Radical action needed

Price Transparency

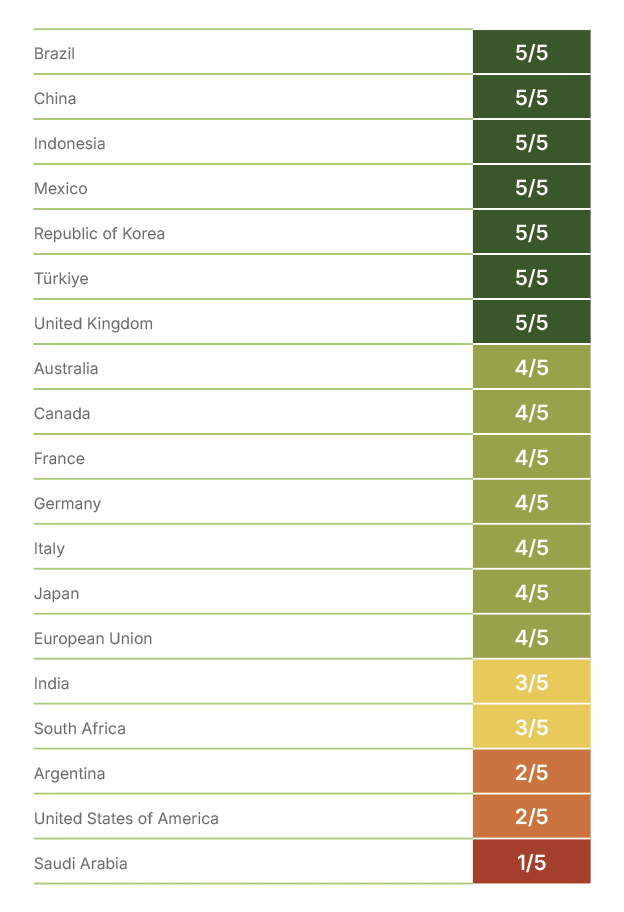

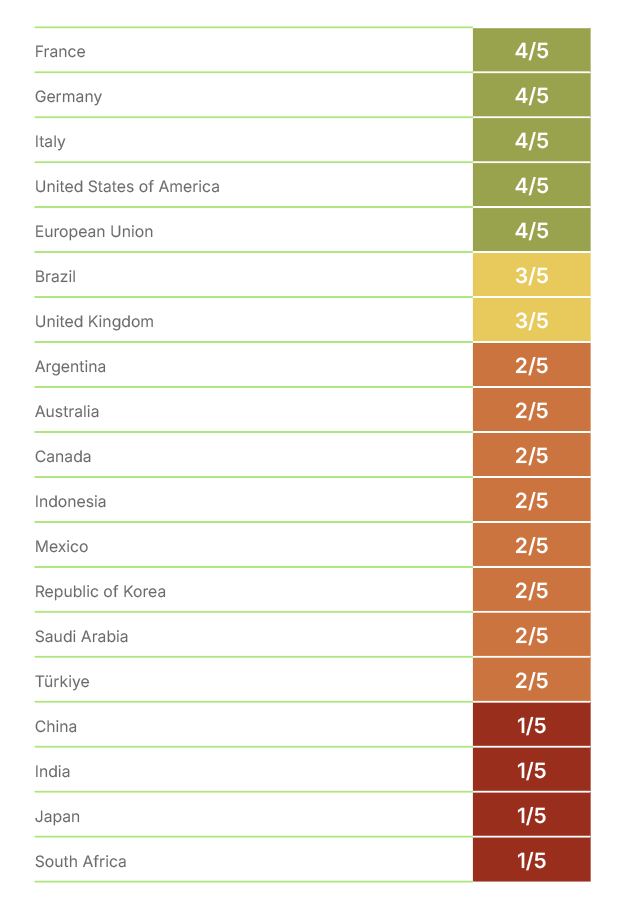

Our report highlights alarmingly slow progress in achieving price transparency in cross-border payments. While countries are moving forward in direct access, transparency remains frustratingly stagnant. The EU and the US have promising initiatives in the works, but to date weak enforcement allows hidden fees to thrive, keeping consumer costs artificially high. In places like Brazil, South Africa, and Australia, transparency is undermined by ineffective regulation, keeping consumers unaware of the full costs. Nations such as India, Japan, and Saudi Arabia have yet to initiate any regulations to ensure cost clarity. The Financial Stability Board recognises that not enough has been done, and has to prioritise this as a matter of urgency.

This disparity underscores the urgent need for robust action. Delve into the report to uncover the transparency shortfalls, and join the movement advocating for stricter regulations and enforcement. Now is the time to demand open, fair cross-border payment practices globally.