Are you paying more than you think with Revolut?

At first, Revolut might look like the cheaper option. Dig a little deeper and it turns out Wise could offer the better deal. How do Wise and Revolut differ?...

We’ve written a couple of times about CBPR2: a new EU regulation that would force banks and other financial services to disclose exactly what it costs for you to send money abroad.

But because banks will be banks, the implementation of the rules has been more than patchy. Either because the industry pleaded for a delay in its application; or because the language of the law is so vague, banks ended up taking it as an opportunity to still do the same dodgy stuff, but with new tricks.

That’s why we’re campaigning to enforce the rules in the way they were intended. So, we’re writing this series of blogs to look into how transparent banks and other fx providers are, based on the following criteria:

- The exchange rate used vs the real exchange rate;

- Disclosure (and visibility) of the mid-market rate;

- Disclosure (and clarity) of how much extra you’re paying.

That’s also why we’re starting with Natwest, as it’s such a vivid example of the complete opposite of transparency.

Score: 0/3. Very opaque.

Natwest is one of the UK’s biggest high-street banks. Many of you manage your money with them –– but if you’ve also relied on them to send or spend money abroad, you’ve paid more than your fair share.

Why? You might ask...

Let’s start with the basics: Natwest is intransparent because it consistently overcharges customers for profit on their FX transactions. By a lot.

It’s unsurprising that big banks charge you more than they’re due by adding a markup – basically, a hidden fee added to the mid-market rate (the exchange rate you see on independent websites such as XE, Bloomberg or Google). So we started looking into this as soon as we came up with the idea of writing this series (back at the beginning of the year).

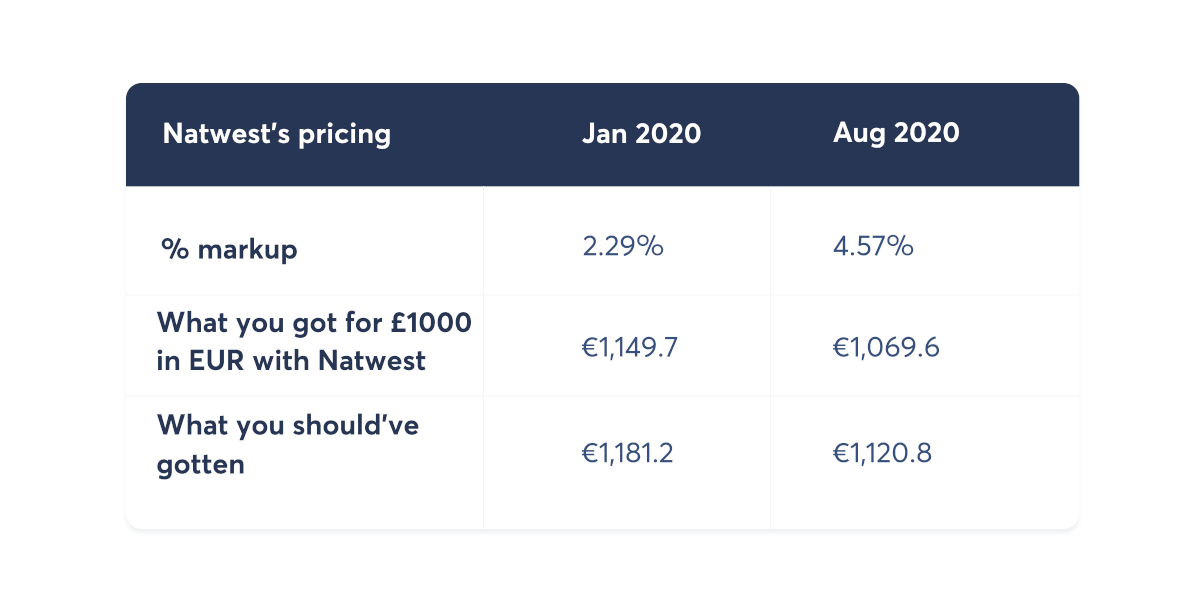

So, already in January, Natwest’s markups varied between 2-3%. Looks small? Imagine you sent £1000 to EUR on the 1st of January, when £1 was worth €1.1812.

If you sent £100 you’d get €118.12, and if you sent £1,000 you’d get €1,181.2. Easy, right? That’s with the mid-market rate, mind you.

But Natwest’s maths was slightly different. With a 2.66% markup, Natwest’s customers would get €114.97 or €1,149.79 (that’s a €31.41 hidden fee!).

