Q2 2024 Mission Update: Price

We believe in money without borders. Which is why we’re building the best way to move and manage the world’s money.

We are always on the lookout for ways to reduce our fees so you never pay more than you need to. And when we do increase fees we make sure to tell you in the most transparent way possible so you know exactly what you are paying for.

We are really excited about the progress we made in Q2 2024!

What happened last quarter?

You might have seen our recent emails letting you know about some changes. After the latest review, we rebalanced our fees to reflect the cost of each transaction so that you only pay for the services you use.

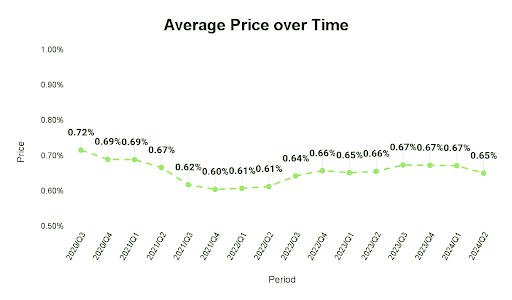

This means the average fee, which has been 0.67% since Q4 2023, went down to 0.65% last quarter.

*The average price is based on a fixed basket of representative currencies to eliminate any route or payment mix effect.

Why do we regularly review our fees?

Our fees reflect our costs. So, if we want to offer you the lowest fees possible then we need to find ways to reduce our costs.

Each feature and route we serve comes with its own costs which we regularly review. It’s a balancing act between spotting opportunities to cut our costs while making sure we carefully invest in ways to improve Wise for you.

You can read more on why our fees changed in this blog post by our CEO, Kristo. Or read below to see what this means for you.

Q2 Highlights

- Large transfers on major routes got cheaper

- Using your Wise card got cheaper

- Funding your Wise account using a card or using direct debit in the USA got more expensive

- US customers now earn more on their USD and GBP Balances

Read below to see which fees changed the most.

Large Transfers on Major Routes got Cheaper

People and businesses who move money between major currencies such as the euro, the US dollar, the Great British pound, the Singaporean dollar and others will now pay less.

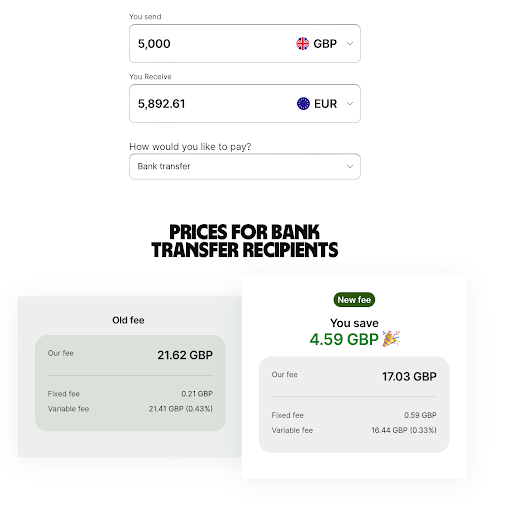

For example, sending £5,000 to Europe is now 21% cheaper.

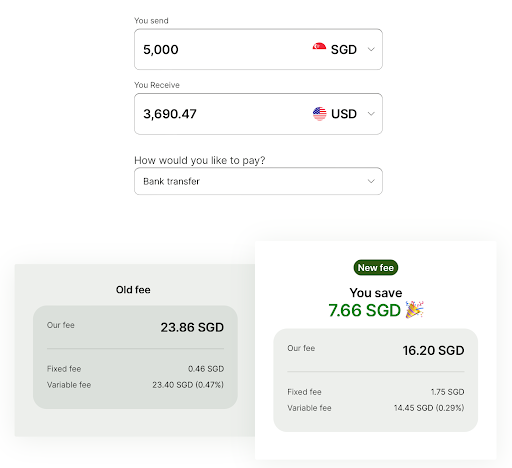

And it is now 32% cheaper to send 5,000 Singaporean dollars to America.

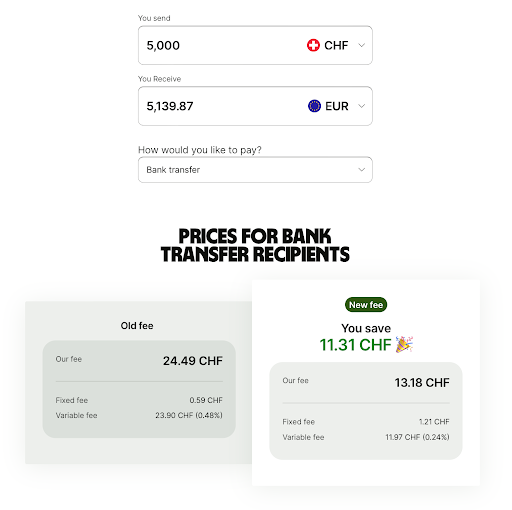

And if you have 5,000 Swiss francs, but need to send them to Europe it will be 46% cheaper.

It is also now cheaper sending larger transfers from Australian dollars, Indonesian rupiah, Japanese yen, Turkish lira. And sending to Brazilian real, Turkish lira, Polish złoty among others.

But it wasn’t all good news, smaller transfers and some routes got more expensive. For example sending £1000 to Mexican peso is now 15% more expensive than before, but still cheaper and faster than most providers.

For more details on what routes are getting cheaper and which are getting more expensive, see our blog. If you want to see for yourself how much you will save, try our fee calculator.

