Benefits of a Business Bank Account

Discover the benefits of setting up a separated business bank account to manage your business finances separated from your personal ones.

Want to grow your business funds, or start building a cash reserve pot for unexpected events? A savings account could be a useful thing to have, but not that all banks offer them.

An alternative solution is a savings account with a digital provider like Revolut. It offers an easy access savings account for businesses, but how good is it?

We’ll cover everything you need to know here in this handy guide. This includes interest rates, fees, security and savings limits.

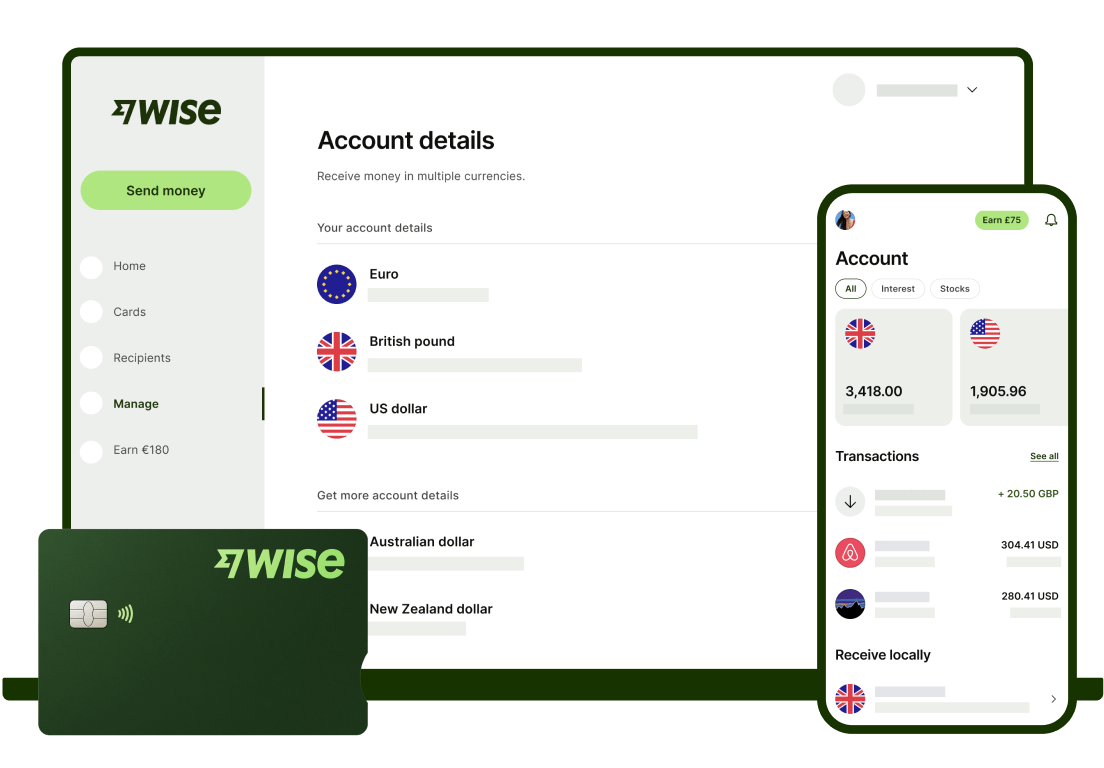

And if you’re in the market for a new day-to-day business account, make sure to check out Wise Business. It’s a great alternative to Revolut Business, especially now that the Wise Interest feature has launched. We’ll look at it in more detail later on.

💡 Learn more about Wise Business

The Revolut Business savings account is available for all businesses signed up to its Grow, Scale and Enterprise current accounts. Basic plan customers aren’t currently eligible.

Each current account plan offers different features, which scale up in parallel with the monthly fee. So the more you pay, the more features you get. This includes access to higher interest rates and limits in the linked savings account - which we’ll look at next.

Savings accounts at Revolut are easy access, so you can deposit or withdraw through the Revolut app or online whenever you want. Importantly from a security perspective, you can set controls over who has access to the account too.¹

Revolut business savings accounts pay interest on your balance, at a variable rate. Interest is calculated and paid daily.

