Building the future of global money movement

From messaging upgrades to hosted onboarding, here is how we’re evolving to help you and your end customers move money with speed and confidence.

Providing customers with instant, transparent global payments has become crucial for delivering an exceptional customer experience and maintaining a competitive edge for financial service providers. Recent industry data shows that customers receiving instant money transfers have a 6% higher retention rate compared to those waiting over 48 hours.1 This article explores strategies to offer an exceptional, instant payments experience that can boost customer satisfaction, reduce costs, grow revenue and drive loyalty.

Low-value cross-border payments (<$100,000) represent a significant revenue opportunity in North America, with global payments outflows expected to reach a staggering $3 trillion by 2026.2 For financial services providers looking to capture payment flows and customer share, the stakes are high.

But winning this market share is far from simple. To meet evolving consumer demands, global payments providers must offer faster, more convenient and cost-effective cross-border solutions to maintain and grow their customer base, introducing complexities around network, treasury management, compliance and operational automation.

In this article, we will unpack how service providers can manage these four key capabilities, enhance the customer experience and address these rapidly evolving expectations through industry collaboration.

As consumers and businesses come to rely on and expect instant domestic payments, their expectations for instant, seamless transactions has started to extend to international payments as well. This is particularly evident in the US, where the speed gap between domestic and cross-border transactions is increasingly stark.

"For small and medium-sized businesses, cross-border payments represent a major obstacle to expansion, with 31% saying they would only enter new markets if the costs of international payments were reduced."

This presents both a challenge and an opportunity for payment providers; international payments are complex and there is no shortage of hurdles to overcome, from regulatory requirements and fragmented global payment systems and the need to balance security with speed.

But meeting the customer expectation for instant will help customers remain loyal to your product no matter where they send their money. Failing to do so will drive them to look elsewhere for alternative providers.

Customers today also expect complete transparency from financial service providers. In fact, over 80% of Americans demand clear details on payment costs and transaction timelines.3 This has created an urgent need for global payments providers to provide full transparency - disclosing the exact cost, delivery time and final amount received by the beneficiary.

What’s more, for small and medium-sized businesses, cross-border payments represent a major obstacle to expansion, with 31% saying they would only enter new markets if the costs of international payments were reduced.4

Today, 80% of Americans demand clear details on payment costs and transaction timelines.

However, navigating an abundance of compliance regulations and requirements is necessary to meet these customer needs. In order to obtain accurate information quickly and prevent transaction failures, success depends on creating tech-driven compliance procedures, real-time data validation and an indepth understanding of local regulations, with over 65 licenses worldwide.

What's more, seven million checks are performed daily by more than 150 machine learning algorithms at Wise Platform to detect fraud, sanctions and AML risks. Eighty checks every second, that is. For each and every payment.

Our compliance capabilities highlight how crucial tech-driven systems and in-depth local expertise are for financial service providers looking to thrive in cross-border payments.

Another hurdle lies in building the right network. The US has several faster payment networks tailored to different transaction sizes, requiring diverse tech stacks and integrations.

"With 63% of Wise Platform’s global payments arriving in under 20 seconds, we enable our partners to leverage our global network to deliver a faster, more affordable experience without a major technical overhaul."

Constructing these independently is an enormous task, especially for financial providers whose core offering is not international payments. In these cases, entering into partnerships with other industry players whose network fills existing gaps is the most efficient route to innovation.

At Wise, we have spent over a decade building a robust network for the world’s money. We’re building scalable infrastructure that directly connects local payment systems around the world without the need for intermediaries.

And it’s this infrastructure that allows us to move customers’ money around the world instantly. With 63% of Wise Platform’s global payments arriving in under 20 seconds, we enable our partners to leverage our global network to deliver a faster, more affordable experience without a major technical overhaul.*

And while the network is crucial, instant cross-border payments also require precise treasury management. Payments providers must adeptly predict daily liquidity needs in all operational markets, ensuring the right amount of capital is available exactly where and when it’s needed. The goal? Minimise spread costs while maximising coverage and guaranteeing rates.

The speed of liquidity- how quickly funds can be made available - has become a key focus. Our real-time treasury management delivers rates across over 40 currencies, available 24/7 and 365 days a year.

With 63% of Wise Platform’s global payments arriving in under 20 seconds, we enable our partners to leverage our global network to deliver a faster, more affordable experience without a major technical overhaul.

Enabling real-time treasury management often requires advanced capabilities that many financial service providers lack the resources to implement internally. Achieving this level of automation demands a significant investment in dedicated technology and resources. However, the payoff is substantial - tech driven solutions can automate key treasury processes, dramatically reducing the time and effort required for compliance and operational management.

And that's just the tip of the iceberg - incorporating artificial intelligence enhances both the speed and security of payments processing, enabling organisations to handle surging transaction volumes while upholding rigorous safety standards. At Wise, we use powerful anti-financial crime engines to protect us and our customers; monitoring 100% of all transactions real-time

It's this innovation that enabled us to process 1.2 billion payments last year alone, with a payment operations team of only 300 people. Combining a robust network, deep local expertise and tech-driven processes has allowed us to achieve an impressive 99% straight-through processing rate for our partners because of our ability to access the right information, at the right time and at speed.

Achieving the right balance of compliance, global network access, real-time treasury management and operational automation pose significant challenges for any organisation. Yet, only by overcoming these challenges can you deliver a truly world-class payments experience to your customers.

