Q3 2024 Mission Update: Speed

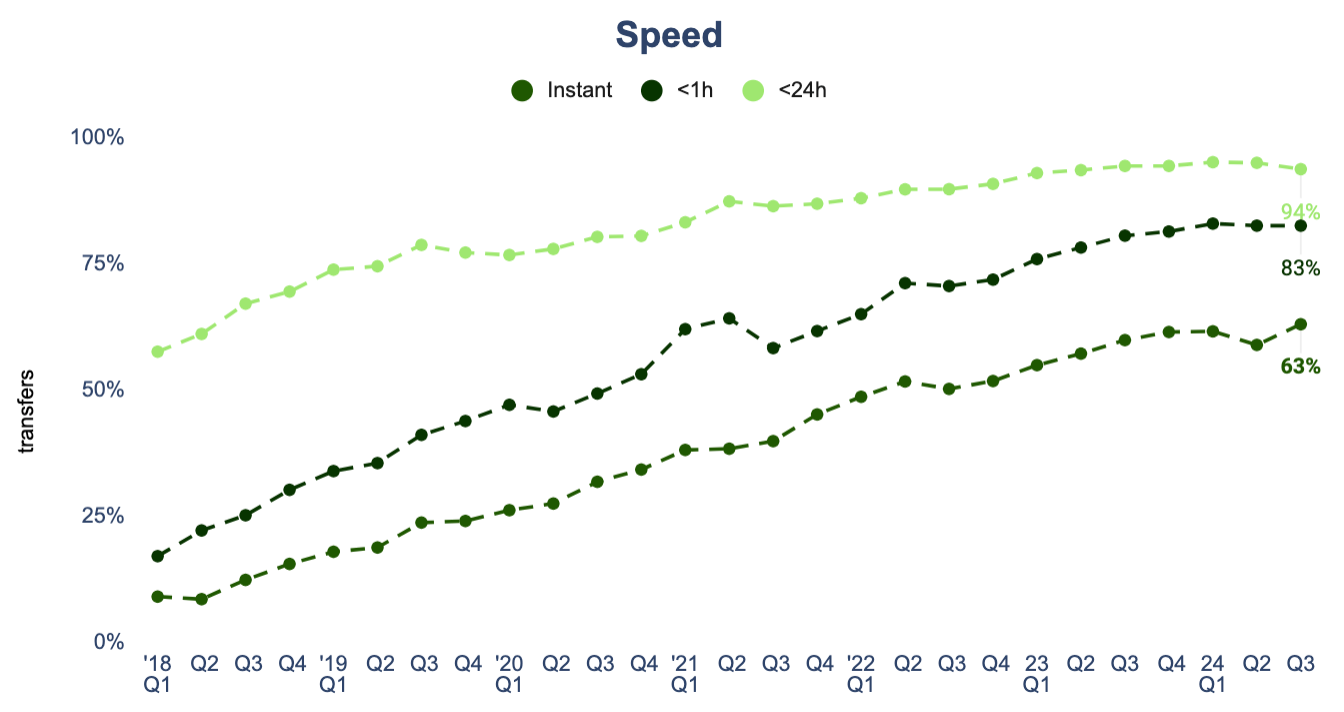

Speed

We are constantly finding ways to make cross-border payments faster and we’re really excited about the progress we've made in Q3 2024.

This quarter, 63%* of your transfers were instant, meaning they were completed in under 20 seconds This is an all time high, especially after seeing a drop to 59% last quarter. This has been possible thanks to a few exciting changes.

So what's changed?

First of all, in August we moved our below 500,000 DKK payments through a new partner which has helped to pay out 50% of DKK transfers instantly.

Also, in the first quarter we announced that international payouts to Australian dollars (AUD) are now instant to a number of banks, including to Westpac and ANZ. We are excited to share that the local network in Australia, the New Payments Platform (NPP), has now onboarded the remaining two major banks, CBA and NAB, to the network. This helps to significantly increase the number of non-Australian customers' payments to AUD that are processed instantly.

We’ve been also working hard to speed up the screening process to make sure we are able to process a large amount of transfers instantly at the same time. As a result, the number of

times where we’ve promised instant delivery but failed decreased from 21% in Q2 to 17% in Q3.

In addition to instant transfers, a new partnership has helped to speed up transfers sent to VND personal recipients from 1 hour to under 25 seconds.

While we’ve made some great improvements, we recently found an issue with some payments to GBP that we wanted to let you know about. When we send money to GBP, we rely on the Faster Payment System (FPS) to confirm the payment has arrived. However, sometimes we get these notifications while the funds are still being held by the recipient's bank for extra checks. This caused confusion, so last May, we updated our speed estimates to give you a more accurate idea of delivery times.

While payments are sent instantly, we don’t always have visibility on when the recipient's bank actually credits the money, as they may delay for further checks. This led to a reporting issue with our instant payments percentage, which we recently discovered in July. A small number of transfers to GBP were affected, but we’ve fixed the issue since and are committed to avoiding similar discrepancies in the future.

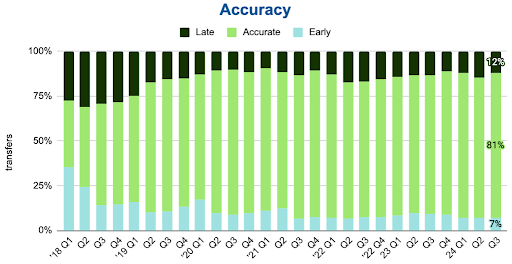

Accuracy

Of course we want to make all transfers as fast as possible, but it’s even more important that we keep our promises and deliver your transfers when we’ve promised. We track the accuracy of our transfer arrival estimates as ‘Early’, ‘On time’ or ‘Late’. In Q3 we saw an increase in speed estimates accuracy from 78% to 81%, back to Q1 level.

What contributed to these changes?

Integrating with new partners always brings excitement, particularly when it enhances transfer speed. However, the implementation phase can negatively affect the accuracy of speed estimates. This is precisely what happened with transfers to VND and DKK. VND on time transfers dropped from 81% to 53%, DKK from 85% to 79%. We are working on getting these back to the same and even better levels than before.

On a good note, we are seeing some great changes in payments sent to CHF and INR. By updating our payout rules for CHF payments we have been able to make them more accurate. In INR, we are now receiving immediate information from our partner HDFC about the payout status. This means we are able to be much more accurate in our speed estimations, from 54% in Q2 to 75% in Q3.

In Q4 we will continue to see the impact of above mentioned changes on speed and estimations accuracy and we’ll focus on understanding the reasons behind late payments even more.

*Transaction speed claimed depends on individual circumstances and may not be available for all transactions.