Below are the rates for each Revolut plan, shown in AER (this is an indication of the interest rate you'll earn on your savings balance if your interest compounds on that balance over a year).

| Revolut Business plan | Savings interest rate¹ |

|---|---|

| Basic | Savings account not available |

| Grow | 2.25% AER |

| Scale | 2.75% AER |

| Enterprise | 3.51% AER |

It’s important to note that the interest rates listed above are verified to the date of writing, but they may vary or change at any time.

Now, let’s run through the answers to some of the most commonly asked questions about Revolut business savings accounts.

To open a Revolut savings account for your business, you’ll firstly need to sign up for a current account plan. Here’s how to do it, step-by-step:²

Once the account is up and running, you can set up your savings account. First, check that you’re eligible. You’ll need to meet all the following requirements:¹

- Be on a Revolut Grow, Scale or Enterprise plan

- Have fewer than 250 employees

- Have a turnover of £36 million or less

- Have a balance of £18 million or less.

Tick all the right boxes? All you need to do is go to ‘Savings’ via the ‘Hub’, accessed online or in the app. Set up a new account and give it a name, then you can start saving right away.³

The Revolut savings account doesn’t have any fees on its own. However, you can only get it if you have a Revolut Business paid plan.

Here’s a look at the pricing for these plans:⁴

- Grow plan - from £19 a month

- Scale plan - from £79 a month

- Enterprise plan - custom pricing.

Revolut Business also has other fees - find out more about them here.

Revolut Business savings accounts are easy access, promising you 24/7 access to your money via the app or online.

To withdraw money, you simply need to go to the Hub, select ‘Withdraw’ and fill in the amount to move funds to your chosen Revolut currency account. Withdrawals are usually instant, but could take up to 1-2 days in some cases.⁵

There are no restrictions on how much you can withdraw.

Revolut uses a number of security protocols to protect your business funds, and your account. This includes anti-fraud systems, including extra verification on accounts and users, and flags for suspicious transactions.⁶

Money held in Revolut savings accounts is also covered under the Financial Services Compensation Scheme (FSCS). We’ll explain exactly what that means next.

For everyday business accounts, funds are protected via safeguarding. This is where customer money is held in a ‘safeguarding account’ with a regulated bank, and kept separate from Revolut’s own working capital.

But for business savings accounts, Revolut works with partner banks to offer Financial Services Compensation Scheme (FCSC) protection up to £85,000 per person.¹ This is how much of your money is protected should Revolut go into administration.

You can only save up to a certain limit in your Revolut Business savings account, depending what plan you’re on.

Here are the maximum limits for each:

- Grow plan - save up to £500,000

- Scale plan - save up to £1 million

- Enterprise plan - save up to £2 million.

If you want to compare all the available options before choosing a new business account, make sure to check out Wise Business.

The Wise Business account is ideal for companies that trade internationally, who buy goods or employ people from other countries.

There’s just one powerful account, with no monthly subscription fees. Features include:

- Local account details for 8+ major currencies

- International payments to 160+ countries for low fees and the mid-market exchange rate

- Employee expense cards

- API integration with business and accounting tools

- Bulk payments - batch pay up to 1,000 people at once

- Bespoke permission levels to control team access.

And if you want to earn returns on your business balance, you’ll love Wise’s newest feature - Wise Interest.

It’s a non-savings alternative offering returns on GBP, USD and EUR balances, through investing in a fund that holds government-guaranteed assets.

The assets follow the Bank of England’s interest rate so when that rate changes so does yours. There’s a small service fee of 0.29% for this account and while your investment isn’t guaranteed, the risk is low.

Get started with Wise Business 🚀

So there you have it, a full review of the Revolut Business savings account. We’ve taken a look at interest rates, maximum limits, FSCS protection and Revolut’s security measures. Plus, how to open an account and how to withdraw your money.

After reading this , you should know exactly what to expect - and decide whether it's the right savings solution for your business.

Sources used for this article:

Sources checked on 25-04-2024.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the benefits of setting up a separated business bank account to manage your business finances separated from your personal ones.

Read our essential guide to the best business bank accounts for startups in the UK, comparing all of the most popular providers

Read our guide to the best online business bank accounts in the UK, including Tide, Starling, Revolut, ANNA and Wise Business.

Discover how to send money from Payoneer to Wise easily. Follow our step-by-step guide to transfer funds securely and save on international transactions.

Read our essential comparison of business bank account fees in the UK, including upfront, monthly and usage charges.

If you’re just starting out on an entrepreneurial journey you need smart ways to manage your money. This probably means you’re looking for the best bank...