What is the Cross-Border Payments Regulation?

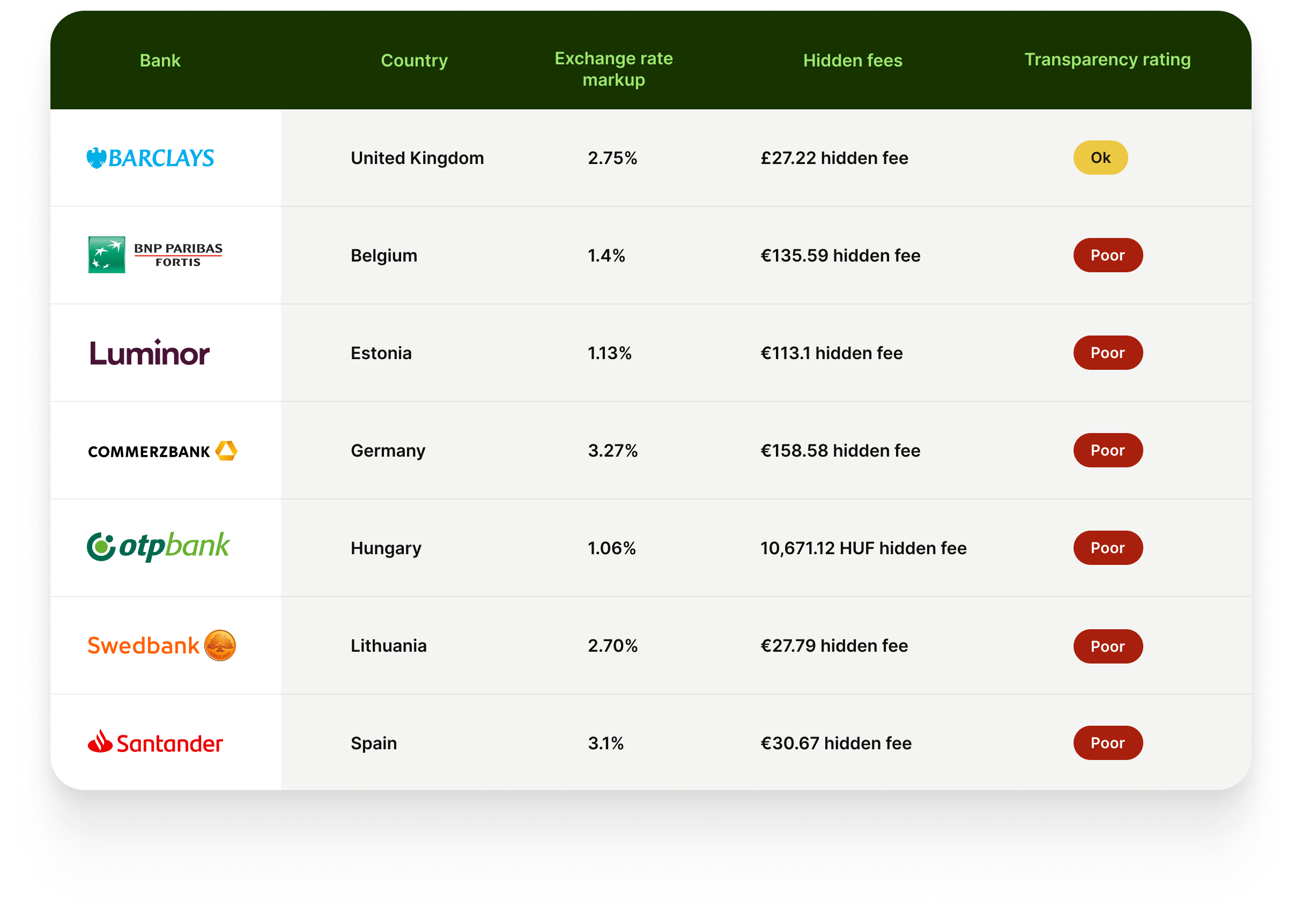

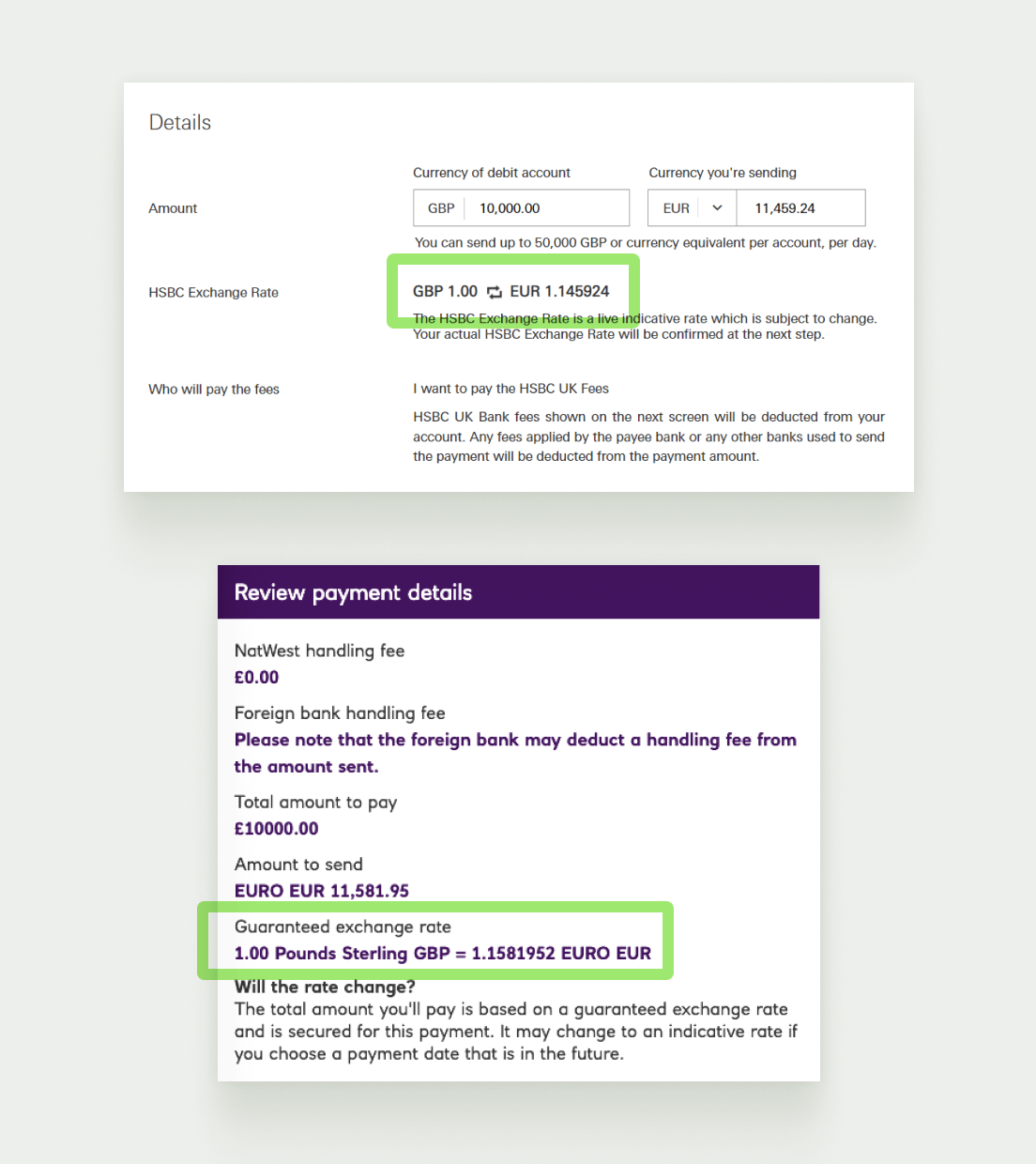

