2025 Update: Wise’s commitment to improving diversity, equity and inclusion for women in tech

At Wise, our vision is money without borders. In order to build the future of global money, we need a team that’s as diverse as the customers we...

Welcome to the Wise Mission Update, our quarterly report on how we're keeping true to our mission of building money without borders: making money move instantly, transparently, conveniently, and - eventually - for free.

There are 9 million of you powering our mission, moving over 4 billion pounds a month.

Last quarter was a busy one for us... we shipped over three dozen changes to our product that moved us closer to achieving our mission. Here are the highlights.

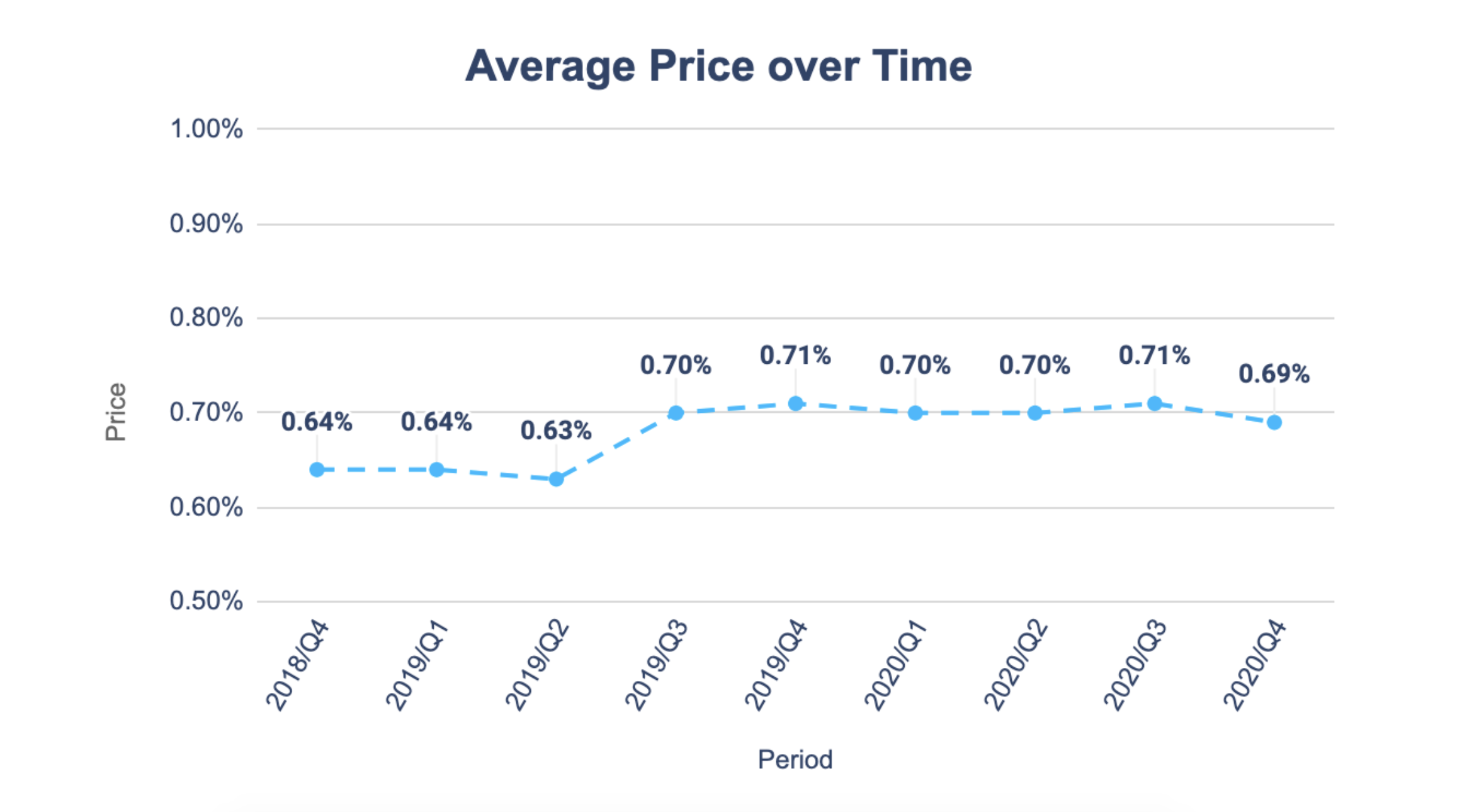

We start this quarter’s update with very good news. The average price* for using Wise decreased this quarter from 0.71% to 0.69%.

In Q3 2019, we had to put prices up on many routes because we had unexpected cost increases and were more accurately attributing costs to specific users and routes. At the time, we promised that we would reduce prices when we realised cost savings –– and that’s what we’re doing now.

After more than a year of no progress on our mission to reduce price, we are now seeing the cumulative effect of steps we’ve taken over the past year to drive our average fees down.

Average fees being 0.02% lower this quarter is the effect of three things:

These things help us put more money through Wise while we keep our costs the same – which means that the average price for a transaction goes down, and so do your fees.

Our pricing graph looks a bit different this quarter because we redefined our pricing metric to be more representative. This helps us better track our progress on our mission of reducing price.

We used to calculate the average price across all transfers that happened on Wise in a quarter. This simple average was skewed sometimes by large volumes on expensive routes and other times by more volume on cheaper routes.

We now removed such volatility based on route by establishing a fixed basket of representative transfers (based on our 2019 volumes). We now track how much progress we’ve made on dropping fees relative to this fixed basket and can clearly distinguish between the impact of “route mix” and our progress on dropping price.

At some point in the future, we may refresh the basket to ensure it’s still representative of how much money moves on Wise and to where.

We lowered the fees for sending large amounts, because these transfers are now cheaper for us to handle. Now, you pay a lower tier of fees when you send more on Wise.

We lowered the thresholds for what is a “large amount” and moved from the price tier being set for each transaction to a model that takes into account your total monthly volumes.

This means more customers, especially business users, benefit from “high amount” pricing. Anyone sending more than £300,000 in a given month will pay less. For example, if you’re sending £1 million to Euros, the fee is 0.22%, compared to 0.26% previously.

It is important that these lower pricing tiers are equally and automatically applied to everyone moving higher amounts. There is no special pricing, no preferential rates, and no fee negotiation - nothing like what you’d expect from your traditional bank.

