Profit and loss statement template

What is a profit and loss statement?

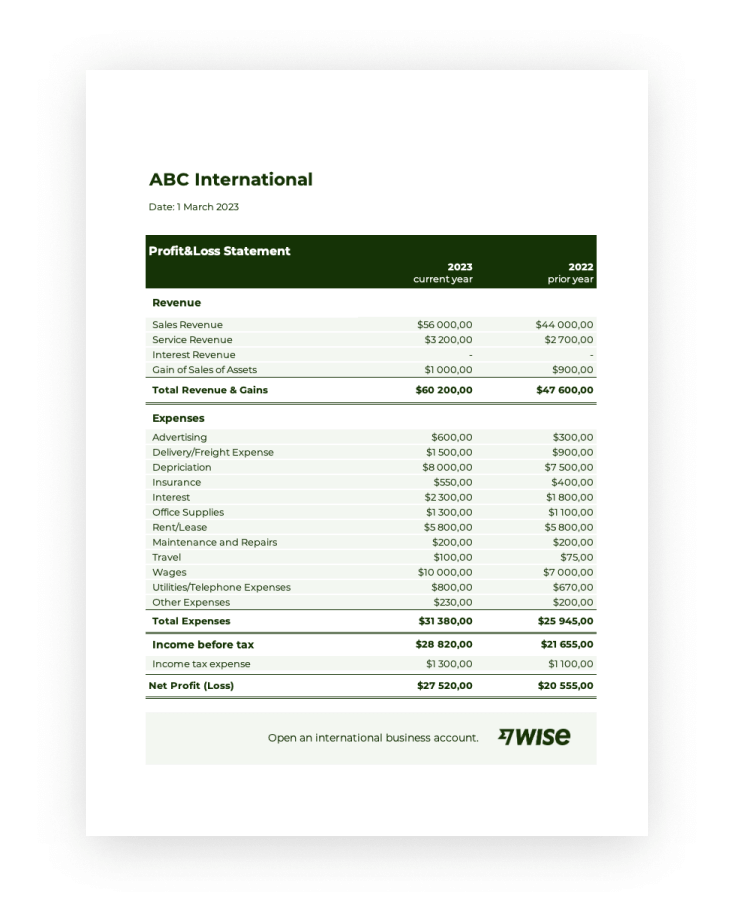

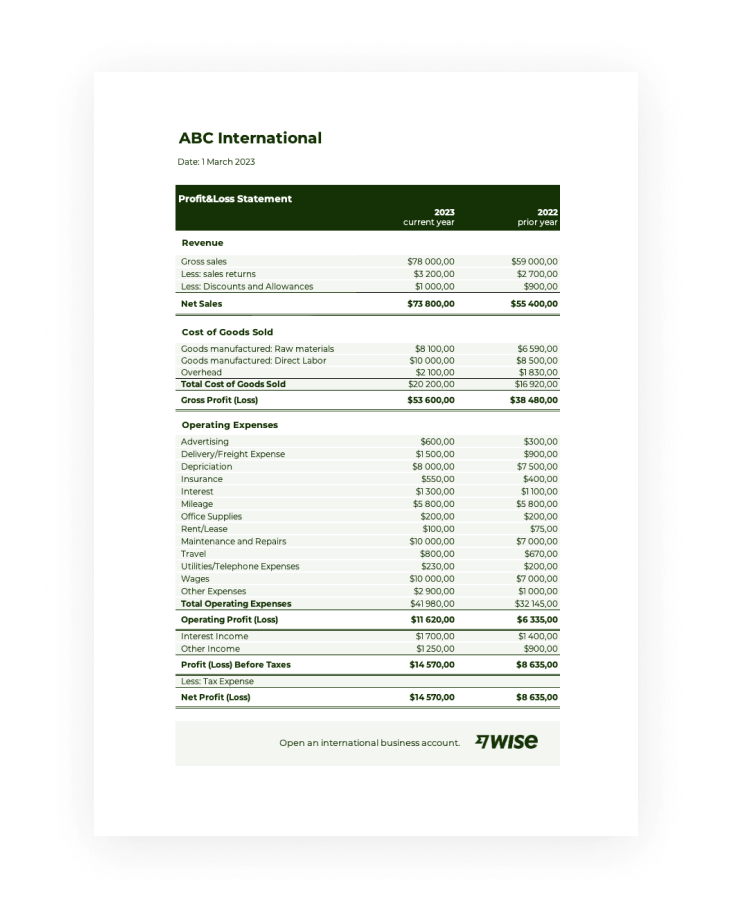

A profit and loss statement (P&L) sets out your company income versus expenses, to help calculate profit. You’ll sometimes see profit and loss statements called an income statement, statement of operations, or statement of earnings.

