5 Ways to Stand Out and Boost Black Friday Sales

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

Alibaba1 is the go-to resource for UK businesses looking to import a whole range of consumer goods, electronics, clothing and more from China. You can find the right Alibaba manufacturer for your business pretty easily by using the Alibaba search tools, then negotiate a contract, pay, and get some buyer protections, all in the same place. However, one important question to consider is how to pay Chinese suppliers through Alibaba to make sure you get the best possible deal.

This guide to paying on Alibaba covers all the available Alibaba payment methods for UK registered businesses - including a look at Wise Business, as a smart way to pay overseas suppliers with the mid-market exchange rate and low fees2.

If you're a business sending more than 100,000 GBP (or equivalent) monthly across different currencies, get in touch with the Wise Business sales team to discuss the best solutions for your needs.

Talk with Wise Business Sales Team 🚀

How to pay Alibaba suppliers is important - but before you can get to the point of paying, you need to agree a deal.

With Alibaba you can search, filter and communicate with suppliers conveniently either online or in the Alibaba mobile app3. You’re strongly advised not to communicate or negotiate outside of the Alibaba platform for safety and to make sure you have a record of your negotiation4.

Alibaba is a treasure trove for Chinese suppliers selling pretty much everything under the sun. But whatever you want to buy you’ll need to consider how to pay, including the ordering currency - often US dollars, or sometimes Chinese yuan (CNY)5. Currency conversion costs can mount up - so check the supplier’s preferred currency before you negotiate, and make sure your preferred payment method lets you get a good exchange rate - more on that a little later.

Costs are typically set out by unit, and the price you pay might depend on the number of units of a particular item you buy. Consider these pricing breaks and increments before you confirm a contract - ordering a few more units may ultimately bring down the price of your order.

Alibaba contracts will be set out according to international incoterms6. These are internationally agreed terms covering things like when payment is due, who pays for shipping or insurance, and at what point in the shipping process the cargo becomes the property of the buyer.

To give a couple of examples, you may spot incoterms like:

As you can see even with this simple example, understanding incoterms is important to make sure there are no surprises with your shipment - if you’re expecting your items to be unloaded upon delivery, and that’s not included in the contract, you’ll rack up extra charges you didn’t expect.

Get to know a bit about international incoterms so you can negotiate the best deal for your preferences - and make sure you’ve checked any other costs involved in the pricing such as set up costs before placing your order.

Before we start to explore the best way to pay Alibaba suppliers, it’s important to get your payment terms in writing in the form of a written contract. The most important points to cover include:

With Alibaba you may also be able to negotiate payment terms which allow you to pay for your goods in stages. Some buyers are invited to do this formally through the Alibaba platform, but even if you aren’t you can always include this as part of your contract negotiation to see if you get a better deal in the end.

There’s no single best way to pay Alibaba suppliers, so you’ll need to pick between options including7:

Let’s look at these in a little more detail.

