MISSION UPDATE

Q4 2023

Q4 2023

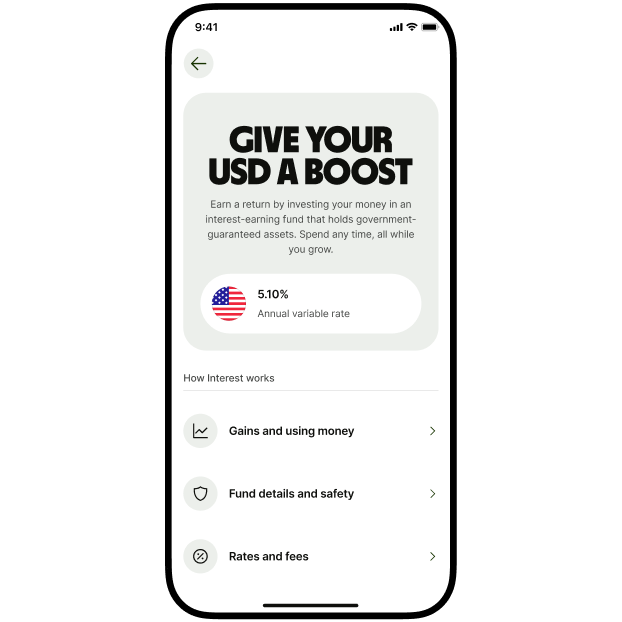

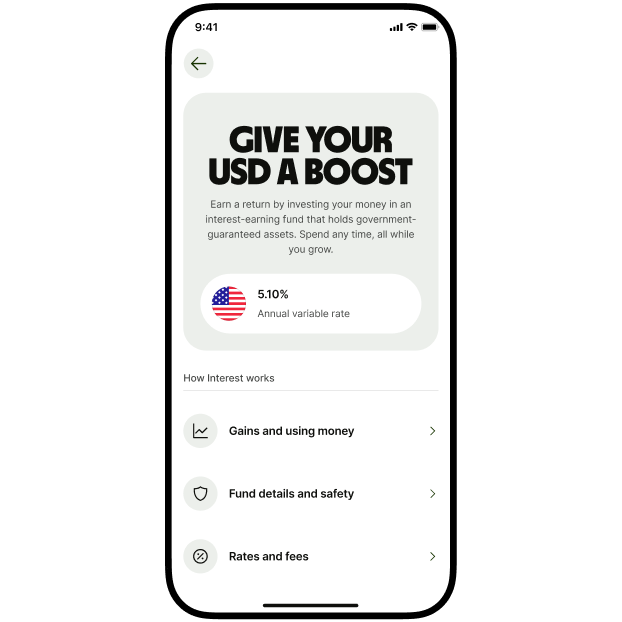

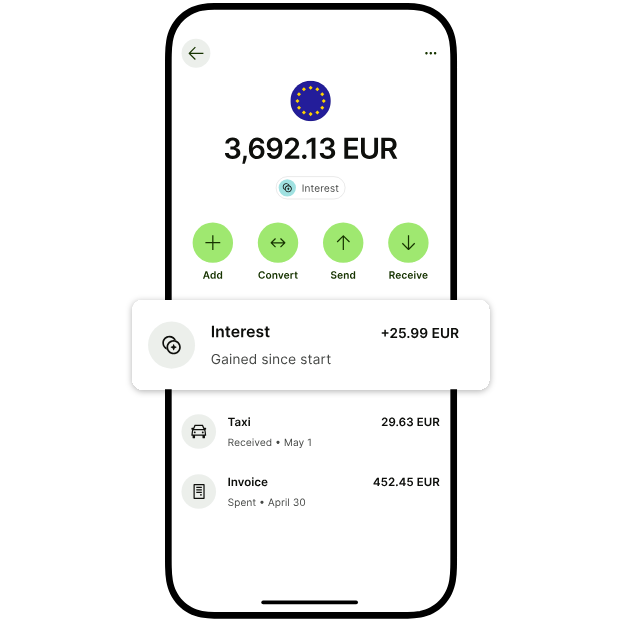

Holding USD? With Interest, you can now hold and grow your money in a fund that holds government-guaranteed assets. Available in France, Finland, Luxembourg, Netherlands, Austria, Spain, and Estonia. Capital at risk. The fund has returned an 1.53% annual average over the last 5 years, excluding Wise fees. The current rates do not guarantee future growth and your return may increase or decrease. For full 5 year past performance of funds, please visit our website.