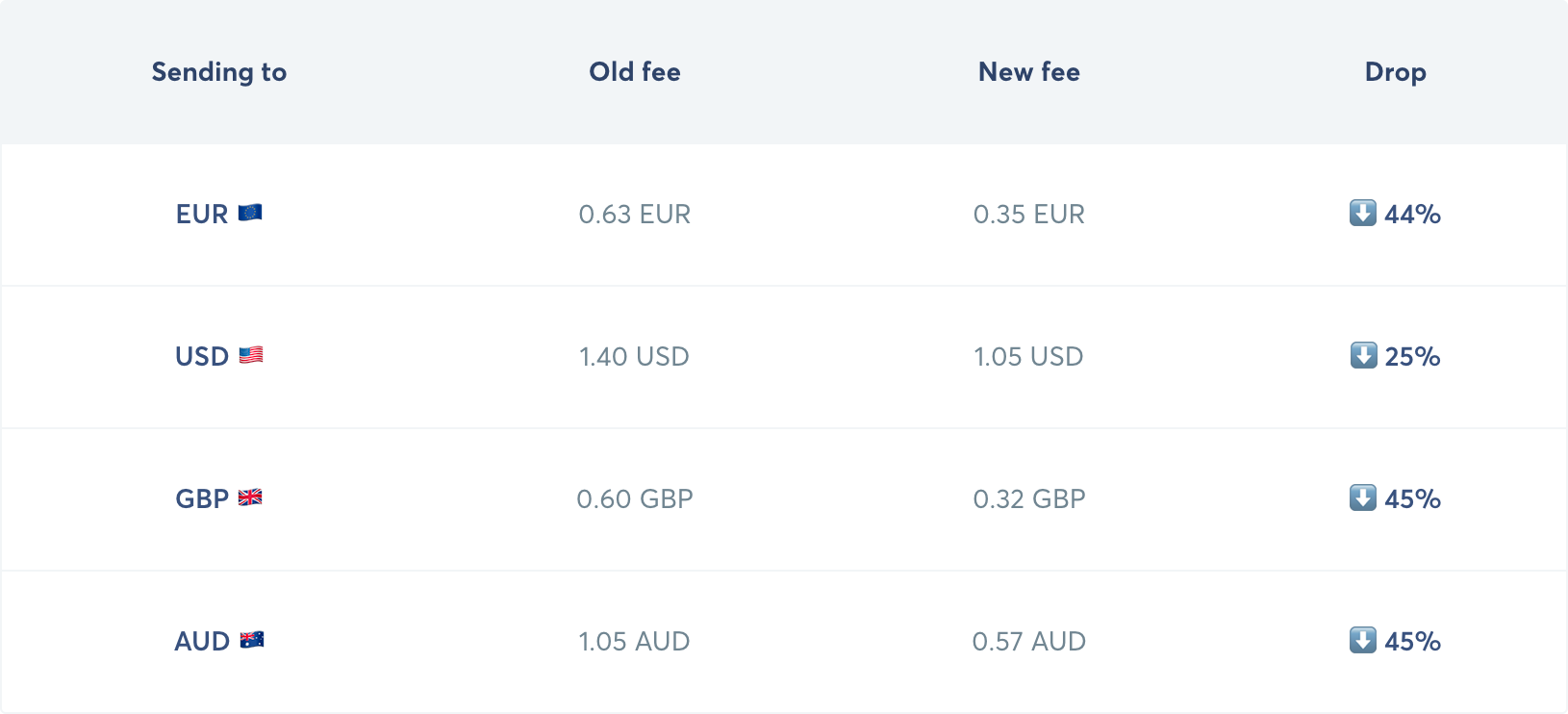

Sending money from your balance to any currency now costs you less, with same-currency transfer fees dropping up to 45%. How? Partly because our network has become more efficient, and partly because these transaction fees used to cover the very high cost of receiving wires to US account numbers.

We now added a $7.50 charge to receive domestic and international USD wire payments. That is still 2 times cheaper than US banks and it’s free to receive USD if the sending bank uses ACH.

Converting money between balances is now cheaper for 85% of currency routes. Some routes saw a larger drop - for example sending from USD to CHF dropped from 0.47% to 0.42%. You can see a breakdown of the price changes for your most used currency pair here.

Pro tip: based on the above, it is now cheaper to use money already on your Wise balance to fund an international transfer, rather than to fund it from your bank. It also means that it is slightly cheaper to transfer via balance - fund the balance first from your bank, then convert and pay out to the recipient’s account.

We know many users still rely on cash. This quarter we made ATM withdrawals cheaper for 80% of those who need physical money. You still get up to £200 of free ATM withdrawals. Now, for anything over that, the withdrawal fee has dropped from 2% to 1.75%.

