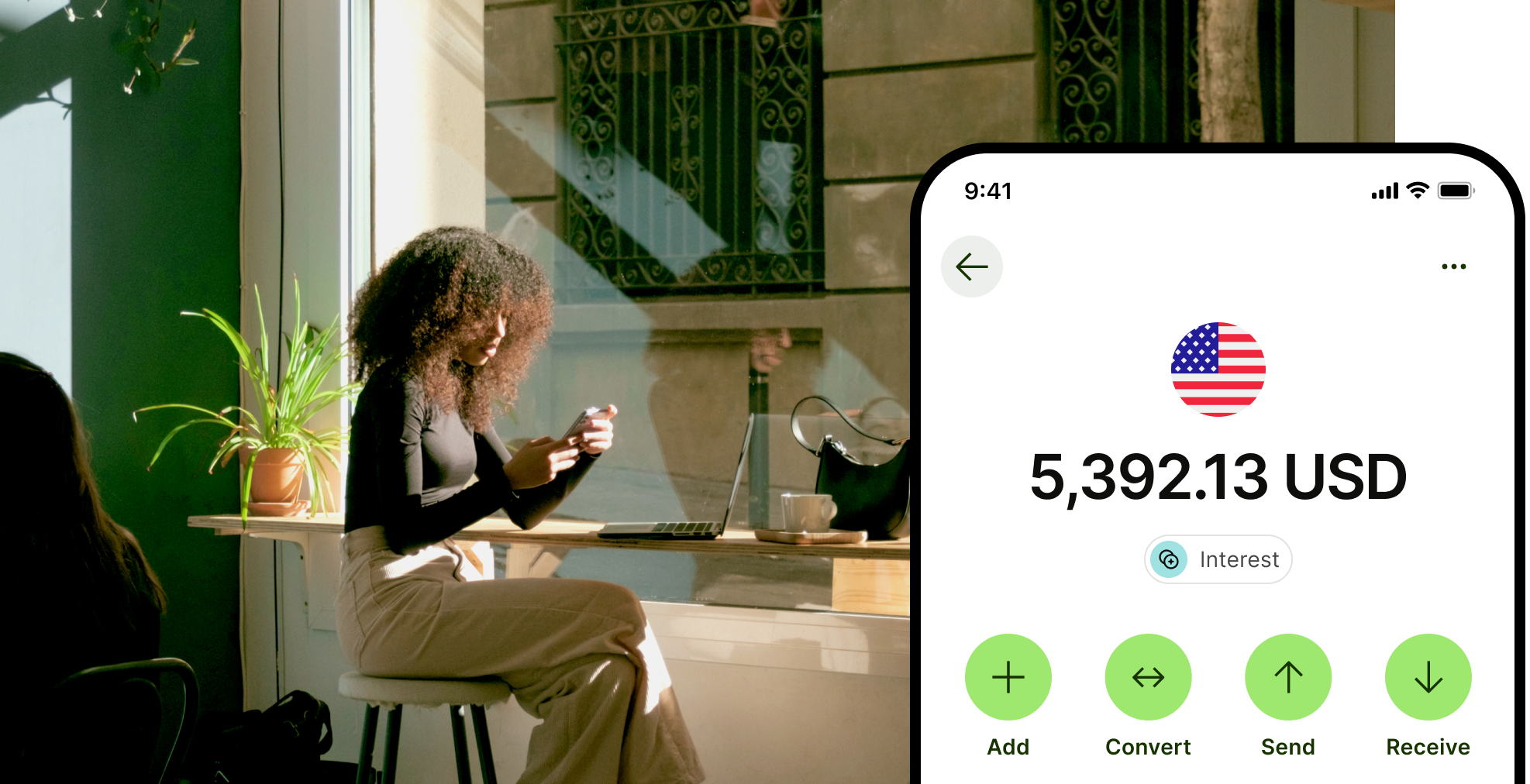

Rates

When you opt in to earn interest, your USD, GBP and EUR balances will be held with our Program Bank**, where Wise earns interest. We use a small portion of the interest we earn on these funds to cover our operating expenses and we pass the rest along to you.

The rates were last updated on 03 July, 2024.