Tanzania Corporate Tax - Guide for International Expansion

Learn about the corporate tax system in Tanzania, its current rates, how to pay your dues and stay compliant, and best practices.

Having visibility and control over your business' cash flow is critical to its success but most importantly survival. Cash flow is flagged as one of the top reasons many businesses fail or struggle to pay employees at any given time so knowing where and how to manage costs is vital to running efficiently.

Cost of sales is one of the most important performance metrics to get a handle on, particularly if your business is goods-based. In this article we'll explain what cost of sales is, how it is calculated and some actions you can take to reduce or manage it as an international business.

| Reduce costs on international payments and transfers with Wise. Find out how |

|---|

| 📝 Contents |

|---|

The cost of sales or cost of goods sold (COGS) is the total direct costs involved in making a product or service ready for being sold. The cost of sales determines how much each unit of a product costs to the business, and helps them calculate the the gross profit and margin from the revenue you've generated.

Cost of sales is one of the key performance metrics for businesses that sell physical products in understanding the profitability of their goods. Put simply, the gross profit is calculated by subtracting the cost of goods from the sales revenue.

| 💡It’s important to mention here that the cost of sales is a core business expense it is a little different from normal expenses. COGS is an expenditure, i.e. where the resources or money involved is directly used to create or build something. An expense is where the item that you spend money on is used or consumed. Usually, both terms are used interchangeably, but they are fundamentally different.² |

|---|

There are numerous factors that make up the cost of sales, and one of the most common variables is the cost of raw materials that are used to manufacture the product, as well as the cost of parts that are used to put the product together. If you are importing raw materials or parts for use in the product, then you can also add shipping and freight fees to the total cost.

Here are some of the other costs added to the cost of sales:

The cost of sales is more than just including the costs of raw materials or the resources that are used up in manufacturing the product. Along with this, the import costs for parts and materials, as well as the costs involved in marketing or selling the product are included in calculating the cost of goods sold.