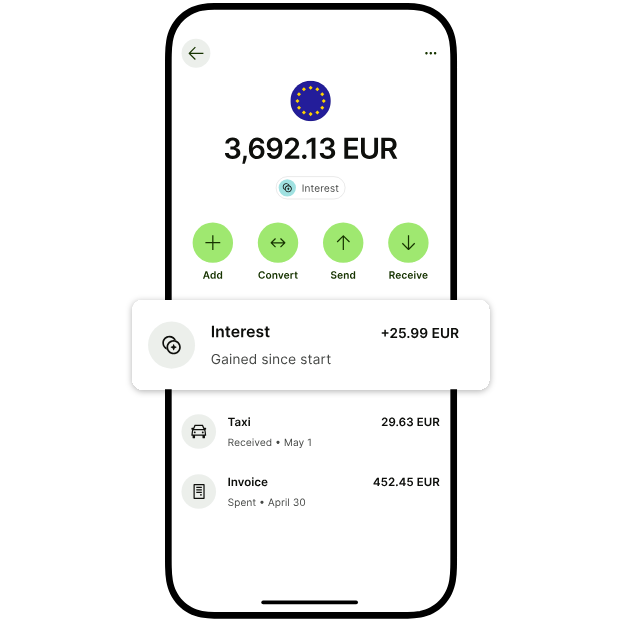

That’s right. US customers can now earn interest on their EUR and GBP balances, as well as on their USD. Not currently available in Alaska or New York. See Program Agreement for details.

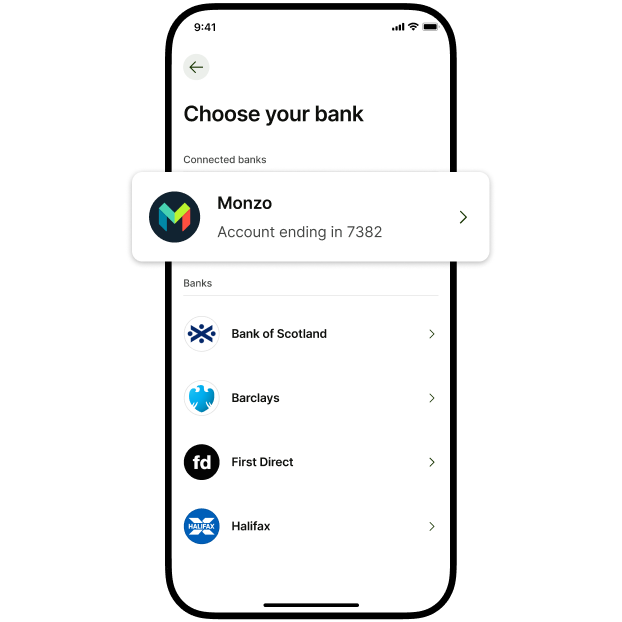

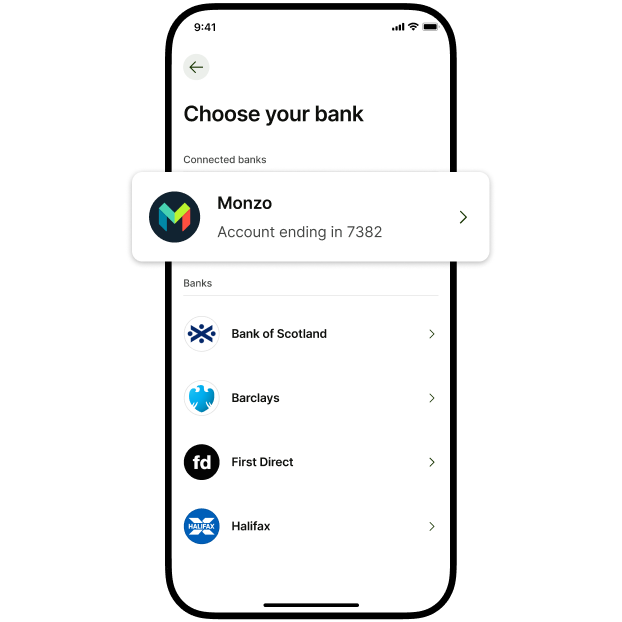

Add money to your balance from your Monzo account without having to leave the Wise app — just like you can from 10 other banks. Authorise Monzo once and then you’ll be set for one-tap top-ups, whenever you need.

