Stop typing, start uploading — your shortcut for adding new recipients

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

Welcome to the Wise Affiliate Program! In this guide you will find all the information you need to get started, optimize and succeed as a Wise affiliate partner. Simply follow the links below to explore each part of the guide.

| 📝 Table of contents |

|---|

We have an expert affiliate team who will always be there to support you, just drop us a line at partnerwise@wise.com whenever you have questions. Now let’s get started!

To track all the new customer referrals you send to Wise, it’s important that you use your affiliate link. Without implementing your affiliate link, we will not be able to track the user referrals you drive to us and as a result you will miss out on referral commission.

Your standard affiliate link automatically directs all customers to our main Wise homepage – https://wise.com

Follow these steps to get your link:

Enhanced tracking tip: If you would like to add additional tracking parameters to your affiliate link, for example, to differentiate performance based on page placement or to create a unique identifier per user, you can use the additional tracking parameters in Partnerize.

– Adref & pubref are free fields that you can use on Partnerize for any custom additional tracking

– We strongly recommend creating a shortened link using the URL shortener by clicking ‘Generate and copy’ if you use additional tracking parameters

If you’d like to promote a specific Wise product – you can deeplink to any landing page on wise.com. To create a deeplink, you just need to add the URL where you want to send traffic.

Some example landing pages you can link to:

We track each user that is referred to Wise if they click via your unique affiliate link. We pay commission out on any user who is:

– A new customer to Wise AND who makes a successful cross currency action

– You need to be the first introducer of Wise to the customer

– A cross currency action can be send money, balance conversion or conversion on debit card

– There is no conversion/cookie window limit. So if a customer visited Wise and did not convert until 9 months later, you would still be rewarded commission for that referral .

Our standard affiliate commission is a CPA (cost per acquisition) for any new paying customer you refer to Wise. They need to make a cross-currency transaction of any amount for you to receive commission.

Our CPA rates start at £10 for personal users and at £50 for business customers.

If you drive one paying customer a day you can earn up to £1,200 a month.

There is scope to review your commission rate once you hit conversion milestones or if you drive a high number of users who transact more than an average customer.

With your standard link you can receive commission if your referred customers use any of the below Wise products (more details on how this shows in Partnerize reporting later):

Money transfers – you receive commission once the user sets up and funds an international bank to bank transfer

Multi-currency account actions – if the user opens balances on the Wise account, you will receive a commission once they convert money between two currencies

Debit card use – when a user tops up their multi-currency account in one currency and then pay with their debit card in another currency, an auto-conversion happens which we also count as a conversion and pay you commission for

Business users – you receive a higher commission rate for both of the above actions, if you refer business customers to Wise

To get paid you need to add a bank account in Payment Settings on Partnerize. You can withdraw your commission into a bank account in the currency of your campaign (currently we offer payouts in GBP, USD, EUR, AUD, and JPY).

If you do not have a bank account in any of the offered currencies, we suggest opening a Wise account (if you don’t already have one!), which offers local banking details to withdraw USD, GBP, EUR, and AUD. Just select an Electronic Funds Transfer as your payment method and your Wise account details and address.

This way you can save on currency conversion fees on Partnerize and avoid paying any additional charges associated with receiving into your PayPal account. This account can also help you save when working with any other affiliate platform.

Follow the steps below to set up your commission payment payouts:

Commission payouts may take up to 5 business days to arrive in your bank account. If it takes longer than that, please get in touch with Partnerize's support team at support@partnerize.com and they help you with it.

Once you have fully set up on Partnerize and started promoting Wise, it’s time to track your campaign performance and use analytics to optimise it.

When you go to ‘Analytics’ in your Partnerize account you will see a topline overview of your campaign.

