Complete guide to doing business in Spain in 2026, for growing startups and entrepreneurs

Thinking of expanding or starting a business in Germany? Our complete guide covers potential opportunities, barriers and cultural considerations.

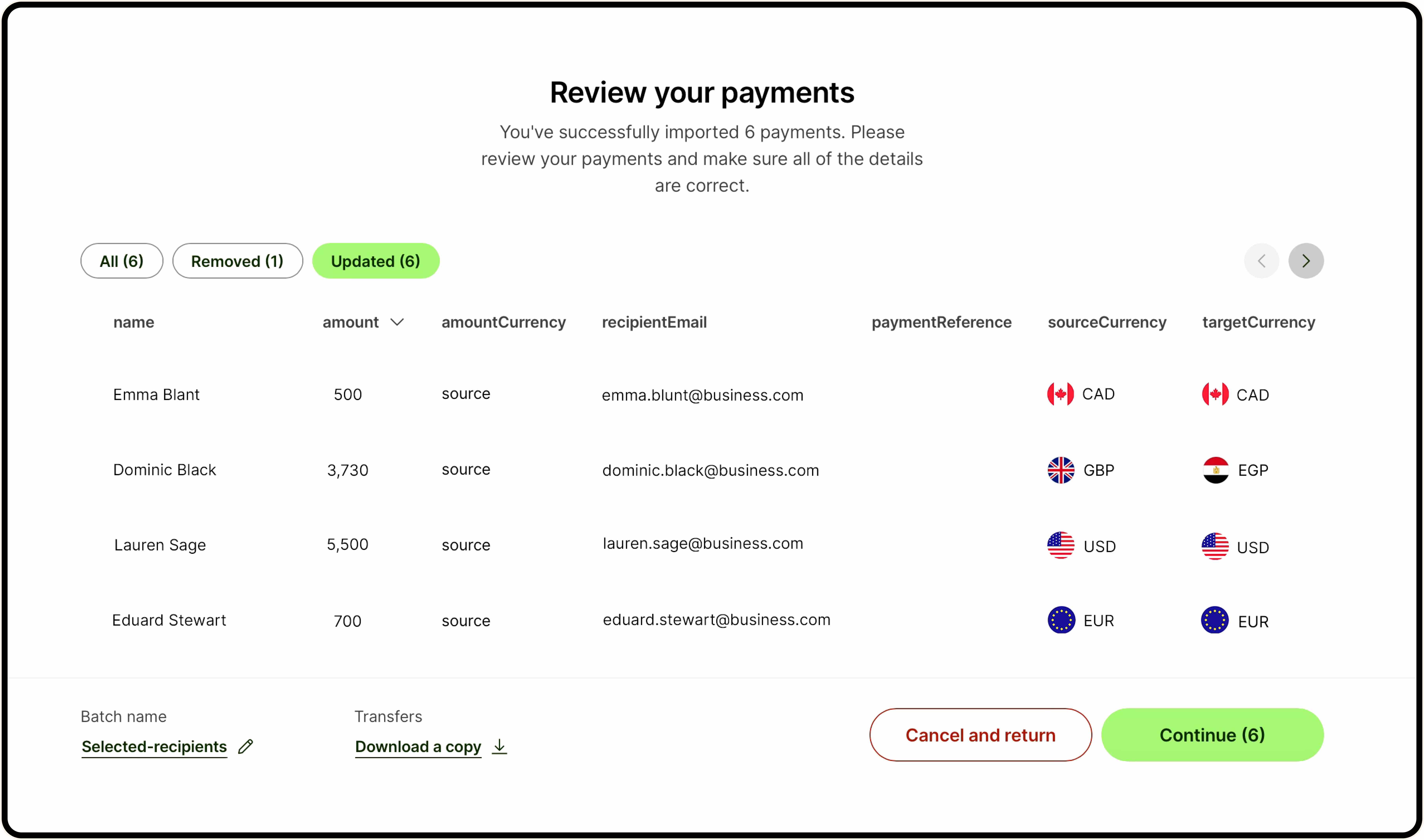

As a business owner, paying your team members, suppliers and invoices on time and in the right amount is crucial for maintaining smooth operations. Instead of handling individual payments one at a time, a Wise Business account offers a batch payment tool, allowing you to pay up to 1,000 transfers in multiple currencies by uploading a single CSV or .xlsx file.

The batch payments tool is free, and you can either use your existing multi-currency account or we'll convert the currency needed the same way as regular Wise transfers. You may also know the tool as bulk payment, mass payout, or mass payment, and it works worldwide in the countries Wise Business operates, helping businesses that need to handle international payroll, pay recurring invoices and suppliers, or streamline their payment processes.