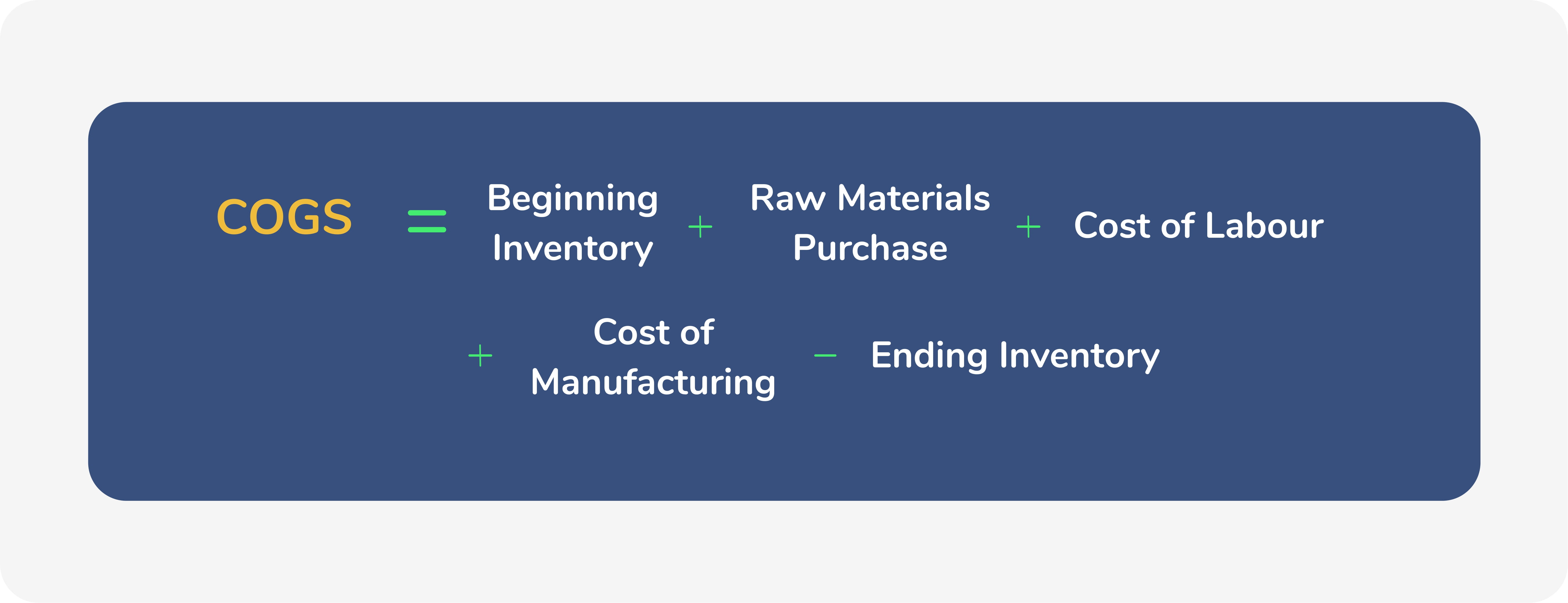

The general formula for cost of sales, or cost of goods sold, is as follows:

A more extensive version of this formula is as follows:⁴

This formula is used by businesses of various industries all over the world to determine the cost of goods sold. Some companies also have their own hybrid formulas that are based on the changes in their inventory.

Now that we have gone through what the cost of sales is, what is included in it, and the formula for it, it is also important to understand how it’s actually calculated. If you have a look at the formula shared in the previous section, there are numerous variables involved that affect the overall cost.

The beginning inventory includes all of the products, raw materials and any other supplies for your goods that you already have at the beginning of the year (normally the new fiscal year). The beginning inventory is calculated by multiplying the number of units available at the start of the year with the price per unit that was applicable when these items were bought.

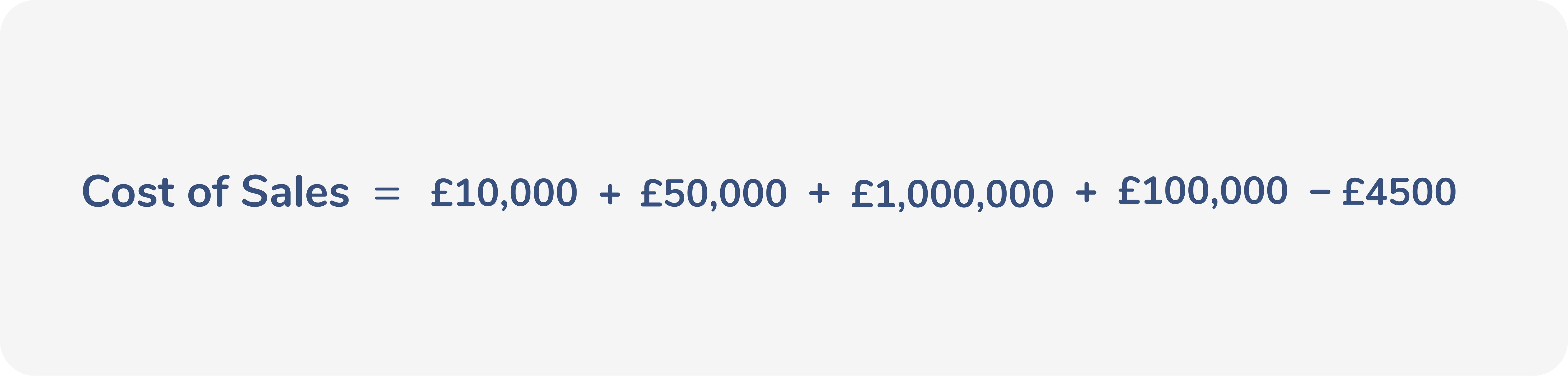

For instance, if you bought 1,000 units for £10 per unit at the beginning of 2021, your beginning inventory would be 1,000 * £10 = £10,000. Since you would use items from your inventory before purchasing anything new, the beginning inventory is added to the formula.

Raw materials are the base of any product, and any raw material that isn’t already available in your inventory will have to be ordered, and the cost for its ordering will be added to the cost of sales formula. If you have imported raw materials from another country, you would also need to add the freight or shipping costs to the purchase cost.