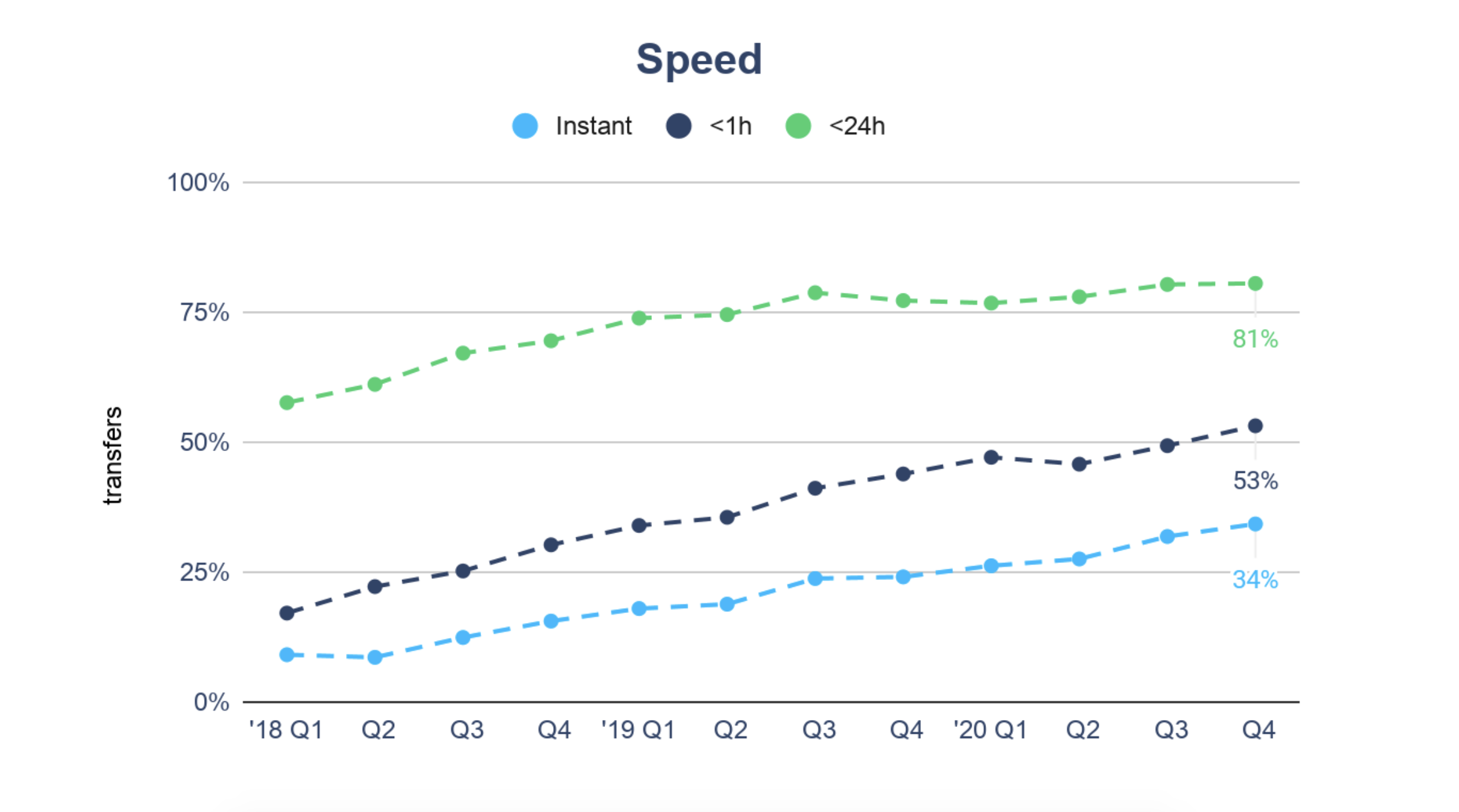

In Q4, 34% of transfers with Wise arrived instantly –– i.e., money left your bank and arrived in the recipient’s bank account, in a different country, and in a different currency in less than 20 seconds. That’s up from 32% in Q3.

53% of all transfers now arrive within an hour and 81% of all transfers within a day.

The two main accelerators were our integration with the central bank in Hungary and improvements to pay-in speed in the US and Canada. In our first full quarter with the Hungary integration complete, 79% of transfers to HUF were instant (up from 17% in Q3) –– and that’s on top of making those transfers cheaper, too.

In the US, 25% of payments from the US that use ACH as a pay-in method are instant (up 4% from last quarter). Half of all users sending from the US to the UK (via ACH) now get an instant experience. In Canada, 20% of users that use direct debit to fund their transfer now get instant transfers.

Better use of our liquidity also made it faster to send money to the Eurozone and new operational partnerships sped up payments to Turkey.

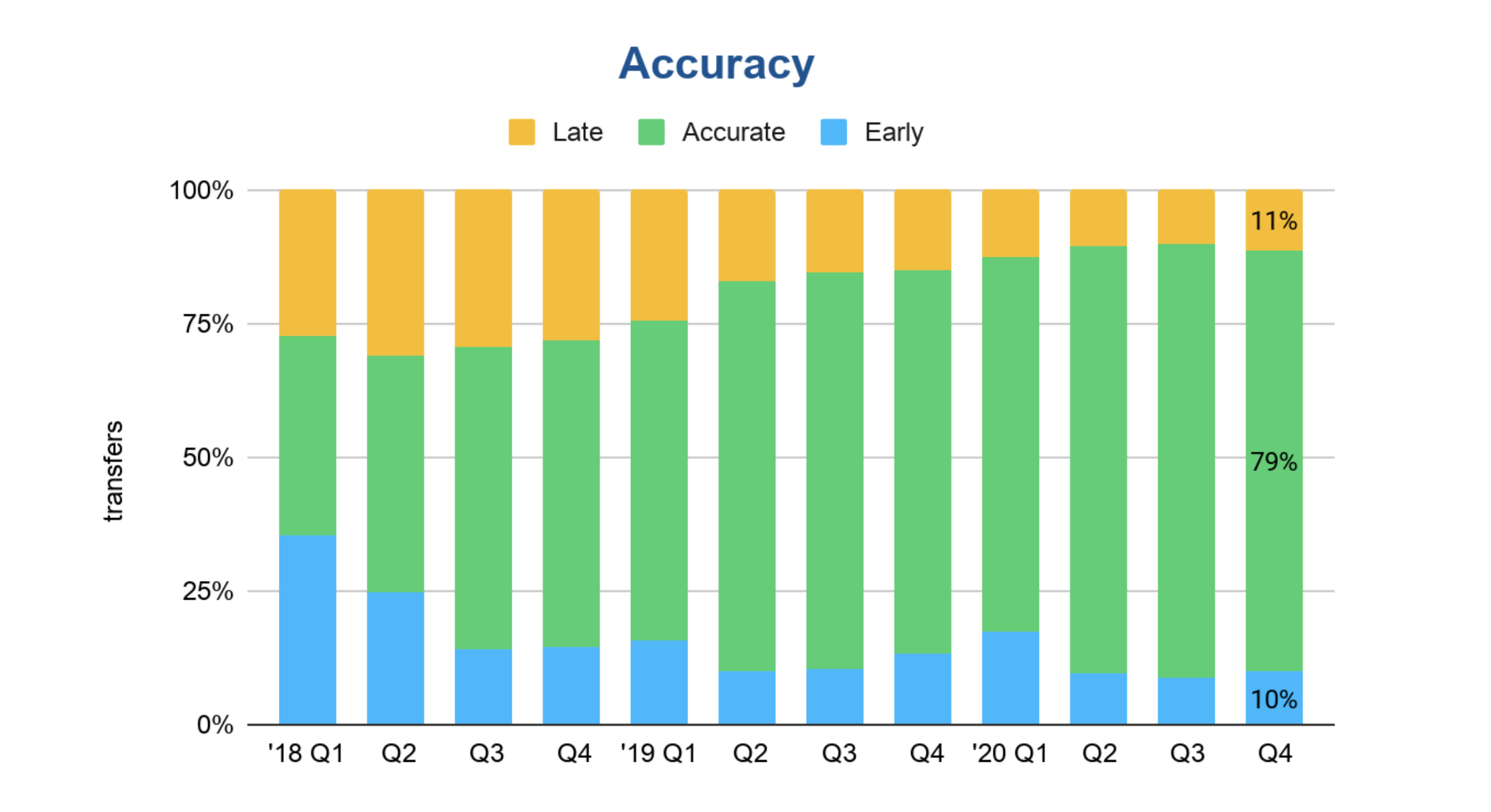

The other aspect of payment speed is estimating a delivery time for your money, with accuracy. When you make a transfer we estimate when the money will arrive to the recipient’s account. In Q4, our estimates were accurate or (early) 89% of the time - that’s down 1% from Q3. This was primarily due to operational issues that affected users sending from Singapore.