The batch payments feature proves valuable for organisations seeking to make multiple international transfers simultaneously, ultimately helping them save time, reduce costs, and simplify their payment processes.

Businesses with International Employees or Freelancers: Companies that employ individuals or freelancers across different countries can efficiently manage their international payroll using batch payments.

Businesses Handling Recurring Invoices or Suppliers: Organisations that frequently make payments to multiple suppliers or deal with recurring invoices can streamline their payment procedures by utilising batch payments.

Fast growing Companies catering to International Clients: Fast-growing companies catering to a global clientele need to be able to operate across borders efficiently in order to keep up with customer demand. The ability to pay out to multiple recipients in multiple currencies easily will speed up payments processing, allowing businesses to focus on improved customer experience.

E-commerce Platforms and Marketplaces: E-commerce platforms and marketplaces often need to execute mass payouts to sellers, customer refunds or affiliates, making batch payments an ideal solution for simplifying their payout processes.

To create a batch payment, follow these simple steps:

We’ve created different templates to help you get started with batch payments. They’re downloadable only in .CSV (comma separated value) format files that you can open using a spreadsheet app, like Microsoft Excel. Let's have a closer look at each of them.

If you're an existing Wise customer, all of your saved recipients' details will be automatically included when you download the template if you click ‘download all’. Otherwise, you can search for recipients and download a template with pre-selected recipients. Take a look at the Recipients section to confirm them. From here, feel free to delete any that you don't want to include in the batch payment. Just remember - this template isn't an option for adding new recipients to send money to, only those that have been pre-selected.

This template lets you manually enter the recipient bank and transfer information. All those who receive payments via this file will be automatically stored in your recipient list. A detailed description of how to fill in a batch payment template can be found here.

If you don't know the bank details of your recipients, you can add their email addresses to the template. Log in to your account on the web (this feature isn't available in the app yet) and provide the transfer value and currency, and a secure link will be sent out for them to claim it. Just make sure you place the email address under the "recipientEmail" column. Even if you need to make multiple transfers in different currencies, we've got you covered - find out more here.

At the final step of the batch payment, you’ll be able to pay for your transfer. You’ll see two payment options: pay by local bank transfer and use currencies already in your Wise Business account.

We'll provide you with our bank details and we'll accept the batch payment through a bank transfer. When you've made your payment, simply click "I have paid" to confirm. We'll then make sure that each of your recipients receive their designated amount.

You can choose to pay from one of your Wise Business currencies. If you're not familiar with those just yet, find out more about how to top up currencies into your Wise account.

Ensuring the recipient gets a certain amount of money in their currency

To ensure your recipient gets the sum you want in their home currency, simply change the “Amount Currency” column to “Target” and type the amount in the “Amount” column. The total amount you’ll pay will include our fee, so you can ensure your recipient gets the right amount. It's best to pay for the transfer batch as soon as it's uploaded, so you can take advantage of the guaranteed rate. If, however, you can't do it right away, your transfers will remain open for a few days before they are automatically cancelled by our system.

How to fix errors in your batch payment

Batch payments let you create and send multiple payments in one go. You are able to fix the errors you encounter on batch payments on the website after uploading your payments to give you more flexibility in setting up large payments.

As a large business, you may require a more advanced solution. Wise API for large businesses uses the same powerful platform as the Wise Business account. Our services are available to companies in any sector, from e-commerce firms looking to automate recurring orders and payroll to banks wanting cost-effective international transfers. With us, you can set up automated invoice payments, recurring transfers, standing orders and payroll processing in seconds.

Plus, notifications on platforms like Slack will be delivered in real time. Integrating Wise API as a disbursement option onto your website can also make expense reports simpler. You'll be able to gain full control over exchange rates and conversions too - essential for businesses that want efficient and effective operations!

Find out more about the Wise API

Contact our business sales team

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking of expanding or starting a business in Germany? Our complete guide covers potential opportunities, barriers and cultural considerations.

Learn how to apply for the Canada self-employed persons program from the UK and how it could lead to permanent residence in our guide.

How to run a global freelancer business from anywhere in the world. This blog includes insights from a webinar with established freelancers.

Discover which UAE business visas you can apply for from the UK, what to keep in mind and how the process works for each visa type in our guide.

Last month, the United States (US) Supreme Court ruled that many of the government’s tariffs were unconstitutional. The 6-3 decision found that the...

Having trouble deciding which Wise Business account is best for your business? We’re breaking down the differences between the ‘Essential’ and ‘Advanced’...