Morgan Stanley selects Wise Platform to enhance payments capabilities for corporate clients

We’re excited to announce that Morgan Stanley, a leading global financial services firm, has teamed up with Wise Platform, Wise’s global payments...

Need to do business in USD? Whether it’s selling to overseas customers, renting out property in the US as a business or paying stateside suppliers, a USD bank account will come in handy.

One of the options you’ll come across is the Barclays USD account, just one of the currency options available with the bank’s Foreign Currency Account. If you are not a Barclays' Business customer already the first step is to check out how to open a Barclays account online.

Read on for the lowdown on the Barclays USD account, including features, fees and an alternative: Wise Business multi-currency account.

Opening a USD account helps you optimise USD payments with your clients, both within and outside the UK. It not only helps you avoid potential rate loss due to FX fluctuations, but also allows you to send, receive and hold money in several currencies.

You can also easily bill your clients in their local currency, which saves them time and money. With any luck, this’ll encourage them to patronise your products and services more.

A Barclays USD currency account offers the chance to reduce your company’s exposure to exchange rate fluctuations, as well as the admin and other costs that come with it. There’s no need to transfer funds between accounts (unless you want to) and you can send and receive money from all over the world.

Other account features include¹:

| Service | International fee | Domestic fee |

|---|---|---|

| Sending money | £15 for online banking £25 if arranged in-branch or by phone | 65p |

| Receiving money | Free for payments below £100 £6 for payments over £100 | 65p |

When looking at the overall cost, it's also important to pay attention to the exchange rate and fees as these transactions are often expensive. You should always look for a provider that uses the real mid-market exchange rate, like Wise Business.

💡Learn more about Wise Business

| ✅ Pros | ❌ Cons |

|---|---|

|

|

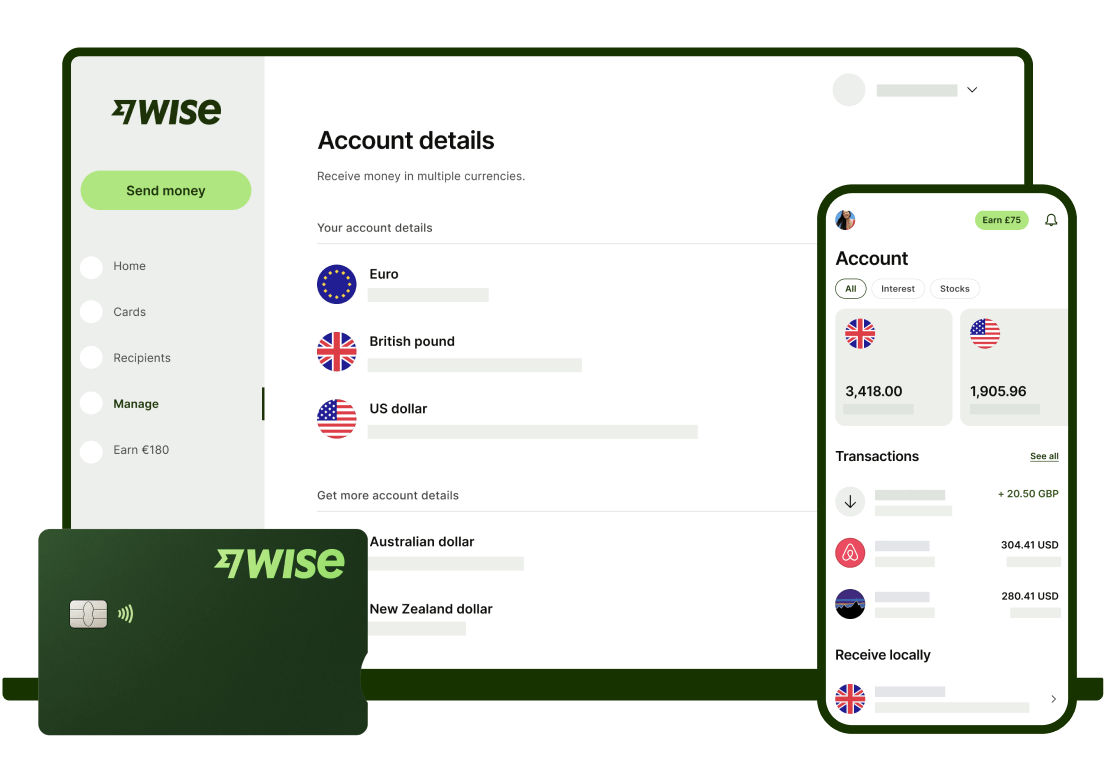

If you want to save money on banking fees, Wise Business multi-currency account is one of the best options for your company, especially if you need to convert between different currencies frequently.

Wise uses the mid-market rate to convert your money and charge only a small and transparent fee for each transaction. You can receive payments in 9 major currencies, including USD.

You’ll get a US account number, branch number (routing number) and SWIFT/BIC bank code, plus an international debit card - this covers multiple currencies, so you don’t need a separate card for each currency. Wise is FCA regulated and uses sophisticated security and anti-fraud technology.

Get started with

Wise Business 🚀

And there you have it - your at-a-glance guide to the Barclays USD account, plus an alternative you can choose from. It’s a good idea to compare carefully, to find the best fit for your business.

Sources used for this article:

Sources last checked on June 21. 2023.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

We’re excited to announce that Morgan Stanley, a leading global financial services firm, has teamed up with Wise Platform, Wise’s global payments...

Discover how to automate expense reporting with our complete guide that covers step-by-step process, tools and best practices.

Travel and expense (T&E) processes are necessary in any business in which employees may spend on allowable business expenses, which need to be recorded,...

Discover the 6 best reconciliation tools available for businesses in the UK.

Discover the 5 best enterprise management tools for businesses in the UK.

South Korean cross-border payments giant Moin has revolutionised the global payments experience for its customers through Wise Platform's Send product.