Advanced) and 13+ global account details (only with Wise Business Advanced) offered by Wise to get paid fast in multiple currencies.

Send a reusable payment request link

Regularly charging the same amount? Create a reusable payment link to share, then get paid the same amount by multiple customers or clients, time and time again.

**Share your account details (only with Wise Business Advanced) **

Once you’ve set up account details (only with Wise Business Advanced) for a balance, you can add them to your invoices or share them with anyone who wants to pay you. Wise currently offers local account details (only with Wise Business Advanced) in multiple currencies including GBP and EUR and 17+ global account details (only with Wise Business Advanced) for businesses to use including GBP, USD or AUD.

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the corporate tax system in Ghana, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Uruguay, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Tanzania, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Botswana, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Chile, its current rates, how to pay your dues and stay compliant, and best practices.