Austria corporate tax - guide for international expansion

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

If you’re a business owner with team members working abroad, you’ll need to decide on how to manage payroll for international employees.

This guide to international payroll can help. We’ll walk through the key things to consider when setting up international or global payroll, and some options to make life easier, including top international payroll providers and software solutions.

We’ll also touch on Wise Business as a helpful solution for UK businesses paying or getting paid overseas, with easy access to a multi-currency account you can use to hold 40+ currencies, send payments to 140+ countries, and get paid with local details in 8+ currencies.

| Read the case study: Discover how Povio uses Wise Business to pay contractors all over the world |

|---|

Disclaimer: The contents of this article is for informational purposes only and does not constitute legal or tax advice. Decisions related to tax should be made after thorough research, consultation and verification from a qualified financial and legal advisor.

International payroll in basic terms is the process of paying salary and benefit payments, as well as required social contributions (like NI in the UK), for employees based overseas.

It’s increasingly common for UK businesses to choose to employ people overseas, in order to find the right talent to match their business needs. As more and more people work remotely anyway, working alongside overseas employees is far less tricky to manage - and can also offer benefits in terms of providing local support for international customers.

International payroll can be a challenge for growing businesses as it’ll mean managing across different jurisdictions. This can mean you need to understand rules, regulations and laws for payroll and employment wherever your employees are based, as well as in the UK. It can also mean paying salaries, benefits and expenses in a selection of currencies - which can be costly if you get hit by high fees and poor exchange rates. We’ll look at ways to make the process easier and cheaper, later in this guide.

Managing employees' payroll overseas presents unique challenges for a business.

This is because you may find that team members working for your business in a different country are subject to different employment law, tax and other regulations. This means that as an employer, your duties to them may also need to change. We’ll walk through some important considerations next.

Because you as an employer - as well as your overseas employees - may be subject to different rules, it’s essential to research the local employment laws and regulations in the country your employee is based.

Employment law varies widely by country, so there’s no definitive list of things to look out for - but you may need to pay attention to:

It’s also worth noting that employment laws may not be as easy to decode in some countries as others. Different rules may apply in different US states, for example, and although much of EU law is harmonised, you’ll still find regional differences in some areas. Thorough research - or professional advice - is needed.

You’ll need to pay special attention to the local tax laws for each country or territory you have employees working in, in order to comply with your duties as an employer both in the UK and overseas, and minimise risk.

Exactly what you’ll need to do at home and abroad will depend on the situation, including where your employees are based and whether their employment overseas is temporary or permanent. You can get useful information from the UK government website¹, and also from the local government sites in the countries your employees are based in.

Generally, you’ll usually find an employee’s treatment for tax depends on their tax residency and where they’re being paid from - if they're a full time resident in a foreign country, they may be liable to pay tax there and not in the UK; but this will depend a lot on how your international payroll is structured, and whether double taxation treaties are in place between the UK and the employee’s country of residency. Again, as it’s a complex matter, employing a payroll specialist prior to onboarding overseas team members strongly recommended.

Running global payroll means paying close attention to exchange rates.

You’ll need to monitor the exchange rates for the currency routes your company uses to pay employees or contractors, bearing in mind that the rate you get when you send money abroad isn’t necessarily the very best rate available.

Banks and some international money transfer services will use their own rates which often include a markup on the mid-market exchange rate for that currency pair. This effectively means an extra fee has been added.

If you’re processing payroll in foreign currencies and get a bad exchange rate, it’ll mean that either your employee gets less money in the end in their currency, or you pay more than you need to. It all depends on how you’ve set up overseas contracts.

Neither situation is ideal. This is why it’s important to find solutions which eliminate this problem - such as using Wise Business to make international payments, as it uses mid-market exchange rates (with no mark-up) for all currency conversion.

