Virgin Money large transfers and transfer limits in 2025

Read our helpful guide to Virgin Money large transfers in the UK, including transfer times, limits, fees, security and the steps to send a payment.

You may not realise it but if you work for a US-listed company and receive RSUs or you sell shares in US dollars or in a different currency you could be losing a lot of money paying currency conversion fees.

These are charged when you have the USD proceeds sent directly to your local GBP bank account; for example moving $50k from a share trading platform directly into a UK GBP sterling account could incur over £389 in currency conversion fees.

With the Wise account, you can get access to USD details and convert those RSUs at a low, transparent rate where the same amount would cost £125 - a 3x saving.*

*Fee calculation taken in October 2024. Saving comparison based on Wise hypothetical example using Fidelity pricing - see below.

Read on to learn how the Wise account offers a flexible solution that allows you to maximise your return on every dollar from RSUs or company share sales.

There are two ways currency conversions costs can creep in:

1. Fees incurred from your share or equity management platform when processing the transfer

2. Fees incurred from your bank account (and corresponding banks) when they convert your dollars into pounds

Fee structures vary depending on which platform your employer uses but some platforms include a currency conversion fee to process payment of your proceeds if you choose to cash out in a different currency to what your RSUs are held in.

Using Fidelity pricing, withdrawing funds in anything other than GBP could result in an additional currency conversion fee anywhere from 0.25% on funds over $150k to up to 1% for funds below $50k* of your pay out.

As an example, this could mean:

With Wise the fee would be only £125 - at least 3x times cheaper*.

*Note: Fidelity pricing taken in October 2024

Similarly, most banks typically charge a one-off fee to receive money - however there could also be currency conversion cost or mark-up on the amount transferred which is often not known until after the payment has been processed.

All of this can significantly reduce the amount you’re eventually left with.

Get your dollars paid straight into Wise for free

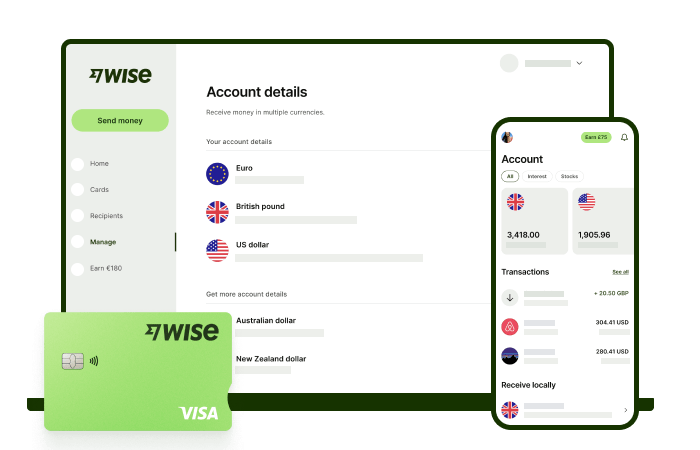

With the Wise account, not only can you convert and send money quickly and cheaply, you can also receive money in other currencies for free by turning on local account details (restrictions apply).

You’ll get access to US Dollar account details (i.e. Account number, ACH and wire routing number) which allows you to get paid directly in dollars even if you are in the UK.

In the US they pay out over a system called ACH (similar to BACS in the UK) and that’s free.

Now you have all your dollars in Wise you can then convert them to GBP within your Wise account at the mid-market rate which means low, transparent fees (up to 4x cheaper than a bank*). You can do this instantly or at a later date with our Auto Conversions tool.

* Based on competitor analysis between Wise and competitors sending £250

You can now easily send your pounds to your local UK account and move on, but now you will want to get the most out of your Wise account.

First the basics - get the benefit of our low transparent fees at the mid-market rate to:

- Get a Wise card and avoid exchange rate markups when you spend abroad and withdraw cash.

- Use your Wise card to spend online in 40+ currencies

- Convert and send money to friends and family in over 140+ countries

Next you can level up and:

* Note - these rates are for UK customers only.

Investments can fluctuate, and your capital is at risk. The Variable rate is based on the performance of the Fund over a 7-day period ending on 9/26/2025. The Fund has achieved an average annual return of 2.76% over a 5-year rolling period exclusive of fees. Interest is offered by Wise Assets UK Ltd, a subsidiary of Wise Payments Ltd. Wise Assets UK Ltd is authorised and regulated by the Financial Conduct Authority with registration number 839689. When facilitating access to Wise investment products, Wise Payments Ltd acts as an Introducer Appointed Representative of Wise Assets UK Ltd. Please be aware that we do not offer investment advice, and you may be liable for taxes on any earnings. If you're uncertain, we urge you to seek professional advice. To find out more about the Funds, visit our website.

You won’t need anything more than your phone and your normal photo ID document:

If you need to get an account - go to Wise or download the app and click on Create account. Next:

- Log in, scroll right and tap Open or the + symbol

- Select Balance and choose USD

- Click ‘Get account details’ under the balance

- Add 20 GBP to your account and verify your identity with your ID and a selfie

- Then click on Payments in the menu bar - scroll to ‘Account Details’ and select US Dollar

- Make sure you have selected the ‘Local’ tab and copy the account details and input these into your share trading platform.

- Get paid. Save money!

You can read more about how to use your USD details here.

If you are looking to sell and convert a large amount of RSUs, we know there’s a lot to consider when managing big sums of money.

That’s why we believe your transfer needs a dedicated support team — as well as a low fee*.

And you can request to speak to one of our experts who can walk you through how it all works to make the process as smooth as possible.

Just fill out this form and they’ll get in touch via email or a call back - whatever works best for you.

For more information on large transfers, watch our video guide here.

| 💰 DID YOU KNOW: We offer discounts on our fees when moving more than £20,000 in one month. Read this article to learn more about how discounts go up the more you send with Wise. |

|---|

Wise is a financial services provider regulated in the UK, and all over the world. It is not a bank but it’s an alternative option whenever you want to receive, hold, exchange or send funds overseas.

In the UK Wise is regulated by the FCA - like banks - and has to follow stringent guidelines to keep customers and their money safe. If you have money deposited to your Wise account, it’s safeguarded and held separately to Wise’s own operating capital. This means that Wise will hold funds on your behalf in banks and secure liquid assets.

Find out more about our

security features here 🔐

Wise customer support is available 24/7. The easiest way to get in touch is in the Wise app - just tap the profile button in the top left of the homescreen, and then select Help. Here you can view and ask questions about recent transactions, view handy guides to common problems, or open a live chat with an agent.

With your Wise account you can convert your USD to GBP straight away at the mid-market rate or you can take advantage of some neat Wise tools to convert when you want.

- Rate Alert: Keep track of the real exchange rate and alerts you when it gets to a certain level

- Auto Conversions: Set your desired rate, let Wise watch the exchange rate for you and automatically convert when it hits.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our helpful guide to Virgin Money large transfers in the UK, including transfer times, limits, fees, security and the steps to send a payment.

Everything you need to know about money gifts to grandchildren living abroad, including inheritance tax obligations and best methods for sending money overseas.

Read our essential guide to MyGuava alternatives in the UK, including PayPal, Revolut, MoneyGram, Skrill, Remitly and Wise.

Read our guide on how to send money to someone without a bank account in the UK, including alternatives like apps, transfer services and postal orders.

Wondering how much an international transfer with Ace would cost? Or how long it would take? Read our guide on fees, rates and transfer times.

Find out how to transfer large amounts of money to Canada from the UK here in our guide, covering steps, fees, FX rates and more.