You think that’s bad? Wait...

At the height of the pandemic (let’s say, between March and April) Natwest almost doubled its markup to 4.57% on GBP-EUR transfers. This means that you’d now get €51.22 less than you should get – a fee that customers, most likely, didn’t know about.

See the table below.

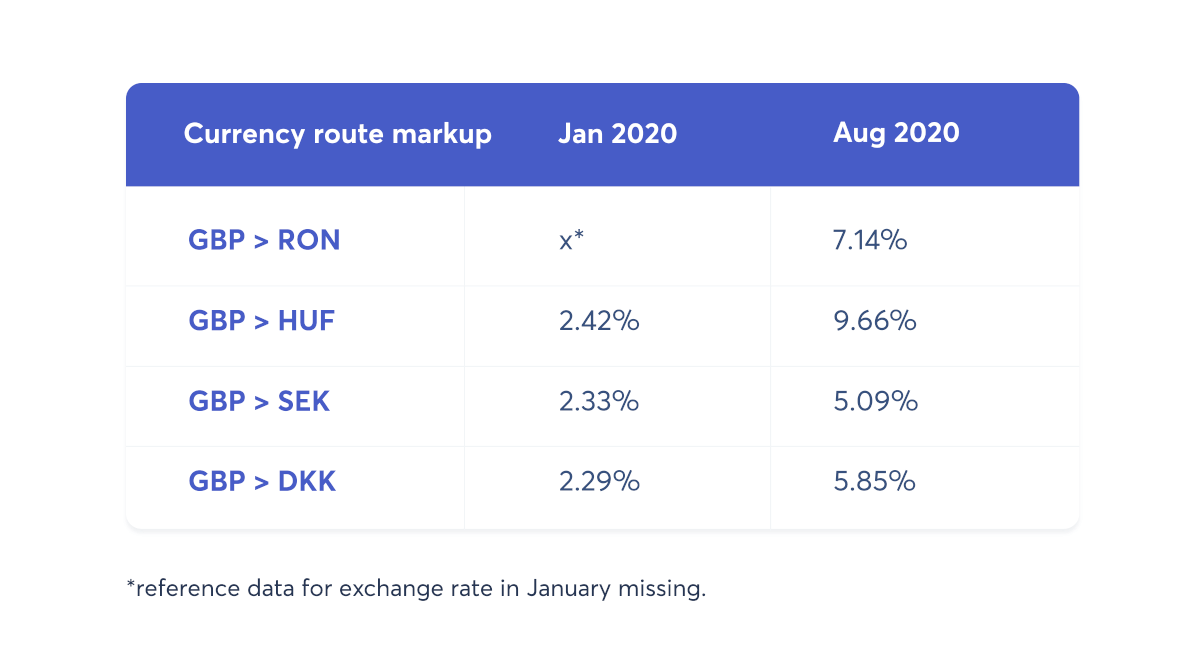

But that’s not all. The markup applied increases even more with other European currency routes – all of which should’ve been protected by the guidelines in the CBPR2 and supported by the British financial regulator (FCA).

I’ll leave you to do the maths.

