Navigating Cross-Border Payments Amid Tariff Uncertainty

Over the past month, businesses around the world have been preparing for a new reality in global trade. As uncertainty grows surrounding tariff regulation...

If you’re a freelancer or the owner of a small business in the UK, you’ll always be looking for cheaper, more convenient ways to handle payments.

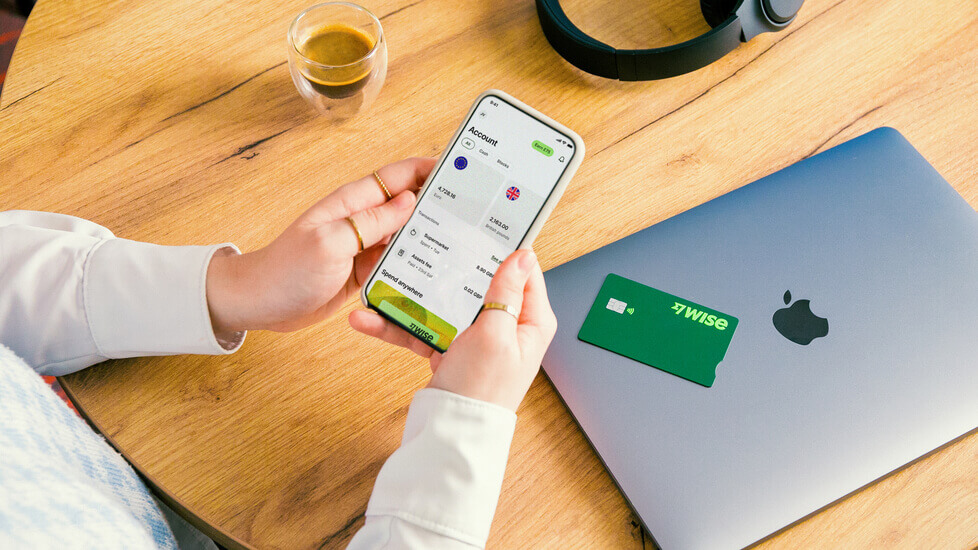

PayPal is a popular choice for businesses needing to make and receive international payments. It’s easy to see why – it’s quick, easy and global. However, PayPal isn’t always the cheapest option when it comes to currency conversion fees and exchange rates. You could save money by using an alternative such as Wise Business.

In this guide, we’ll cover everything you need to know about sending money from PayPal to Wise.

💡Learn more about Wise Business

When a customer pays you in another currency using PayPal, the next step is to withdraw it to your bank account.

At this point, the currency will need to be converted to GBP before it hits your bank account. It’s likely that PayPal will use an exchange rate with a mark-up added on top for this conversion, while also charging additional currency conversion fees. This all eats into the total sum and means you receive less of your hard-earned money in your bank account.

The solution? Withdraw your PayPal balance to Wise Business instead of your bank account.

When you open a multi-currency Wise Business account, you’ll get your own local bank details for 9 major currencies. For example, the Euro, US, Australia, Canada and Singapore dollars among others.

If you use these local details to withdraw your money from PayPal, you can receive the money in the same currency and no conversion will be needed.

From there, you can spend using your Wise Business debit card or send a payment to another country. This can be handy for covering business expenses, or simply to pay employees, contractors or suppliers abroad.

You can also hang onto the money for future payments, or withdraw it to your bank account right away. You can do this easily, and for a far smaller conversion fee. Even better, the conversion will be done at the real, mid-market exchange rate (so no expensive mark-up).

Get started with Wise Business 🚀

It’s easy to set up Wise Business as your go-to payment account for PayPal withdrawals.

Before you start, make sure you have a PayPal account that can receive and hold foreign currencies. This means that you need to enable or add new currencies to your PayPal account.

PayPal doesn’t allow international payments by default so you have to enable this yourself.¹ But before you do so, add foreign currency accounts for the currencies that you want to receive on PayPal. Here’s how:

This feature will allow you to hold funds in different currencies rather than having it converted automatically to your local currency. While that sounds convenient, it can get expensive especially with the conversion fee PayPal charges which is 3%².

| Learn more about PayPal business fees in the UK |

|---|

Sign up for a Wise Business account. It’s quick to register, and you will need to verify yourself and your business. Check here the requirements to open a Wise Business account in the UK.

Explore the features of your new account. In particular, take a look at your new local bank account details under ‘Balances’. You’ll see a number of options under currency symbols. From here, you can access sort code and account numbers for various countries worldwide.

Sign into your PayPal account and head to ‘Wallet’. This is where you link bank accounts and debit/credit accounts, which fund PayPal payments and enable you to withdraw your balance.

Link a new account to your PayPal account. Check back into Wise and find the local account details you need. For example, you can use your US bank details if you have a regular customer who pays you in USD. Enter these local Wise account details into PayPal, review and submit.

Skip the step relating to setting up Direct Debits (by clicking ‘Finish later’) – PayPal may ask you a few times for this, but Direct Debits aren’t an option with Wise account details so you will need to keep skipping this step.

Verify your new account details. PayPal verifies its users by sending a tiny transaction to their new bank account along with a unique 4-digit code as a reference. This can take up to a few days to arrive, but hopefully it will happen in under a few hours. Keep checking your Wise Business account under ‘Incoming payments’ to find this transaction. Enter the accompanying code in your PayPal ‘Wallet’ as part of the ‘confirming your bank’ process. This should verify your account.

And that’s it! Your Wise Business details should be added to PayPal and you can choose this account as your withdrawal method whenever you need to.

As you can see, it’s just like adding any new bank account to your PayPal wallet. You can set these new details as your preferred bank account if you like, or use it only when payments in a particular currency come in.

So that’s it – all the essentials you need to know to send money from PayPal to Wise.

From there, you can hold up to 40+ different currencies at once. It’s completely up to you whether you spend, send, convert or withdraw, and the tiny fees are always clear and upfront. This means you’re in the driving seat at all times.

The Wise Business account is ideal for freelancers and small businesses who trade internationally.

Get started with Wise Business 🚀

Sources used:

Sources last checked September 14, 2023.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Over the past month, businesses around the world have been preparing for a new reality in global trade. As uncertainty grows surrounding tariff regulation...

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

December kicks off the end of year shopping period, with huge uplifts in on and offline sales as people grab a bargain and get ready for the holiday season....

The term "turnover" is used often in the world of business, but its implications vary significantly depending on the context. At its core, turnover is a...

Wise is a financial technology company focused on global money transfers that offers two different types of accounts: a personal account and a business...

In today's fast-evolving digital landscape, e-commerce is quickly transforming the ways consumers shop and how businesses operate worldwide. DHL’s E-Commerce...