Wise Business Pricing Explained

Having trouble deciding which Wise Business account is best for your business? We’re breaking down the differences between the ‘Essential’ and ‘Advanced’...

The Profit Margin that a business generates is one of the most important elements that inform decision-making by owners, investors, and finance teams.

However, there is no single profit margin calculation that can provide an indication of a company’s business health and financial performance. In this article, we'll explore the four profit margin formulas and how they give visibility over your company’s profitability, what ‘good’ looks like and some tips on how to increase your profit margin if you business operates across borders.

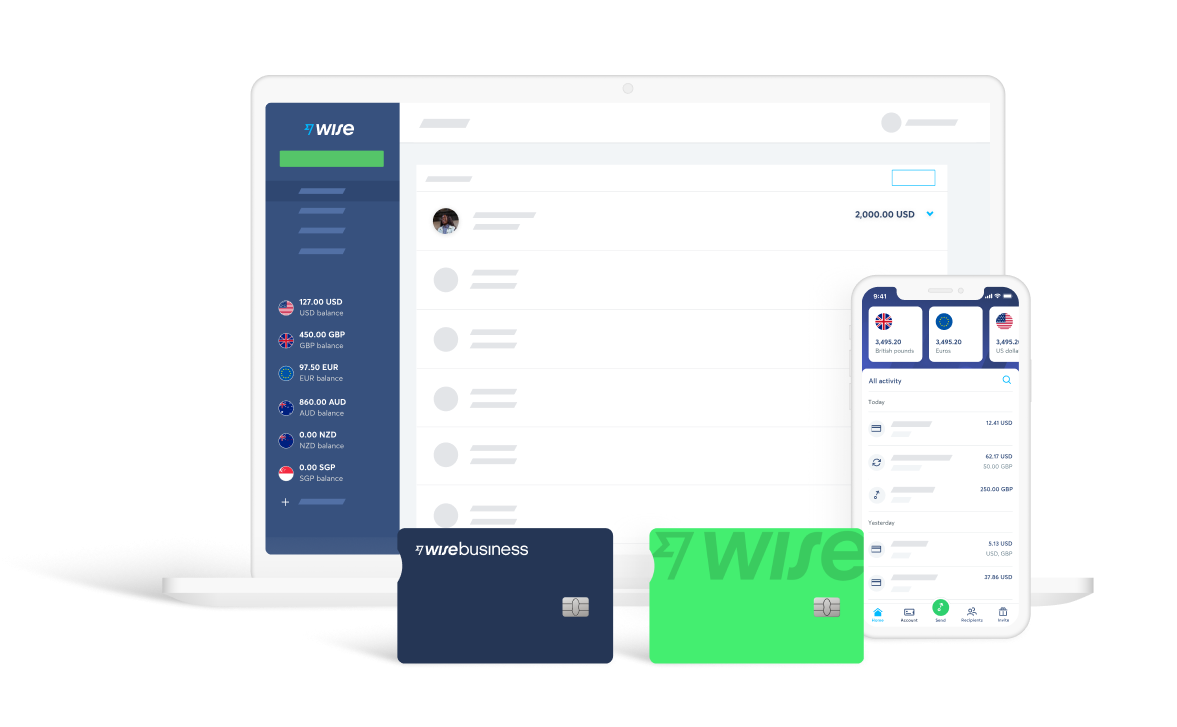

| Wise is up to 19x cheaper than PayPal. Cut your business’ costs - find out how today. |

|---|

There are four types of profit margin that can be calculated:

These calculations should be used in conjunction with each other to assess the health of a business, or to benchmark it to next to other businesses. Let’s get started!

| 💼 Contents |

|---|

To illustrate how to calculate Profit Margin, we will use an example. A business with the following assumptions:

| 💡 Depreciation in accounting is a method of assessing and allocating the value of a physical/tangible asset. It's used to represent the current value of assets like machinery and equipment after they’ve been used. |

|---|

In the income statement (also called a Statement of Profit & Loss), the Gross Profit Margin is the first profit metric line item. To put it simply, it’s a metric that shows how much profit a business makes after the direct costs of producing and getting its products and services ready for sale. If you’re in a goods/product-based business these production costs are called Cost of Goods Sold (COGS for short).

The Gross Profit Margin expresses the gross profit as a percentage of revenues, and provides an indication of what percentage of each pound or dollar of revenue generated is used to create the goods or services being provided.

The formula for Gross Profit is as follows:

The Gross Profit Margin is then calculated as:

The operating profit margin takes the gross profit, and deducts all the other regular expenses that a business incurs while operating (except for interest and tax).

These are called operating expenses. In addition, operating profit also includes items such as a one-time gain or loss on a sale of an asset, profits earned from minority investments, legal damages paid, etc. In short, all income and expenses that a business has to pay outside of interest and tax are encompassed within the Operating Profit Margin calculation. That is also why operating profit is often called Earnings Before Interest and Tax (EBIT).

The good news is that we can use the work from the Gross Profit Margin calculations, and just add a step to it. In the business above, payroll, rent, depreciation and marketing are operating expenses.

The formula for calculating operating profit is as follows:

The Operating Profit Margin is then calculated as:

| 💸 Reduce your operating cost and increase profitability with Wise. Find out how! |

|---|

Moving further down the income statement, the next Profit Margin calculation is that of the Pre-Tax Profit Margin which shows you how much profit your business is making minus all expenses except tax. This is useful in evaluating the performance and efficiency of businesses that operating across different jurisdictions with differing corporate tax rates. The pre-tax profit is also referred to as the Profit Before Tax (PBT).

Once again, we can use the work that we have done so far on the Operating Profit Margin calculations, and simply deduct interest costs from it to get to the Pre-Tax Profit Margin.