P&L statements can be created to analyze and compare business performance over a month, a quarter or a year, and are an effective tool to review cash flow and predict future business performance.

Smart business owners use profit and loss statements alongside other key financial documents, like the balance sheet and cash flow statement, to check up on and improve the health of their businesses.

Download a simple proft and loss statement for small business

Download your profit and loss statement template.

To receive the download link on your email, please enter your email address. When you enter your email, you’ll also be signed up to receive the Wise Business newsletter, our free monthly email packed with handy guides and tips on how to grow your business internationally. You can unsubscribe at any time.

By subscribing, you agree to receive marketing communications from Wise. You can unsubscribe at any time using the link in the footer of our emails. See our privacy policyThe cheap & easy way to manage your international business.

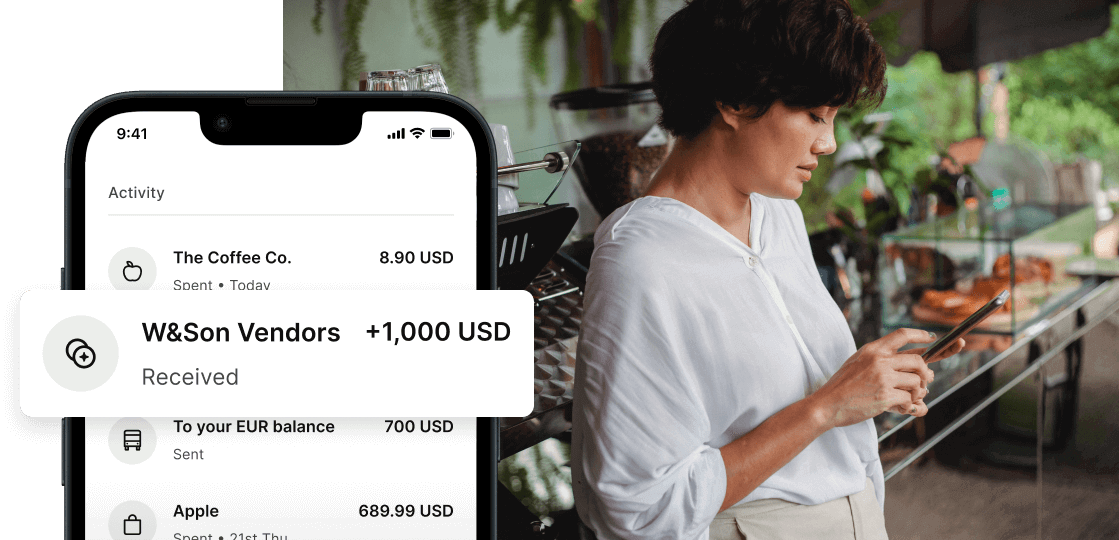

Wise for Business is the smart and speedy way to pay and be paid in multiple currencies.

Are you invoicing clients overseas, or working with suppliers based abroad, but waiting around for slow international transfers to finally reach your account? Wise can cut down on the cost and time of international transfers into your multi-currency account.

You’ll get bank details for the US, UK, euro area, Poland, Australia and New Zealand, to receive fee-free payments from these regions. Hold 40+ different currencies, and switch between them using the mid-market exchange rate.

Integrate your Wise business account with Xero online accounting, and make it easier than ever to watch your company grow.

Profit and loss statement format.

Profit and loss statement formula.

