MISSION UPDATE

Q2 2024

Q2 2024

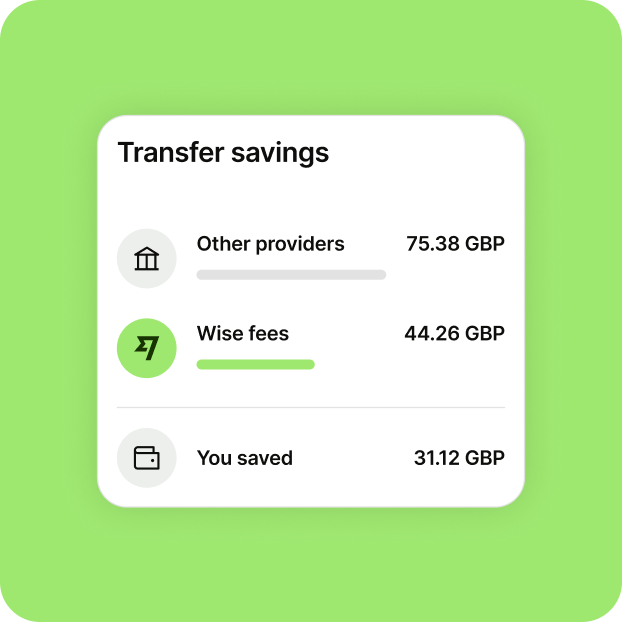

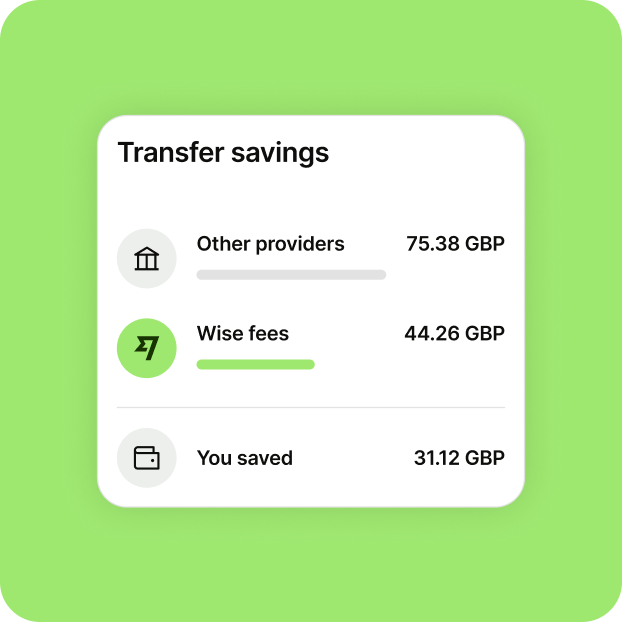

Whether you’ve sent 1 international transfer or 100, you’re likely to have saved on fees by sending it with us and not another provider — you can see just how much in your account summary.