The cost for raw materials is also calculated in a similar method to the beginning inventory. You multiply the number of units purchased with the price per unit levied at the time. So, if you have ordered 5,000 units of raw materials for £10 per unit, your purchase of raw materials would be valued at 5,000 * £10 = £50,000.

Labour is another integral part of the manufacturing process and its cost must be included in the cost of sales to get a more accurate value. It is calculated by multiplying the hourly wage you pay your employees with the hours of production and the number of labour resources that you have. To put it simply, if the hourly wage is £10 and you have 100 workers who invested 1,000 hours into the production, you get £10 * 1,000 * 100 = £1,000,000.

The cost of manufacturing involves the hourly overhead costs, which include the utilities and other resources used up in the production process, and also the number of production hours. Simply put, if your overhead cost per hour is £100 and the production hours are 1,000, as in the previous example, you would get £100 * 1,000= £100,000.

The last value is the ending inventory, which is essentially the total value of all products or goods you have left at the end of your fiscal year. It is calculated by multiplying the number of units at the end of the year with the current price per unit.

Suppose that, out of the 1,000 units that you had at the beginning of the year, 300 are remaining and the price per unit has increased to £15 from £10. Then, your ending inventory will become 300 * £15 = £4,500.

If you bring together all of the fictional values that we have calculated in this section, the cost of sales would look like this:

Identifying ways of reducing your total costs of sales is important when trying to figure out how to increase your overall profitability - here are some times on how reduce cost of sales and other expenses.

You probably spent a fair amount of time looking for the right manufacturing partner but as you start to get more clarity on your numbers, it might be worth re-evaluating the landscape in other countries. China is popular destination for many UK small business owners because production costs are significantly lower. Alibaba is one of the biggest global B2B marketplaces serving businesses all over the world - you need to order products in bulk but the price per unit tend be incredibly low. Be sure to also compare your preferred suppliers with other competitors and marketplaces - it could help you negotiate an even better price.

As your business matures, you’re likely to realise the importance of not losing money on poor foreign exchange rates and high transaction fees when you send or receive payments overseas (particularly when you pay suppliers abroad).

Foreign currency accounts are available with traditional banks, but you still need to deal with the hassle of having multiple accounts for all the currencies you operate with making it harder to consolidate your finances. You could benefit from using an alternative like Wise Business Account where you can manage all your currencies in one account and reduce international transaction costs by over 70% compared to leading banks.

You could cut the cost of labor and optimise some business processes when you apply automation. This could be as simple as using an Order management software, Epos system or accessing a batch payment feature for multiple recipients. This can save you time so you could focus more on your core business functions.

Having a better view of your inventory is one of the most important factors that affect your bottom line. When you understand your inventory well enough to better forecast future sales, you could reduce overstocking. This also improves your cash flow and signals better operations management.

If you’re a business in a country where supplies are either low or expensive, or dealing with a market that is overly saturated, you’ve probably considered sourcing from abroad and selling in different locales. If this is the case, you need to know about Wise Multi-currency Account.

Here’s why:

When you have to deal with paying suppliers overseas, you’ve probably figured that you’re losing money on foreign exchange fees offered by leading banks which means mark-up on exchange rates and high transfer fees.

This is what [Wise] (https://wise.com/gb/business/) is solving for over 10 million customers who are using the service to move more than £5 billion a month, saving themselves £3 million a day compared to using a bank.⁵

With Wise you can:

Sources:

Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the corporate tax system in Tanzania, its current rates, how to pay your dues and stay compliant, and best practices.

Learn the most effective ways to handle and prevent late payments as a small business based in the U. Our guide covers all of the main things you need to know.

Learn how to do invoice reconciliation the right way and key things to note to help your business in the UK in our quick guide.

Learn how automation and AI can sharpen your company's competitive edge in accounts payable by boosting efficiency, ensuring timely vendor payments, and more.

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Botswana, its current rates, how to pay your dues and stay compliant, and best practices.