Mozambique corporate tax - guide for international expansion

Learn about the corporate tax system in Mozambique, its current rates, how to pay your dues and stay compliant, and best practices.

If you do business overseas or if you are considering opening up your company to markets outside the UK, you can benefit from Barclays Foreign Currency Account.

Barclays bank is one of the unique British banks, which is headquartered in London, England, offering different services for both citizens and non-residents of the UK. Their services are also divided into four core businesses - personal banking, wealth management, investment management, and business banking.

In this article will be focusing on opening a Barclays business foreign currency account, covering all the essentials such as fees, available currencies and an alternative that can be cheaper and more convenient for international companies: Wise Business multi-currency account.

Opening a foreign currency account helps you optimise international transactions with your client both within and outside the UK. A foreign currency account does not just help you avoid potential rate loss due to FX fluctuations, but also allows you to send, receive and hold money in several currencies. You can also easily bill your clients in their local currency which saves them time and money, which encourages them to patronise your products and services more.

Read more: Barclays USD Account: cost, features and alternative

Opening a Barclays multi currency account can be done in the branch or simply over the phone, however, it’s required to have a business bank account before you can open a foreign currency account with Barclays.

If you are already a Barclays Business customer, you can reach out to them by phone in order to open your Foreign Currency Account:

- If you have up to £1m turnover call the number: 0345 605 23451

- If you have between £1m and £5m turnover call the number: 0333 202 74552

- If you have more than £5m turnover call 0800 027 12212

- And if you are an agricultural client call 0333 202 74522

If you are not a Barclays' customer you can call 0800 515 462.

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Chinese Yuan (CNY)

- Czech Koruna (CZK)

- Danish Krone (DKK)

- Euro (EUR)

- Hong Kong Dollar (HKD)

- Japanese Yen (JPY)

- New Zealand Dollar (NZD)

- Norwegian Krone (NOK)

- Polish Zloty (PLN)

- Singapore Dollar (SGD)

- South African Rand (ZAR)

- Swedish Krona (SEK)

- Swiss Franc (CHF)

- UAE Dirham (AED)

- United States Dollar (USD)

| Service | Price |

|---|---|

| International payment made through branch | £ 25 |

| International payment made online | £ 15 |

| Cancelling international payment | £ 20 |

| SEPA transfer made through branch | £ 0.65 |

| SEPA transfer made online | £ 0.35 |

| Cancelling a SEPA transfer | £ 20 |

| International drafts | £ 25 |

| Receiving SEPA transfer or international payments (non-euro) below £100 | Free |

| Receiving international payment greater than £ 100 | £ 6 |

| Use debit card abroad | 2.75% for non-sterling transactions |

Barclays doesn't present their exchange rate transparently upfront. They inform you that they will apply a mark-up to the mid-market exchange rate - the real one that you can find on Google - but they won't tell you how much this mark-up is unless you call or ask their customer service in a branch.³

This can be a bad experience for your business when doing international payments, since you don't have visibility of total costs and the transaction can get more expensive than you expected. Wise Business multi-currency account solve all of this.