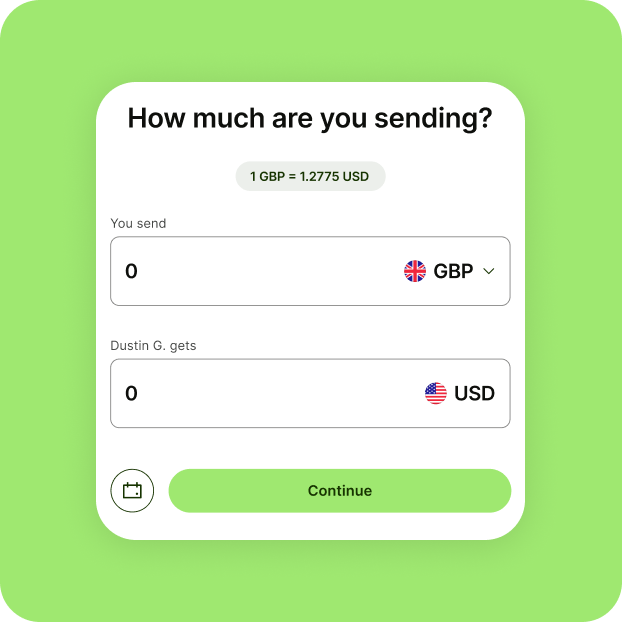

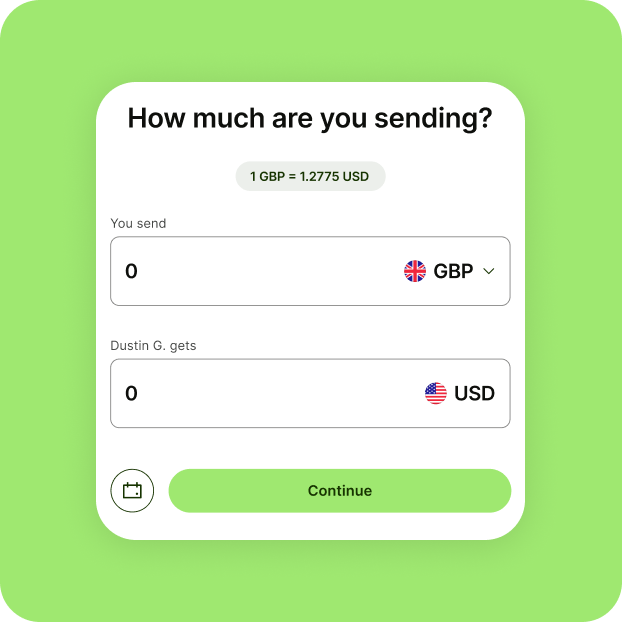

You’ll now select your recipient first so we can give the most accurate fees and delivery time. If you’re using it on your browser, you’ll now see the exchange rate at the top, and can enter an amount without having to clear a default value. We’ll also show you detailed payment methods, delivery estimates and a concise fee breakdown, so that you know exactly what you’re paying for.

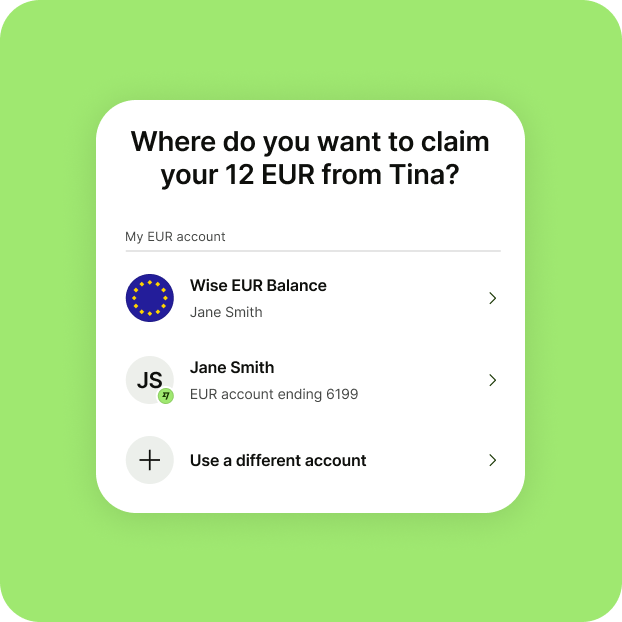

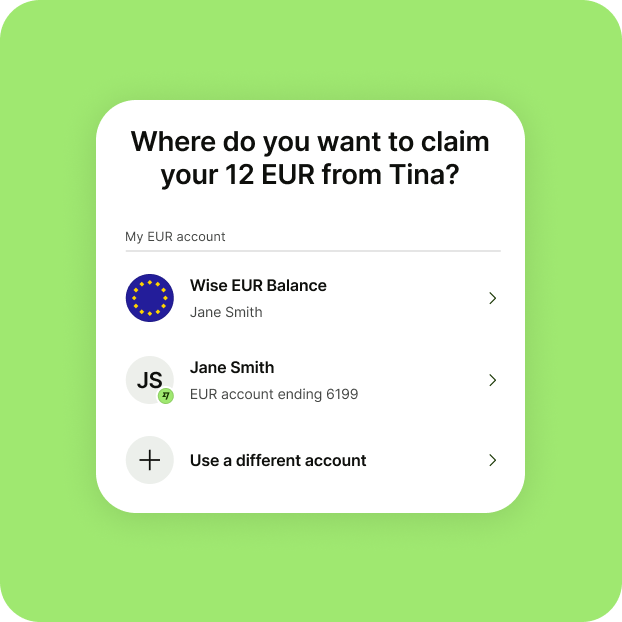

If you receive an email from someone sending you money using Wise, you no longer need to enter your bank details. You can now receive the money directly to your Wise balance.

Whether you’ve sent 1 international transfer or 100, you’re likely to have saved on fees by sending it with us and not another provider — you can see just how much in your account summary.

