Q3 2024 Mission Update: Price

We believe in money without borders. Which is why we’re building the best way to move and manage the world’s money.

We are always on the lookout for ways to reduce our fees so you never pay more than you need to. And when we do increase fees we make sure to tell you in the most transparent way possible so you know exactly what you are paying for.

We are really excited about the progress we made in Q3 2024.

What happened last quarter?

You might have seen our recent emails letting you know about price drops. After the latest review, we rebalanced our fees to reflect the cost of each transaction so that you only pay for the services you use.

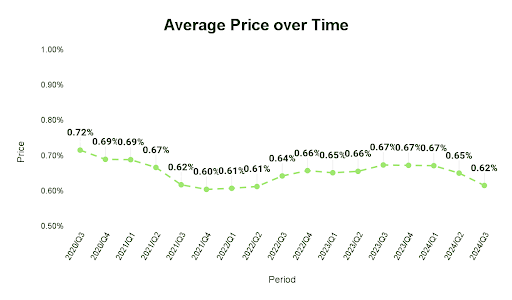

Our average fee, which has been 0.67% since Q4 2023, went down from 0.65% in Q2 to 0.62% in Q3. The 0.62% is the average of all the months combined in Q3 but we actually got the average fee as low as 0.59% in September.

This means we’ve managed to drop the average fee 0.08% since the start of the year.

The price provided is a global average based on a fixed basket of representative currencies and may not reflect specific prices for consumers in the United States or Canada. Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information in your region.

Why do we regularly review our fees?

Our fees reflect our costs. So, if we want to offer you the lowest fees possible then we need to find ways to reduce our costs.

Each feature and route we serve comes with its own costs which we regularly review. It’s a balancing act between spotting opportunities to cut our costs while making sure we carefully invest in ways to improve Wise for you.

Q3 Highlights

- International transfers on 15 currencies got cheaper

- Funding your transfers with bank-issued cards, direct debit (ACH), and Wire transfers in the US and Canada got cheaper

- You can now get discounted fees on transfers exceeding 20,000GBP (instead of 100,000GBP)

- Most conversions on your Wise account got cheaper

Read below to see which fees changed the most.

International transfers on 15 currencies got cheaper

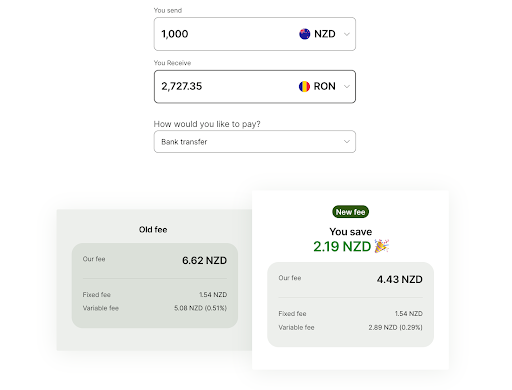

People and businesses who send US dollars, Singapore dollars, New Zealand dollars, and send money to places like Brazil, Hong Kong, Romania, and others will now pay less.

For example, suppose you want to convert New Zealand Dollars (NZD) to Romanian Leu (RON), for your upcoming trip. Sending 1,000 NZD to RON used to cost 1.54 NZD + 0.51%. This now costs 1.54 NZD + 0.29%. This means the fee for a 1,000 NZD transfer is now 33% cheaper than before.*

You can use our handy calculator on the Wise homepage to see how you could benefit from these changes.