Last quarter we rolled out multi-currency accounts for personal and business users in Japan, allowing users there to get their own account numbers in the UK, Eurozone, US, Australia, New Zealand, and Singapore - to pay and get paid like a local.

This quarter we opened a limited beta for our first users in Japan to order a debit card. If you haven’t yet got a card, we’re now rolling it out more broadly and you can be one of the first to order a card and start spending with your Wise card in Japan.

In December, we started rolling out Canadian account numbers so personal and business users around the world can now get paid like a local in Canada. Hundreds of users have already activated their CAD account details, sending and receiving Canadian dollars.

In addition, we opened up for users in 103 new countries to get US account numbers for domestic USD wire and ACH payments. Users in Argentina, Mexico, and many more countries can now get paid like a local in USD.

We also began to roll out Turkish account numbers in limited beta and are slowly expanding this to more customers. Already tens of thousands of users have received millions of lira using their TRY account numbers.

We also made Romanian account numbers available to all users in the UK, EEA, and Switzerland.

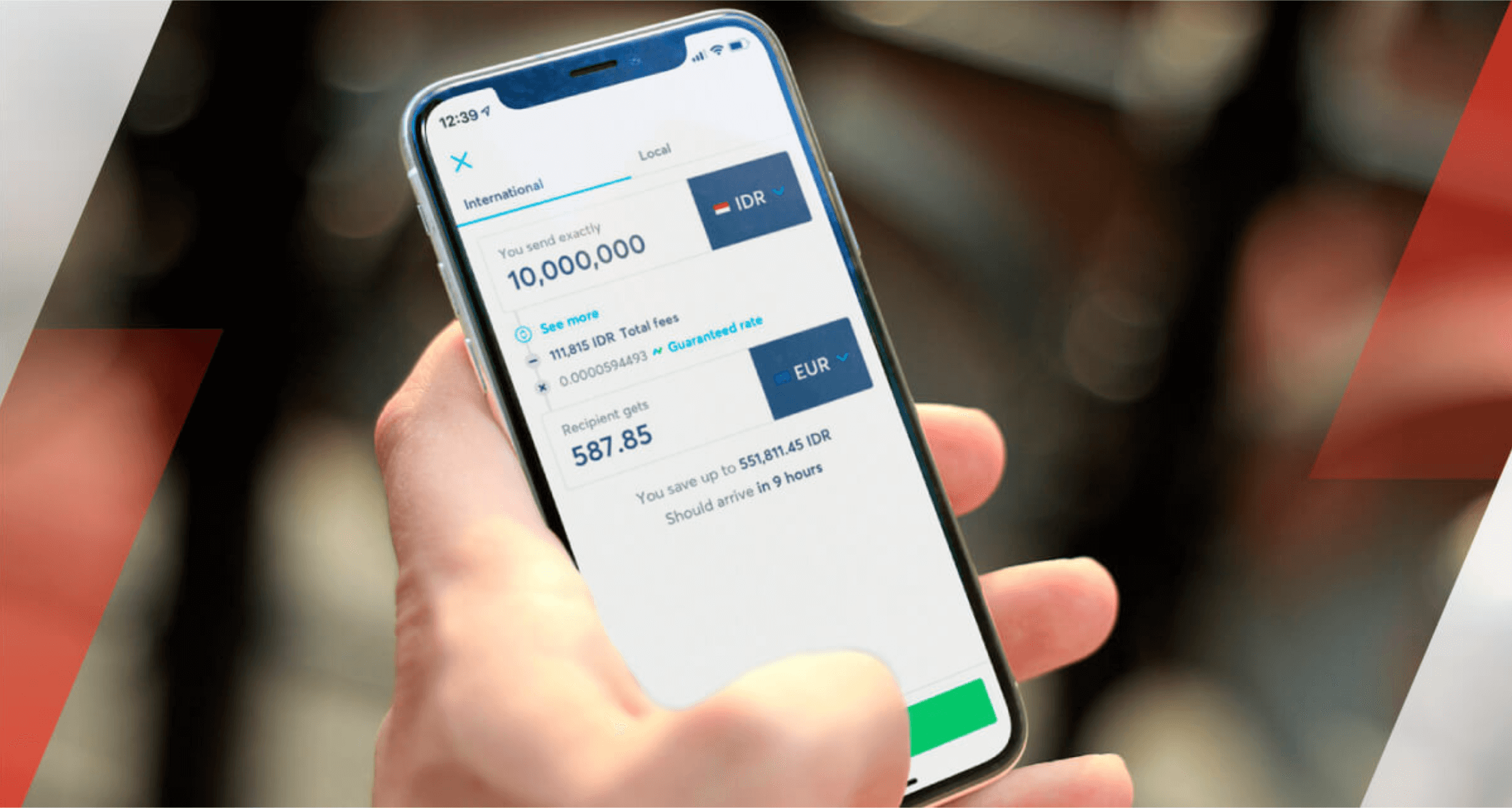

This quarter we launched Wise in Indonesia. Personal and business users - whether Indonesian or expat workers - can now send money to more than 80 countries around the world. Already we’ve seen tens of thousands of transfers set up and more than 70% transfers are under 30 mins.

And to ensure we’re supporting users in the best way possible, we also launched support in Bahasa.

Also, many more users can now send money to China, specifically our users based in Turkey, UAE, Brazil, Switzerland, Indonesia, and New Zealand

We also expanded for users in Malaysia; now, foreign workers can use Wise. Foreign workers is a special visa class that was previously not allowed due to regulation and is now open on Wise.

