Mission Update

In Q4 2024, Wise customers moved 7bn GBP more than in Q4 2023 and paid us less for it. Since we lowered our fees, they saved 40m GBP, or an average of 4 GBP back in the pocket of every customer. See what else is new since October and the biggest highlights from 2024.

Dropping fees even more

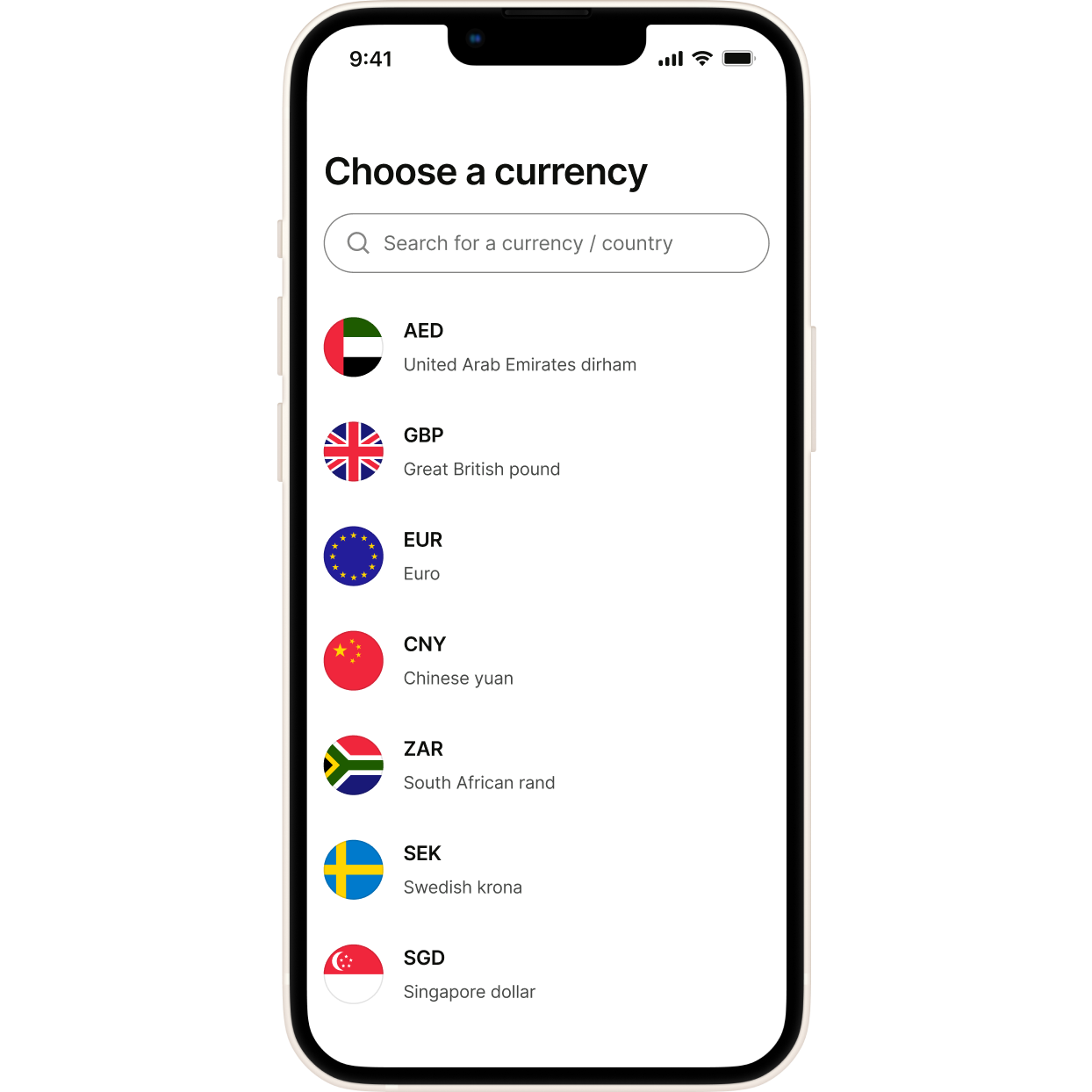

In November we made it cheaper to withdraw Australian dollars, send Vietnamese dong and pay for Chinese yuan transfers using your Wise balance or bank transfer. Some fees, like larger Alipay transfers, card payments in Singapore and Hong Kong, and services in Hungary increased due to rising costs and Hungarian tax laws.