You can now securely pay with your Wise card anywhere you see the Apple Pay, Google Pay or contactless symbol at checkout.

Holding USD? With Interest, you can now hold and grow your money in a fund that holds government-guaranteed assets. Available in France, Finland, Luxembourg, Netherlands, Austria, Spain, and Estonia. Capital at risk. The fund has returned an 1.53% annual average over the last 5 years, excluding Wise fees. The current rates do not guarantee future growth and your return may increase or decrease. For full 5 year past performance of funds, please visit our website.

That’s right. US customers can now earn interest on their EUR and GBP balances, as well as on their USD. Not currently available in Alaska or New York. See Program Agreement for details.

Add money to your balance from your Monzo account without having to leave the Wise app — just like you can from 10 other banks. Authorise Monzo once and then you’ll be set for one-tap top-ups, whenever you need.

You can now securely pay with your Wise card anywhere you see the Apple Pay, Google Pay or contactless symbol at checkout.

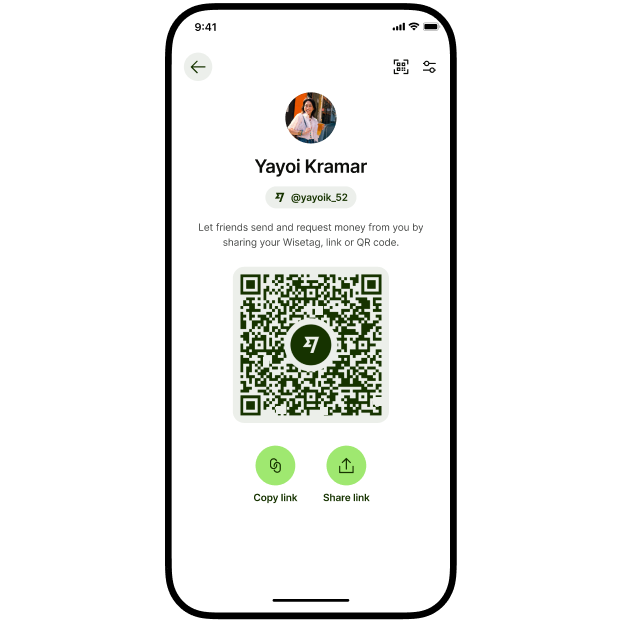

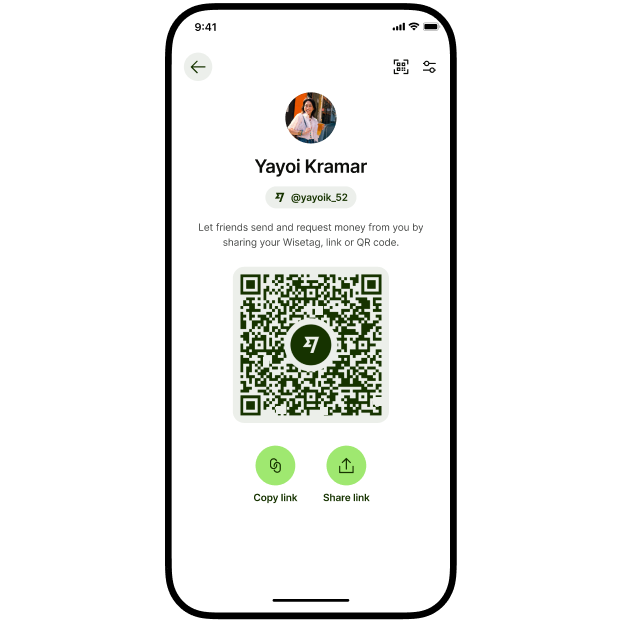

With your unique Wisetag link or QR code, you can now quickly and easily receive and request money from other Wise users. And the best part? You can do it for free. To receive money, just share your Wisetag — you’ll find this in the app, just tap your profile picture and then ‘Get your Wisetag’. Other Wise users can then send you money, even if they don’t have your mobile number or account details.