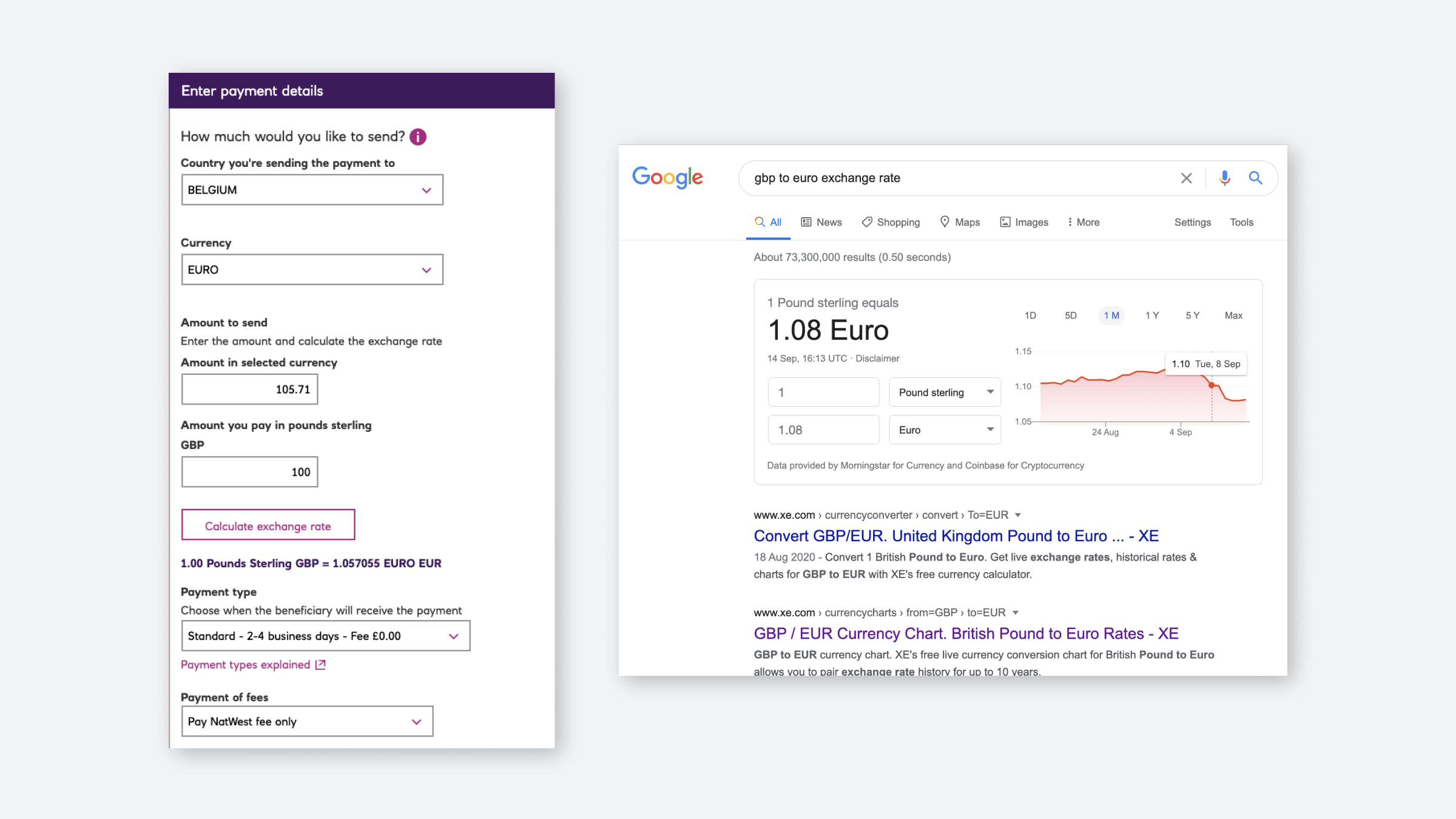

What you can see below is an exchange rate provided at the time of this transfer was an malicious fixed rate provided by Natwest. To the right, is an exchange rate provided by XE, Google and Reuters (or even Wise’s calculator), exactly at the same time.

Unlike when you check the exchange rate given to you by different banks, third-party websites always give you the same exchange rate. This is because they use the mid-market rate as a common denominator i.e. the real exchange rate.

Zoom in, and you can see that Natwest stated a different exchange rate. And they never made it clear what the value of your money, once exchanged, was.

So, it isn’t a pass on this criterion either.

