Navigating Cross-Border Payments Amid Tariff Uncertainty

Over the past month, businesses around the world have been preparing for a new reality in global trade. As uncertainty grows surrounding tariff regulation...

Want to tap into global talent, or expand into new markets? Your organisation might want to look into hiring overseas employees or establishing satellite teams in other countries.

If you’re considering taking on international employees, there are a few important things you need to know. One of the most complicated can be payroll, as you navigate the legal, tax and financial implications of paying overseas workers in multiple currencies.

Read on to find out all you need to know about paying wages to overseas employees from the UK. Below, we’ll take a look at the different ways a UK business can hire people in other countries, and best practices for paying them.

We’ll also look at a solution ideal for global businesses of all sizes - Wise Business. It offers convenient international mass payout tools, so you can pay employees spread all over the world for low fees and great exchange rates.

💡Learn more about Wise Business

Following the Covid-19 pandemic, the doors to remote working were flung wide open. Many companies took advantage of the opportunity to harness skills from a global talent pool, making use of advances in remote and collaborative working technology.

It’s estimated that around five million international employees work for UK-based companies.¹ Some UK organisations even give their home-based teams the freedom and flexibility to work in other countries, ideal for those looking to travel or even move abroad.

However, taking on overseas staff doesn’t come without its challenges and complications. UK business owners need to get to grips with the different employment classifications, including contractors, freelancers and permanent employees working for a newly established overseas entity.

There are a few ways you can hire teams abroad, including using an employer of record or setting up an overseas entity. Alternatively, you can hire contractors under a services or consultancy agreement.

Whichever option you choose, it’s always a good idea to get professional advice to help you understand the tax and legal implications.

If you want to hire an international worker under the same employment terms as your UK-based staff, you’ll need to set up a new legal entity for your business in their home country.

This can be a little complicated, so it's recommended to seek expert advice before proceeding. You’ll need to check that you’re adhering to local employment laws, as well as payroll and accounting regulations.

But the benefit is that you’ll have a permanent, full-time employee with the skills and local expertise (and perhaps language skills too) that you’re looking for.

Another option is to work with an employer of record (EOR) or professional employer organisation (PEO). This company will employ full-time workers on your behalf, so you don’t have to set up a new entity overseas.

Rather than taking on full-time staff overseas, many UK businesses prefer to work with international contractors. This option can offer much more flexibility, without so much paperwork.

Hiring a contractor gives you access to the talent you need for a specific project, for a specific period of time. You’ll need to both agree to a contract setting out the scope of the work and the terms of the payment.

With this option, it’s a good idea to seek tax advice. Certain UK tax laws such as IR35 could affect how you work with and pay contractors, and how much tax you need to pay.

And of course, you’ll need to work out the most cost effective way to pay your overseas contractors.

💡 Read Povio's complete case study

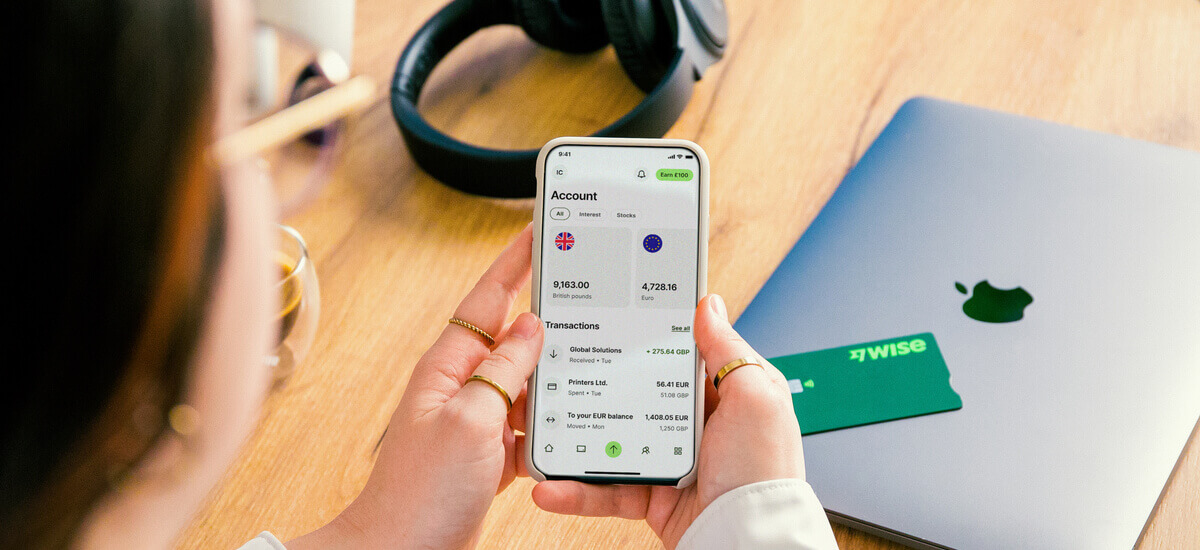

One of the easiest and most cost-effective ways to pay international contractors is with Wise Business. It offers a time-saving batch payments tool for paying up to 1,000 people in just a few clicks.