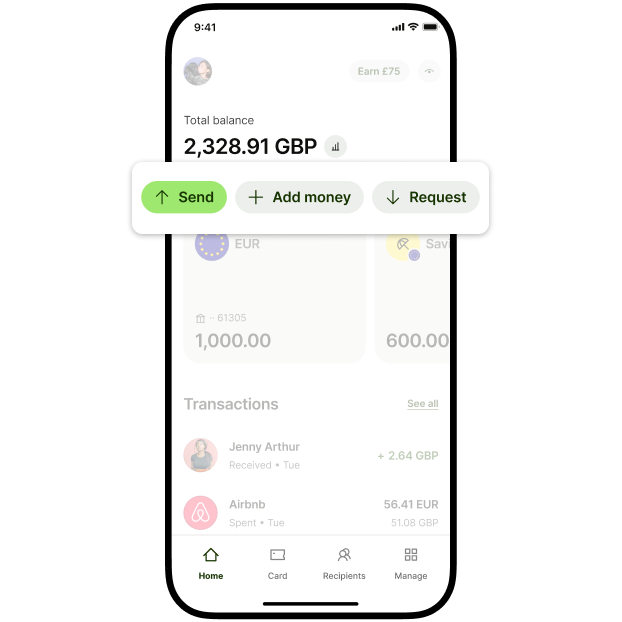

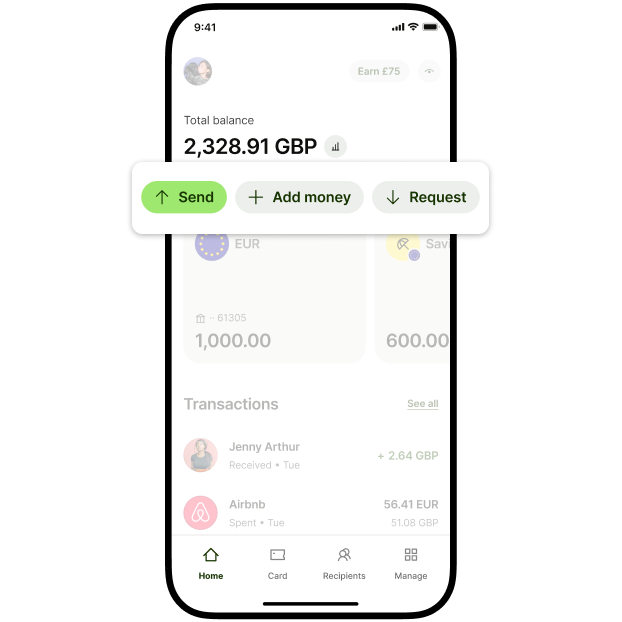

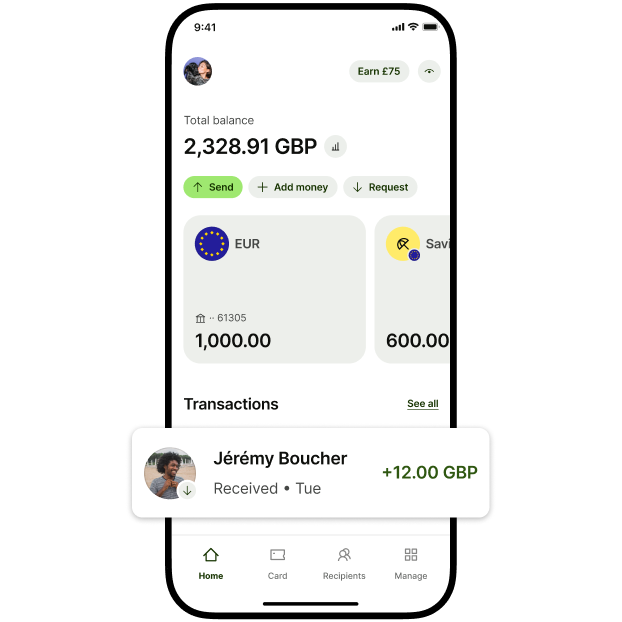

You can now send, add and request money from the home screen of your Wise app. Now that’s what we call max ease.