In Australia, users can now pay bills in Australia with BPAY. BPAY is the most common way to pay utilities in Australia and it is now easy to pay a merchant this way - simply add a new recipient and select “BPAY” to get started.

We had a few hiccups expanding Wise around the world this quarter.

We had to limit options for users sending money from UAE. For operational reasons, bank transfers are temporarily shut, but users can still send money from the UAE with a debit or credit card.

We also had to shut transfers to West African Franc as we had reliability issues with our partners in the region and weren’t able to provide a level of service up to our standards.

We’re working hard on bringing these back up, and we’ll keep users informed when we do.

Lastly, we had to shut down payments to Nigeria this quarter due to new regulations from the Nigerian Central Bank that require all transfers to Nigeria to be paid in US dollars rather than naira.

Last quarter, we rolled out direct debits for USD accounts for customers in the US. This quarter we expanded the feature for users outside the US, who have a Wise USD balance with an account number.

Direct debits let you link your Wise account to other financial services in the US - for free. So now users around the world can move money in or out of their Wise account to and from American banks, Stripe, PayPal, investment platforms, and more.

This means that no matter where you live, you can link your Wise account to most US financial institutions to manage your finances and pay bills - allowing users to save massively on the hidden exchange rate markups that banks, PayPal, and others charge when converting US dollars into other currencies.

We also removed limits on how much you can receive into your Wise USD account.

Users around the world can now schedule transfers from their multi-currency account balance.

So whether you’re moving money between accounts, sending to family, or paying monthly bills - you’ll never miss a payment again.

For business owners too, managing payroll and recurring business expenses just got even more convenient. It’s free to schedule your transfers and you can choose to send at a single future date or on a recurring basis.

This has been one of our most highly requested features for some time and we’re already seeing thousands of users set up regular, recurring payments on Wise

Apple Pay was one of our most requested features for debit card users around the world and this quarter we finally got it live in Australia and Singapore. Already we’re seeing more than 30% of eligible users adding their Wise debit cards to their Apple Pay wallets.

Users in Europe and Asia Pacific countries can now get spending faster than ever. If you order a card, you can spend immediately by adding your card to Apple Pay, as well as Google Pay, and many more. No more waiting for your physical card to arrive.

International delivery for cards has been a long requested feature and this quarter we enabled European customers to get replacement or renewal cards delivered anywhere in the world.

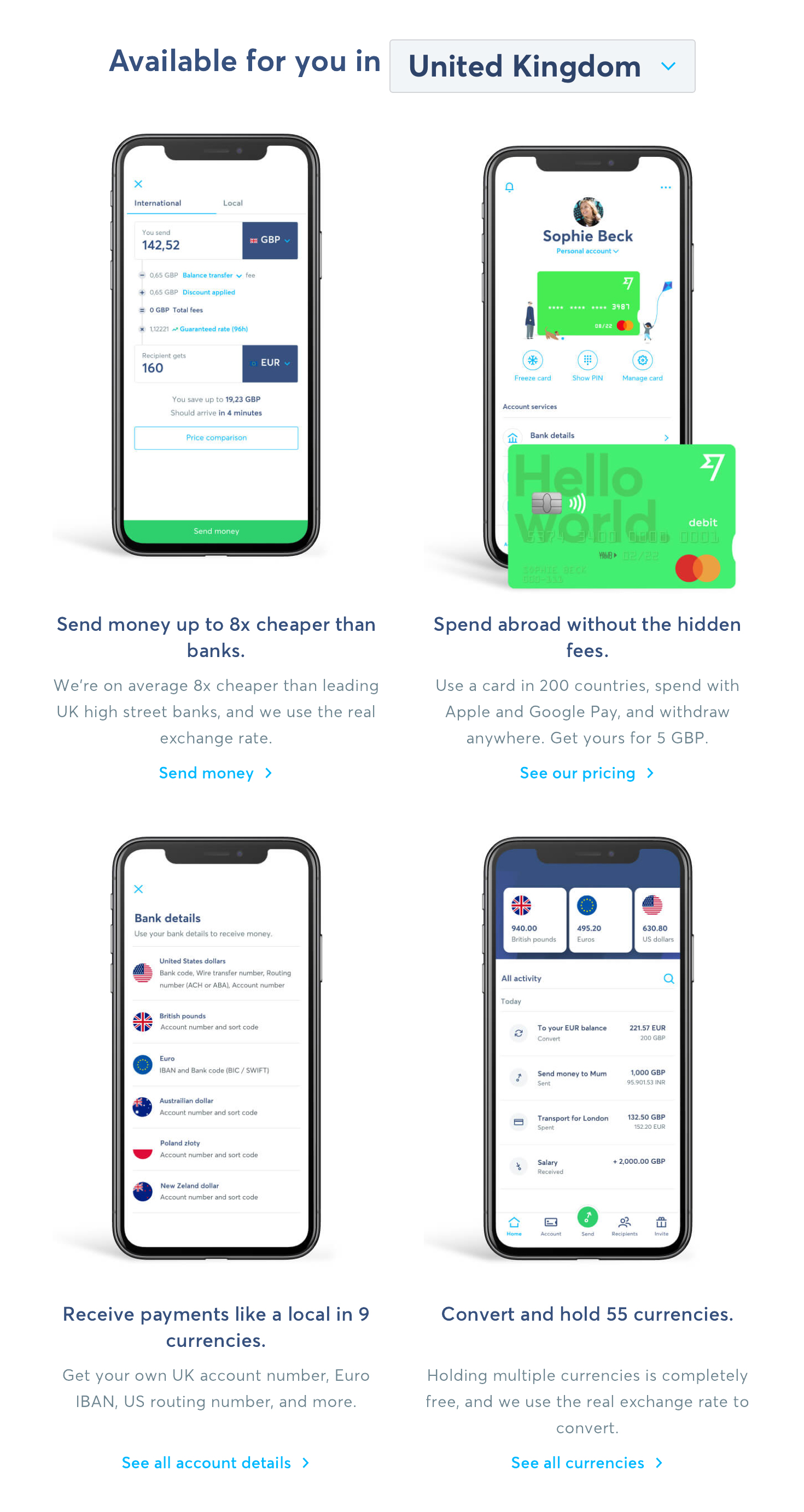

Millions of users have a Wise multi-currency account and millions more could save money and benefit from having their own international account numbers.