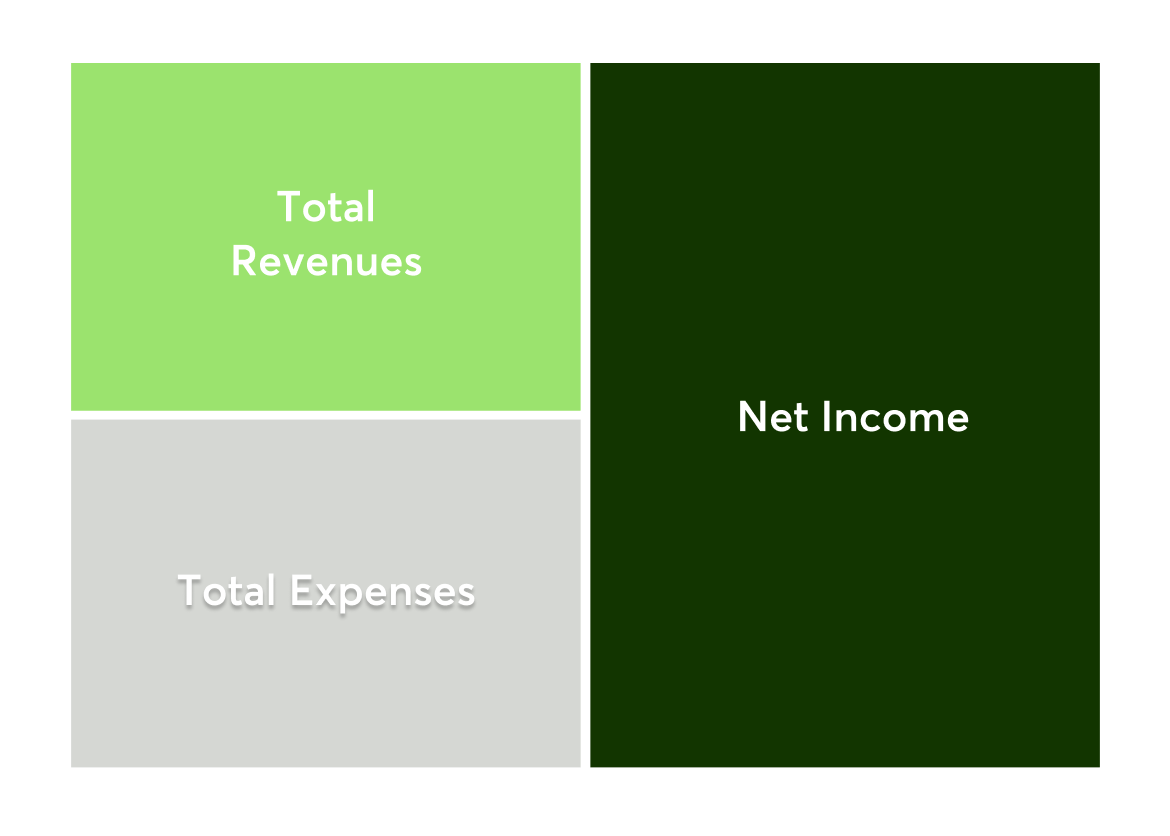

The single step profit and loss statement formula is:

Total Revenues - Total Expenses = Net Income

A P&L statement compares company revenue against expenses to determine the net income of the business.

Subtract operating expenses from business income to see your net profit or loss. If revenues are higher than total business expenses, you’re making a profit. If your business expenses over the period being examined were higher than your income, the company has made a loss.

This calculation is useful for business owners and investors as it shows the net profitability of a business, and how efficient a company is at generating net income.

Profit and loss statements give a snapshot view of business performance - create a monthly, quarterly or annual statement, which you can analyze and compare to performance over the same period in previous years.

How to create the profit and loss statement template?

Download your multi step P&L statement template.

To receive the download link on your email, please enter your email address. When you enter your email, you’ll also be signed up to receive the Wise Business newsletter, our free monthly email packed with handy guides and tips on how to grow your business internationally. You can unsubscribe at any time.

By subscribing, you agree to receive marketing communications from Wise. You can unsubscribe at any time using the link in the footer of our emails. See our privacy policyWatch your business grow with Wise

Pay international invoices, and receive payments from clients based abroad - making it easy, and cheap, to connect with more customers.

FAQ

Both the profit and loss statement and balance sheet are important financial statements - but each has a different function for business owners and investors.

A balance sheet gives a point in time view of a company's assets and liabilities, while the P&L statement details income and expenses over an extended period of time (usually one year). A balance sheet helps determine a company's current financial situation and make important financial decisions. The profit loss statement can be run at any time of the fiscal year to determine profitability and compare one period of time to another to show growth.