You’ll now select your recipient first so we can give the most accurate fees and delivery time. If you’re using it on your browser, you’ll now see the exchange rate at the top, and can enter an amount without having to clear a default value. We’ll also show you detailed payment methods, delivery estimates and a concise fee breakdown, so that you know exactly what you’re paying for.

If you receive an email from someone sending you money using Wise, you no longer need to enter your bank details. You can now receive the money directly to your Wise balance.

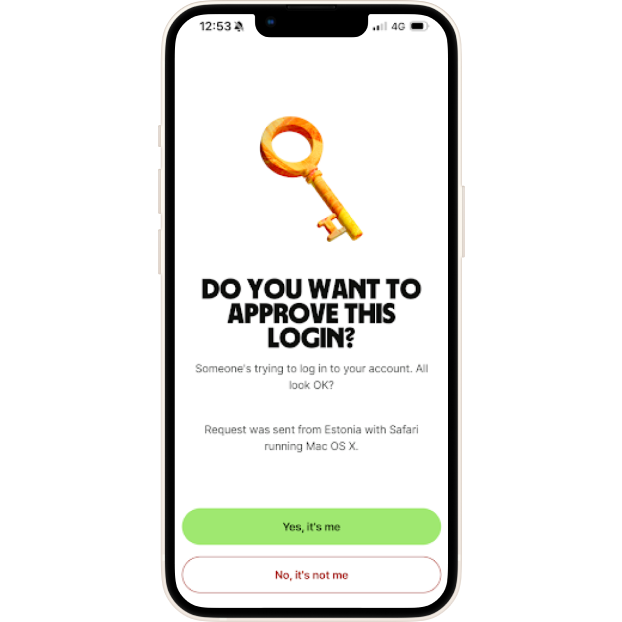

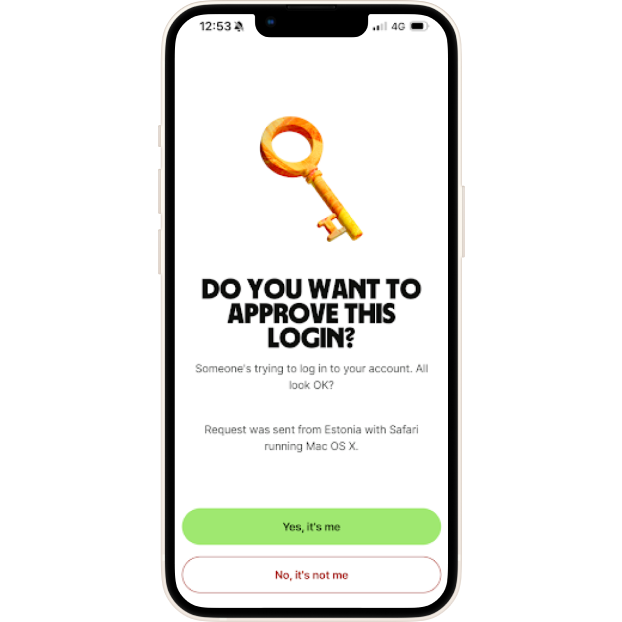

We’ll now send push notifications for 2-step verification from our own system, rather than a third party. This means it’s more reliable and much, much faster. On top of that, we can better detect when we need to send you one. You can also approve other trusted devices from your phone.

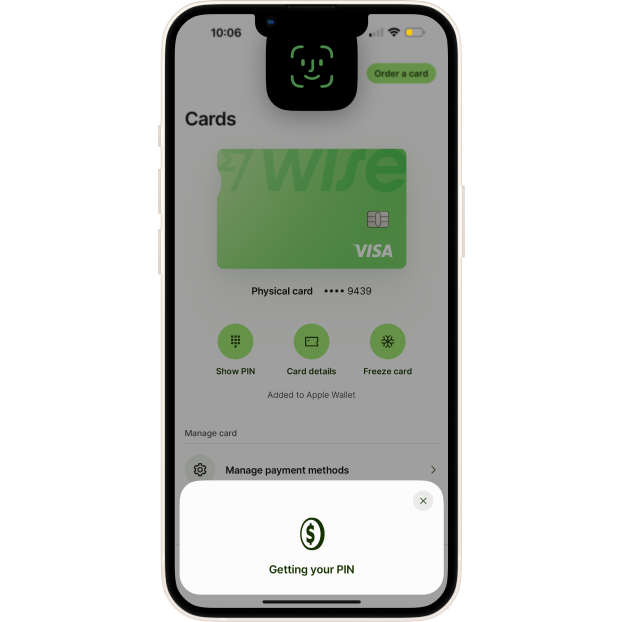

When checking sensitive items like your PIN, Face ID will automatically run to verify it's you.

