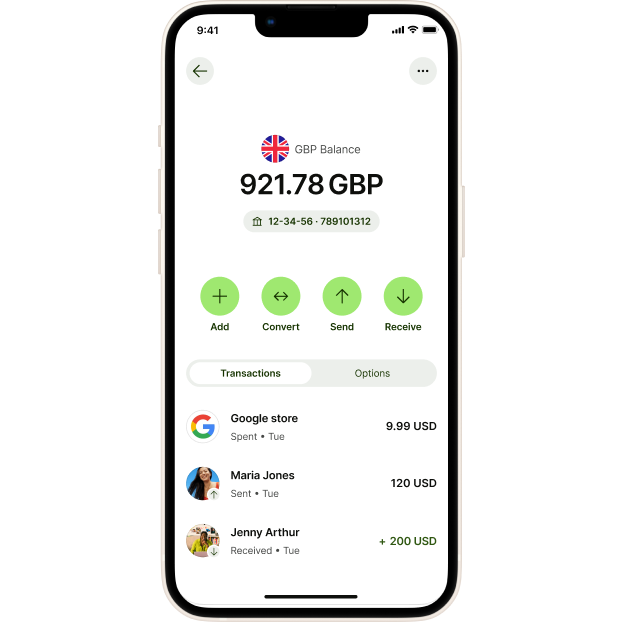

Since May, we’ve consistently dropped our fees, which means our average fee is now just 0.62%. That’s down from 0.65% last quarter².

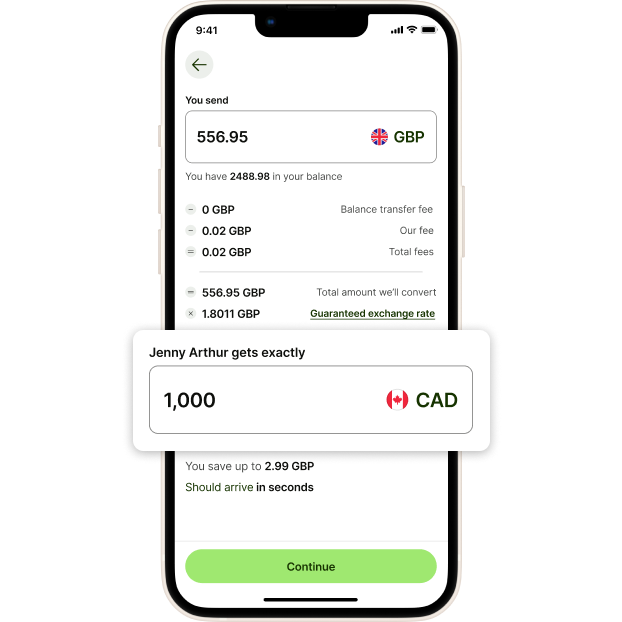

It's now cheaper to send 15 currencies, including major currencies like the euro, US dollar, and British pound. If you're in Canada or the US, adding money to your account or funding transfers with ACH, cards, or wire transfers is now cheaper, too. As an example, this means sending 1,000 USD to AED via wire transfer is now 17% cheaper.

It's also never been cheaper to send large amounts with Wise. You'll now get a discounted fee when you send over 20,000 GBP (or equivalent) in a month, whether that’s in a one-off payment or multiple transfers. The more you send, the lower that fee will be.

See how much you can save.