Using your Wise card got cheaper

And of course this means using the Wise Card or converting currencies between balances in the Wise Account will also be cheaper with these currencies! For example, if you live in the UK, and are going on a trip to Turkey, it will now be 59% cheaper to pay in Turkish lira.

Some payment methods got more expensive

Topping-up your Wise account or funding transfers using a bank card got more expensive. For example, funding a transfer to Swedish krona, Danish krone, or Norwegian krone using a credit card will now cost you more. And using direct debits to top-up your Wise Account or to fund a transfer from the US and Canada got more expensive too.

Bank transfers are generally a good alternative to using a bank card and, in the US, Wire Transfers provide a cheaper alternative when sending large amounts.

Fortunately, receiving your salary or invoices directly into your Wise Account remains free which means you can skip the fees of moving money from another bank into Wise. You’re also likely to get a better return on your own money if you opt into ‘Interest Assets' in the UK, Singapore or Europe, or ‘USD Interest’ in the US.

Investments can fluctuate, and your capital is at risk. Interest is offered by Wise Assets UK Ltd, a subsidiary of Wise Payments Ltd. Wise Assets UK Ltd is authorised and regulated by the Financial Conduct Authority with registration number 839689. When facilitating access to Wise investment products, Wise Payments Ltd acts as an Introducer Appointed Representative of Wise Assets UK Ltd. Please be aware that we do not offer investment advice, and you may be liable for taxes on any earnings. If you're uncertain, we urge you to seek professional advice. To find out more about the Funds, visit our website.

Same-currency payments in some countries now cost more

This affects people and businesses who use their Wise account to make payments locally in the same currency. For example, paying locally from your Australian dollars balance increased from A$0.57 to A$1.23. Local payments within the US went up from $0.39 to $1.13.

Local payments in the UK, Europe, Singapore and Hungary remain free.

You can read more about which fees went up here.

Give your money a boost

Customers and businesses holding their money with us earned $99.5m (£78.7m), thanks to governments and central banks paying high interest rates.

What’s new for European Balance Cashback customers?

Balance Cashback available on USD, GBP and EUR balances.

In Q2, the European Central Bank reduced their rates by 25 basis points. This had a knock-on effect for customers holding euros, and the balance cashback rate reduced from an annualised rate of 2.28% to 2.11%.

What’s new for US customers?

Customers in the US can opt-in to receive interest on money they hold in their GBP, EUR and USD balances and benefit from FDIC insurance.

In Q2 we negotiated better rates with our banking partner, which means customers holding USD or GBP now earn a better rate:

- Interest on USD balances increased from 4.85% to 4.95% APY (Annual Percentage Yield)

- Interest on GBP balances increased from 3.22% to 3.32% APY

If you’re a US based customer with an eligible personal or business account you can opt into the Wise interest feature to start earning 3.66% annual percentage yield — APY — (as of December 20, 2024, subject to change) on the USD in your Wise Account.

However, similar to the story for European customers. The decreased European Central Bank rates, means the interest rate for EUR balances decreased from 2.29% to 2.12% APY.

What's new for Wise Interest in the UK, Europe, and Singapore?

In the UK, 12 EEA (European Economic Area) countries, and Singapore, you can invest your money in ‘Wise Interest’ to get a return in line with the central bank rate.

In Q2 customers earned**:

UK customers earned (annualised):

4.66% on GBP

5.04% on USD

3.45% on EUR

EEA customers earned (annualised):

4.66% on GBP

5.04% on USD

3.45% on EUR

Singapore customers earned (annualised):

3.84% on SGD

4.47% on USD

**Past performance is not an indicator of future performance. For full 5 year past performance of the funds, please visit our website.

Investments can fluctuate, and your capital is at risk. Interest is offered by Wise Assets UK Ltd, a subsidiary of Wise Payments Ltd. Wise Assets UK Ltd is authorised and regulated by the Financial Conduct Authority with registration number 839689. When facilitating access to Wise investment products, Wise Payments Ltd acts as an Introducer Appointed Representative of Wise Assets UK Ltd. Please be aware that we do not offer investment advice, and you may be liable for taxes on any earnings. If you're uncertain, we urge you to seek professional advice. To find out more about the Funds, visit our website.

Know what you pay, and how much you save

So that’s a wrap of Q2 on how we progressed in lowering the cost of moving money across borders. In some areas we made great progress, but in others we still have a way to go.

It is important to remember that most banks would never tell you about increasing their fees on international transfers. That is because they hide their fees by marking up the exchange rate and unless you check every time against the mid-market exchange rate - you would never find out. To make it easier for you, we’ve set up a comparison table that covers a few banks and other cross borders specialists.

We have been on this mission for almost 14 years now. This past year we saved our customers £1.8bn in hidden fees and this is growing every year. You can check if your bank is hiding fees here.

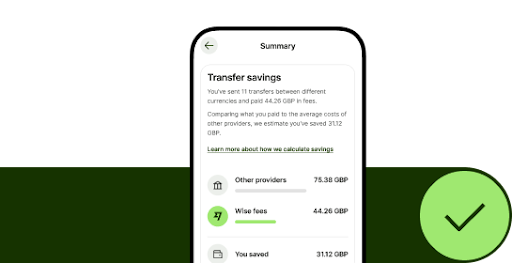

We also added a new feature that shows you exactly how much you’ve saved on fees for the international transfers you’ve sent with us.

Compare the fees you paid with us to what other providers would have charged you — and see what you’ve saved over time.

You can try it in the Wise app, in your Account Summary. Tap the graph icon next to your total balance on the home screen and scroll down to see ‘Your savings’.