Building the future of global money movement

From messaging upgrades to hosted onboarding, here is how we’re evolving to help you and your end customers move money with speed and confidence.

The second quarter of the year has been another busy and successful one for ‘Wise Platform’, hitting some major milestones! This included us entering new markets, introducing a new product as well as our first partners in Brazil and Thailand, launching our refreshed brand, and hosting our second annual Wise Connect event in London.

Read on to find out more about what we’ve been up to in Q2.

Nubank

In April, we announced our partnership with the world’s largest digital bank, Nubank in Brazil. Entering this new market and launching our multi-currency account and cards solution marked a significant milestone for Wise Platform, furthering Wise’s mission to make payments as easy and convenient as possible. Our partnership enables Nubank’s premium Ultraviolet customers to seamlessly manage finances internationally, hold money in USD and EUR, and transact like locals with an international debit card accepted in 200+ countries and territories.

Read more about the partnership in Bloomberg (Brazil), FFNews and listen to the 11:FS Fintech Insider podcast.

Swan

We also launched our partnership with Swan, the European leader in embedded finance. Swan enables companies across Europe to easily embed banking features such as accounts, cards, and payments into their own product. Thanks to our partnership, their 100+ clients can enable their customers to send and receive funds in 20+ currencies at the mid-market rate in just a matter of seconds.

Coverage of the announcement included in L'Agefi, and Finextra.

T2P - DeepPocket

Additionally, we announced leading fintech, T2P as our first Wise Platform partner in Thailand to bring faster, cheaper and more transparent transfers for customers directly in their DeepPocket app. This integration also made T2P the first fintech in Thailand to provide international money transfers to their customers with no exchange rate mark-ups or hidden fees within their app.

Read more about the partnership in FinTech News Singapore and IBS Intelligence.

Qonto

Most recently in June, our partnership with Qonto, the leading European business finance solution, was launched. With this partnership, we’re simplifying the payments experience for over 500,000 SMEs and freelancers across Europe by offering them fast, transparent and low-cost international payment services.

“We're now able to better support our existing customers by offering faster, more transparent transactions as well as fair pricing and timely payments with their international business partners. Additionally, this partnership allows Qonto to welcome new customers, enabling them to utilise our daily business banking services across multiple markets and currencies,” Philippine Rougevin-Baville, Managing Director France at Qonto commented.

Read more about the partnership in Finance Magnates and Financial IT.

Innovate Finance Global Summit

We kicked off April with our Wise Platform team attending Innovate Finance Global Summit in Guildhall. Prasangi Unantenne, Wise Platform’s Global Head of Implementation, spoke on a panel with speakers from Airwallex, Nium, Stripe and Square to discuss where digital payments have had their greatest impact, the infrastructure required to take us towards a cashless future and its implications for consumers, institutions and governments.

Wise Connect London 2024

In May, we hosted our second annual Wise Connect London 2024, uniting over 150 international payments experts from across the globe for an afternoon of insightful discussions, innovation and valuable networking.

We had some fantastic speakers from leading banks and businesses, including Raiffeisen Bank, Lloyds Banking Group, NatWest, International, Bank of America, Bank for International Settlements and McKinsey discussing the future of cross-border payments and the five core capabilities banks must cultivate to capitalise on the $12 trillion low-value cross-border payments opportunity.

Money 20/20 - Europe

In June, Till Wirth, Wise Platform’s Head of Product and Roisin Levine, Head of UK & Europe Partnerships were flying the Wise Platform flag high at Money 20/20 in Amsterdam.

Till was on stage with Nium, Airwallex and Convera to discuss what the future of cross-border payments looks like and had an insightful debate on the latest trends and innovations shaping the global landscape. Roisin spoke with Financial IT about Wise Platform's growth and the impact our collaboration with Swift and Correspondent Services solution have had so far.

Watch Roisin’s interview with Financial IT.

EBADay 2024

Later in June, the Wise Platform team travelled to Lisbon for EBADay 2024. We kicked off the event by hosting a breakfast roundtable with Finextra for 25+ senior representatives from top tier banks including Lloyds, UniCredit and BNP Paribas to discuss the next generation of cross-border payments.

