Benefits of a Business Bank Account

Discover the benefits of setting up a separated business bank account to manage your business finances separated from your personal ones.

It is common that employees may need to spend on the company's behalf, like buying coffee for clients or booking flights. Historically, businesses did it with receipts and manual entries in an expense sheet.

Thankfully, we have better solutions available nowadays. One of these solutions is a corporate credit card. It makes the overall process much more efficient and helps track expense management.

In this article we break down the differences between a corporate credit card and a small business one, types of credit cards, main UK issuers and an alternative that can fit your business better: Wise Expenses Card

Learn more about

Wise Business expenses card

| 📝 Table of contents: |

|---|

Corporate credit cards are a type of credit card given to employees by business owners to incur business-related expenses. They are designed for large corporations to manage business expenses in an efficient way. Banks and other issuers provide them to the business entity, not the employees.

They are generally issued to corporations with established creditworthiness¹. However, small businesses with solid revenue streams are also eligible.

The basic difference between small business and corporate credit cards is which party is responsible for payments, fees and other charges. In a corporation, it is the company that bears the liability. In contrast, the main cardholder (business owner) is personally liable for small-business credit cards².

| Corporate credit card | Small business credit card |

|---|---|

| Ideal for bigger companies. | Ideal for sole traders or small business. |

| A good credit score is essential. | It is available for all sizes of businesses with a solid personal guarantee. |

| Doesn't require a personal credit check. | May require a personal credit check for the business owner. |

| The company has the liability. | Business owner has the liability. |

Corporate credit cards work similarly to small-business credit cards in many aspects. Both cards can be used to buy things and generally provide businesses with perks like cashback or bonus airline miles depending on overall employee spending.

However, corporate credit cards have various benefits that small-business credit cards do not. In addition, the corporate credit card provides businesses with extensive insights into how employee spending functions on an individual basis and helps in setting credit limits. It also helps detect fraud before it becomes a problem for the company.

The payment process and terms for corporate credit cards are slightly different than typical credit cards. You can't carry a balance from statement to statement. Instead, you must pay the amount in full by a specific date. There are fines and interest incurred when the payment is not made on time.

If you're thinking about moving your small business credit card to a corporate credit card, here are some of the benefits:

There are two main types of corporate credit cards: Individual liability and corporate liability. The main difference is whether the employee or the business entity will be liable for paying the credit card bill, charges, or fines. Let's break down these two types:

As the name suggests, the repayments and other charges are paid by employees who use credit cards.

Here's how it works:

The employee will spend money on approved business expenses like travel, hotel, and even inventory. On the financial closing date, the employee will submit an expense report to their finance team. They will then check the records and make reimbursements accordingly.

Now, let's discuss some of the pros and cons of individual liability cards:

| ✅ Pros of individual liability cards |

|---|

|

| ⛔️ Cons of individual liability cards |

|---|

|

In this case, the business entity or the corporation is liable for the repayment of debts and other charges. However, employees must still disclose any business expenses incurred with this employee card.

Here's how it works:

An employee will spend money on the approved business expenses on behalf of the company. The software records payments on corporate liability cards on the company's credit card accounts. This separates the employees' personal finances while allowing the finance teams to individually monitor and track corporate credit card usage.

Here is a list of the pros and cons of corporate liability cards:

| ✅ Pros of corporate liability cards |

|---|

|

| ⛔️ Cons of corporate liability cards |

|---|

|

Unlike personal or small business credit cards, corporate credit cards can have extensive application processes. The issuers generally ask you to present your company's revenue and spending to know if they are high enough to justify obtaining a corporate credit card.

In addition, an issuer can ask for a financial audit as part of the application to check eligibility criteria which is different compared with a personal and small business credit card.

Here is a list of 5 issuers for corporate credit cards in the UK:

Maximum credit: it is a charge card, so N/A

Representative APR: N/A

Fees: free for the first 12 months, then 175 GBP after that

Maximum credit: up to 250,000 GBP

Rates: 9.9% APR

Fees: unlimited cards for your company with no annual fees

Maximum Credit: not stated

Representative APR: 14.9% APR

Fees: no fee (in Europe)

Maximum credit: up to 25,000 GBP (subject to status)