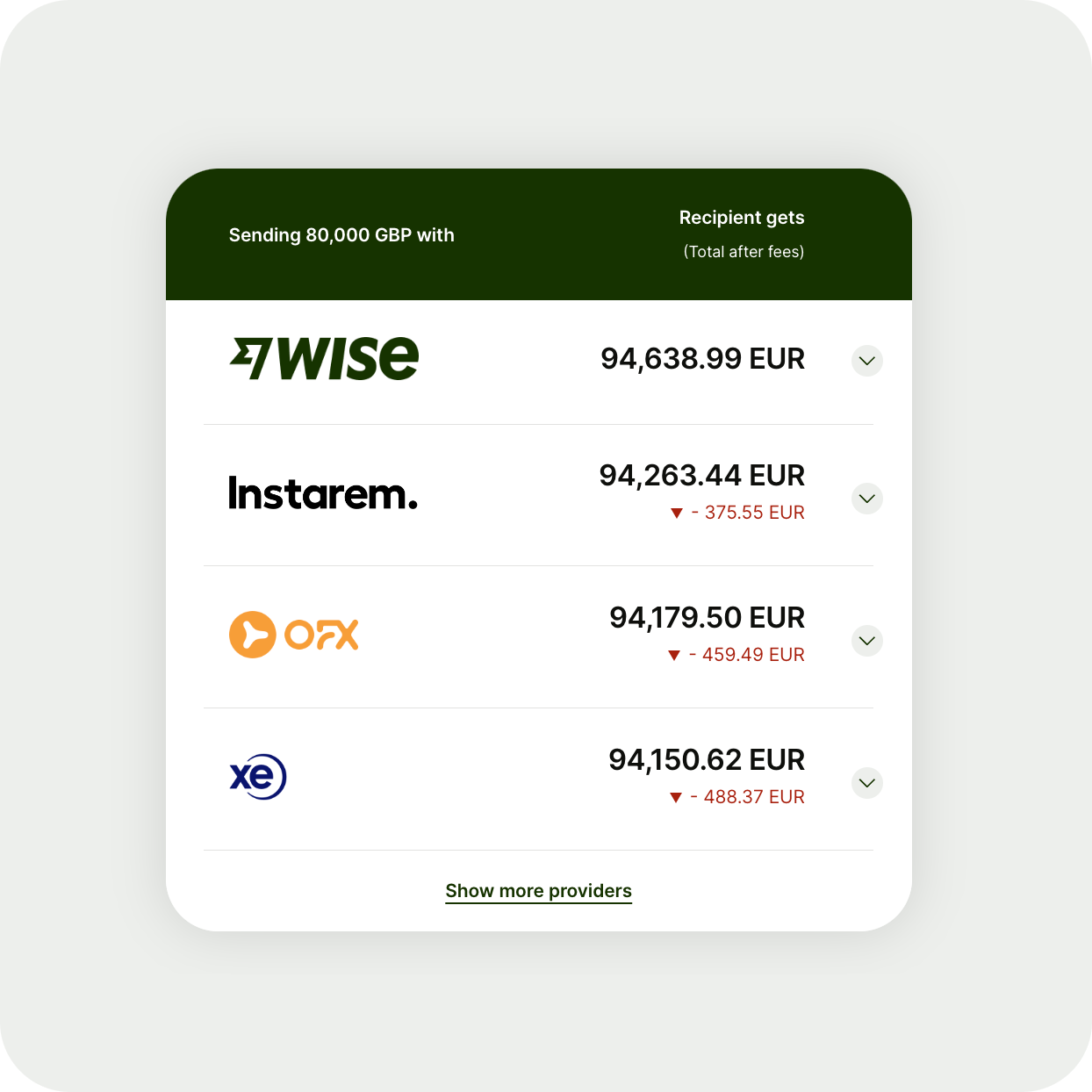

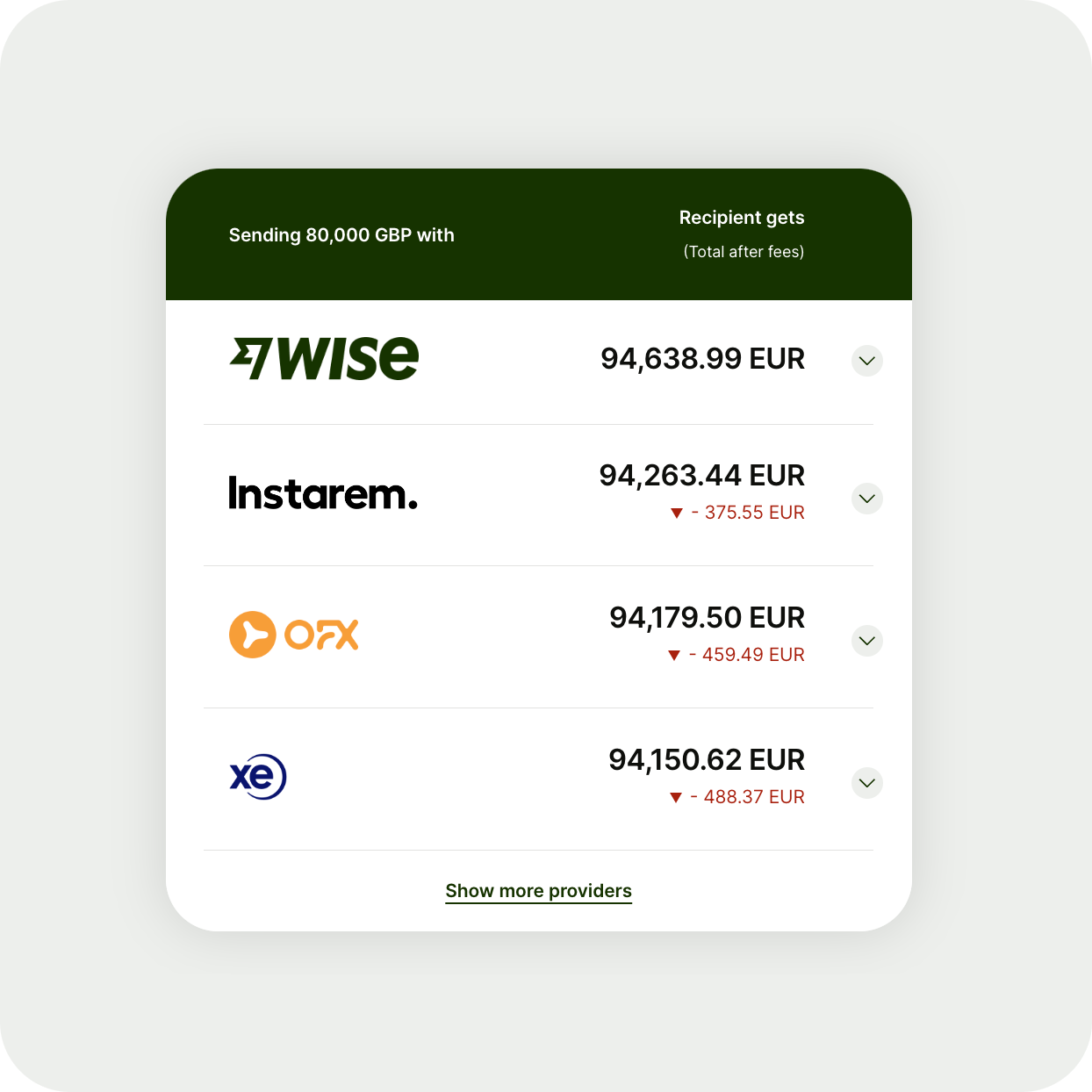

Sending £50k or more? Now you can compare against other providers and see how much you’ll save with us. And we’ve added a callback form in case you need our support when sending a large amount.

We’ll now send push notifications for 2-step verification from our own system, rather than a third party. This means it’s more reliable and much, much faster. On top of that, we can better detect when we need to send you one. You can also approve other trusted devices from your phone.

When checking sensitive items like your PIN, Face ID will automatically run to verify it's you.

Sending £50k or more? Now you can compare against other providers and see how much you’ll save with us. And we’ve added a callback form in case you need our support when sending a large amount.

*Savings estimates are based on the average savings Wise offers compared to all the collected providers we have on the transactions transfer route from 01/03/24 to 30/06/24.

**Past performance is not an indicator of future performance. For full 5 year past performance of the funds, please visit our website.

***The price provided is a global average based on a fixed basket of representative currencies as of Q2 2024 and may not reflect specific prices for consumers in their regions. Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing information.

****Transaction speed claimed depends on individual circumstances and may not be available for all transactions.