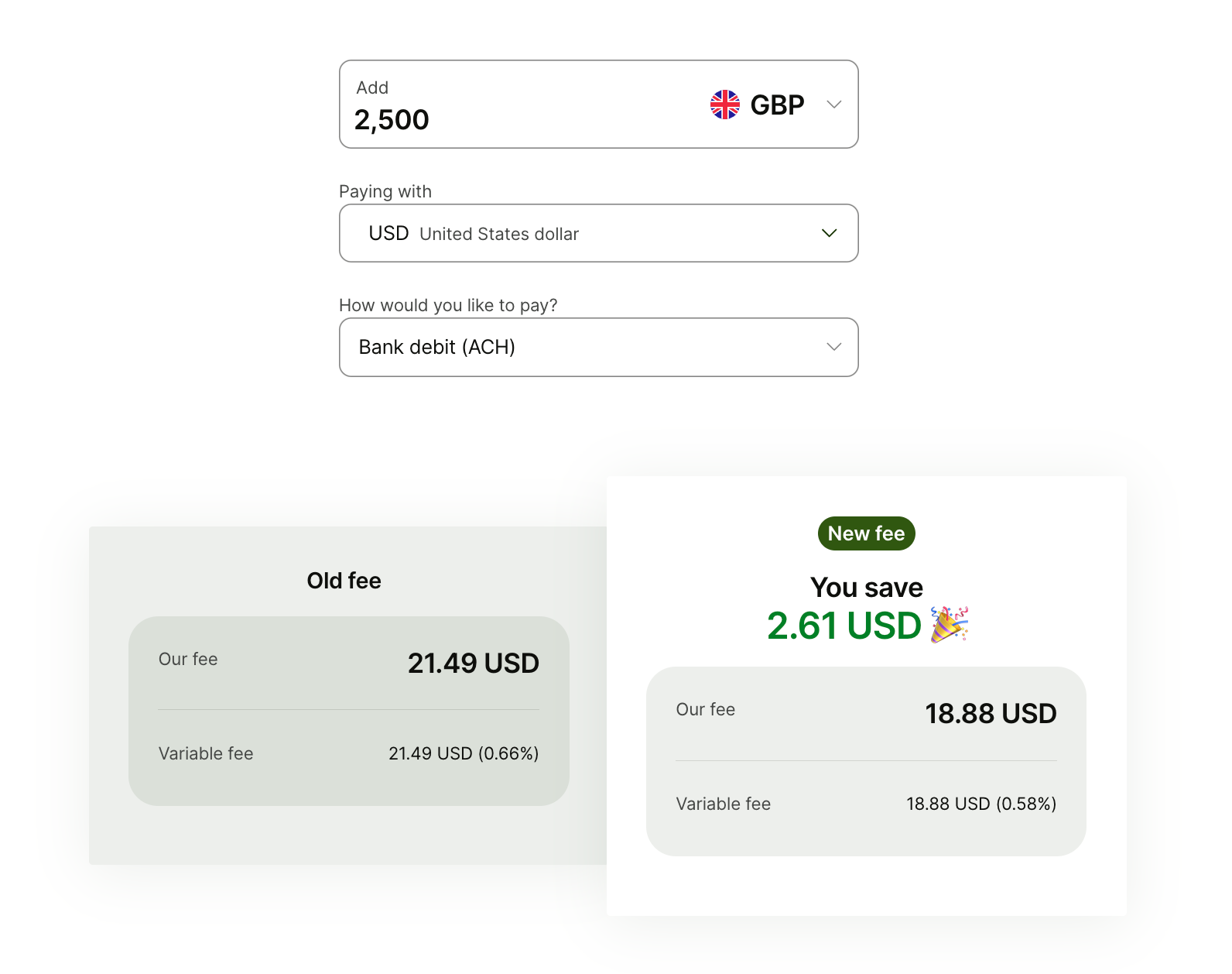

Some major payment methods in the US and Canada got cheaper

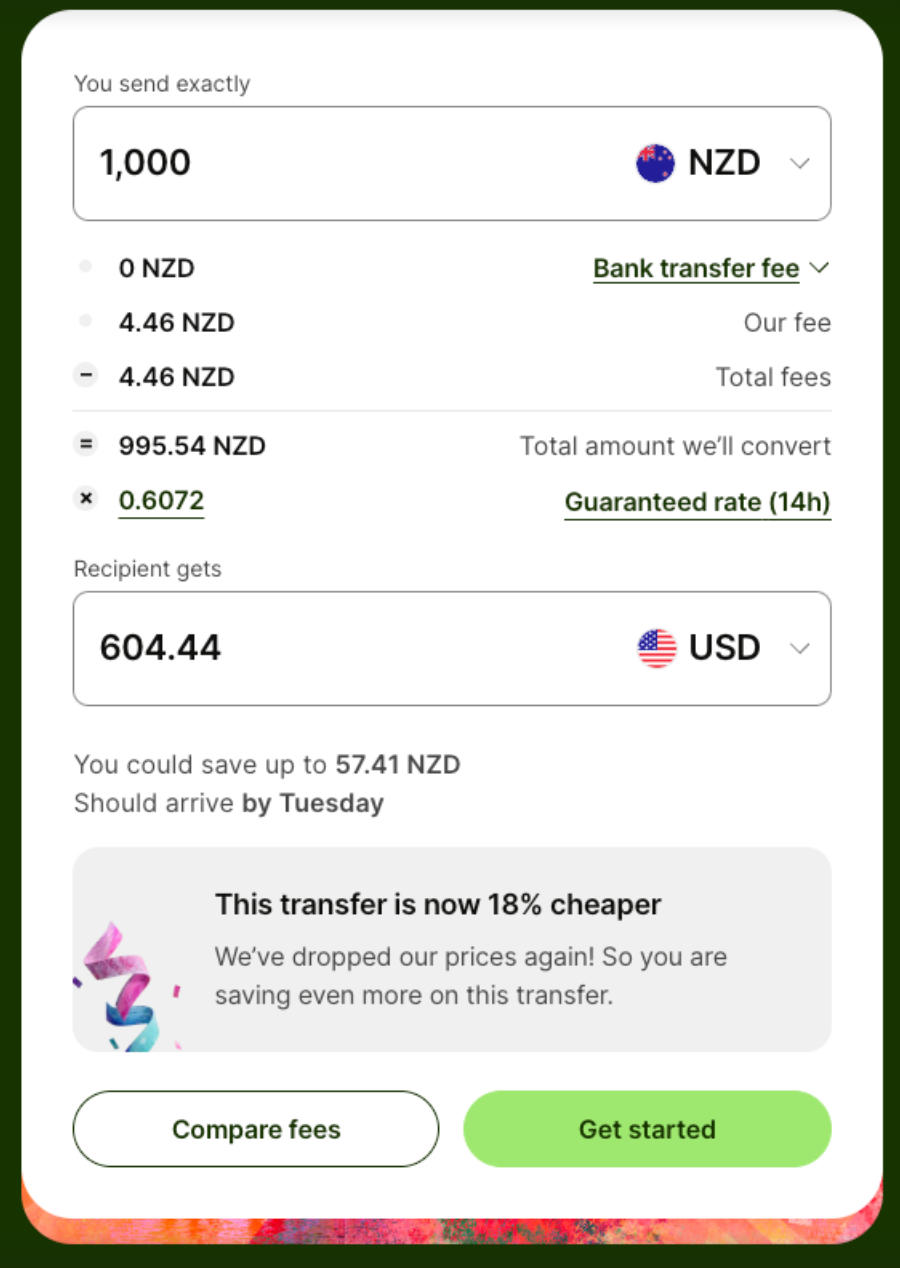

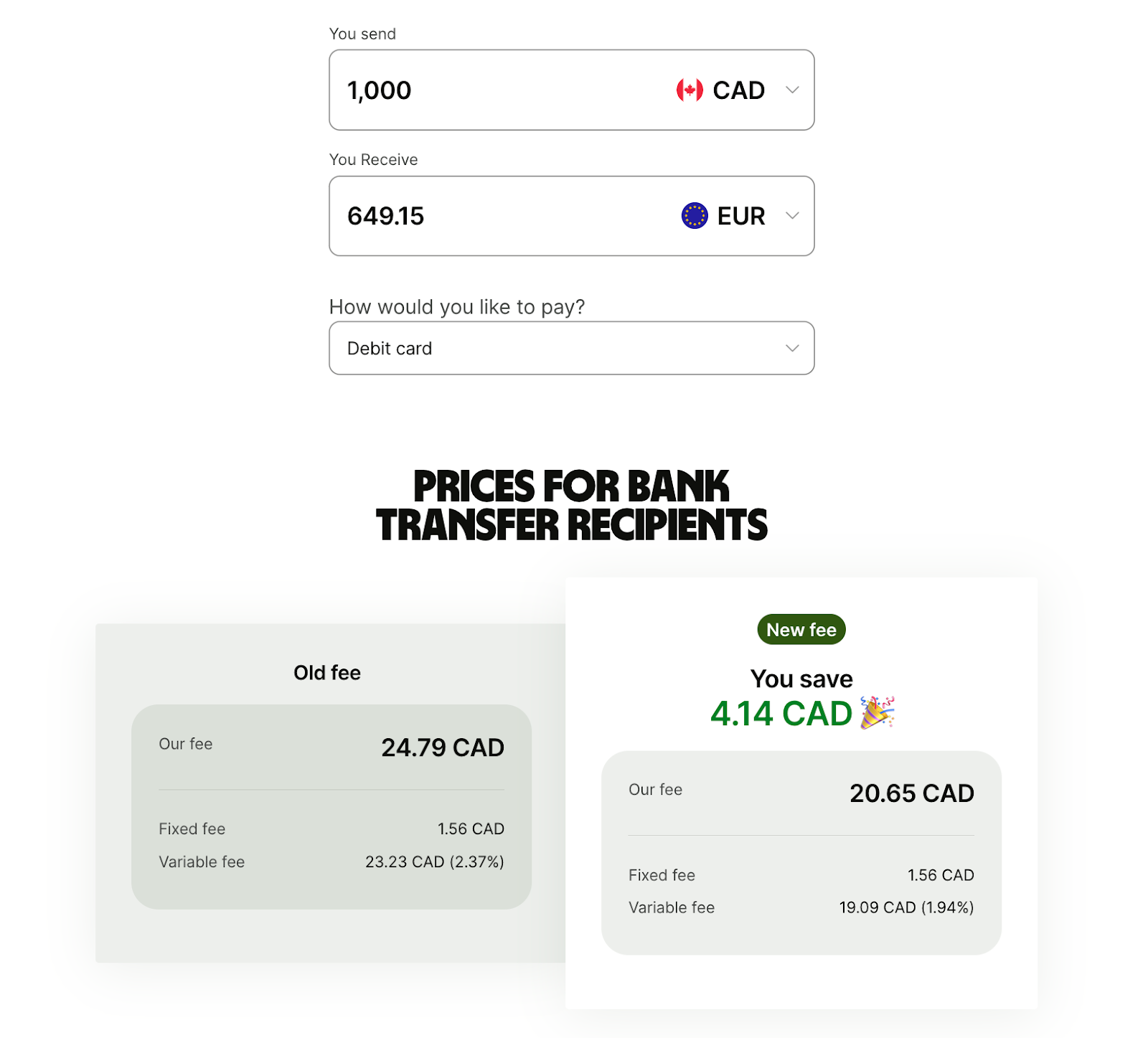

Adding money to your Wise account or funding transfers using bank-issued cards, direct debit (ACH), and Wire transfers all got cheaper.

For example, if you’re in Canada it’s now cheaper to fund your transfer using a bank card. Using your card to fund a transfer of 1,000 CAD to Euro it used to cost 24.79 CAD and will now cost you 20.65 CAD. That’s 18% cheaper than before.*

Or, if you live in the US and want to add money to your GBP balance using ACH, it will now cost you 18.88 USD, instead of 21.49 USD - 13% cheaper than before.*

You can avoid these types of fees altogether by using your Wise account details to receive money more regularly - like your salary, invoices or regular payments from friends and family. That way you avoid the fees that come with moving money from your other bank to Wise.