We knew there were lots of users who simply weren’t aware of the full capabilities of the account and how it could help them send, spend, and receive for less.

So, this quarter we rolled out a new homepage for the account to fully explain what it does and how it can help you. In short: receive money in 9 countries, hold over 50 currencies, and spend abroad without hidden fees.

About half of our users upload identity documents through our mobile apps when they get started with Wise. Before, when a document was rejected users were sent back to the web, despite having the app installed.

Many customers were getting lost in this transition. To help them complete the onboarding, we added the ability to re-upload identity documents on mobile apps. We also added a handy push notification that alerts users right away when there were problems with their documents - helping them get verified even faster.

These changes have helped nearly 3,500 customers a month get started on Wise.

We also fixed issues for users who have to take selfies with their IDs to get verified. It is now easier to follow and this has helped 6,000 customers every month get started.

We have been expanding our support channels around the world the past few quarters and most recently added chat support in 4 new languages –– French, Russian, German and Spanish. Last month we helped more than 3,000 users in those languages alone.

We have also made chat available on Android devices and are now helping another 7,000 users a month this way. Chat support on iOS is coming in 2021.

We know that sending a large transfer can be stressful and you might have questions. So, we launched chat support that you can access in the middle of setting up large transfers. Already more than a quarter of users with such transfers have taken advantage of this feature for a smoother experience.

We redesigned our Help Centre on iOS so that it’s quicker to navigate on your mobile device. It’s now easier to find the support article you’re looking for, and there are more accurate search results. 20% of users who would have previously had to contact us for help are now able to find their answers quickly and complete their transfers.

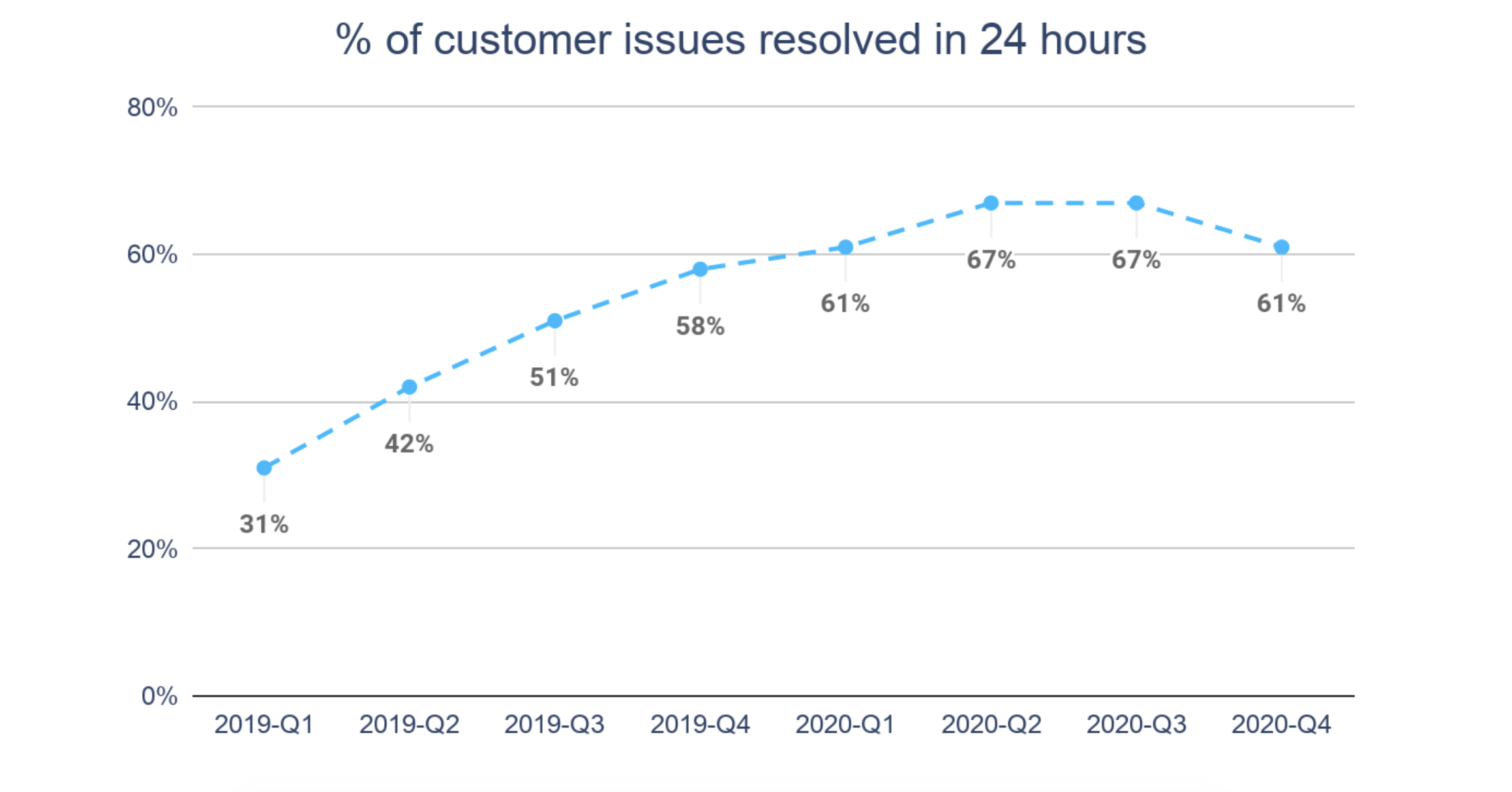

This quarter, we solved 61% of our customer contacts within 24 hours. The decline from Q3 was due to our support team getting stretched under higher transaction volumes.

Emburse is a leader in automated expense management and is made up of products like Abacus and Chrome River.

Making payments to reimburse employees outside the US for expenses has traditionally been slow and expensive. That’s why Emburse integrated the Wise API to make submitting, paying, and tracking international expenses easy, fast, and cost-effective.

Now over 4.5 million people working at 14,000 companies - like Classpass - can benefit from Emburse’s integration with Wise to save on fees and receive their payments up to 90% faster.