The formula for Pre-Tax Profit is as follows:

Pre-Tax Profit Margin is then calculated as:

The last profit margin calculation is net Profit Margin; also known as 'the bottom line' as it appears at the very end of the income statement. The net profit shows you how the business is performing after all expenses have been deducted (including tax) and Ancillary Income streams have been accounted for. Put simply, the net profit margin calculation essentially displays how much of each pound or dollar of revenue generated is turned into a profit.

| 💡 Ancillary Income are revenues that are not generated from a company’s core products or services. |

|---|

The formula for Net Profit is as follows:

Net Profit Margin is then calculated as

Understanding what constitutes a 'good' profit margin is heavily dependent on several factors including the type of industry your business is in and how mature it is (to name a few). As an example, if you're a sole trader and your business is in consulting or coaching, you're likely to have far fewer overheads than a business that manufacturers bike parts and needs to pay for logistics, equipment maintenance and raw materials.

The most important thing to bear in mind is that you're comparing your performance like for like with other businesses in your sector.

Additionally, as discussed above, these profit margin calculations should be used in conjunction with each other to get the full picture of business performance.

While the Net Profit Margin seems like it covers all income and expenses generated to give the user an idea of overall profitability, it is not as useful when viewed in isolation. The Pre-Tax Profit Margin provides a better insight into the profitability of the business without taxes (which can fluctuate between different tax jurisdictions, or even between different years in the same jurisdiction).

Further up the income statement, the Operating Profit Margin is a good indicator of a company’s ability to convert its revenues into profit without accounting for interest and tax costs. This is useful because taxes paid can differ between businesses that operate in different jurisdictions.

| 💡 Tip! For businesses with international suppliers, costs such as FX fees can start racking up pretty quickly and add to the total Cost. Companies could benefit from using alternatives like Wise for Business when making international payments. Wise helps cut the cost of overseas payments, increase your Net Profit Margin, and subsequently boost profitability (as we will see later in this article!). |

|---|

Similarly, the financing decisions that a business makes (proportion of debt vs. equity) can impact overall P&L(Profit and Loss). A business that uses both equity and debt would have higher expenses through interest costs than a business that funds itself using only equity.

Lastly, the Gross Profit Margin offers a view of production costs as a component of overall revenue, i.e., how much it costs to produce a good or service, and get it ready for sale. The higher your Gross Profit Margin, the faster you can achieve break-even on your units sold.

As a business owner and/or decision-maker, exploring the differences between these four profitability margins is a great starting point for understanding and optimizing the costs that may be weighing down your business’s P&L.

|💡💵 Get paid like a local - get account details

(only with Wise Business Advanced)

| in up to 10 currencies to save money on payments and international transfers |

|---|

Running a business that has an international footprint comes with several potential complexities from a financial standpoint. There are likely more partners involved at each step which may reduce margins from the time that you operate your business from the same country.

While these partners have local knowledge that may be critical to the success of your business in international territories, there are certain best practices that can be followed to preserve your Profit Margin as you expand globally.

If your business is in dropshipping or e-commerce, consider whether your distribution and logistics partner is the most cost-effective one available to you. Transport and warehousing costs can often be significant when factored into Cost of Goods Sold. Consider working with a Third-party Logistics (3PL) service provider - they often work with carriers for lots of different businesses which typically brings rates down

If your business sells or operates in different countries and relies on using multiple currencies, you will likely incur FX costs in switching from one currency to another. By partnering with a payment provider such as Wise, these costs can be eliminated to a large degree, thus saving you added costs on your international purchases. You can get paid like a local - get account details

(only with Wise Business Advanced)

and receive payments in 10 different currencies for free!

Having insights on your product levels and which ones are making your business the most money is a key to improving your bottom line. Using specialist order management software can help you monitor and optimize inventory levels to make sure there’s not too much or too little stock.

This has an added advantage of improving your cash flow as until your products are sold, they are effectively costing you money. There are also probably some products that don’t do well at all - the money you front for these could be used to develop or make more of your best performing lines.

If your business has grown quite fast and there’s much more demand for your product, you might be able to revisit your contracts. Bigger overall orders could mean there’s room to push for a discount. If you’ve been working with a more expensive supplier you might find new partners in different countries who can offer you a better pricing structure.

Whether your business works with freelancers in different countries or you're working with suppliers in multiple currencies, reviewing your overseas payments can be one of the most impactful ways to reduce your costs and improve your profit margin.

International payments are often overlooked by businesses, but these transactions could be weighing on your operating costs if you’re not using the right banking solution.

Here’s an example:

Traditional banks typically charge 2% - 3% on FX mark-up when you convert between currencies. On top of that, there’s a Swift fee of £20 - £60 per transfer. When these add up, international payments become expensive. That’s £300 for every £10,000 pounds sent. On top of that, the receiving bank also takes a cut when your recipient receives the money.

But here’s the good news. There is a solution!

Wise for Business is designed to reduce payment costs for SMEs on international payments. Which is why:

Check out Wise Price Page to see how much you could save.

| See how other businesses used Wise to save money |

|---|

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Having trouble deciding which Wise Business account is best for your business? We’re breaking down the differences between the ‘Essential’ and ‘Advanced’...

From messaging upgrades to hosted onboarding, here is how we’re evolving to help you and your end customers move money with speed and confidence.

Discover the essential costs involved in starting a business in Malaysia as a UK resident. Our guide covers incorporation fees, capital requirements, and more.

There comes a time in almost every startup’s journey — whether in the UK, Europe or further afield — when its executive team considers expansion to...

Learn about all the costs to budget for to start a business in Spain as a UK resident. Our guide covers incorporation fees, capital requirements, and more.

Learn all about popular credit cards UK self-employed individuals can use in 2026. Our guide explains features and fees to help make an informed decision.