Asia-Pacific players embrace partnership to win customer share in cross-border payments

Many banks are taking the first steps toward delivering exceptional customer experiences by using next-generation correspondent service providers.

In 2024, Wise Platform celebrated a strong year of growth and hit significant milestones. In Q4, we announced new partnerships with some of the world’s largest financial institutions, spoke at leading industry conferences and hosted payment leaders at our second Wise Connect event in Singapore. Before we get stuck in, here’s a quick reminder of what Wise Platform is and why leading banks choose to partner with us.

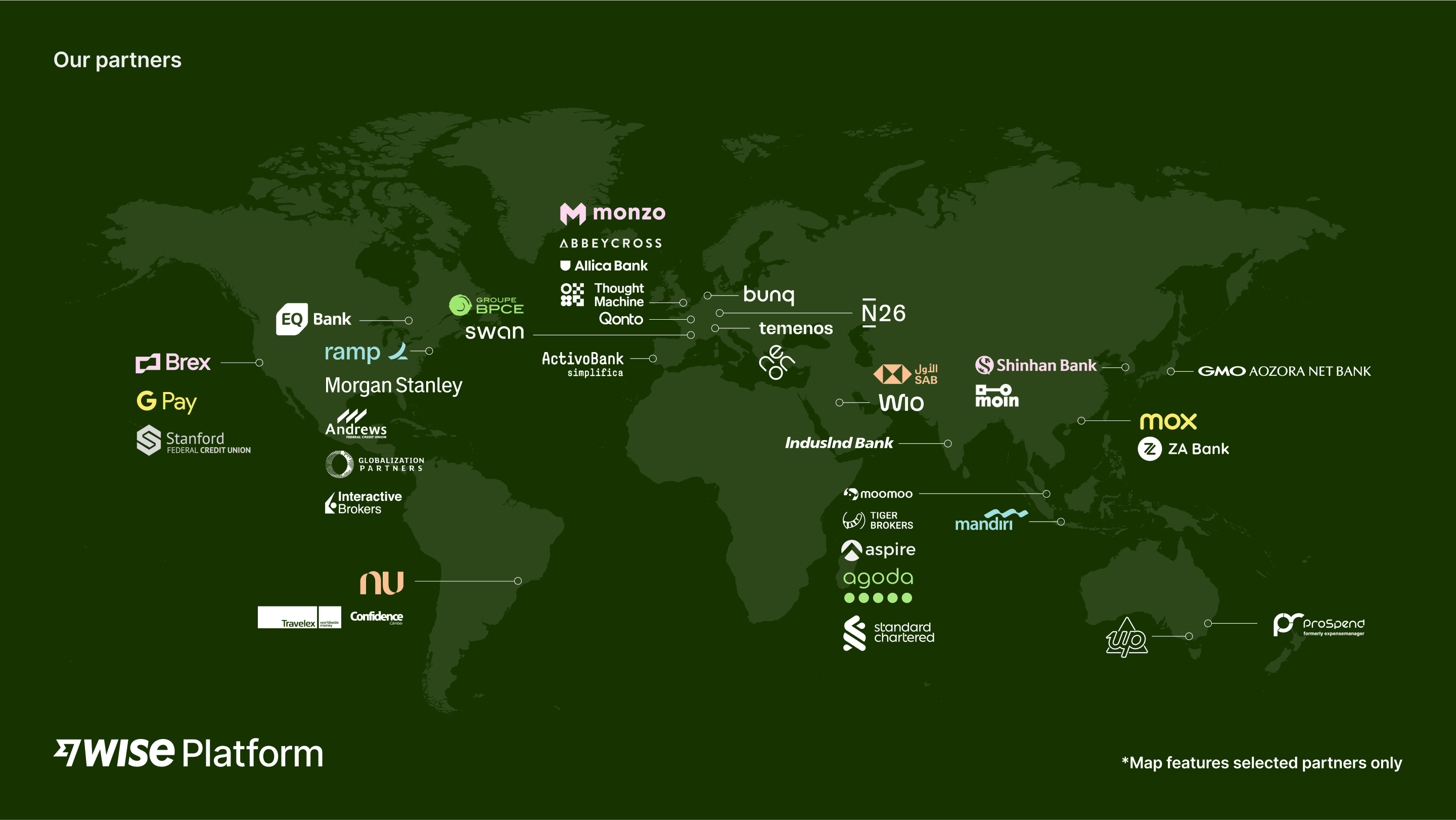

Wise Platform enables banks, financial institutions, and businesses to integrate Wise’s cutting-edge infrastructure directly into their platforms. This provides advanced technology and one of the largest international payment networks in the world, allowing for fast, secure, and affordable transactions for end users. Our infrastructure is powered by 90+ local gateway banking partners, 65+ licences and 6 direct connections to local payment systems, enabling fast, reliable and low-cost cross-border payments in 40+ currencies across 190+ countries.

