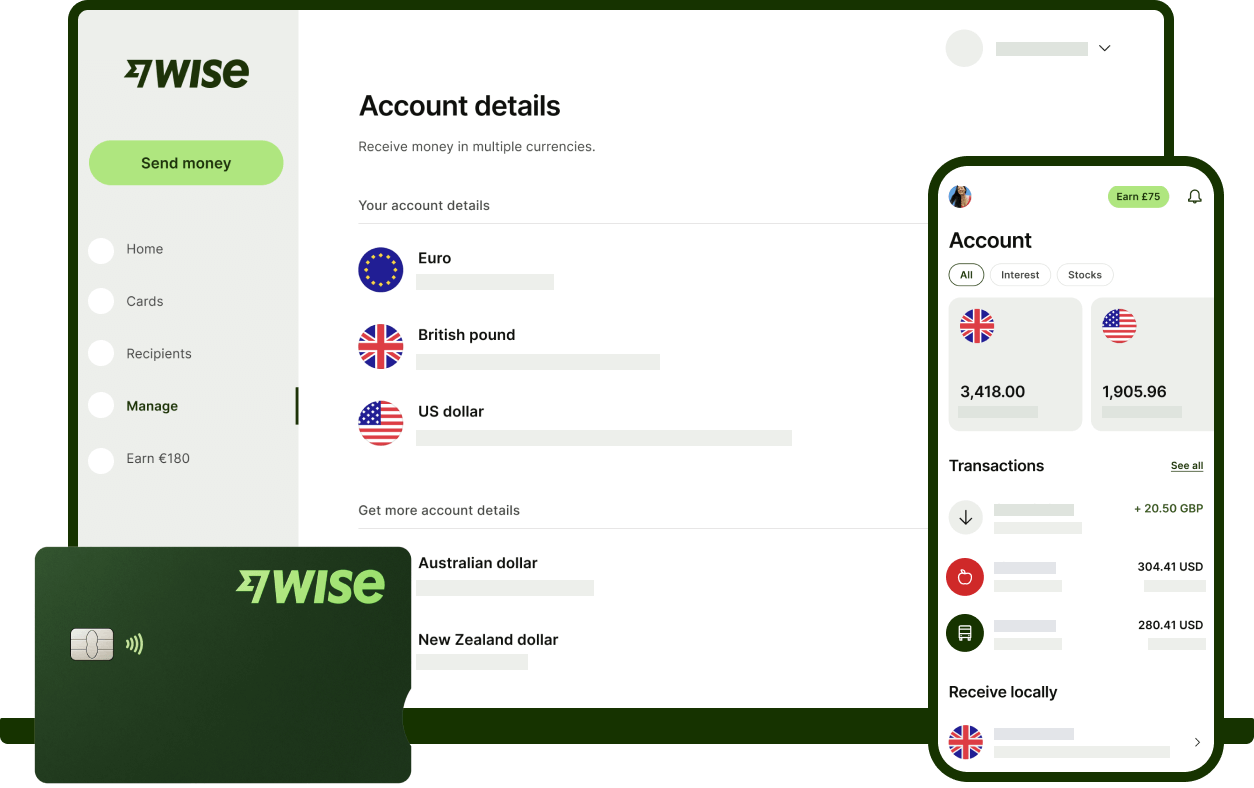

Do you work with customers, contractors, suppliers or staff abroad? Whether you need to pay - or get paid - in a foreign currency, you might find you’re better off with Wise Business.

Get local account details in

10 major currencies with your Wise Business account, so you can receive fee-free payments from 30+ countries. Cut out high currency conversion fees, and keep more of your money for yourself.

Plus, effortlessly pay international invoices, vendors, and employees — with the real exchange rate, in 70 countries.

Find out more about

Wise Business

Receive money