In the digital age, cultivating customer loyalty can be challenging. But, the message is clear - cross-border payment solutions must prioritise the customer experience. Businesses that offer payments with enhanced speed, price transparency and convenience are more likely to succeed.

Clear upfront communication about total costs fosters trust and loyalty. In fact, a recent industry study conducted by Wise found customers with instant transfers have 6% higher retention rates than those with payments taking over 48 hours.5 Instant payments not only provide a competitive edge, but also allow businesses to focus on their core offerings rather than complex international payment issues.

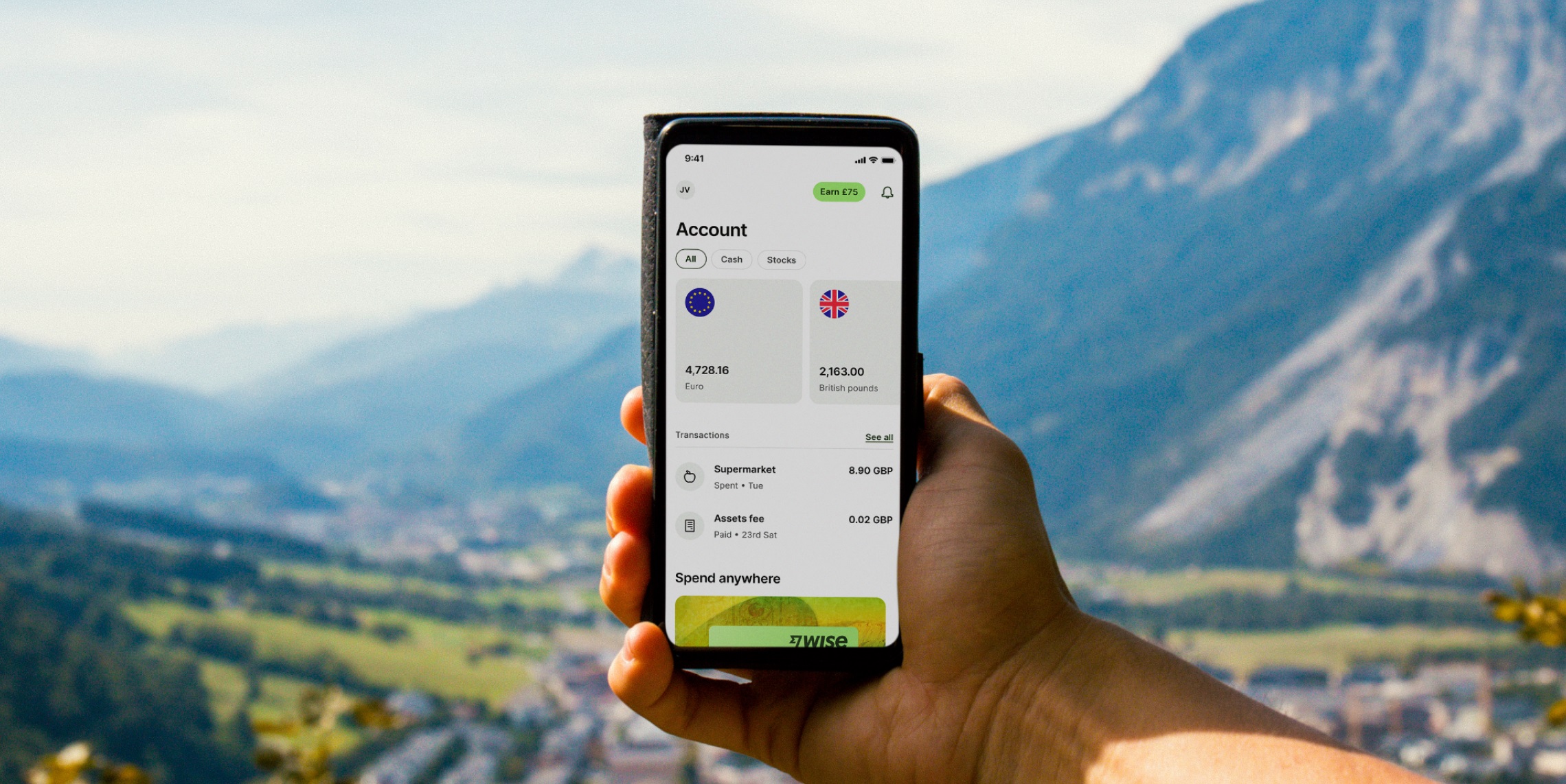

Wise Platform’s API and correspondent service solutions allow partners to leverage our extensive global network and innovative technology to deliver exceptional payments experiences - all without a major technical lift.

The future of instant payments in the US and abroad is being driven by these collaborative strategies, which enable international payment providers to more successfully compete in the cross-border payments market.

We are helping organisations like yours transform the way they send and receive global payments to increase NPS scores, reduce operational costs and manage compliance.

*Transaction speed claimed depends on individual circumstances and may not be available for all transactions.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

From messaging upgrades to hosted onboarding, here is how we’re evolving to help you and your end customers move money with speed and confidence.

Building on momentum, IBKR has now rolled out the same seamless transfer experience to business customers across 50+ countries.

Discover how global fintech Aspire partnered with Wise Platform to deliver over half its payments instantly.

Discover how recipient verification ensures your customers send money to the right people, eliminating payment failures and friction.

Explore the 5 cross-border payment trends defining 2026. From G20 targets to retail customers, discover how global payments are moving from sprint to standard.

Discover how EQ Bank launched international payments in just one month — with 75% arriving instantly* and 70% becoming repeat users.