Representative APR: 21.9% variable APR

Fees: no annual fee

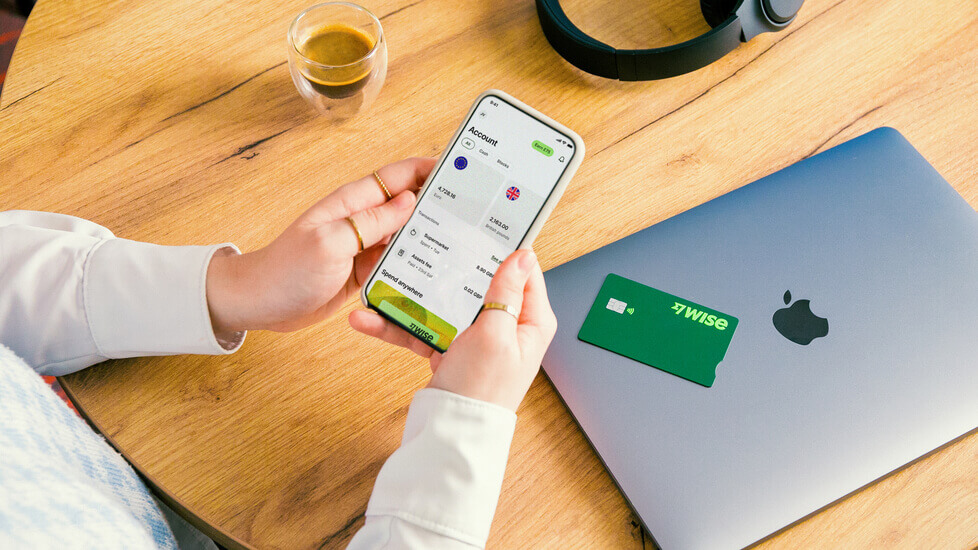

Wise offers a business multi-currency account and Employee Expense Cards as an alternative for corporate credit cards to let your employees spend money on business expenses while keeping their personal transactions separate.

Wise Business account allows you to order unlimited cards for your staff, and you can place spending limitations of your choice. It has a one-time cost of 3 GBP per card, and you can integrate your expense management tools like Xero, FreeAgent or Quickbooks.

Get started with Wise Business

The process for requesting a business credit card for most providers is quite exhaustive as it is not online. Your finance team must meet with the issuer's dedicated manager to learn about corporate business credit card features and offerings they can provide.

On the other hand, Wise Business Account has an online process and a verification process of 2-3 working days. It works with all sorts of businesses, from freelancers and entrepreneurs to larger corporations.

As a corporation, putting in place a strong expense management system can protect your business.

An employee card can help you streamline and save some of the costs. Although, using it without an expense management system might expose your company to mismanagement and fraud and leave you with a bad credit score.

You can use these practices to manage your corporate credit card expenses:

Business credit card policies are part of a company's accounting policy and establish a clear set of rules for employees. It saves a lot of time with tracking employee personal spending and helps to avoid fraud.

Here are examples of expenses management software that can be helpful:

If a corporate credit card is not serving your business in the way you want, there are more options to explore, like:

The Wise Expense Cards work differently from an average corporate credit card. Expense cards are made for easy tracking of employee expenses.

Using the Wise Expense Cards, employees can make international business payments no matter where they are in the world. The cards work in multiple currencies, have zero subscription fees (there is only a 3 GBP one-time fee per card), and allow employees to avoid having to spend on their own cards.

Wise expense cards also come with a lot of admin options. This allows companies to set spending limits and have complete control over their employee expenses. They are designed to make accounting as simple as possible, so you can focus on the growth of your business.

Get started with

Wise Business expenses card

Having some type of business card can contribute to sorting finance and spending management. Just make sure you have the right type of card and the necessary tools, information and services you require to acquire it.

Bear in mind that the best corporate credit cards allow you the integration of several accounting and finance tools. Plus, it allows you to earn cash back with perks, which may rapidly mount up if your company spends a lot of money on business expenses each month.

Sources used in this article:

Sources checked on 26/10/2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the benefits of setting up a separated business bank account to manage your business finances separated from your personal ones.

Discover the direct debit collection rules in place for UK business to collect payments at ease!

Providing customers with instant, transparent global payments has become crucial for delivering an exceptional customer experience and maintaining a...

Discover if expenses should be paid through payroll, with pros, cons and directions from HRMC.

Discover the best practices when setting up per diem expenses, how to set up rate, proceed with payment and more.

We’re excited to announce that Morgan Stanley, a leading global financial services firm, has teamed up with Wise Platform, Wise’s global payments...