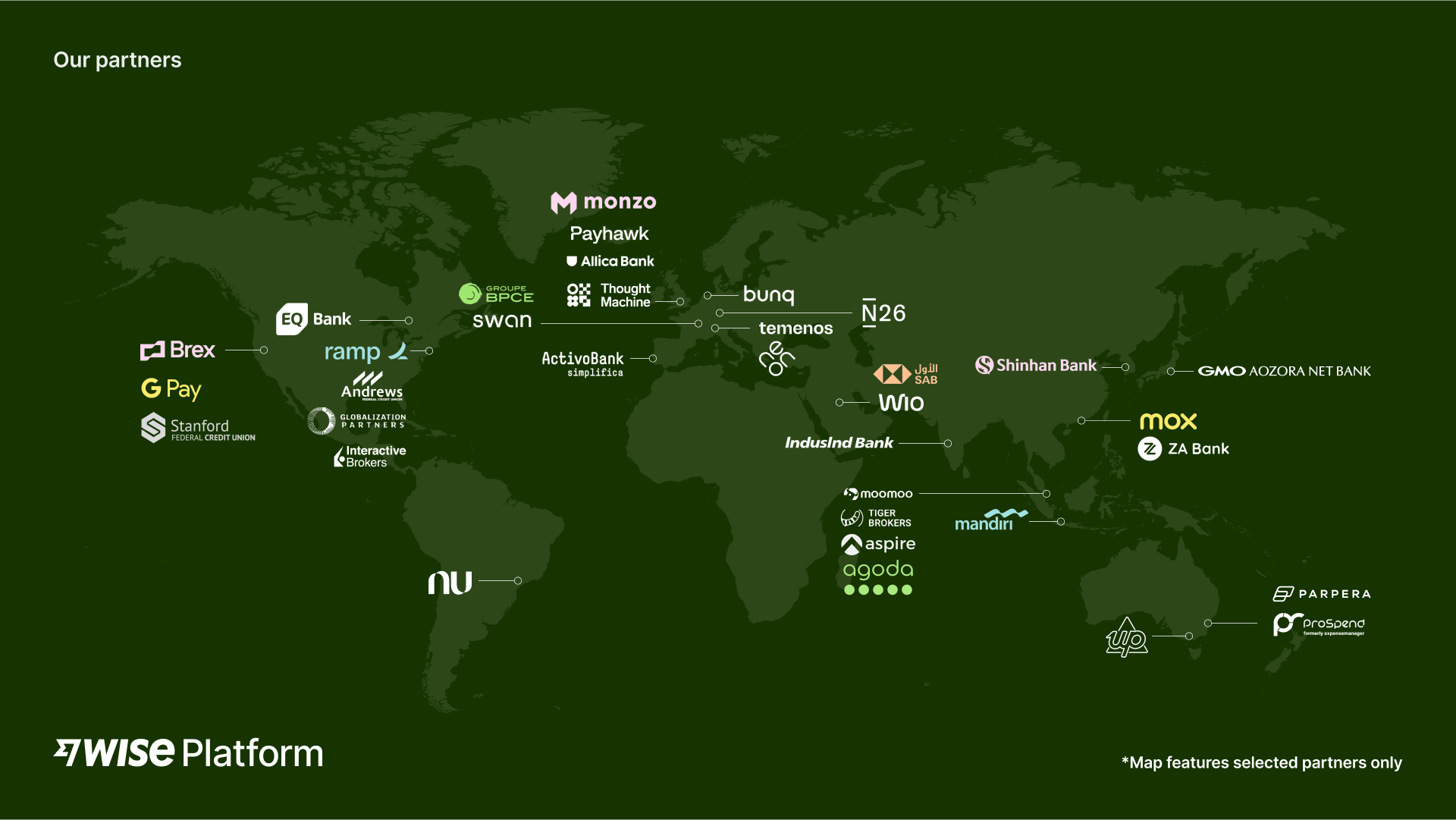

Next up, Roisin Levine was joined on stage by panellists from Deutsche Bank, CaixaBank, Cecabank and Celent to discuss the current state and evolution of correspondent banking services across the world. Roisin highlighted how Wise Platform works with over 85 partners worldwide and how our Correspondent Services solution can help banks distribute risk.

Read more about the session in Finextra.

From messaging upgrades to hosted onboarding, here is how we’re evolving to help you and your end customers move money with speed and confidence.

Building on momentum, IBKR has now rolled out the same seamless transfer experience to business customers across 50+ countries.

Discover how global fintech Aspire partnered with Wise Platform to deliver over half its payments instantly.

Discover how recipient verification ensures your customers send money to the right people, eliminating payment failures and friction.

Explore the 5 cross-border payment trends defining 2026. From G20 targets to retail customers, discover how global payments are moving from sprint to standard.

Discover how EQ Bank launched international payments in just one month — with 75% arriving instantly* and 70% becoming repeat users.