Have contractors spread out across the world? Paying them is no problem, using the powerful Wise API to automate payments. There’s no need to manually pay out to vendors or employees. All you need to do is fill in one spreadsheet and Wise’s smart tech will do the rest.

Wise works worldwide, letting you pay contractors in their own currencies for low fees and mid-market exchange rate.

Get started with Wise Business 🚀

If you like the idea of hiring people as and when you need them, you might want to start searching for international freelancers. From a legal point of view, these are essentially independent contractors - and will need to be classified and paid as such.

You can hire freelance talent to work on a particular project, building up a useful global network of skills you can tap into whenever you need to.

Now that you’ve looked into the hiring process, you’ll need to know how to pay an employee in another country.

If you’ve decided to open a new entity, you’ll need to open a bank account in that country. You may be able to use your existing payroll system to pay staff, or set up a new one if it turns out not to be compatible with the country’s rules and regulations.

If you’re using an employer of record (EOR) to hire overseas staff, you’ll be able to use their local expertise in payroll and HR compliance.

However, if you’re paying independent contractors and freelancers in other countries, you’ll be paying invoices following the completion of each project - as per the contractor agreement. You can choose your own payment system, but your main priority will be to keep costs down when paying people in different currencies.

Whichever option you’re using, here are some key considerations and best practices to bear in mind:

UK businesses don’t have to go it alone when it comes to running international payroll. You can work with a specialist accountant or global payroll expert, or make use of global payroll software. Or, a combination of both.

However, if your needs are particularly complex, software alone may be inadequate. When you need to ask a difficult question or navigate complicated regulations, there’s simply no substitute for face-to-face assistance from a global payroll services expert.

Global payroll software is specially designed for businesses with workers or contractors outside of the UK. It can help you with the following:

Many software providers even offer in-house experts to give you support on things like local employment laws and tax regulations.

Outsourcing international payroll to a specialist agency could be a smart option for UK businesses, especially those with complicated employment arrangements.

A specialist payroll agency will be able to handle every part of the process for you. This includes everything from calculating pay, reporting to the relevant tax authorities and the delivery of payments. They’ll ensure UK and international compliance obligations are met, so you’ll be completely covered.

Just as valuable is the access you’ll have to international payroll experts. If you have a question or need a bespoke solution, they’ll be an important and reliable source of information.

Looking for the best way to pay overseas employees? Wise Business could be the powerful international payment tool you’re looking for.

Tax complexities aside, one of the biggest challenges of paying overseas employees is currency. Your workers will expect to be paid in their home currencies, and not doing so could limit your access to the global talent you need.

It can be expensive to make payments in multiple countries from the UK, with banks charging high fees and offering poor exchange rates. It can also be time-consuming manual work, setting up lots of different payments.

Wise Business makes it easier and cheaper. You can easily make batch payments and pay up to 1,000 people in just a few simple steps.

You’ll only pay low fees, with discounts available for larger monthly volumes. And you’ll always get the mid-market exchange rate, which could help you make considerable savings in the long term.

As well as making international payroll easier, Wise Business also has an open API so you can integrate it with your other business tools.

This includes accounting software such as Xero or QuickBooks, enabling you to meet your HMRC and Make Tax Digital (MTD) obligations.

Wise Business is a safe provider, authorised and regulated, which uses advanced security tools to protect its customers.

Get started with Wise Business 🚀

And that’s it - everything you need to know about paying wages to overseas employees.

The chance to hire international talent is hugely attractive, especially if you’re struggling to access the skills your business needs here in the UK.

But it can also be complicated and expensive. This is why it’s important to establish the right processes and understand your obligations. And of course, choose the right tools and services to save you time and money.

Sources used:

Sources last checked on date: 05-Sep-2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Over the past month, businesses around the world have been preparing for a new reality in global trade. As uncertainty grows surrounding tariff regulation...

75% of consumers and SMEs seek out alternative cross-border payment providers beyond their primary bank - now is the time for banks to modernise offerings.

Discover why agile partnerships are trumping complex, costly global payments infrastructure builds for banks like yours.

Can you use Payoneer in Nigeria? Find out here in our essential guide for UK businesses, covering everything you need to know.

Can you use Payoneer in the UK? Find out here in our essential guide for UK businesses, covering everything you need to know.

Can you use Payoneer in Argentina? Find out here in our essential guide for UK businesses, covering everything you need to know.