Read on to find out more about what we’ve been up to in Q4.

Morgan Stanley

In December, we announced that leading global financial services firm, Morgan Stanley selected Wise Platform to facilitate their foreign exchange international settlements capabilities for its corporate customers. Morgan Stanley now offers clients high-speed cross-border settlements, making Morgan Stanley the first investment bank to enable these capabilities on Wise Platform.

Read more about this milestone in Bloomberg and City AM.

Standard Chartered

In November, Standard Chartered partnered with Wise Platform to enable Standard Chartered’s SC Remit customers in Asia and the Middle East to send money in 21 currencies faster, cheaper and more transparently. Standard Chartered will roll out the service via the Wise Platform API in the coming quarters, with a further expansion on the horizon both in the number of currencies supported as well as more markets where Standard Chartered operates.

Read more about what this partnership means in Forbes and Bloomberg.

Shine

Later in November, we announced our third partnership in France with Shine, the business account for SMBs and freelancers, who have chosen Wise Platform to launch their brand new international payments product. This integration allows French entrepreneurs to enable fast, secure and low-cost cross-border payments in 10 currencies for their clients and suppliers worldwide.

Read more about this partnership in Finyear.

Travelex Confidence

In October, Travelex Confidence in Brazil became the first foreign exchange broker in the world to integrate with Wise Platform. Through this collaboration, Travelex Confidence now offers a global account through its app, using Wise Platform’s infrastructure to provide a simpler and more cost-effective global financial experience for its Brazilian customers. The global account allows users to hold balances in multiple currencies and to make purchases in local currencies using the digital debit card linked to the global account.

Find out more about the announcement in Seu Dinheiro.

Sibos

In October, our team travelled to Beijing for Sibos, the leading global financial services event organised by Swift. We kicked off the week with some of our own experts joining discussions around why the future of banking depends on global collaboration, the future of cross-border payments and how interoperability can improve payments for customers around the world.

Read more in Finextra’s Future of Payments 2025 Report.

As a proud sponsor of the Sibos 5K run, our team also brought together over 500 payment enthusiasts for a scenic jog through Beijing’s Olympic Forest Park.

Money 20/20 Las Vegas

Later in October, our team took the stage at leading fintech event, Money 20/20 in Las Vegas. As part of two separate panels, we discussed payments innovation and modernization in the cross-border and real-time payments ecosystem, complexities of international payments and how speed, transparency and partnerships, like those being led by Wise Platform, are driving the future of global money movement.

Wise Connect APAC

In November, we welcomed over 175 senior payments leaders from leading banks, fintechs and businesses across the Asia-Pacific region to our second Wise Connect event in Singapore. Our expert speakers, including from Mox Bank, J.P. Morgan, DBS Bank, Agoda and McKinsey explored why robust networks, operational automation, real-time treasury management and scalable compliance are key to exceptional cross-border payments experience.

Watch the highlight video here.

And hear from our existing partners…

We recently sat down with Moin, a South Korean cross-border payments giant to hear about their journey and how they revolutionised the global payments experience for their customers with Wise Platform.

Read our case study here.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Many banks are taking the first steps toward delivering exceptional customer experiences by using next-generation correspondent service providers.

Triin Teppo, Wise's Head of Global Products Operations, examines the importance of straight-through processing for improving the customer experience.

Problem Getting paid on time and the right amount has long been the biggest downside of flexible work for freelancers or contractors. Often it is the...

Deel is a leading global HR and payroll company enabling more than 15,000 companies, spanning from SMBs to large enterprises, to scale their teams around the...

Problem Sending money abroad can still be complex, expensive, and slow. For too long, Swiss customers have had few choices about how to send their money...

Discover how leading SME financial service provider Qonto partnered with Wise Platform to double the adoption of its international transfers feature.