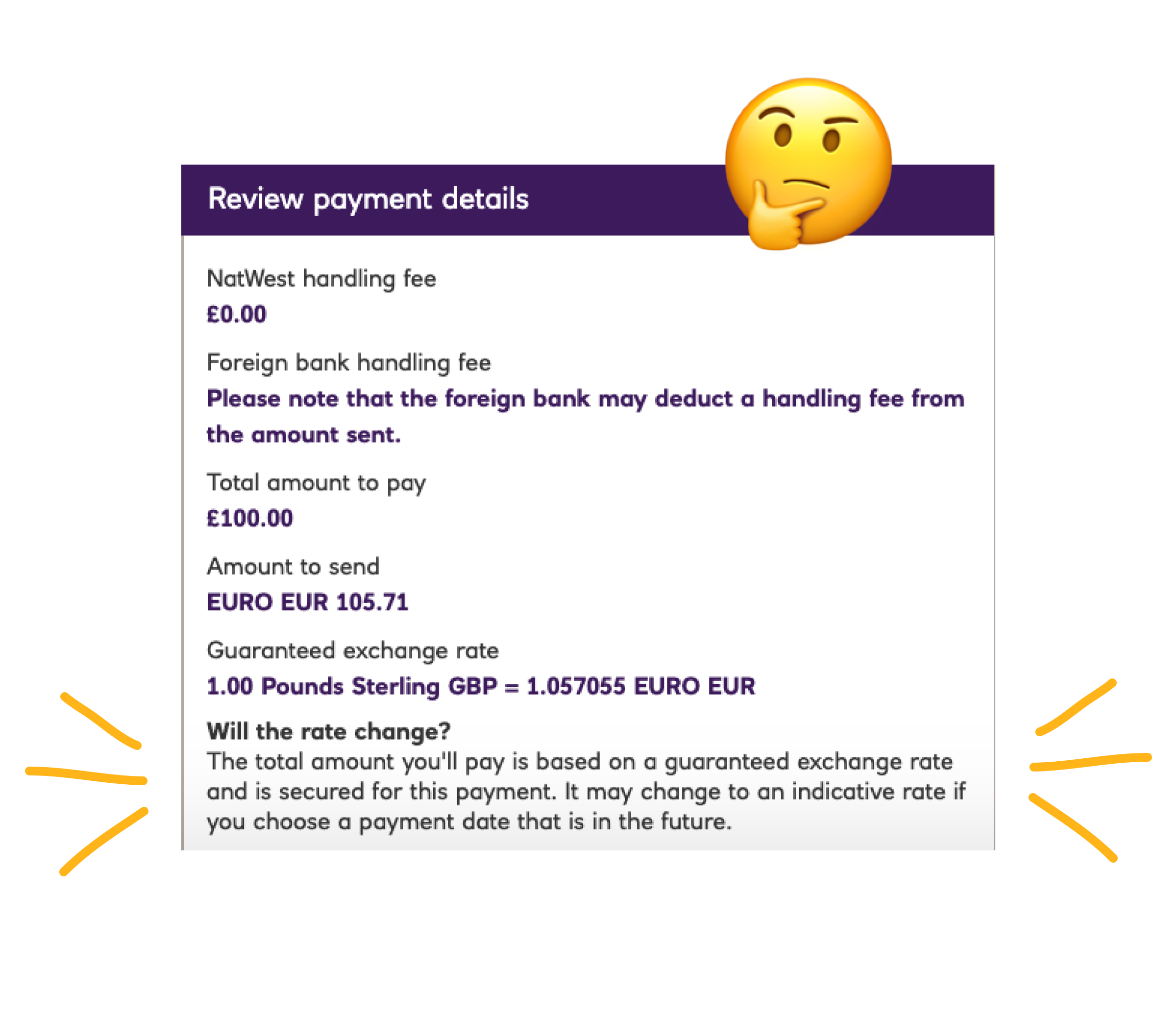

This one will be short. There isn't any disclosure of what exchange rate is applied, plus it states it charges a £0 fee.

Hard no from us in this category.

Natwest is a prime example of why we’re concerned about legislation like CBPR2. Without clear rules or clear deadlines, banks and providers will continue to hide the total cost and pocket the profits. Sometimes, they’ll even do it overnight in the middle of a global crisis.

Natwest isn’t alone

We’ve seen multiple examples of banks and other providers around the world applying the same strategies.

Change is coming — but unless we call out the biggest offenders of CBPR2, banks will never be transparent. So help us make transparency the norm. Check whether your bank or broker is dragging their feet on transparency – and spread the word. Call it out on social media, by adding the hashtag #banksaresneaky and tag us as well.

Help make transparency the new norm

Check whether your bank or provider is being sneaky. Then spread the word on social media: tweet the screengrab of the rate they provided you for your international transfer vs the mid-market rate. You can check the real exchange rate on a reliable third-party site (XE, Google or even Transferwise).

Don’t forget to tag the bank and Wise. And add #banksaresneaky to your post if you can fit the characters in.

We also teach you herehow to make a formal complaint and ask your bank to put things right.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

At first, Revolut might look like the cheaper option. Dig a little deeper and it turns out Wise could offer the better deal. How do Wise and Revolut differ?...

An independent research team compared Wise to six UK bank accounts, as well as Monzo, Starling, Revolut, PayPal, Xoom, Western Union and Post Office. They...

A dedicated comparison research team in Wise compared Wise to four India bank accounts. They found that we’re on average 1x cheaper to send ₹9,000 abroad....

In the UK, our research found that it’s up to 87% cheaper to spend with a Wise card abroad, compared to high street banks, if you’re spending £1000. High...

Detailed research by Wise reveals substantial savings compared to Singapore banks and services like Instarem, Revolut, and Youtrip by EZ link.

Discover how Wise compares to 5 major Japanese banks and Revolut, offering savings of up to 6x on international transactions.