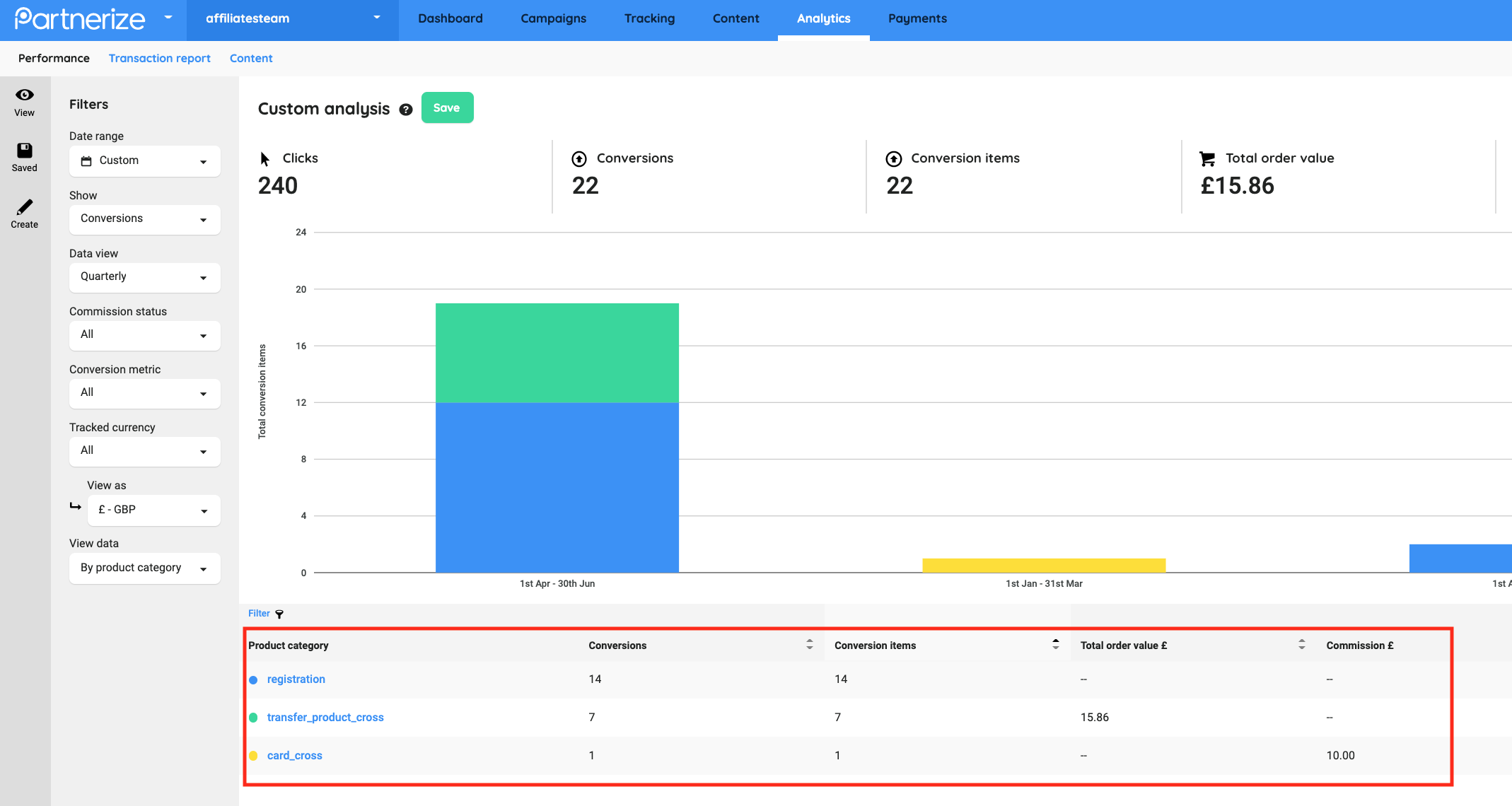

Please note that the total number of conversions you see in your dashboards includes non-commissionable conversions (like account registrations) and paid-for conversions like money transfers and debit card uses.

See identification of the three different types of conversions you will receive commission for:

