PayPal Fees Calculator in the United States

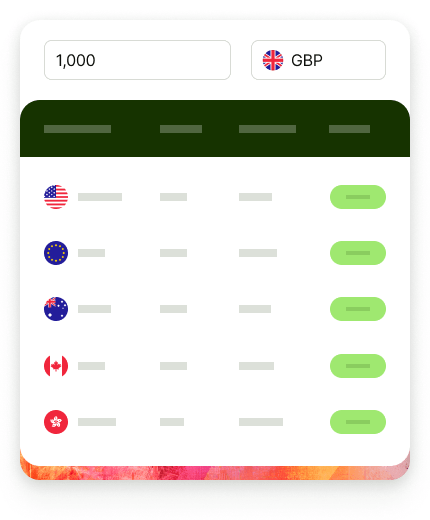

PayPal merchant fees are confusing. Use this simple calculator to find out how much PayPal will charge you, wherever your customers are.

Get a business account that is up to 3x cheaper than PayPal

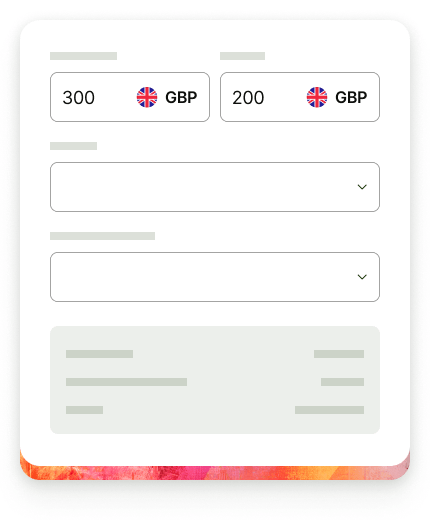

As well as merchant fees, you’ll also face PayPal charges if you receive payments from a different country or currency. PayPal adds a markup to the exchange rate used to convert your money back to dollars which might mean you get less than you expect when you withdraw your PayPal balance.

Avoid PayPal currency fees by withdrawing your balance to the Wise multi-currency account and save even more when you use Wise to send and receive money internationally. Source.

Other useful calculators

PayPal Exchange Rate Calculator

Use this calculator if you’re using PayPal for your international wire transfers.

eBay Calculator

Check out the eBay fees you’ll need to pay, so you can set your product prices to cover the costs, and protect your profits.

Standard rate for receiving domestic transactions with PayPal

PayPal US fees vary depending on whether the payment is considered domestic or international, as well as whether the transaction happens online or in your physical store. Also, the PayPal fees will differ for in-store transactions or if you are a charity.

Domestic payments: a fee of 2.99% of the transaction amount without a fixed fee.

International payments: a fee of 4.49% of the transaction amount plus a fixed fee based on the currency. It included a 1.5% international transaction fee.

*Note: The rate for PayPal goods and services fee are updated according to the policy dated July 28 2022. For more details with the payment type and fee charges, please visit the official website.

| Payment type | PayPal fee |

|---|---|

Send/Receive Money for Goods and Services | 2.99% (no fixed fee) |

Invoicing fee | 3.49% + fixed fee |

Standard Credit and Debit Card Payments | 2.99% + fixed fee |

Pay with Venmo | 3.49% + fixed fee |

All Other Commercial Transactions | 3.49% + fixed fee |

PayPal’s Fixed fee based on received currency

PayPal’s Fixed fee based on received currency

| Currency | Fixed fee |

|---|---|

Australian dollar | 0.59 AUD |

Brazilian real | 2.90 BRL |

Canadian dollar | 0.59 CAD |

Czech koruna | 9.00 CZK |

Danish krone | 2.90 DKK |

Euro | 0.39 EUR |

Hong Kong dollar | 3.79 HKD |

Hungarian forint | 149.00 HUF |

Israeli new shekel | 1.60 ILS |

Japanese yen | 49.00 JPY |

Malaysian ringgit | 2.00 MYR |

Mexican peso | 9.00 MXN |

New Taiwan dollar | 14.00 TWD |

New Zealand dollar | 0.69 NZD |

Norwegian krone | 3.90 NOK |

Philippine peso | 25.00 PHP |

Polish zloty | 1.89 PLN |

Russian ruble | 39.00 RUB |

Singapore dollar | 0.69 SGD |

Swedish krona | 4.09 SEK |

Swiss franc | 0.49 CHF |

Thai baht | 15.00 THB |

UK pounds sterling | 0.39 GBP |

US dollar | 0.49 USD |

PayPal currency conversion fee

If you’re selling to customers based abroad and receive a payment in a currency different to the default currency of your PayPal merchant account, you'll have to pay the currency conversion fee.

Transaction such that the recipients receive a different currency from the currency in which the sender pay involving the following types of transaction is 4% of the transaction value:

- Paying for goods or services

- Sending money to friend or family

- Sending money using PayPal Payout

For other transactions to convert your money back to dollars is 3.0% of the transaction value.

List of Paypal merchant fees

That's not all. There may be other business fees if you use PayPal to collect payments from your customers, such as:

-

Transferring balance from Business Accounts to your linked bank account is free and are usually completed on the next day. You can choose an 'Instant transfer' to an eligible linked bank account or a debit card that is usually realised within few minutes. The fee for an instant transfer is 1% of the amount transferred, up to $10.

-

Chargeback Fee if your buyer requests a chargeback. If you’re covered by Seller Protection, PayPal will cover the costs of both the chargeback and the settlement fee.

-

Card Verification Transactions: used to verify that a cardholder’s account is in good standing without processing a purchase transaction: $0.30 per submission.

-

American Express® Card usage fee 3.5% per transaction

-

PayPal Website Payments Pro and Virtual Terminal Rates for integrated online and in person payments

-

Mass Payments used to organise and mail payments to many people at once

-

Micropayments for eligible businesses processing payments under $10

Note: With effective from July 28, 2022: U.S. business accounts will not be able to receive personal transactions from U.S. PayPal accounts vice versa U.S. PayPal accounts will not be able to send personal transactions to U.S. business accounts.

PayPal fees FAQs.

Wise is your easy, cheap alternative to a bank account abroad

Open online in just a few steps, with no monthly fees and no minimum balance - just simple currency services using the real exchange rate.