Is your bank transparent?

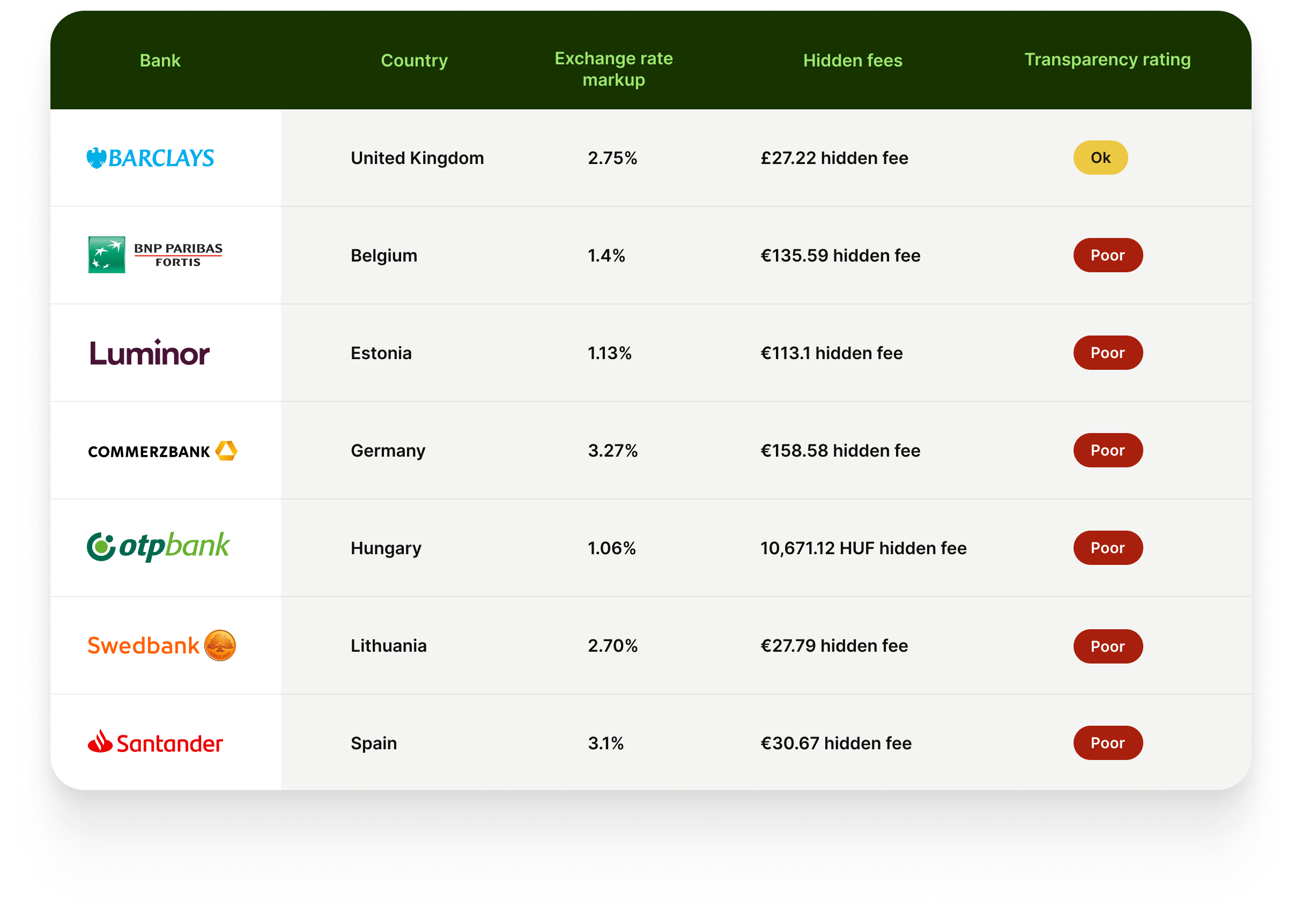

We looked at a number of banks across different countries. View the table below and download the reports.

In some countries, rules set out that banks need to be transparent about the fees they charge for international payments. But some rules are more vague than others and some regulators are not holding their banks accountable. That’s why - unfortunately - most banks are still hiding fees in exchange rate mark-ups.

Information on this website has been collected from each of the featured banks, by following their money transfer flows.

This is a one-off snapshot from the bank's payment journey at a specific point in time. These payments flows are subject to change. The exchange rate markups may fluctuate.