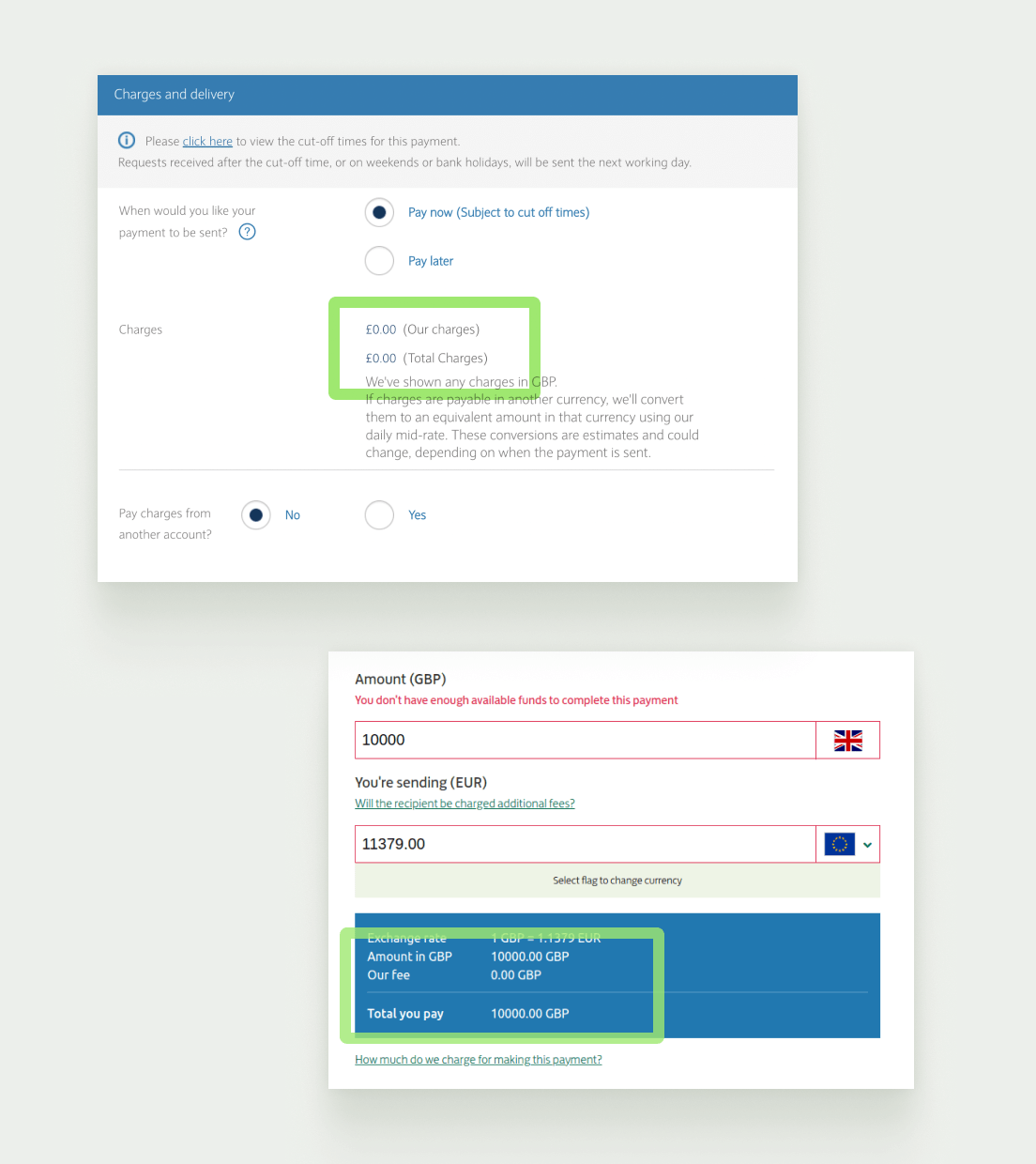

The Law also sets out that it was necessary to come up with additional rules in order to protect consumers against excessive charges for currency conversion services – and to ensure that consumers are given the information they need to choose the best currency conversion option.