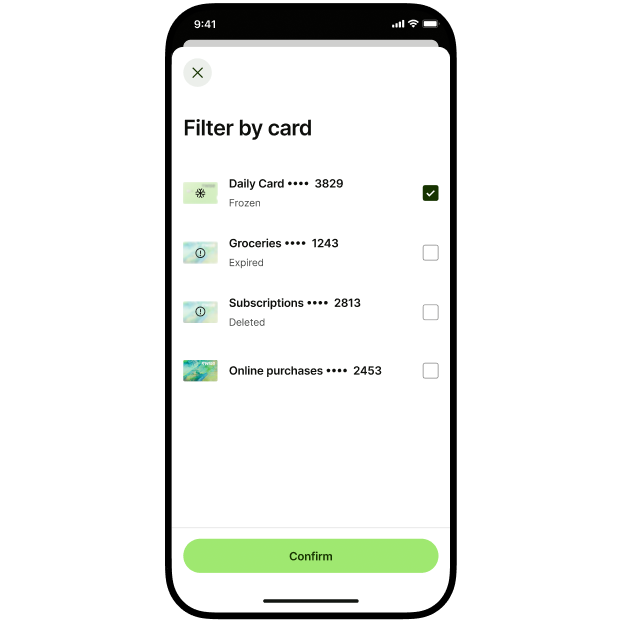

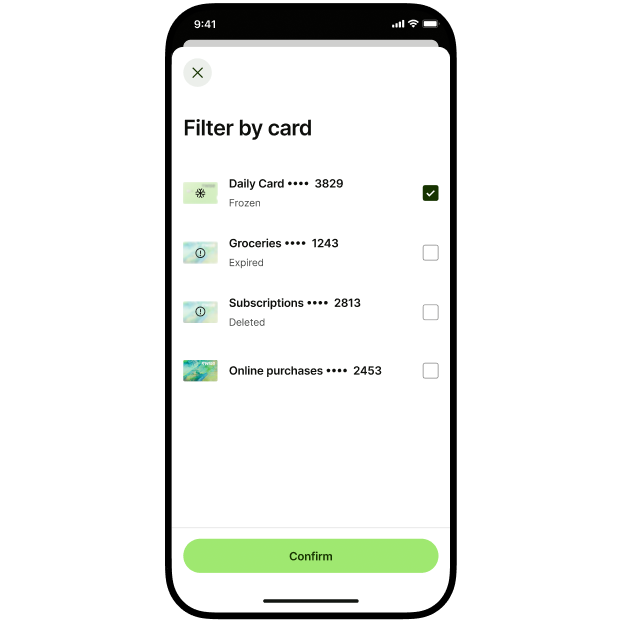

Carrying more than one card? However you’re using them, whether it’s for groceries, subscriptions or online shopping, you can now view each card’s transactions separately. Making it even easier to track your spending.

With your unique Wisetag link or QR code, you can now quickly and easily receive and request money from other Wise users. And the best part? You can do it for free. To receive money, just share your Wisetag — you’ll find this in the app, just tap your profile picture and then ‘Get your Wisetag’. Other Wise users can then send you money, even if they don’t have your mobile number or account details.

You can now send, add and request money from the home screen of your Wise app. Now that’s what we call max ease.

Carrying more than one card? However you’re using them, whether it’s for groceries, subscriptions or online shopping, you can now view each card’s transactions separately. Making it even easier to track your spending.