Sending large amounts got cheaper too

The more you send with Wise, the more you save. And we’ve made it easier for you to save money when you send large transfers or lots of transfers within a calendar month.

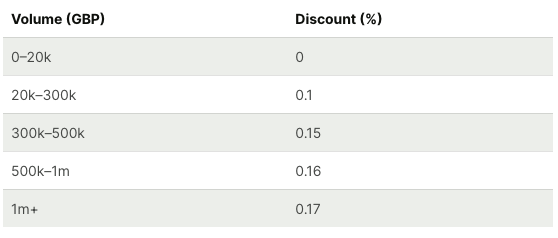

Previously, if you sent over 100,000 GBP (or equivalent) in a month, we’d automatically apply lower fees on any transfers after the 100,000 GBP limit. In August, we lowered this limit to 20,000 GBP (or equivalent) so more of you can unlock lower fees.

Let’s say that in September, you send 2 transfers of 20,000 GBP to EUR, and 1 transfer of 500 GBP to EUR. On the first transfer, we’ll charge our normal fee for sending GBP to EUR by bank transfer, which is 0.41%. On the second transfer, we’ll charge 0.31%, because you sent more than the 10,000 GBP limit.*

This table shows the estimated percentage discount depending on how much you send within one month.

If you're sending or converting more than 2m GBP or equivalent read more info here.