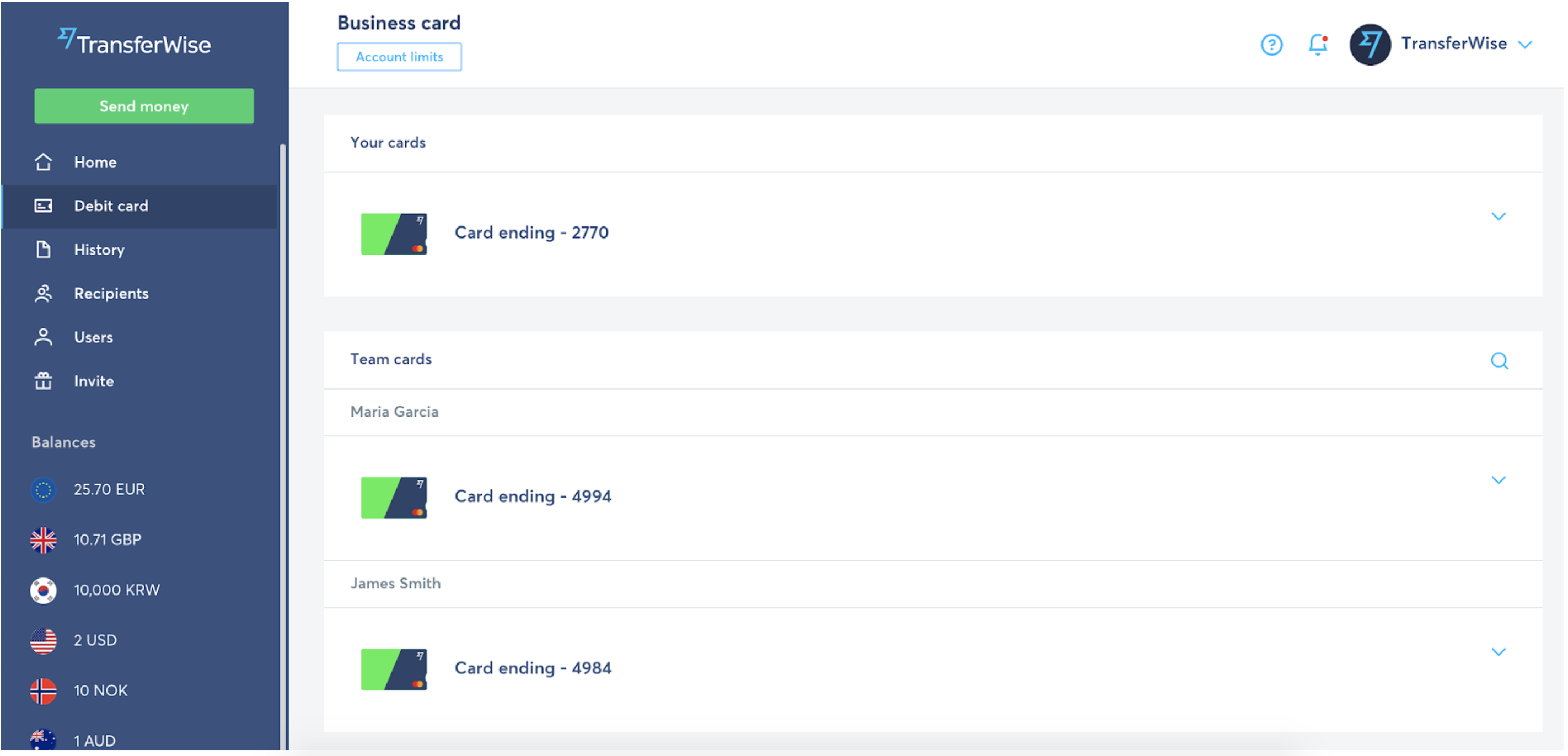

Previously, business users could only get one debit card per business. Having multiple debit cards has been the most requested feature by business users who already have one card.

This quarter, we started rolling out multiple cards to “admin” users of businesses across the UK, Australia and New Zealand.

Right now, only users with an ‘admin’ role can get an additional card. Eventually, any admin user in a business will be able to invite employees to order a card and set up a predetermined spending limit. If you’d like to get on the waitlist for this feature, you can sign up here.

It’s been a few quarters since we created the ability for business users to add team members to their accounts as ‘admins’. This quarter we added another permission with the ‘payer’ role.

Now business users can have Directors or CFOs as ‘admins’, finance managers, accounts payable pros, or purchase ledger clerks as ‘payers’ and others as ‘viewers’ - giving users the ability to have multiple controls in place for your business. We used to get hundreds of requests for this feature every quarter. We’re already seeing many thousands of business users take up the increased functionality. So far, 20% of business users have assigned a ‘payer’ role in their teams.

Admins and payers can now also fund their USD transfers via ACH. It’s secure, convenient, and they don’t need to leave Wise to make their payment.