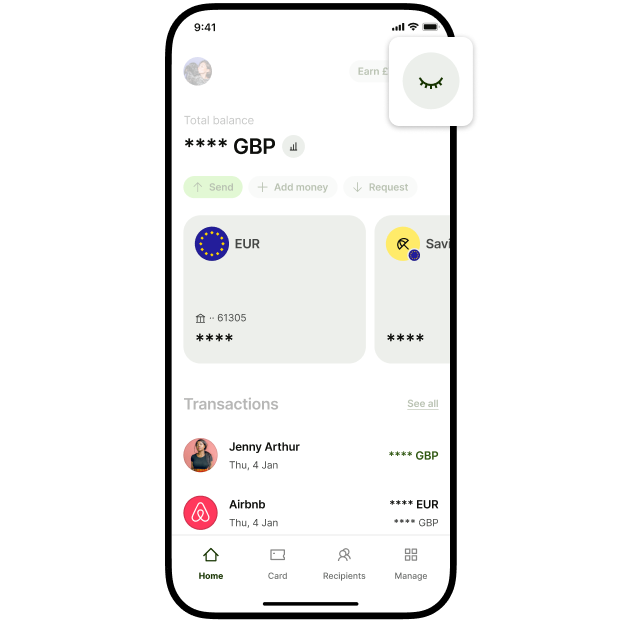

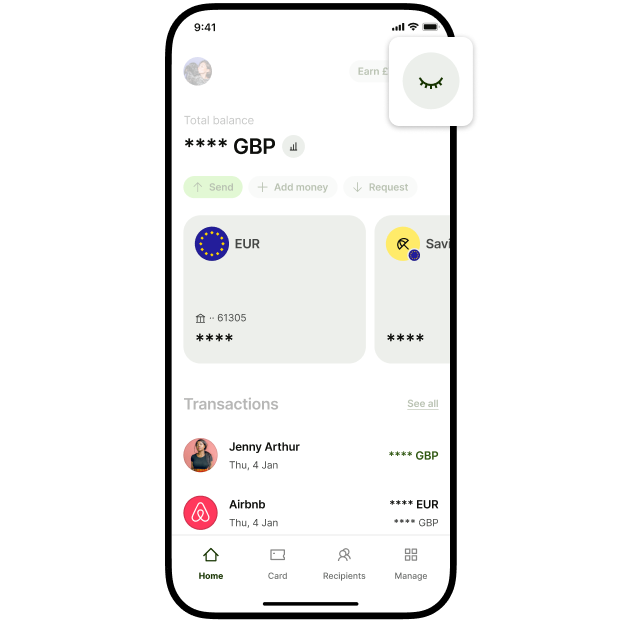

Hide your total balance and any sensitive transactions using the privacy view, and keep what you’ve got to yourself. Especially handy if you’re showing off the Wise app.

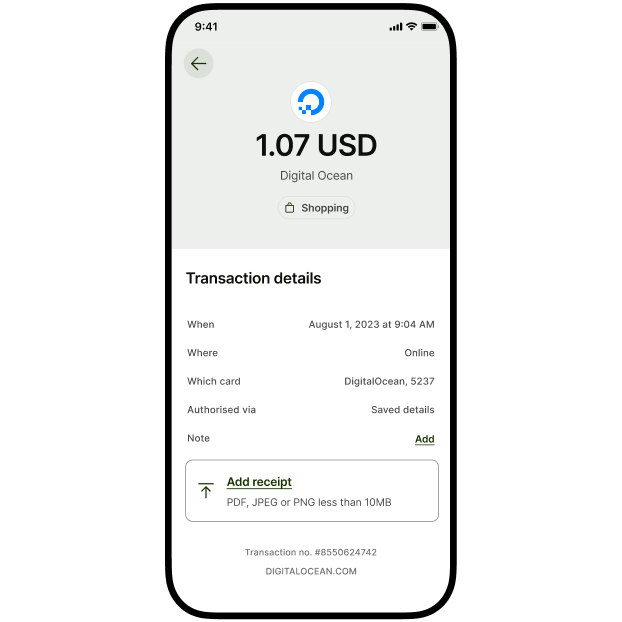

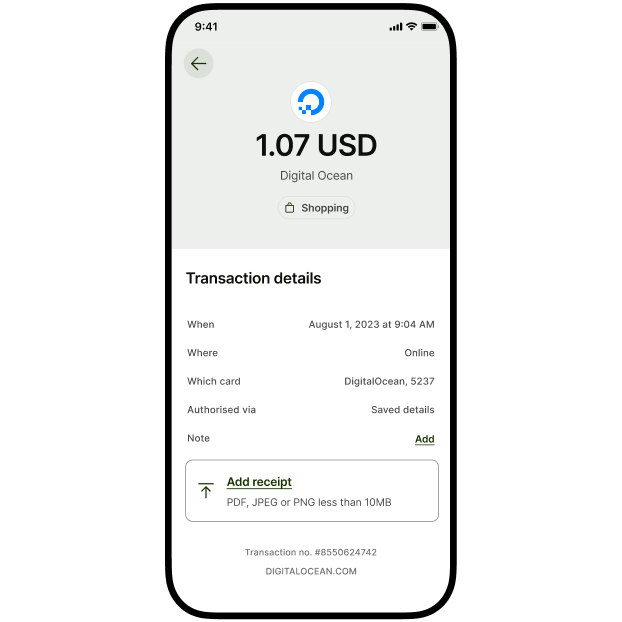

With just a tap, you can now get more information about pending transactions, such as when, where and how the payment was made.