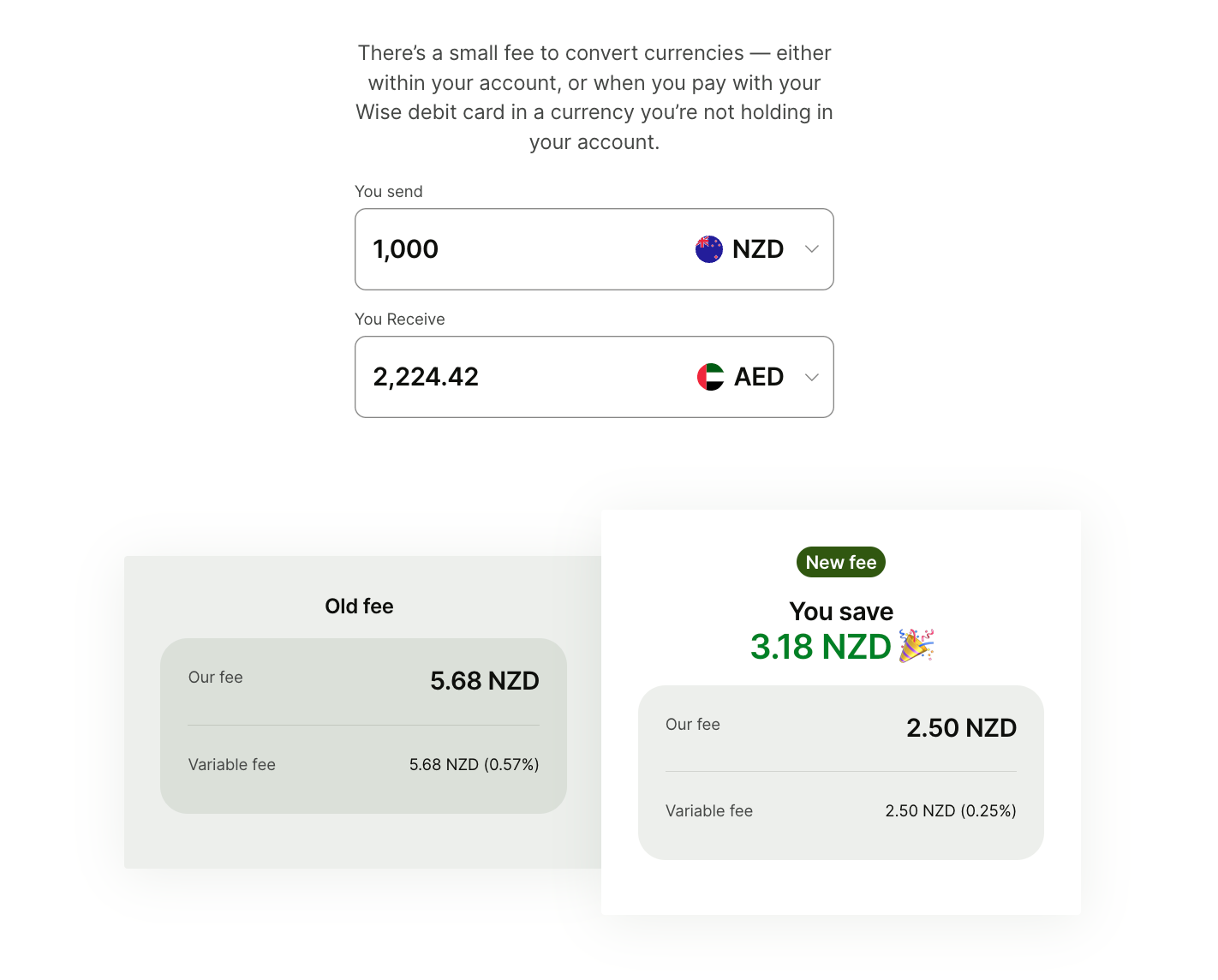

Most conversions on your Wise account got cheaper

Along with international transfers, some conversions on your Wise account are now cheaper.

For example, converting 1,000 NZD to AED used to cost 5.68 NZD and now costs 2.50 NZD. That’s 56% cheaper than before.*

You can find out how much your next transfer will cost from here.

Give your money a boost

What's new for Wise Interest in the UK, Europe, and Singapore?

Customers in the UK, Europe and Singapore can get a return on their money by switching their balance and Jars to use Wise Interest and invest their money in assets guaranteed by the government while continuing to spend and send as normal.

Customers transferring over certain amounts from your Interest balances or Jars will now be subject to a processing time of up to 2 days.

United Kingdom

- 10 000 pounds for personal accounts

- 100 000 pounds for business account

Europe

- 12 000 euros for personal accounts

- 120 000 euros for business accounts

Singapore

- 20 000 Singapore Dollars for personal accounts

- 200 000 Singapore Dollars for business accounts

You can still transfer under 10,000 GBP/12,000 EUR/20,000 SGD daily without delay.

We are doing this to make the product more resilient to risks and the pricing fairer for all.

Know what you pay, and how much you save

So that’s a wrap of Q3 on how we progressed in lowering the cost of moving money across borders.

Making sure our fees are fair for all of our customers, and lowering them whenever we can, is core to our mission at Wise. You’ll never see us hiding fees in marked-up exchange rates like some other providers. To make it easier for you to compare your options, we’ve set up a comparison table that covers a few banks and other cross borders specialists.You can also check if your bank is hiding fees here.

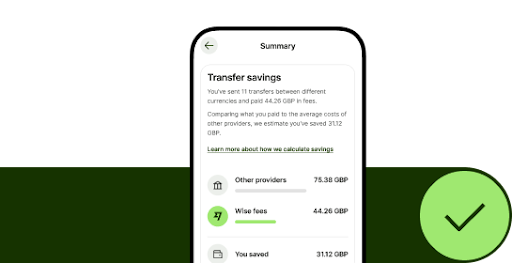

If you haven’t tried it already, try our Account Summary feature in the Wise app, which shows you exactly how much you’ve saved on fees for the international transfers you’ve sent with us.

Compare the fees you paid with us to what other providers would have charged you — and see what you’ve saved over time.

Tap the graph icon next to your total balance on the home screen and scroll down to see ‘Your savings’.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.