Your money moving at full speed

Payment transparency around the globe

Digital cards just got a new look

Save time with smarter transfers

Stay safe with new checks

Receive 5 more currencies to your euro balance

A smoother start with Wise

Olá businesses in Brazil

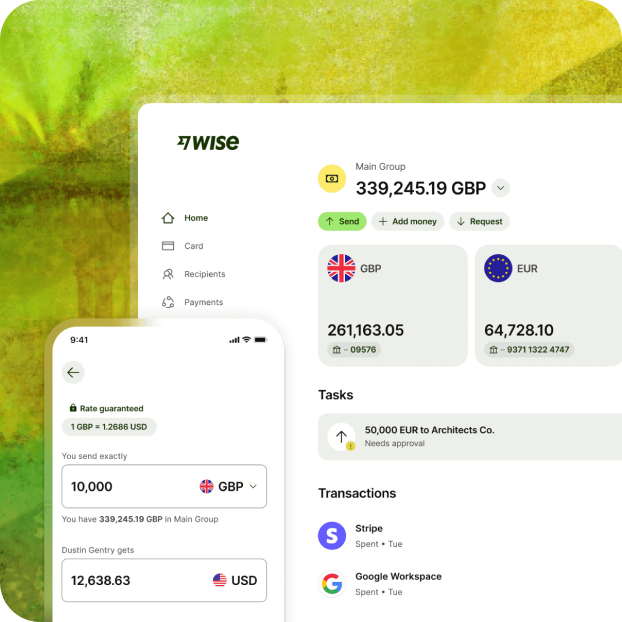

Simpler settings for your business account

13 million customers

Over £1.5 billion saved

Dropped fees 6 times

20 seconds

EUR topped the charts

Customers spent the most at Booking.com

The US was the #1 destination to go abroad

Brazilians racked up the most miles

Customers in the UK sent the most

Bringing Wise to more people, in more places

Customers in Japan can move up to 150 million Japanese yen per transfer — 149 million more than before.

If you’re in India, sending money abroad is easier than ever. Whether it’s for tuition or medical expenses, you can send up to 4,200,000 Indian rupee per transfer, with most transfers arriving in under 24 hours — even on weekends.

Prioritising your peace of mind

For extra security, Apple, Google, or Facebook requires a password, because your money should always stay yours.

Convenience you can count on

Sending money from Jars is easier — no need to move it to your balance first.

Sending got smarter, you can set the amount your recipient receives in the final currency while we handle the rest.

Staying transparent

Setting up transfers is clearer than ever. Before, you had to enter all your details to see fees and delivery times. Now, pick your recipient first, and we’ll show accurate fees and delivery times upfront.

Receive 19 more currencies with Swift

Getting paid got easier

Wise Business

Partnering up for easier global payments

Wise Platform

Since October, we’ve added four more partnerships. With Travelex Confidence, customers can now hold and spend in currencies like USD, EUR, and JPY using a digital debit card, all within their app.

In France, we partnered with Shine to help small and midsized businesses and freelancers make fast, low-cost payments in 10 currencies around the world.

Teaming up with Standard Chartered, we helped enhance SC Remit, enabling faster, cheaper transfers in 21 currencies across Asia and the Middle East, with more markets and currencies to come.

To complete the year, we partnered with Morgan Stanley to power fast, low-cost cross-border settlements for their corporate clients, making them the first investment bank to use Wise’s global payments infrastructure.

Learn more about our latest partnerships

¹ The price provided is a global average based on a fixed basket of representative currencies as of Q4 2024 and may not reflect specific prices for consumers in their regions. Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing information.

² Transaction speed claimed depends on individual circumstances and may not be available for all transactions.

³ Savings estimates are based on the average savings Wise offers compared to all the collected providers we have on the transactions transfer route from 01/01/2024 to 31/12/24.