– TRANSFER_PRODUCT_CROSS – international money transfer

– BORDERLESS_CROSS – conversion between currencies on the user’s Wise account

– CARD_CROSS – conversion when paying with the debit card

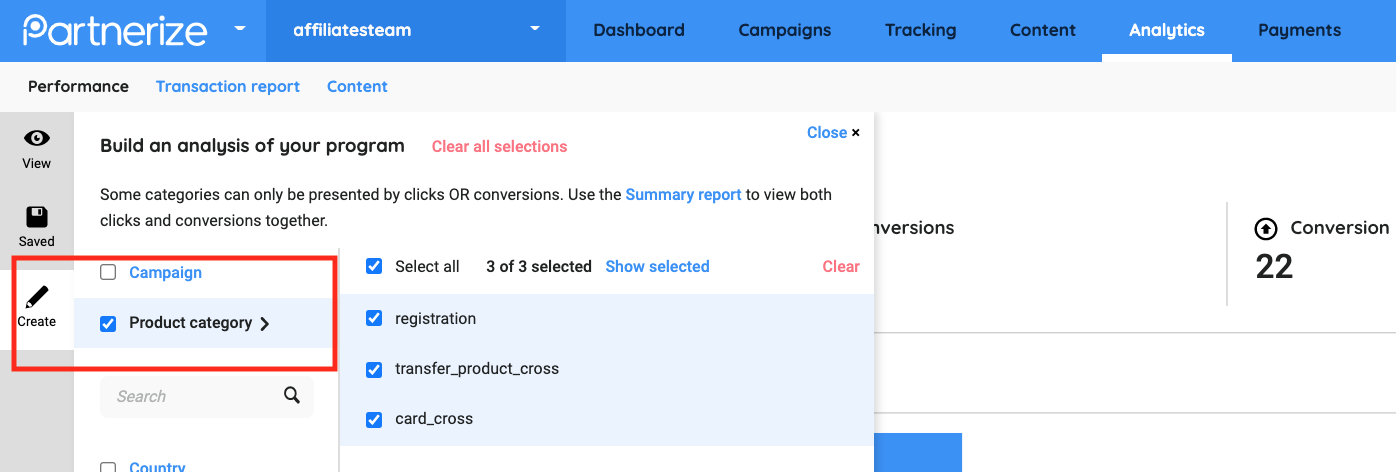

If you would like to see a full breakdown of your conversions, you can create a custom report using the filters in Analytics.

To download a detailed conversion report called 'transaction report' in CSV format follow these steps:

| ⏳ Note on timing – Please note that it can take between 48-74 hours for conversions to show up in your reports. For example, if you check your reports on 5th March, you will only be able to see conversions up to 3rd March. Clicks are updated and shown in real time. |

|---|

We welcome all partners onto our program and you can use the Affiliate Terms & Conditions to guide your promotional activity.

You will find the full list of rules on our Partner Guidelines page, but here are some highlights:

Wise is so much more than money transfers and we want to help our partners find the best ways to promote any relevant part of our product.

This is why we send quarterly newsletters and alert our partners whenever there are new product or currency launches. This often comes with useful material and commission increases so don’t forget to add our email partnerwise@wise.com to your contact to avoid missing out on updates.

According to our Affiliate Program Guidelines, you can promote Wise:

Check out our Resources Hub to find more about ways you can promote Wise, content briefs, widgets and more.**

Our main products include:

– International account with over 50 currencies to hold, spend and receive money (includes direct debit functionality)

– International money transfers that always use the mid-market exchange rate and are up to 7 times cheaper than traditional banks or PayPal

– Debit card – to spend money all over the world (when travelling or online)

– Wise Business – the international account that helps companies save on foreign transactions and make it easy to streamline business processes – with accounting software integrations, batch payments and API

– High-amount transfers – get a discounted rate and additional support when sending large sums of money abroad

| Use your universal affiliate link to promote any of the Wise products! |

|---|

Know how to target the right customer – Wise is a product that can be used by a wide variety of people, starting with expats sending money to their family to freelancers and businesses working with international clients.

We have outlined the main types of customers who use the Wise account and how you can target them in this directory.

We have also put together a handy guide on how to write a review article about Wise.

As you know, Wise is an account that helps customers save on sending, receiving and spending money internationally. We know how important it is for our partners and customers to have access to up-to-date data about exchange rates, fees and delivery times before they make transactions.

This is why Wise is making our unique widgets and API available to all affiliate partners.

| Asset | Description | Instructions |

|---|---|---|

| Calculator widget | An interactive calculator that allows you to select an amount and currency route for your intended transfer and shows real-time exchange rate, and a Wise transfer quote | Implementation guide |

| Comparison widget | A powerful table that compares exchange rates, fees and speed of various money transfer providers, with selectors for the route and amount. | Implementation guide |

| Rates and fees APIs | With our powerful API you can enrich your site or internal tools with access to live and historic exchange rates, transfer fees and speed. | Google Form to request access |

Here is how a simple version of our calculator widget can look like on your website:

You can use your partner tracking link with each widget to make sure you get affiliate commission for each new customer you refer to Wise.

As always, get in touch with our team if you have any questions – partnerwise@wise.com.

Log into my Partnerize account

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

We're thrilled to introduce a powerful new feature designed to save you time and eliminate the frustration of manual data entry when sending money. Now,...

The new Wise Card is here! 🇧🇷

We have great news for our customers in Brazil! You can now set up your own Pix key directly in the Wise app

Welcome to the Wise Partner Program! In this guide, you will find all the information you need to get started, optimize and succeed as a Wise partner. Simply...

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...