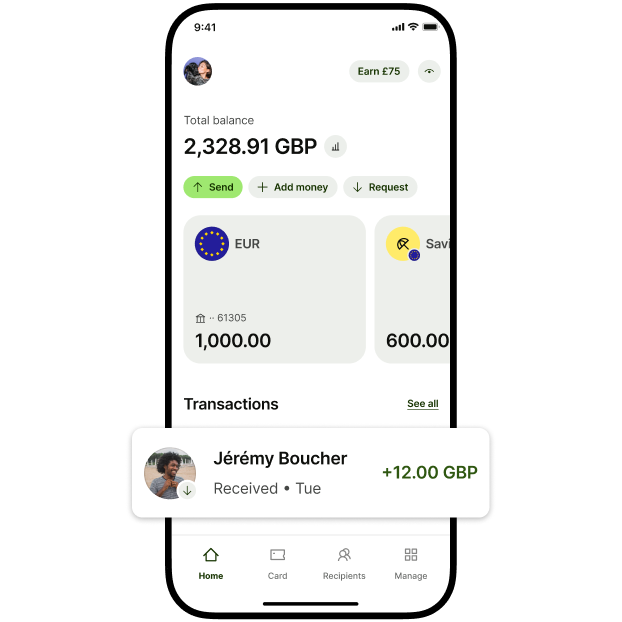

You asked, we delivered. Now you can see the profile pictures of friends and family who you send and receive money from.

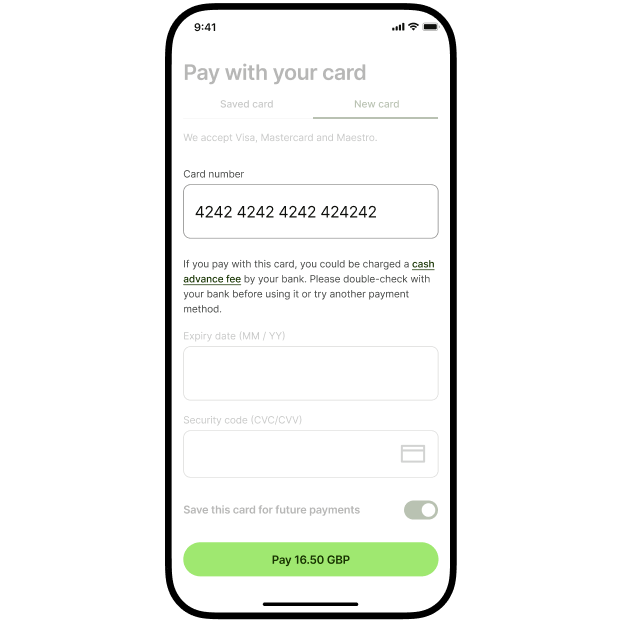

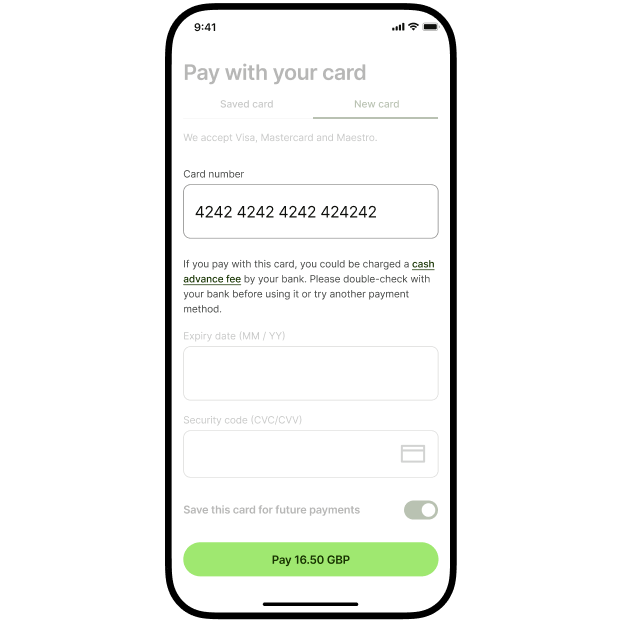

Whether you’re ordering a Wise card, adding to your balance or making a transfer, if you pay for it with your credit card, you’ll now see an advanced warning about any credit card charges you might face.

Hide your total balance and any sensitive transactions using the privacy view, and keep what you’ve got to yourself. Especially handy if you’re showing off the Wise app.

With just a tap, you can now get more information about pending transactions, such as when, where and how the payment was made.

You asked, we delivered. Now you can see the profile pictures of friends and family who you send and receive money from.

Whether you’re ordering a Wise card, adding to your balance or making a transfer, if you pay for it with your credit card, you’ll now see an advanced warning about any credit card charges you might face.

*Savings estimates are based on the average savings Wise offers compared to all the collected providers we have on the transactions transfer route from 1/10/23 to 31/12/23.

**Past performance is not an indicator of future performance. For full 5 year past performance of the funds, please visit our website.