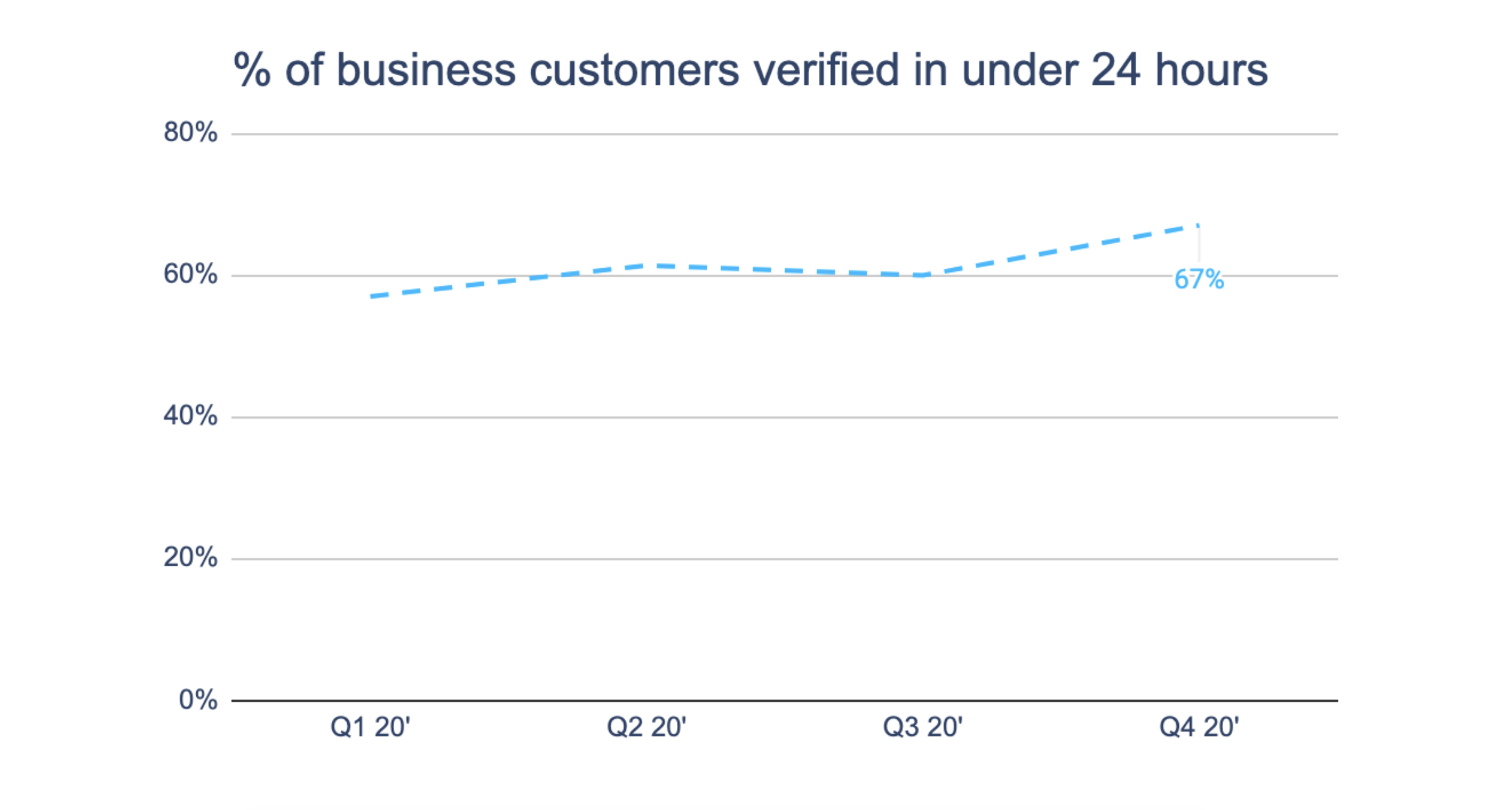

New business users rightfully care about how quickly they can get started with their account. Verification is often the lengthiest part of onboarding.

This quarter we verified 67% of new business users in less than 24 hours. That’s up 7% from Q3 and up from 57% in Q1. The improvement was driven by operational improvements as well as making our business onboarding flow smarter so fewer customers have to send us more documents.

Additionally, we also tweaked some old logic in our code so that now users can join with just a business account - no longer any need to set up Wise for personal use as well.

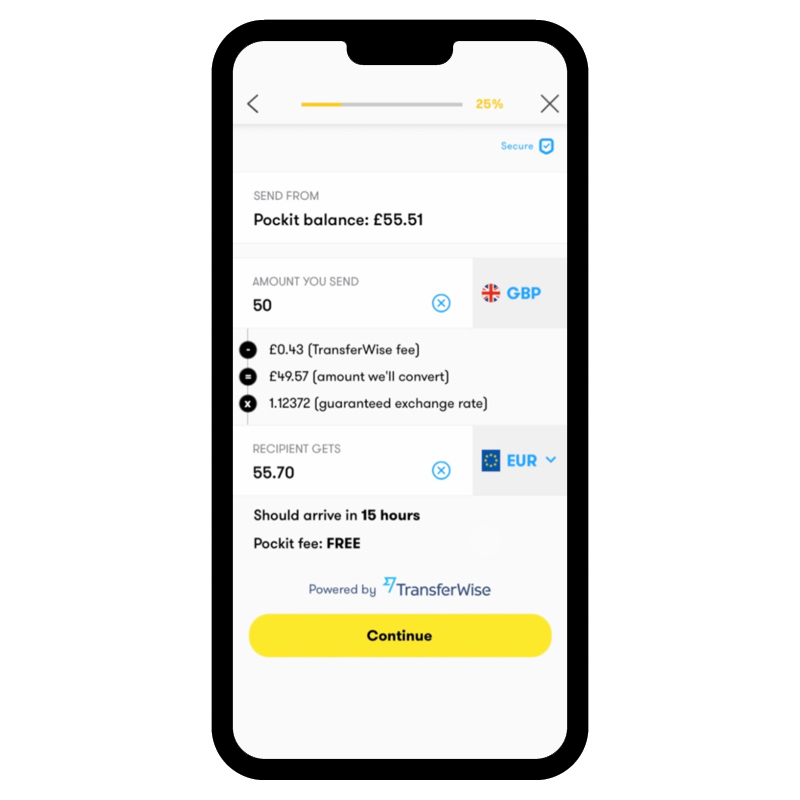

This quarter Pockit integrated international payments through Wise in their app.

Pockit is a digital bank working on making current accounts more accessible in the UK. Now their half million users can make cheaper, faster transfers abroad straight from their Pockit account.

In addition to the dozen banks that have integrated Wise directly for their customers, many other banks can get Wise integrations as a component of core banking services when they use core banking platforms like Mambu.

This quarter we also added Finxact to that list. Finxact provides core banking services and helps clients integrate solutions that complement their core banking proposition. Now Finxact banking and credit union customers can integrate Wise’s international payments experience into their digital experiences.

We continued to work fully remote this quarter and are back to offices in Tallinn, Singapore, London, Budapest, and New York (with safety restrictions in place). We still shipped more releases than ever.

Through the lockdown we’ve been actively hiring and we have onboarded 439 new Wisers since we started working remotely. We are adding 750 roles over the next six months and have 120 open roles right now. We’re looking for a VP Sales & VP People, as well as many roles in engineering and product. Come join us!

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

At Wise, our vision is money without borders. In order to build the future of global money, we need a team that’s as diverse as the customers we...

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

We believe that the world’s a richer place when money moves fast and flows free. That’s why we work hard to ensure our product is as convenient as can be,...

Speed In Q4, 61% of our transfers were instant, meaning they were completed in under 20 seconds. That’s an increase of 1% from Q3. What's changed? We’ve been...

The key indicator that we’re offering a truly convenient product is your ability to use Wise without any hiccups. That’s why we’re measuring convenience (or...

Maximum Speed: Moving at the Speed of Light At Wise, we are committed to providing our consumers with the best possible experience when it comes to...