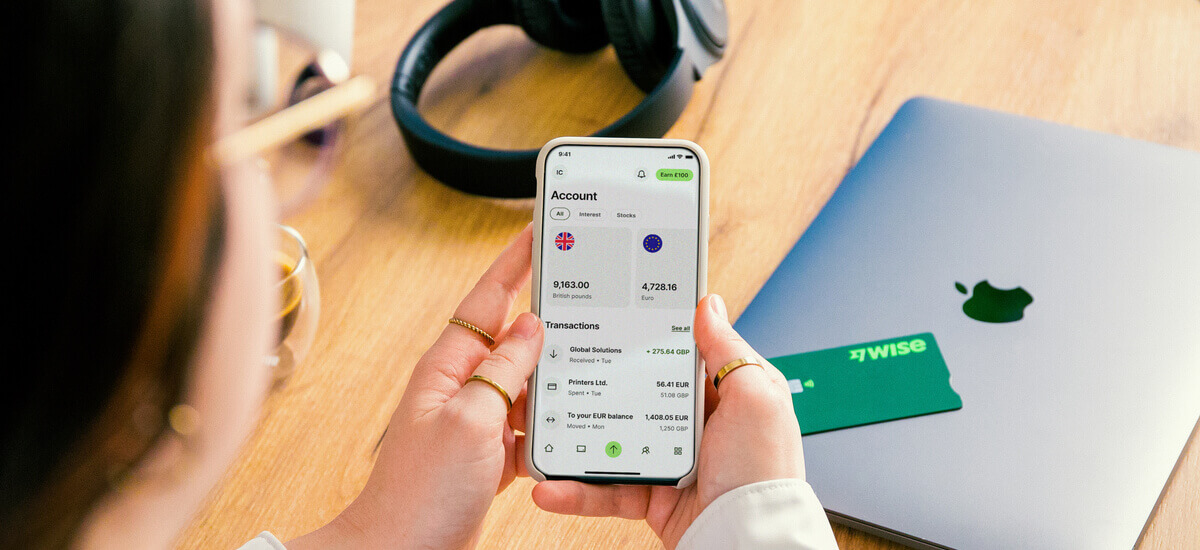

With Wise Business you can send, receive and manage your money internationally, without crazy fees or even-crazier exchange rates – Wise always use the real mid-market exchange rate to convert you money.

With Wise Business you can easily pay suppliers

and workers all over the world while getting paid from customers quickly and easily, accepting payments in 9 major currencies.

For even more convenience, you can also link your Wise Business account with your favourite accounting tools, such as Xero or Quickbooks

. This makes keeping track of your company’s finances a breeze.

💡Learn more about Wise Business

It is possible to send any currency across the globe with online banking. Moreover, with the Barclays app and banking method, euros and US dollars can be sent from one country to another. Interestingly, online transfer is fee-free, while transactions via physical banks attract nothing less than £25.²

Barclays foreign currency account offers two payment methods when sending money to Europe, and these options include international payments and SEPA payments.³

You can send money via your online banking app to different countries within the EEA. You can also check the A to Z country list on the Barclays site for more information. Whenever you send money to a European country at a Barclays branch, a fee of £25 is charged.

You can transfer money from your foreign currency account just by yourself or simply by getting in touch with Barclays bank customer care account, by calling them. Suppose you want to transfer money from your currency account to another company’s account. In that case, you should visit any of the Barclays local branches, and the certificate of interest, financial history reports, and statement frequency will be provided to you.

You can also close your foreign currency account the same way you would close your Barclays Business Account simply contacting Barclays Bank.

If you look for transparency and fair charges when paying or getting paid internationally Wise Business account is the perfect alternative to Barclays Foreign Currency Account.

You can open a Wise Business account quickly and easily online, and it gives you a powerful platform for sending, receiving and managing your business finances in over 40 currencies.

You can easily pay suppliers and workers all over the world, for low fees and the mid-market exchange rate. And best of all, you can get paid for your products or services quickly and easily, accepting payments in 9 major currencies.

Need a solution for expenses? You can get Wise Business expense cards for each team member who needs one. It works in 174 countries, and charges no foreign currency transaction fees. There’s even 0.5% cashback on spending.

You can also link your Wise Business account with your favourite accounting tools, such as Xero or Quickbooks. This makes keeping track of your company’s finances a breeze.

💰 Start saving today with Wise Business

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Sources used in this article:

Sources last checked 26/06/2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the corporate tax system in Mozambique, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Uganda, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Lithuania, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Kuwait, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Jordan, its current rates, how to pay your dues and stay compliant, and best practices.

How do payments work with Nuvei? This guide explains fees, settlement times, APMs, and cross-border payments.