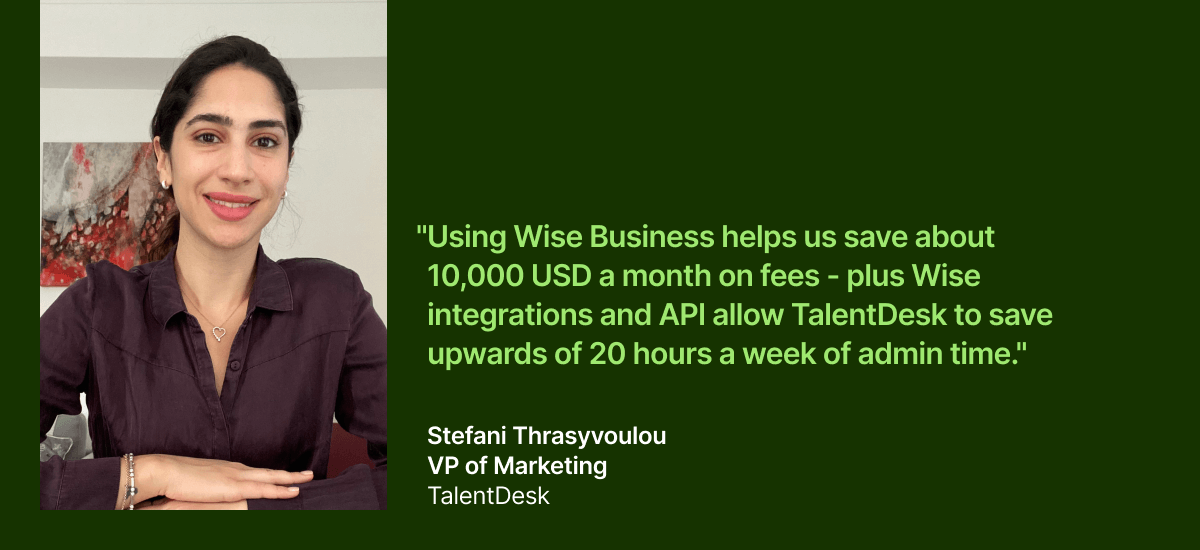

💡Read TalentDesk's complete case study

Before you start to employ overseas employees, it’s a good idea to research employee standards, mandatory or expected benefits for the locations you’re hiring in. This covers things like health or maternity benefits, pension, childcare and bonus payments.

Some benefits may be required by law. But even if a specific benefit isn’t mandatory, not offering it could make it harder to recruit in that location, and may result in disengaged employees.

Let’s walk through some of the different ways of processing international payroll.

International payroll software offers a good half-way house between engaging a fully outsourced provider, and bringing international payroll in house (both of which we’ll look at next).

UK businesses choosing this option get a good range of tools to run international payroll efficiently, and support to get systems up and running internally. You’ll also always know there’s someone on the phone to help if you need it. You’ll pay a fee to use most international payroll software services, but the overall costs may be lower than using a specialist provider or setting up a full in-house operation.

Different payroll software services have their own features and fees, from major providers covering all aspects of accounting software, through to specialists in overseas payroll, like Deel®³, Oyster HR and Remote®⁴.

Payroll service providers offer a selection of different packages and plans to support businesses at different stages. You’ll be able to choose a full end to end solution if you want one, including all aspects of payroll, record keeping and compliance, all from one provider.

Using an international payroll provider can be cost effective if you only have small numbers of overseas staff, as it’ll mean your own finance team doesn't need to get so involved in setting up new software and processes.

One of the biggest time-saving benefits is not having to research employment and tax laws in different jurisdictions. Full service packages from international payroll providers may cost more than using a software tool, though.

Some of the main global payroll providers for the UK include Frontier®⁵, BDO®⁶ and JPS®⁷.

| 💡 You may also like: Best international payroll providers |

|---|

UK businesses can also choose to do global payroll in-house, bringing the entire management of the process into the finance department. There are both challenges and benefits involved with this approach. You’ll need to have enough resources and expertise to set everything up in the first place, but in-house operations can offer great flexibility and cost savings compared to using third party providers or software.

If you’ve got a large and growing team it’s well worth looking into inhouse global payroll options to give you control over exactly how everything is structured, and potentially to drive down costs over time. On the other hand, if you’ve only got a few people to pay overseas, but have the necessary HR and legal support to make sure you’re compliant with the rules wherever they’re based, an in-house solution can be a good money saving option.

If you run international payroll in-house, check out Wise Business as a great way to send money across borders with fair and transparent fees. You can use Wise’s smart batch payment process to pay up to 1,000 people at a time, in a selection of 40+ supported currencies. Plus, there’s the powerful Wise API to help automate tasks and save time where possible.

A final option for managing employees overseas is to use an Employer of Record (EOR). The EOR effectively stands in for the UK business to onboard, manage and pay global employees.

This means that the UK-based team can worry less about learning local laws and expectations overseas, and rely on the EOR to keep everything moving. However, this kind of service does come at a cost, which won’t suit every type of company.

If your business has a global footprint, you could save money when you send, spend, receive or exchange foreign currencies with Wise Business.

Open and manage your Wise Business account online, or using the handy Wise app. Find out the requirements here.

Once it’s up and running, you can manage business finances in 40+, all in one place. You’re guaranteed mid-market exchange rates on all currency conversions, which could help you make considerable savings when paying employees and suppliers spread across the world. Plus, you can save time by using the convenient batch payments tool to pay up to 1,000 people at once.

You can also get local account details in 8+ currencies to get paid conveniently from customers and clients (only with Wise Business Advanced plan), and effortlessly manage expenses with multi-currency Wise Business cards.

Get started with Wise Business 🚀

Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

It’s increasingly common for UK businesses to look for top talent overseas, and employ remote workers around the world. This means you can more easily find the right fit for your team, and offer the very best service to your customer - but it can also mean running a more complex international payroll process, involving payouts in different countries and currencies.

Use this guide to navigate what’s involved with international payroll - and get professional support and advice where you need to, to make sure you comply with the law in the UK and wherever your team is based. Plus, check out Wise Business as a smart, low cost way to help your business grow at home and abroad.

Sources used: N/A

Sources last checked 17-Oct-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Botswana, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Chile, its current rates, how to pay your dues and stay compliant, and best practices.

Understand the essentials of terms sheets in business. Learn the key components to help you negotiate your next deal.

Learn about the corporate tax system in Montenegro, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Monaco, its current rates, how to pay your dues and stay compliant, and best practices