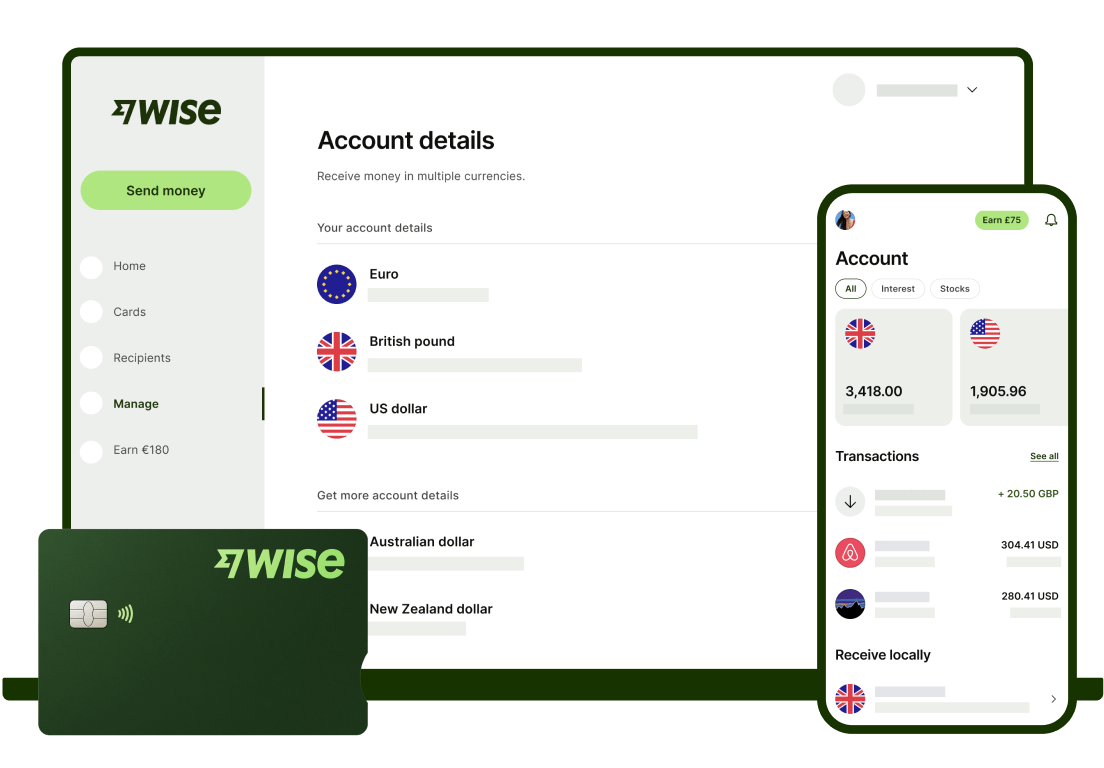

With a Wise Business account you can pay suppliers all over the world using the mid-market exchange rate and low, transparent fees for currency conversion.

You can open a Wise Business account for your UK registered business online or in-app easily, and then order a Wise Business debit card for convenient online and in person payments. You’ll be able to hold and exchange 40+ currencies in your account, and receive payments with local details for a selection of major currencies - making it easier to pay and get paid in foreign currencies.

If you ever need to pay a supplier directly, you can also pay foreign business invoices with Wise. Whatever you need your Wise Business account for, there are no ongoing fees, and currency conversion uses the mid-market rate - when you send, spend, receive or exchange foreign currencies.

Alibaba has an online checkout which allows you to pay easily with a debit or credit card, with a fee of 2.99% applied by Alibaba for the transaction7. You can also use your card alongside a wallet like Apple Pay or Google Pay for an even easier checkout7.

There are a couple of important things to note when using a credit or debit card with Alibaba.

Firstly, your own card issuer might add fees - including a foreign transaction fee if you’re making a payment in USD or CNY from a GBP denominated account.

You may also find that your credit card payment means you’re not eligible for the Alibaba Trade Assurance Scheme8. We’ll look at this in a moment - but it’s an escrow service which offers extra protection to buyers with no additional fees. That can be very reassuring, which may mean choosing to pay by a different means is better.

You may also be able to choose to make an international wire transfer to pay for your Alibaba goods. In this case, you’ll want to check the fees your own bank charges - which can be on the high side. The exchange rate is also important if you’re making a telegraphic transfer to China, so look at this as well before you hit send.

The upside of a wire transfer is that it’s very low risk if you use Alibaba’s Trade Assurance scheme - however, it can be pretty slow, and expensive. Transfer times can vary, but Alibaba estimates up to 7 days for an international wire - and also warns that in some cases the supplier may get less than you sent as a result of third party charges9. This may mean you need to make a second payment to cover any shortfall.

The Alibaba trade assurance10 option is an escrow service which provides peace of mind when using international suppliers you’re not familiar with. In this service, you’ll pay for your goods, but the funds are then held by Alibaba until you’ve received the shipment and confirmed it is as ordered. Once you’ve agreed that the items are as agreed, the payment is released - and all with no extra fee for you11.

Not all payment methods are supported on Alibaba Trade Assurance, so if you’re planning to use this service, do check your options before you get started.

PayPal is offered through the Alibaba online checkout, with an Alibaba fee of 2.99% for the transaction7. Multiple currencies are supported by Alibaba, but do bear in mind that if you’re paying with PayPal in a currency different to the base currency of your account, you may pay a currency conversion fee to PayPal of 3%12. This will be in addition to the Alibaba fee you pay.

We've covered in this article whether Western Union is safe. However, Western Union is usually recommended for personal payments more than business transfers - and Western Union does not offer any buyer protections or escrow service to keep buyers safe13.

Western Union used to be an available payment method for UK businesses buying goods from China through Alibaba. However, it’s no longer an option14 - so if this was your preferred method you’ll need to pick one of the other payment routes like Wise, credit or debit card or a wire.

Alibaba dominates the market when it comes to finding a supplier based in China. If you’re importing from China to the UK, Alibaba is a great way to find a supplier to suit your needs, with a huge selection of products to suit everyone.

Before you decide how to pay for your goods on Alibaba, check out the different ways to pay Alibaba suppliers to make sure you don’t add in extra costs unnecessarily which can eat into your profit. While you can choose to pay using a third party like PayPal, a debit or credit card, you might find you get a better deal with Wise Business. Wise offers fast, transparent and low fee international transfers, so your business can pay suppliers in China and elsewhere.

Get started with Wise Business 🚀

Sources used in this article:

Sources last checked April 26, 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

December kicks off the end of year shopping period, with huge uplifts in on and offline sales as people grab a bargain and get ready for the holiday season....

The term "turnover" is used often in the world of business, but its implications vary significantly depending on the context. At its core, turnover is a...

Wise is a financial technology company focused on global money transfers that offers two different types of accounts: a personal account and a business...

In today's fast-evolving digital landscape, e-commerce is quickly transforming the ways consumers shop and how businesses operate worldwide. DHL’s E-Commerce...

In an increasingly interconnected global economy, small businesses in the United Kingdom (UK) have more opportunities than ever to expand through import and...